Palantir (NYSE:PLTR) reported both top-line and bottom-line beats in Q3 FY23, along with raised full-year guidance. I am encouraged by their profitability growth, achieving a 29.3% adjusted operating margin. I anticipate further margin expansion in the coming years. However, I don’t believe their operating margin can reach the levels of most typical software companies, as I analyzed in my initiation article. I maintain a “Hold” rating with a fair value of $16 per share.

Q3 FY23 Review and Outlook

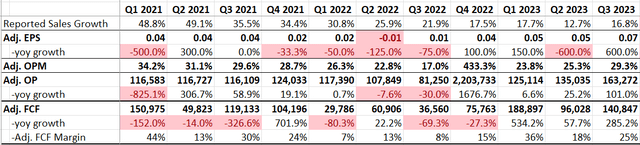

Palantir’s commercial revenue grew by 23% in Q3 FY23, and government revenue increased by 12% year over year. The adjusted operating income for the current quarter was $163 million, indicating a 101% year-over-year growth.

PLTR Quarterly Results

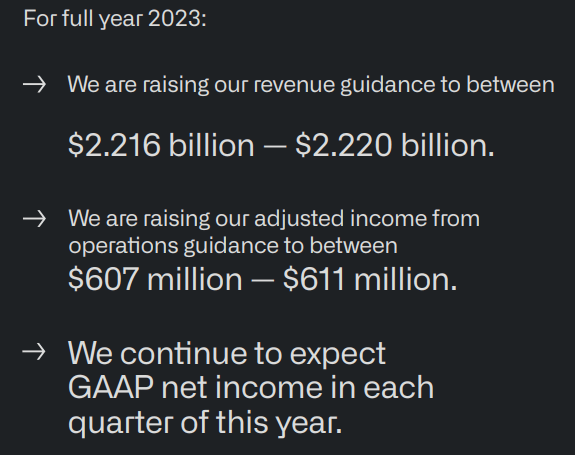

On the balance sheet, they ended up with $3.3 billion in cash and equivalents, maintaining a robust financial position. In Q3 FY23, total contract value bookings were $830 million, up by 29% sequentially. This booking growth suggests a strong trajectory for future quarters. For the full year FY23, they raised their revenue guidance to $2.216-$2.22 billion and increased their adjusted income to $607-$611 million. Their strong booking growth positions them well for full-year growth.

PLTR Q3 FY23 Earning Presentation

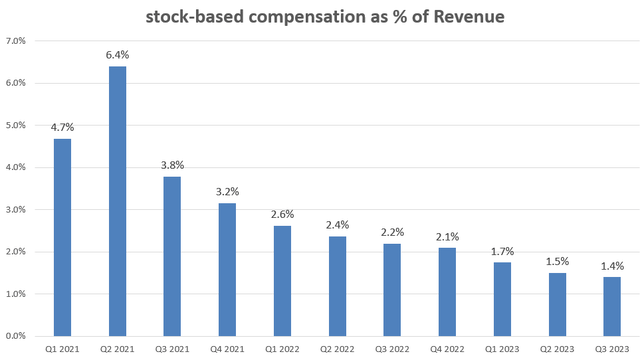

Reducing Stock-Based Compensation

My key takeaway is their profit margin improvement. They achieved flat expense growth for four consecutive quarters while investing in AI-related projects. Additionally, they managed their stock option expenses effectively. As discussed in my introductory article, Palantir’s high stock option expenses impacted their profitability margin in recent years. Controlling and reducing the percentage of stock options to revenue is crucial for Palantir’s margin expansion. In Q3 FY23, their stock-based compensation dropped by 25.8% year-over-year. As illustrated in the chart below, their stock-based compensation as a percentage of group revenue has been declining for several quarters. I believe their management did an excellent job managing these stock-based compensations, crucial for long-term shareholder value creation.

PLTR Quarterly Earnings

Strong U.S. Commercial Deals Driven by AIP

On the earnings call, their management indicated that the deal count in the U.S. commercial business is 2.4 times that of Q3 FY22, and their U.S. commercial business grew by 55% year over year on a dollar-weighted duration basis. They are witnessing the acceleration of larger deals and shorter times to conversion and expansion. They attributed the strong growth to their AIP solutions. Their Chief Revenue Officer, Ryan Taylor, told Reuters that by the end of November, they are on track to conduct boot camps with 140 organizations, and half of those will take place in November. More importantly, the number of users of Palantir’s AI platform almost tripled in the July-September period. I believe their AIP will continue to drive their commercial and government business growth in the coming years. The boot camps that Palantir launched in October have gained tremendous interest from enterprises. These boot camps can help Palantir present their differentiated generative AI technology.

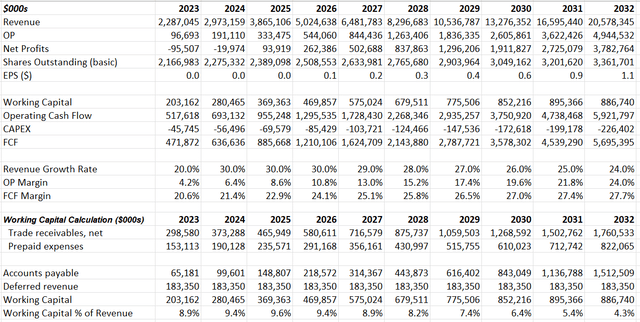

Valuation Update

Given the strong profit margin improvement, I revised their operating margin assumption for FY23, forecasting a 4.2% operating margin. My revenue guidance is at the high end of their full-year guidance. Regarding the margin expansion trajectory, I maintain my initial opinion that Palantir cannot achieve a similar operating margin level as other software companies. Palantir provides many customized projects/systems to clients, and these non-standard software solutions prevent the company from achieving very high profit margins. The revised fair value of their stock price is estimated to be $16 per share in the DCF model.

PLTR DCF – Author’s Calculation

Conclusions

Palantir delivered a robust quarter with significant margin expansion. I am encouraged by their management actions in reducing stock-based compensation. I maintain my “Hold” rating with a fair value of $16 per share.

Read the full article here