Investment Thesis

The Trade Desk (NASDAQ:TTD) delivers investors a rare negative surprise. This stock was deemed immune to competitive pressures and had been on a tear in 2023.

And as long as the share price was going up, nobody was going to be asking difficult questions about the investment. But now that the company has delivered unappetizing guidance for Q4, all of a sudden all those pesky considerations that investors had but weren’t voicing now abound in a clamor.

According to my estimates, TTD stock is priced at 27x forward EBITDA. A multiple that is too high for a stock that will struggle to grow in the low-20s% in 2024.

Quick Recap

In my previous analysis, I said:

Given where expectations are, I believe that paying more than 45x this year’s EBITDA for The Trade Desk doesn’t leave new investors with much upside potential. Amongst advertisers, I see several more compelling investment opportunities.

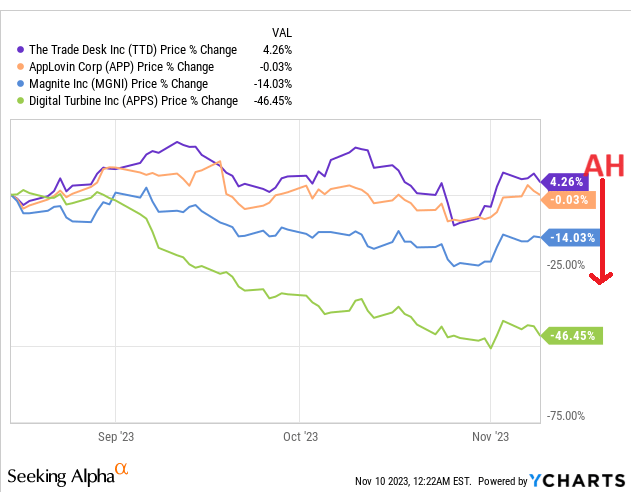

YCHARTS

The reference I was making at the time was to AppLovin (APP), a stock that I’ve been recommending since 15 August 2023. Its performance is flat since my recommendation. Not the best return for a stock, of course, but the best of its peer group to the best of my knowledge.

The Trade Desk’s Near-Term Prospects

TTD highlights partnerships with major retailers like Walmart, Albertsons, Walgreens, and Dollar General. The company envisions continued growth in the retail media sector, with retailers leveraging data to help global brands sell products more effectively. The trend involves retailers adopting bold strategies, spurred by economic pressures, leading to mutually beneficial outcomes for TTD, retailers, and advertisers.

In the realm of connected TV (”CTV”), TTD anticipates sustained growth due to the increasing choices available to consumers in the streaming world.

In line with its custom, TTD describes the role of programmatic advertising in supporting content providers’ growth, especially as consumers seek more affordable alternatives for accessing quality content. TTD emphasizes the significance of ad-funded models, highlighting Disney’s (DIS) and Netflix’s (NFLX) recent path, asserting that the key to sustaining revenue growth lies in making ads more relevant. The adoption of Unified ID 2.0 (UID2) is seen as a crucial step in achieving this relevance in a cookie-less world.

OpenPath, TTD’s initiative, plays a vital role in providing a direct route for publishers to connect with the platform. This is particularly beneficial for connected TV, creating a cleaner supply chain and enhancing the overall integrity of the ecosystem.

Recall, OpenPath makes it easier for publishers to work with The Trade Desk, giving them a direct route to make their ad space available on the platform. This can be especially beneficial for publishers in the connected TV space, ensuring a cleaner and more direct supply chain for their advertising inventory.

That’s the bull case described. Now, let’s turn to discussing The Trade Desk’s financials.

