Rose’s Income Garden “RIG” has 5 “HY” high yield monthly payers from the sectors of energy, utility and finance. RIG itself is composed primarily of common stock dividend payers with quality S&P credit ratings. Sadly, most HYs rarely have S&P credit ratings, secondarily have more risk associated with owning them, and most popular research investment services do not cover them. RIG owns 5 and this report is limited to what was found at Morningstar, and other public analysts including those on SA.

5 Monthly High Yield Payers

The following chart has the RIG monthly payers listed from highest to lowest dividend yield.

The following are abbreviations used in the chart.

Div = Dividend

Dividend per share is monthly.

Price is for August 19th, 2023.

|

Stock |

Stock |

Dividend |

Yearly |

Div% |

Aug 19 |

|

|

Sector |

Ticker |

Name |

per share |

$ Div |

Yield |

Price |

|

Finance |

(PFLT) |

PennantPark Float |

0.1025 |

1.23 |

11.70% |

10.51 |

|

Finance |

(SLRC) |

SLR Investment |

0.1367 |

1.64 |

10.88% |

15.07 |

|

Finance |

(ARDC) |

Ares Dynamic Fund |

0.1125 |

1.35 |

10.64% |

12.69 |

|

Energy |

(NML) |

Neuberger Berman |

0.0584 |

0.7 |

10.01% |

6.99 |

|

Utility |

(DNP) |

DNP Select Inc Fund |

0.065 |

0.78 |

7.76% |

10.05 |

1- PennantPark Floating Rate Capital Ltd.

PFLT is a closed end fund/ CEF and the CEO since 2010 is Arthur Howard Penn, as can be noted with his name used within theirs. It is a business development company “BDC” headquartered in Miami Beach, FL. which makes secondary direct, debt, equity, and loan investments through floating rate loans primarily in the United States and to non-U.S. companies at a much lesser extent. 65% of the portfolio are senior secured loans with maturities ranging 3 to 10 years.

The Price:

Morningstar analyst, a premium service I use, has a fair value “FV” or 3-star price of $12.86 and a buy at a really cheap or 5 stars price of $8.69. They calculate it to be about a 19% discount from that “FV” selling now at $10.51. Yahoo Finance has a 1-year price target of $11.50.

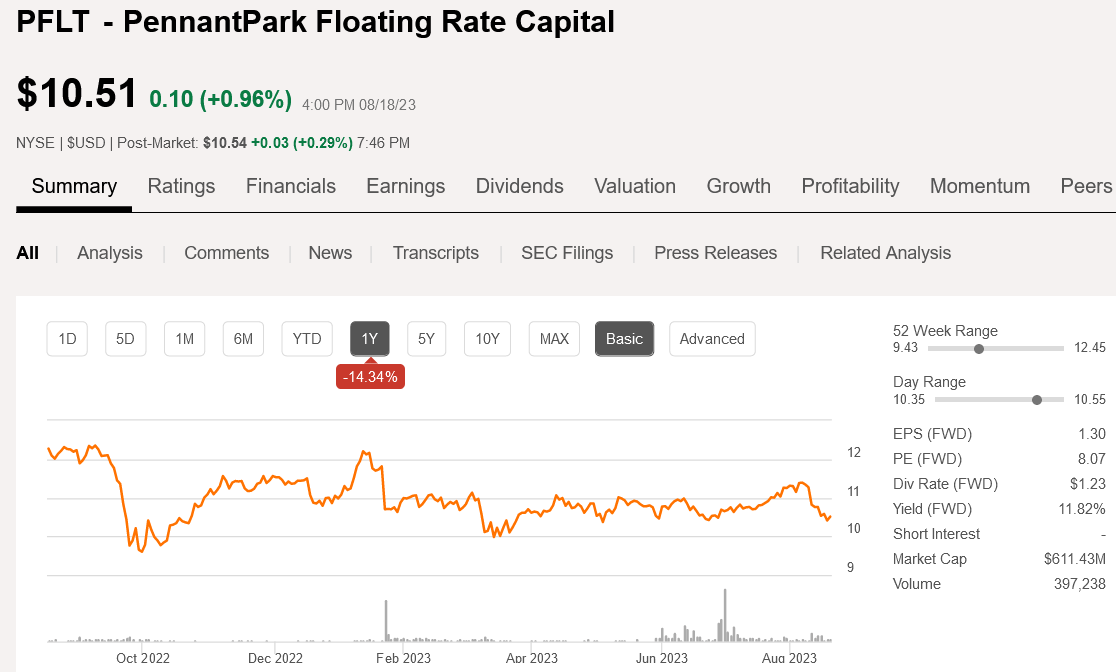

The 1-year chart below from Seeking Alpha “SA” shows its price movement and 52-week range. It could have been purchased for as low as $9.43 and all the way up to $12.45 during that 2-year period. Right now, the price is a “Goldilocks” $10.50 valuation.

