There are two ways to be fooled. One is to believe what isn’t true; the other is to refuse to believe what is true.“― Soren Kierkegaard.

Apple Inc. (NASDAQ:AAPL) has the largest market capitalization of any equity in the market at a bit over $2.8 trillion. The shares of the tech giant from Cupertino had a great run in the first half of 2023, but the rally in the equity has stalled out since then and the stock has become rangebound. For a variety of reasons (listed below), the stock seems like dead money at best, which is a negative for Apple shareholders as well as for the overall market.

Seeking Alpha

Negative Growth:

What is amazing about the overall run-up in Apple stock this year is that both revenues and earnings for FY2023 are projected to be down significantly from the same period a year ago. Apple made $6.11 a share of profits in FY2022 on just over $394 million of revenue. The current analyst firm consensus has earnings shrinking to $5.72 a share in FY2023 as sales fall to just over $360 billion.

Valuation:

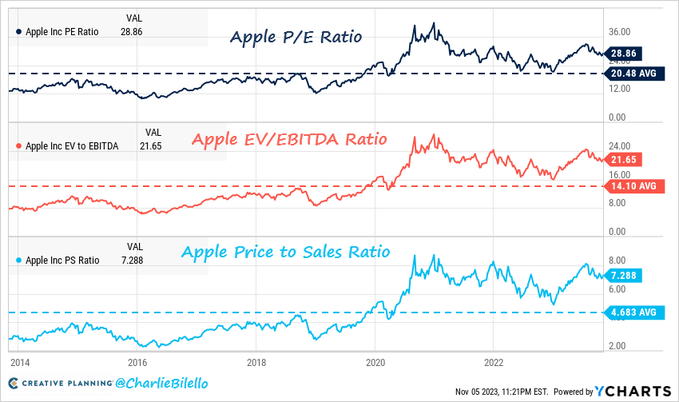

As of last Friday’s close, AAPL is priced at 29 times earnings and 7.3 times revenues. This is substantially above its 10-year average of 20 times profits and 4.7 times sales.

Charlie Biello – Chartered Financial Analyst

Lack Of Risk Premium:

In addition, Apple’s lower valuation metrics of years past were achieved against a much lower “risk-free” Fed Funds rate. Apple’s valuation has moved substantially higher even as the Fed Funds rate has soared since the Federal Reserve started raising rates in March of 2022. At this point, any risk premium to justify holding the stock has completely disappeared.

Fed Funds Rate (Macrotrends)

A Top-Heavy Market:

There has been little breadth to the rally so far in 2023. In fact, the small cap Russell 2000 is slightly in negative territory for the year, as can be seen in the chart of the iShares Russell 2000 ETF (IWM) below.

Seeking Alpha

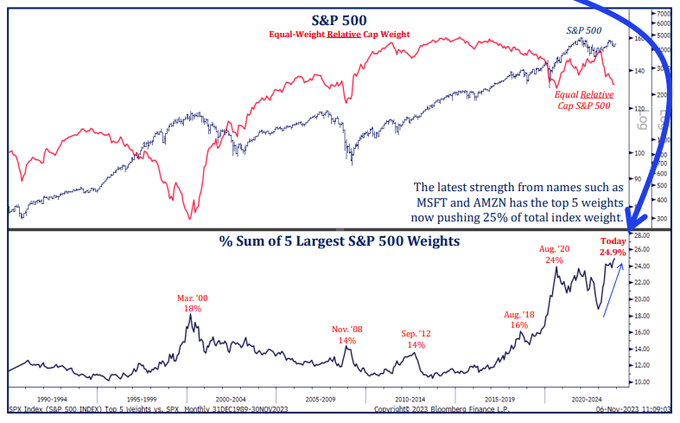

The Invesco S&P 500® Equal Weight ETF (RSP) is also flat for the year. The top 5 largest companies in the S&P 500 now make up 25% of the Index’s overall market capitalization. This is the highest weight ever recorded and much higher than the 18% recorded in 2000, right before the Internet Bust. Whenever this weighting has peaked in the past, a reversion to the mean downside event has occurred. Obviously, if history repeats, this would not be good for Apple shareholders.

Todd Sohn – Technical Strategist

The Ultimate Black Swan:

There are several large geopolitical concerns for the market right now. The largest land conflict in Europe since WWII is over a year and a half year old and has dissolved into a bloody stalemate. The slaughter of over 1,400 Israelis on October 7th has also triggered a bloody invasion of Gaza which may yet evolve into a much wider conflict in the Middle East.

And then we have a real Black Swan, a potential Chinese invasion of Taiwan. While the chances of this scenario seem very low despite much higher speculation in recent months, few companies would be more negatively impacted if this event played out than Apple. Over 95% of the company’s iPhones, AirPods, Macs, and iPads are still made in China, and the country accounts for nearly a quarter of the company’s overall revenues as well.

Conclusion:

There doesn’t seem to be any compelling reason to own Apple at current trading levels. At best, the equity appears range bound and will be “dead money” over the next year. And if things go south for the overall market for a variety of reasons, the stock could easily give up a good portion of the 45% returns they have delivered to shareholders so far in 2023. An investment in risk-free one-year treasuries is yielding north of 5.3%, compared to Apple’s paltry dividend payout of just over one-half of one percent. Therefore, this seems a much more prudent bet for investors at this moment.

The person who writes for fools is always sure of a large audience.”― Arthur Schopenhauer.

Read the full article here