Investment Rundown

Still lacking solid margins there is no decent fundamental basis for PTC Therapeutics, Inc. (NASDAQ:PTCT) to trade on and this is increasing the risks of investing quite drastically. The company hasn’t quite been able to set up some revenue streams the way I would have preferred, like having to renew their drug licenses in the EU annually to maintain business there. Disapproval and PTCT would lose out on important revenues.

The company focuses mostly on both the discovery and development of medicines and treatments for patients who have been diagnosed with rare disorders. The company has a broad portfolio of products from which it has grown its business to where it is today. The failure of one of their drug tests back in May sent the stock price tumbling and that highlighted the volatility associated with investing right now. I am fine staying on the sidelines with this one and not starting a position. As a result, I am rating PTCT a hold.

PTC Therapeutics Company News

One of the more significant news that came out was back in late May. PTCT showcased a failure to meet its endpoint targets in a trial for the Vatiquinone MOVE-FA revisitors-directed. This sent the stock price tumbling and I think investors got spooked by the negative news. Since then, the share price has not been able to recover at all and continues to trade around the $40 mark.

In the new release, there were some comments by the CEO of PTCT Matthew B. Klein on the results of the trial. “While we are disappointed that the study did not achieve its primary endpoint, we are encouraged by the findings of meaningful impact on several different aspects of FA disease progression and morbidity over 72 weeks”

I think we need to see strong progress in the pipelines for the company if we ever are going to consider them a rating above hold. There needs to be proof of concept with their new products before we see the share price rebound to previous levels.

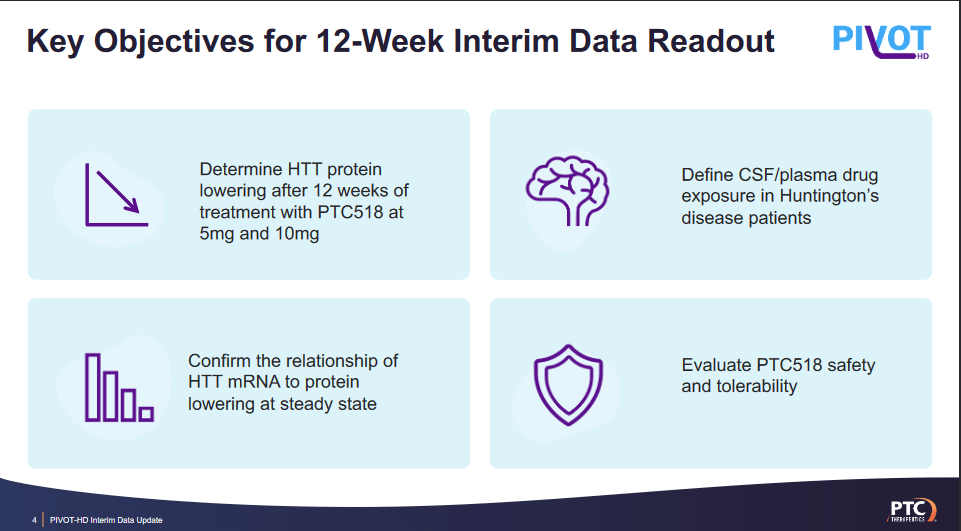

Objectives (Investor Presentation)

Diving deeper into the results of the trials, the clinical study, unfortunately, fell short of achieving its primary objective, as it did not yield a statistically significant change in the mFARS (Modified Friedreich’s Ataxia Rating Scale) score at the 72-week mark within the primary analysis group. This outcome underscores the complexities inherent in developing effective treatments for diseases like Friedreich’s Ataxia, which can present multifaceted challenges.

However, amidst this disappointment, there were notable positive findings that shed light on vatiquinone’s potential benefits. The treatment exhibited a substantial impact on specific disease subscales and secondary endpoints, indicating its potential to influence certain aspects of the disease progression. This suggests that vatiquinone might have a targeted effect on particular manifestations of Friedreich’s Ataxia, even if it did not achieve the broad primary endpoint.

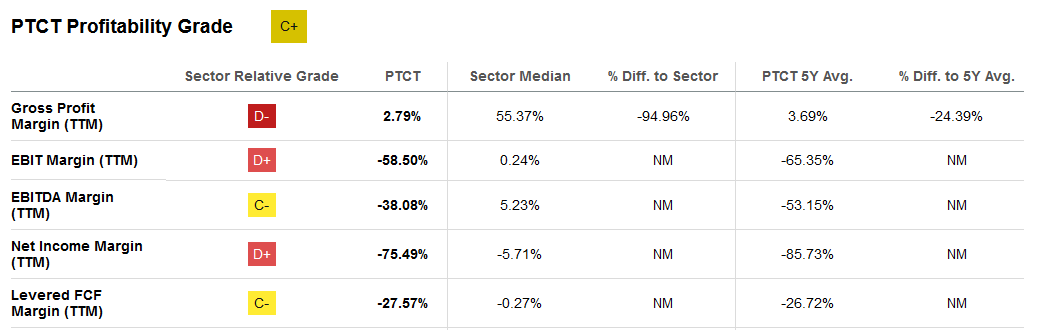

Profitability Of The Business

Profitability (Seeking Alpha)

Looking at the margins for the company they are barely staying above water when the gross margins aren’t even over 3%. I think they will continue to struggle for a lot longer and this will be reflected by the share price decrease. There is potential in the work they are doing and that is what keeps me holding.