PFLT 1-year price chart with 52-week range (Seeking Alpha Aug 19th, 2023)

The Dividend:

Dividends are consistent, but raises are not given often. 2015, saw a 5.55% raise from $.09 to $.095 for the April payment and not until 8 years later, to the month, in 2023 did it happen again. Oh My, what a nice surprise with a 5.2% raise to $.10. Then: Wow, just 3 months later it was raised to $.1025 for the July payment, a raise of 2.5%. The forward yearly payment is now $1.23, offering an amazing yield of 11.7%, and total raise for the year being 7.8%.

It has a nice record of no cuts for at least 13 years, which makes it quite outstanding and pleasing to own. I thank The Fortune Teller for suggesting it quite a few years ago.

2- SLR Investment Corp.

SLRC is a financial BDC headquartered in NY, NY. specializing in secured debt generally in first lien unitranche and second lien, subordinated (unsecured) debt, and other debt issues primarily in the US. It makes some quite complex loans that this article is not here to review, so due diligence is recommended.

The price:

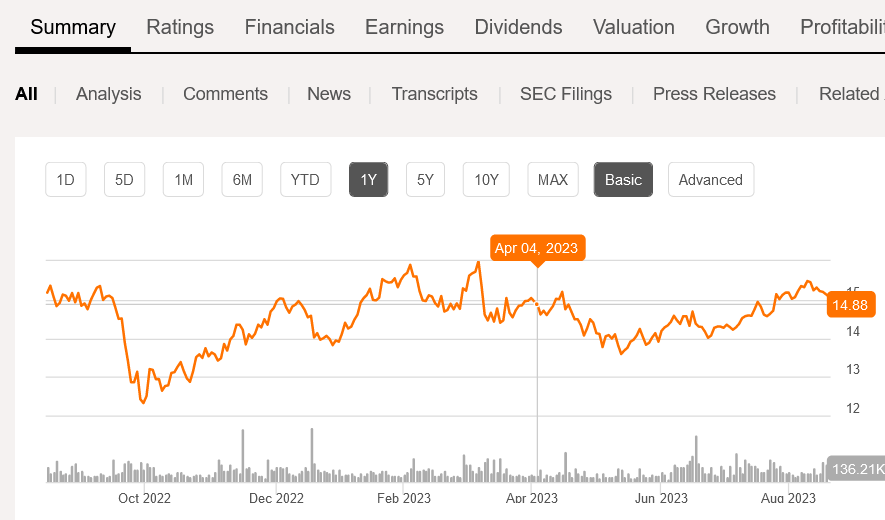

Morningstar has a fair value “FV” 3-star price of $17.45 and a buy at a really cheap 5 stars price of $12.44. This translates to about a 14% discount from that “FV” as it sells now at $15.07. Yahoo Finance has a $15.39 1-year price target which is very close to now. The price has certainly been a roller coaster ride and thus important to watch it closely. Below is the 1-year chart from SA, showing the movement down under $13 and now back up near $15.

SLRC 1-year price chart (Seeking Alpha Aug 19, 2023)

The Dividend:

It did cut the dividend in 2012 and 2013 but has held steady at a $1.60 distribution yearly from 2014. It gave a raise in 2018 to $1.64, or 41c quarterly, where it stayed. It converted from quarterly payments to $0.1367 monthly starting in April 2022.

The FASTgraph below shows technical information for 2 current years and 2 years of future estimates.

The black line is the price and dotted lines are future estimates. The statistics for each year are found at the top and bottom of the chart. The white line for the dividend will be covered by earnings (dark green area) and predicted to stay the same, which means about 10.8% yield at the price shown. Lots of information is shown on the right side of the graph in the FAST Facts box and graph color key area.

SLRC Technical 4-yr chart (FASTgraphs Aug 19, 2023)

It does have what looks to be potential price advancement to get the normal blue P/E line for earnings of 11.57x. It currently is selling below that at 9.47x earnings. The price should rise with the earnings projected to rise 14% this year.

