Chad Lusco, CEO P3 Services.

As a business owner, you accept there’s no such thing as “two weeks’ notice.” Grappling with a transition or succession plan can be challenging and emotional, but you’ll need to prepare an exit strategy well in advance to maximize your ROI and ensure the continuation of your company. You should plan this strategy at least three to five years in advance (ideally ten years) with the understanding that your goals and business may evolve over time.

1. Identify your expectations.

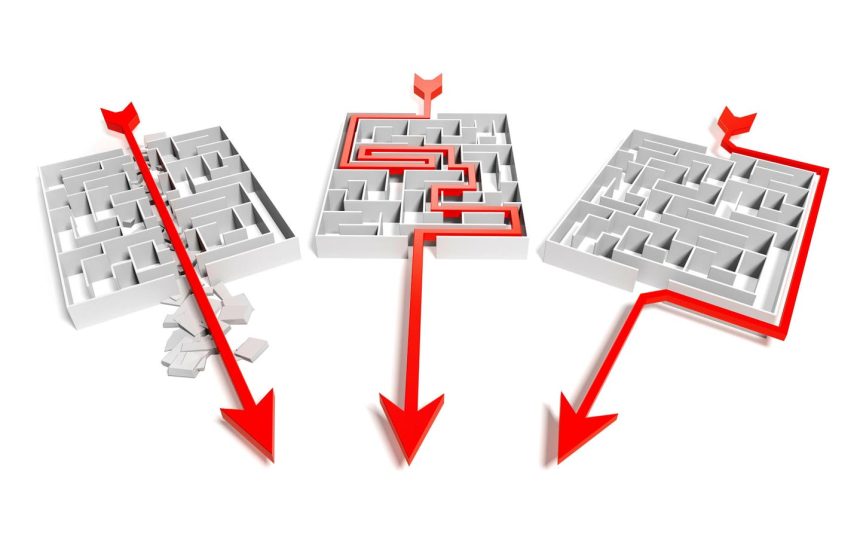

Every business owner needs an exit strategy, but not all exit strategies are right for everyone. You’ll need to spend some time reflecting on what’s right for you. There is no right or wrong answer; your exit strategy should allow you to meet your goals—both personal and financial—and your business’ needs. Each strategy has its unique set of advantages and disadvantages.

Consider these common types of exit strategies:

• Legacy

Keeps the business in the family by choosing a successor, but can often come at a discounted price to the seller and substantial debt service to the buyer.

• Merger And/Or Acquisition

M&A (via private equity or investment group) may benefit the seller with a higher purchase price, but the business may become part of a larger entity or investment portfolio with a new set of procedures or strategy.

• Strategic

One company (typically a direct competitor) purchases another to acquire its talent and/or book of business, often with the hopes of finding synergies, efficiencies or cost savings through consolidation.

• Friendly Buyer

Involves selling your stake to a partner or investor; often involves minimal disruption to the business, but may not achieve the highest purchase price possible.

2. Strengthen your management team.

In my experience working with small business owners, I’ve found the most common stumbling block is the owner. Often, the owner handicaps their own business by hoarding decision-making ability and failing to establish clear roles and responsibilities for team members. This creates bottlenecks for scaling the business, and the dysfunction becomes far more evident when an exit strategy is considered. Extricating the owner from day-to-day affairs is more difficult in a centralized power dynamic.

To strengthen the management team, begin by providing clarity on your team members’ roles, responsibilities and decision-making authority. It’s also essential to define the organizational structure and key performance indicators (KPIs) for all team members. Once this is accomplished, the next step is to plan for the gradual transfer of responsibilities to prepare the management team for the transition.

Speaking of transferring responsibilities, you may need to choose your successor, particularly if you’re planning an exit strategy that doesn’t include long-term seller involvement. Selecting a successor often proves challenging if the candidate is a family member or long-time acquaintance. Be sure the individual you pick is the best suited in terms of skills, experience, education and temperament. It’s often a good idea to turn to an advisory board or consultant for neutral guidance.

3. Streamline your operations.

Are there any operational inefficiencies to iron out or unnecessary expenses to eliminate? Look for ways to improve processes, and be sure to resolve any pending or potential legal liabilities, as well as any outstanding debts.

Some operational challenges I commonly see are a lack of systemization and an inability to provide in-depth data and insights into the business. You’ll want to be able to pinpoint data that potential buyers will be interested in—from year-over-year (YOY) growth to the number of locations served, new customer growth, expansion of existing customer accounts and relationships—the list goes on.

4. Clean up your financials.

Before engaging with potential buyers, ensure your business has clean books that follow generally accepted accounting principles (GAAP).

Additionally, you’ll need to have a clear picture of your numbers—both personal and corporate—so you can head into negotiations with a fair asking price and use your financial performance to justify it.

Be warned, a common mistake entrepreneurs make is running their company so lean that it lacks a strong foundation. Efficiency is important, but running on a skeleton crew can create instability. Avoid trying to squeeze out every dollar of profitability leading up to the sale, as this will restrict scalability and create a questionable succession plan for a potential buyer.

5. Identify your differentiators and key selling points.

Treat potential buyers as you would potential customers and consider what sort of sales pitch you might give them. Ask yourself the following questions:

• What target market does your brand appeal to?

• What are the unique attributes of your products/services/brand?

• Do you have a proprietary method?

• What’s your brand heritage/story?

• What technologies/patents do you have?

• Do you have any endorsements or awards?

Identify your most compelling differentiators and use them to create an elevator pitch. Then, build on that elevator pitch to develop an appealing presentation for potential buyers.

6. Do your due diligence.

Lastly, do your due diligence. Get all of your relevant organizational and legal documents organized, including:

• Vendor and customer contracts

• Permits/licenses

• Financials

• Audits

• Employee and payroll backup

• Insurance information

• Vehicle and asset lists

In addition, consult a CPA on how to optimize your tax strategy for the sale (don’t expect buyers to offer guidance on your tax situation). Your location, company structure and the structure of the sale can have significant effects on your sale price and valuation.

Preparing Your Exit Strategy

If these steps seem overwhelming, remember that you should have at least five to ten years to execute them. If you’ve held exit strategy planning in abeyance until you’re just about ready to retire, you may want to consider staying at the helm for at least a few more years. This will allow you time to plan adequately for a healthy transition that allows your company and talent to continue to flourish. Your company is your legacy, after all, whether or not it stays in the family.

Forbes Business Council is the foremost growth and networking organization for business owners and leaders. Do I qualify?

Read the full article here