In this article, we discuss the latest quarterly results from the Business Development Company Ares Capital (NASDAQ:ARCC). The company delivered a very strong 4.9% total NAV return over the quarter as well as a rise in core earnings.

ARCC trades at a 10.1% dividend yield and has a core earnings yield of 12.4%. Its valuation is 100% as of this writing.

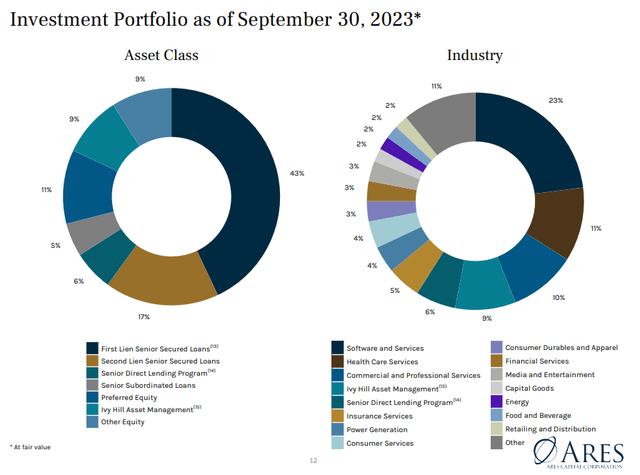

ARCC’s sector allocation is fairly typical of BDCs with software and healthcare being the key areas. It has a lower first-lien portfolio than the average BDC with a focus on larger companies than the traditional middle-market BDC borrowers.

ARCC

Quarter Update

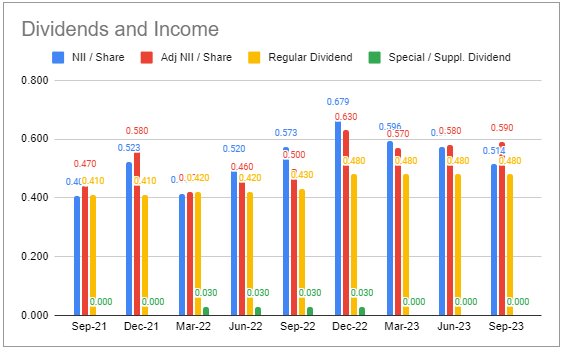

Core earnings ticked higher by a penny to $0.59 and stand 18% higher year-on-year. Slightly higher base rates continue to support earnings though at a much lower pace compared to the preceding quarters.

Systematic Income BDC Tool

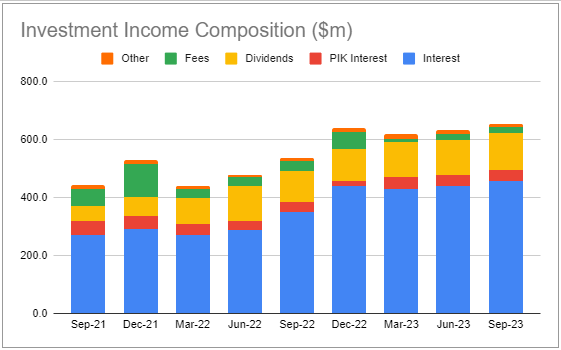

Total investment income has moved out to a new high – above the previous high in Q4 of 2022. The company’s net income profile has a clear seasonality with a high level of fees in Q4 as companies race to push deals over the line. ARCC expects another bumper Q4 though they don’t expect the level of fees to exceed previous Q4 levels.

Systematic Income BDC Tool

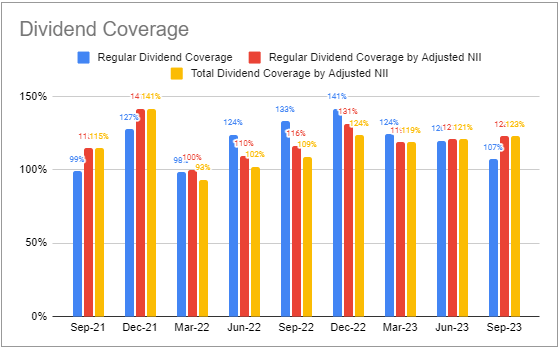

ARCC kept the dividend unchanged at $0.48 for the fifth quarter in a row. Coverage has now risen to 123%. So while the company has a 10.1% dividend on NAV its core net income yield on NAV is 12.4%.

Systematic Income BDC Tool

In addition to the high coverage of 123%, spillover was $1.18 per share or close to 2.5 quarters of the regular dividend. High dividend coverage and a high spillover should support the dividend over the medium term.

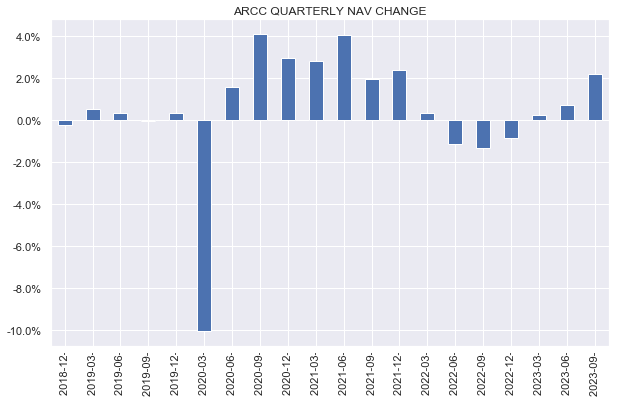

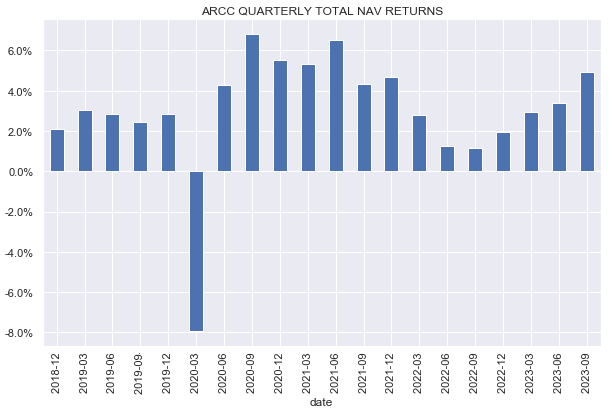

The NAV rose by over 2% – the largest gain since 2022. This was because unrealized appreciation exceeded realized losses.