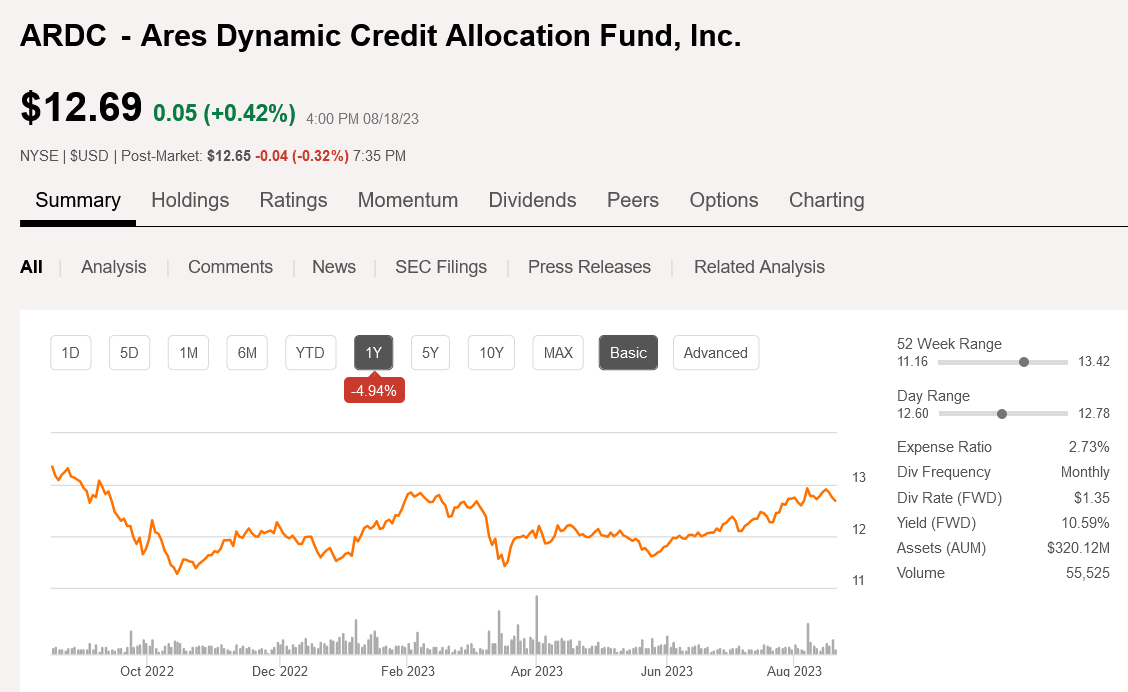

3- Ares Dynamic Credit Allocation Fund

ARDC is a CEF-closed-ended fixed income fund managed by Ares Capital Management II LLC., formed on November 27, 2012, is headquartered in LA, CA. It primarily invests in the fixed income markets of Europe through loans and bonds.