Revenue Growth Rates Decelerating

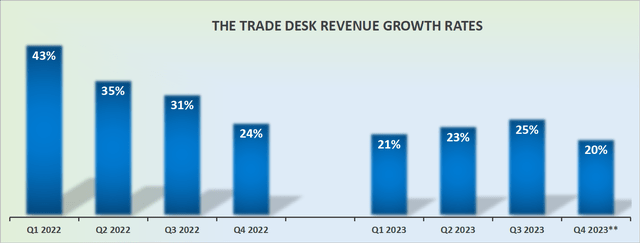

TTD revenue growth rates

TTD guides for about 20% CAGR for Q4. CEO Jeff Green used its earnings call to highlight the underlying reality that for the past several years The Trade Desk has been able to deliver impressive growth rates, even as the rest of its peer groups saw their market shares compress.

This is undoubtedly true. Nevertheless, the fact is that TTD isn’t immune to underlying vicissitudes of the market, and it had been carrying a premium on its stock on the expectation that it was immune.

What’s even more disconcerting is that Q4 should have been up against easier comparables with the prior year, and that’s what negatively surprised investors.

Naturally, looking out into 2024, it now appears that analysts may have been too bullish on their consensus revenue estimates.

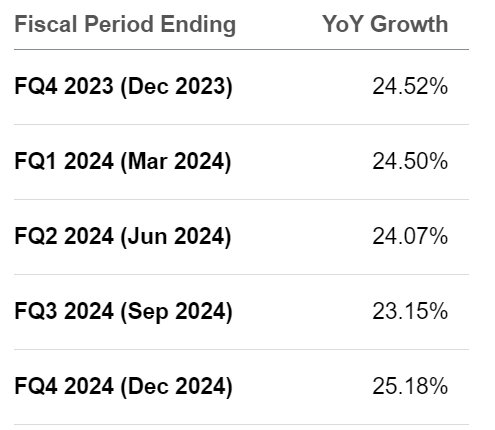

SA Premium

As we went into the earnings results, the expectation was that TTD would grow by at least the mid-20s% CAGR. And now?

Now, I suspect that low-20s% CAGR is a much more realistic figure. And this reinforces the underlying bearish argument that The Trade Desk’s growth rates are decelerating.

TTD Valuation — 27x Forward EBITDA

In my previous analysis, I said:

We now know that H1 2023 saw The Trade Desk deliver $288 million EBITDA, slightly higher than my prior estimate. And we also see that The Trade Desk guides for at least $185 million for Q3, so, let’s assume that the final figure will come in at $205 million.

Altogether, I suspect this will mean that The Trade Desk will report around $830 million of EBITDA in 2023. Slightly higher than I had previously estimated. (Emphasis added)

The problem that TTD now has is one of negative operating leverage. When its revenues were growing very fast, all the excess topline growth dropped to the bottom line as EBITDA.

But now that TTD is expected to grow at a slower clip than many, myself included previously estimated, this means that its underlying profitability will be even more meaningfully impacted.

Case in point, even a small amount of deceleration, even in just the final quarter of the year can have a lopsided impact on TTD’s full year 2023 EBITDA.

According to its latest guidance, it now appears that TTD will probably end up reporting about $790 million of EBITDA in 2023, down from my previous estimate of $830 million.

That being said, TTD is always conservative with its guidance, so let’s assume that TTD actually delivers about $800 million of EBITDA.

This now leaves TTD priced at 35x this year’s EBITDA. Let’s assume that TTD will grow its EBITDA by around 20% in 2024. This would make TTD likely to deliver $1 billion of EBITDA, thereby pricing its stock at 27x forward EBITDA.

I don’t believe this valuation is justified, not when there’s a realistic concern that TTD could be struggling to grow even the low-20s% CAGR.

The Bottom Line

The Trade Desk faces a challenging landscape marked by competitive pressures and a valuation that appears disconnected from the realities of its growth outlook.

The recent negative surprise in growth rates brings to the fore concerns about its future performance. The premium attached to its stock, once justified by robust growth, now seems precarious as the market dynamics evolve.

Altogether, I don’t believe TTD should be valued at 27x forward EBITDA when its peers are priced below 20x EBITDA. Particularly since it now appears that The Trade Desk isn’t likely to grow higher than 20% to the low 20s% CAGR in 2024.

Read the full article here