On Friday October 6, the Employment Situation report for the month of September will be released by the Bureau of Labor Statistics. The Fed will be watching for signs that the job market is cooling. Inflation has now declined to levels closer to the Fed’s goal on recent figures, so jobs data becomes more significant. That’s because the Fed ultimately targets stable prices and full employment. With inflation perhaps becoming less of a concern, or at least a less extreme concern, the Fed can focus a little more on the jobs picture.

A Cooling Jobs Market

Over the summer, the jobs market has cooled somewhat. Unemployment ticked up to 3.8% in August, a level not seen since February 2022. In addition, having consistently created over 200,000 jobs a month since 2021, for the last three months the economy has added under 200,000 jobs on a seasonally adjusted basis. However, just three months of softer data may not yet be considered a decisive trend.

It’s unclear if this represents a shift to a more normal job market after the effects of the pandemic have fully played out, or if a bigger slowdown looms. Equally there is noise in the jobs data due to events such as the recent failure of a large trucking company and various strikes. As such, the Fed will be looking to determine if the apparent cooling of the jobs market represents noise or the start of a more sustained trend.

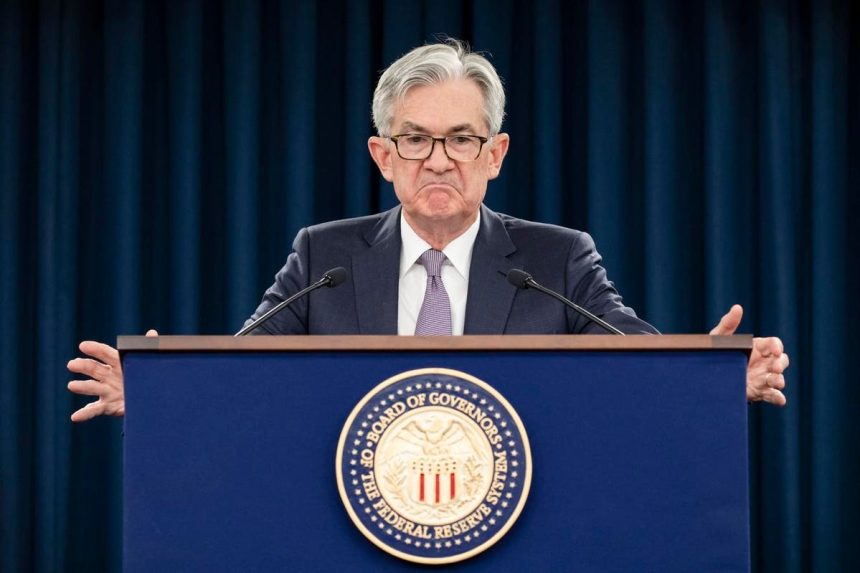

The Fed’s Perspective

Though the Fed doesn’t want rising unemployment, the jobs market was running hot and wage growth was fueling higher prices, especially in services, on the Fed’s view. Therefore, to a degree, a more balanced jobs market would be welcomed by the Fed as a way to help ease inflation in the economy.

That said, the Fed doesn’t want to overdo it. Interest rates are currently relatively high and have certainly increased sharply over a short period of time in historic terms.

As much as the Fed is committed to lower inflation, it does not necessarily want to cause a major recession in the process, if that can be avoided. Therefore, if the jobs market were to show too much weakness, the Fed may be more likely to consider rate cuts in 2024, or at least hold off on another potential rate increase in 2023. Ultimately, it’s unclear what the Fed’s interest rate decision will be on November 1, but the upcoming jobs numbers will be significant in informing the Fed’s thinking.

Read the full article here