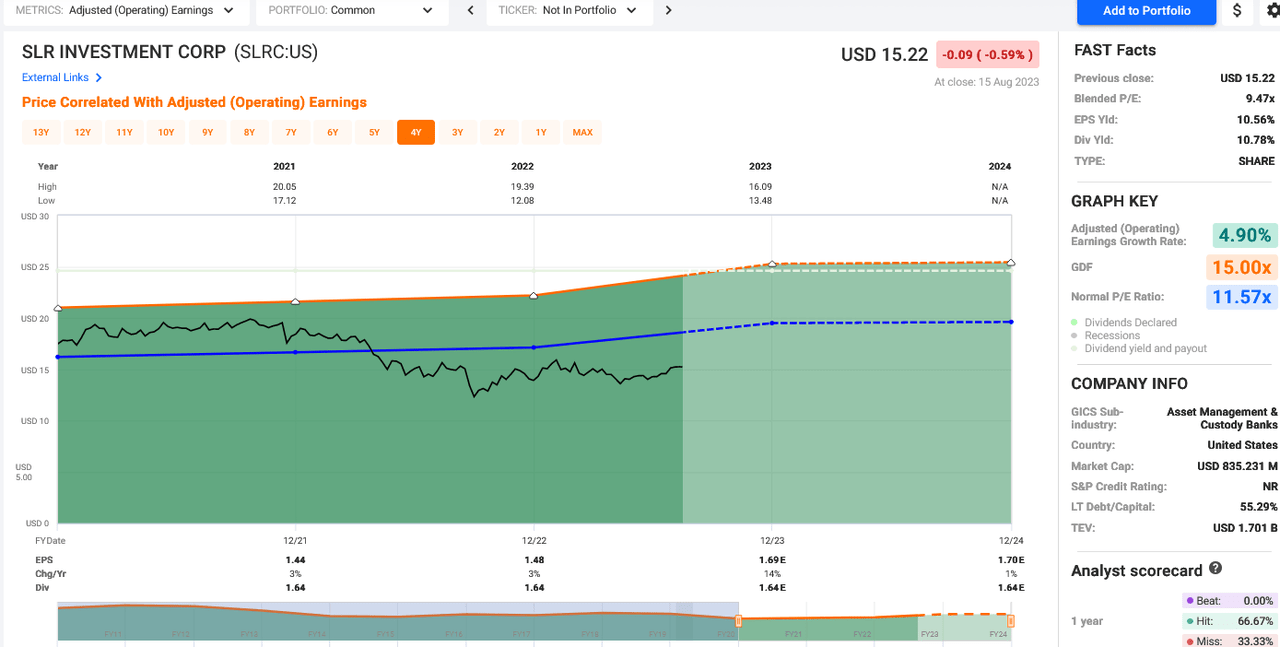

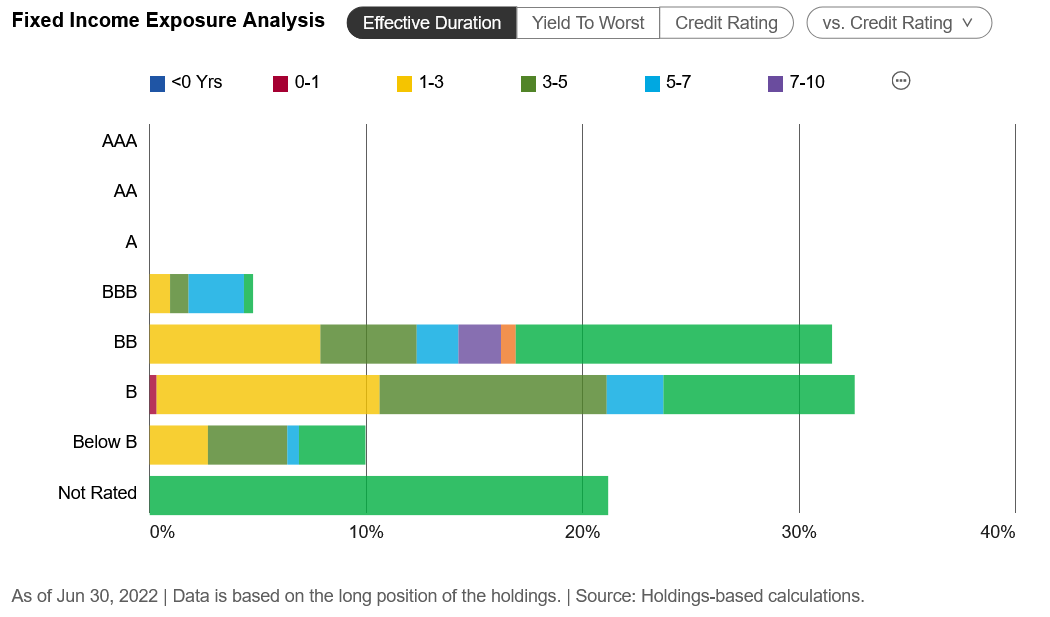

The following was found at M* for the bond composition and ratings:

ARDC bond composition/ ratings (Morningstar Aug 2023)

The following chart also from M* shows quality of the bonds and durations:

ARDC Bond durations and ratings (Morningstar Aug 2023)

Many of the bond durations are 1-3 years, but more last out to 5 years or so, with few out much longer.

The price:

Morningstar gives the current Net Asset Value “NAV” as $14.10 and considers it selling at a 9.6% discount at the current price of $12.69.

The SA chart below for 1 year price movement shows it is doing well for price and has sold for as low as $11.16 in the past 52 weeks. It was around $11.62 just earlier this year. It does hit $13 too, so be careful when adding shares.

ARDC 1 year price chart movement (Seeking Alpha Aug 19. 2023)

The Dividend:

The dividend has been steady and even rising from April 2020 when it was $.0975. Rising to $.1025 for August 2022, $.1075 for Jan 2023 and in April it rose to $.1125. However, in 2015, it was $.117 and has moved around from there up and down, but remains quite close to that, but still not at a high. Just know it can vary but is holding nicely and remains at a nice level with a 10.46% yield.