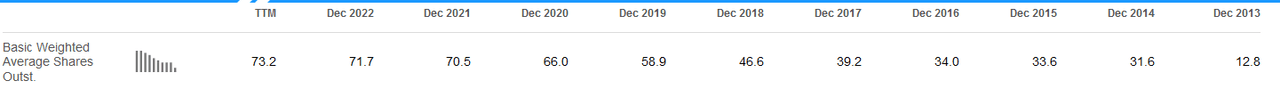

Shares Outstanding (Seeking Alpha)

As for the way the company has been raising capital, it seems to have largely come from share dilution over the years. I think it’s likely this will continue to happen and investors will have a lower and lower share of the company as time goes on. But as products hopefully come to the market and PTCT showcases positive trial results then I think we might see a quick upswing for the share price to reflect the new sentiment around the company. Biotech companies are notoriously volatile and I don’t think PTCT is any different but they also offer a lot of potential ROI which is why they are so intriguing. Allocating a smaller portion of a portfolio though for them seems advisable to not overleverage and destabilize yourself.

Risks

Complicating the situation further, PTCT is required to reapply for its license to market the drug in Europe annually. This seemingly routine process introduces a layer of uncertainty and risk that might not be immediately apparent. While securing a license renewal might have been a relatively straightforward task in the past, the changing regulatory landscape and evolving requirements could potentially make this process more complex and uncertain in the future. This leaves them with a lot of difficulties to establish proper revenue streams and post better earnings results.

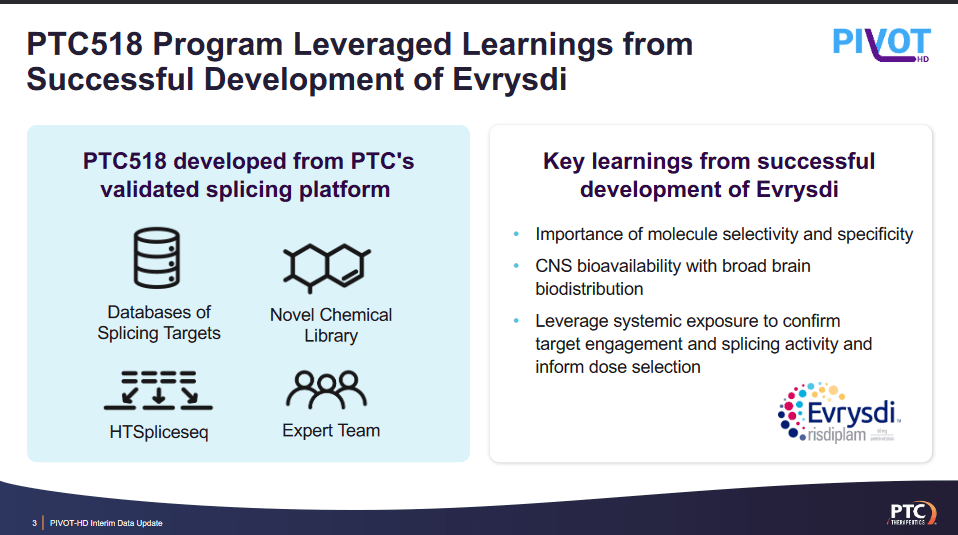

Program Overview (Investor Presentation)

The recent setbacks experienced by PTCT have cast a shadow over the company’s development pipeline and strategic prospects. Particularly concerning are the disappointing outcomes observed in one of PTCT’s leading pipeline candidates, Vatiquinone. Unfortunately, this compound did not meet its primary endpoint in a pivotal study involving patients with Friedreich’s Ataxia. This unexpected outcome not only raises concerns about the drug’s effectiveness but also calls into question the potential viability of this candidate as a treatment option for this condition.

Final Words

The failure to meet targets back in May caused the share price to slip for PTCT and it hasn’t recovered since. This new trading level is no more appealing than it was before unfortunately, and the company remains a hold for me. We need to see better progress on coming trials if we are to see the share price return anytime soon. Allocating a small amount of a portfolio for the company does seem like a decent risk/reward bet, somewhere between 0.5 – 1% is where I would be. Concluding though with stating PTCT is a hold for me.

Read the full article here