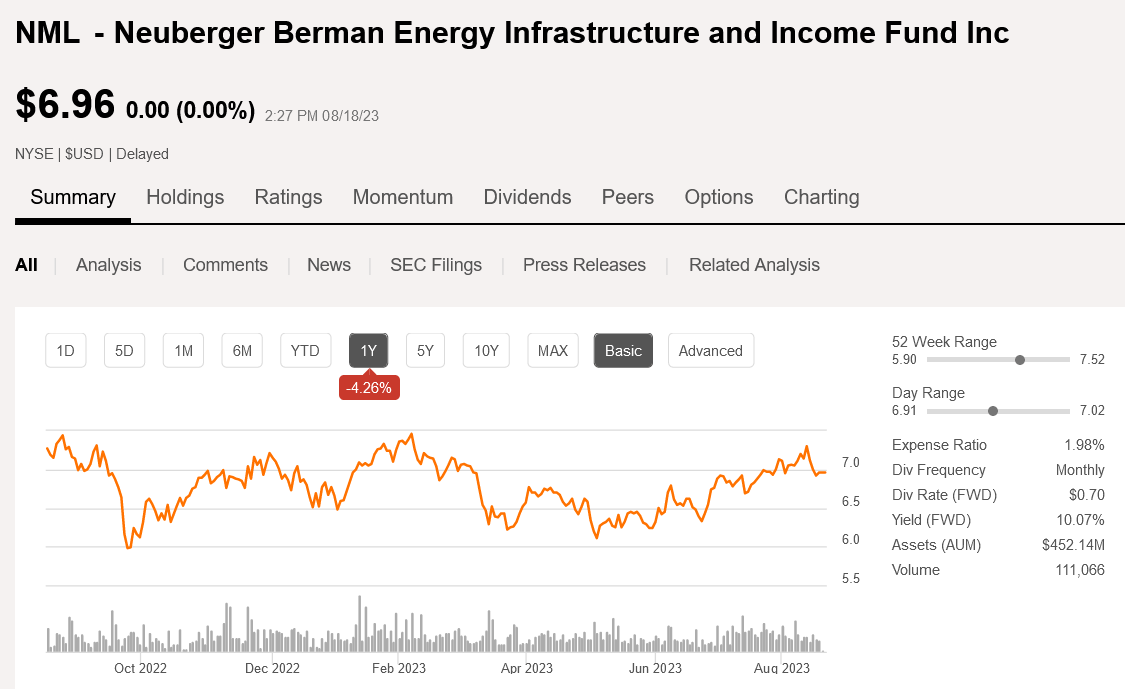

4- Neuberger Berman Energy Infrastructure Income Fund

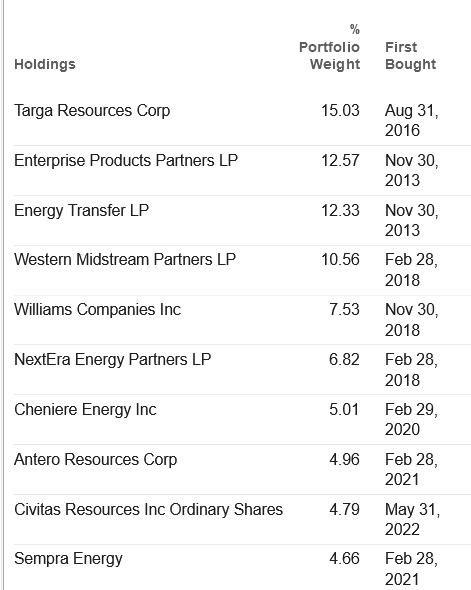

NML is a fund composed of numerous MLPs primarily from the USA. Listed below are the top 10 holdings by % holding and first purchase date found at M*:

NML Top 10 holdings by % (Morningstar Aug 19, 2023)

Strategy of NML from M*:

“The Fund’s investment objective is to seek total return with an emphasis on cash distributions. Under normal market conditions, the Fund invests at least 80% of its total assets in master limited partnerships or energy companies. The Fund may invest up to 20% of its total assets in income-producing securities of non-MLP or energy-related issuers, such as common and preferred equity securities.”

The price:

Morningstar gives the current Net Asset Value “NAV” as $7.98 and considers it selling at a 12.78% discount at the current price of $6.99. Below is a chart from SA that shows the 1-year price movement, which has moved between ~$6.00 – $7.50.

NML 1-year price movement (Seeking Alpha Aug 19, 2023)

The Dividend/ Distribution:

The payments vary and were less in 2022. Last December and thus far in 2023 they have all been $.0584 per month. My hope is that it continues at the same payment, as energy prices seem rather constant lately, but nothing is guaranteed. I also believe and what I like about this distribution is that it has a 1099 tax form.

5- DNP Select Income Fund

DNP is a utility CEF managed by Duff & Phelps Investment Management Co. which is domiciled in the US and was formed on November 26, 1986. It invests in the public equity and fixed bond income markets of the United States.

The price:

Morningstar gives the current Net Asset Value “NAV” as $7.96 and considers it selling at a 26% premium at the current price of $10.05. Honestly, this is one fund that is rarely selling anywhere near its NAV, which means buying it at a premium most of the time. Right now, near $10 is very favorable in my opinion and gives it a 7.8% yield. I have owned this fund for most of my investing life.

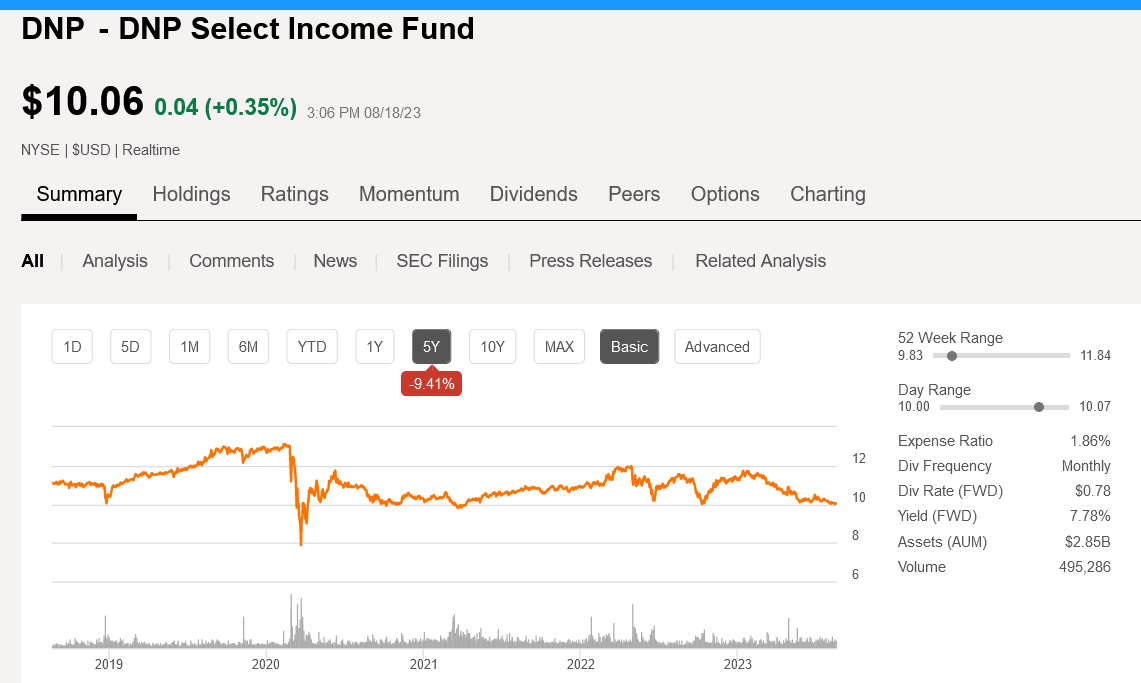

Below is a 5-year chart of the price movement from SA:

DNP 1-year price movement technicals (Seeking Alpha Aug 19, 2023.)

The dividend/ distribution:

The payment rarely changes and is actually guaranteed to be $.065 monthly or 78c yearly. Every year it reports which part of the payment is return of capital or qualified, etc; it changes. Closed end funds make distribution payments through three primary sources, current income, capital gain, and return of capital. Each carries a specific tax consequence for investors holding DNP in taxable accounts.

I am not expecting to ever sell this one from my taxable account and therefore truly do not worry about the dividend classification, but this is important for those that might trade it.

Summary/Conclusion

These 5 monthly payers have been great for income and buying them at an advantageous price is very wise. I have learned that lesson slowly over my many investing years and remain happy with these 5 for RIG. All of these and the remainder of the 80-stock portfolio are available at the service.

Income/ yield is the goal, and a low price is important to attain the best yield. Holding on and then buying more when the price is down is the most difficult aspect for owning HY. Many get discouraged seeing portfolio value decline, but that is when real investors take advantage and add on. The opposite can also be true with selling when the price rises and the yield gets low, so it can work both ways, being hard to watch and accomplish. Investing is what you make it and having goals is always wise in all respects for each and every investment type and especially for owning HY.

Read the full article here