Systematic Income

However because net income has also grown since 2022, the total NAV return was the best since Q2-2021.

Systematic Income

Income Dynamics

In this section, we highlight some of the key factors that will drive net income over the medium term.

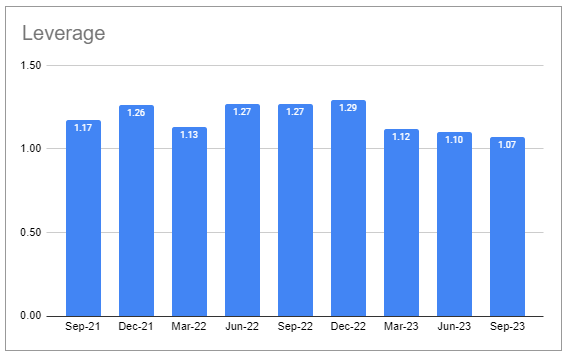

Leverage continued to fall – dropping for the third quarter in a row. This is somewhat in contrast to a credit market that ARCC has described as very attractive. Management described the leverage level as being at the lower end of the target range. Overall, a modest level of leverage does not detract a whole lot from net income given the marginal asset faces a hurdle of 8% (without counting incentive fees) before contributing to net income.

Earlier in the year Ares bought a portfolio of bank loans from PacWest. Keeping some dry powder in reserve allows the company to pursue large opportunities that it otherwise may not be able to.

Systematic Income BDC Tool

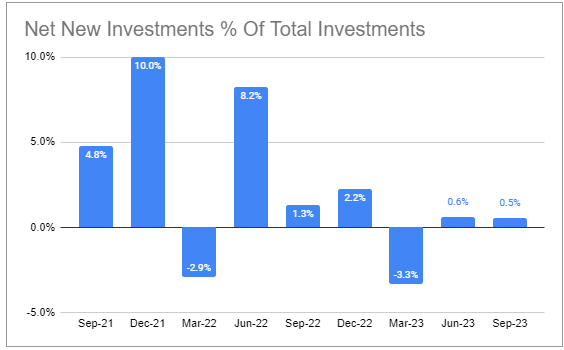

Net new investments were slightly above water. A modest level of new investments together with a flatlining in base rates largely explains a stall in the company’s net income trajectory.

Systematic Income BDC Tool

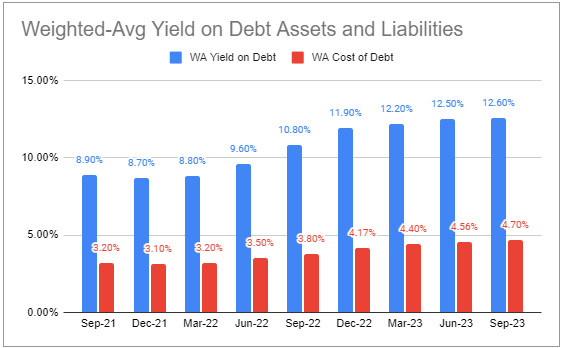

Asset and liability yields continued to increase primarily due to a further rise in short-term rates. The new bond marginally increased the company’s interest expense – something we discuss in more detail below.

Systematic Income BDC Tool

ARCC’s cost of debt remains one of the very lowest in the sector, giving it a continued competitive advantage. Debt maturities coming up in 2024 will not materially increase the company’s weighted average interest expense given where the company can refinance debt today.

While credit spreads tightened, they remain above historic averages according to ARCC. This should allow the company to replace repayments with wider spread loans, further contributing to net income.

The New Bond

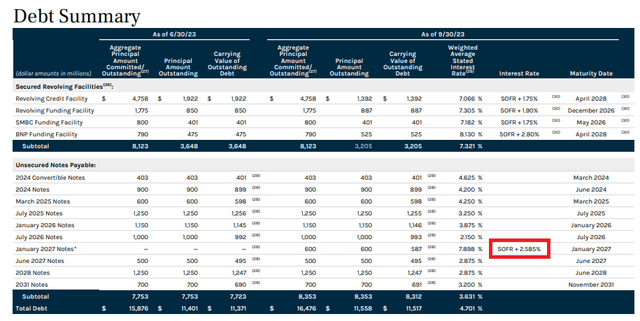

In July, ARCC issued a $600m 7% unsecured bond. Recall that the 3.5% $750m bond matured in 2023 and, at the time, around half of the principal was soaked up by increasing the credit facility with the rest being repaid in cash.

What’s very interesting is that this new $600m bond 1) is relatively short-dated, being just over three years to maturity, and 2) was swapped out to a floating rate of SOFR + 2.585%.

ARCC

The presentation said that the bond was swapped to better align with the portfolio’s floating-rate profile. Investors shouldn’t take this at face value. If ARCC really wanted to align its liabilities with its portfolio, it would have swapped the other bonds as well.

The reason the other bonds weren’t swapped out was because the coupons on them were amazingly low – the lowest being just 2.15%. In any case, we should be very glad this didn’t happen since the company’s interest expense would be much higher than it is now.

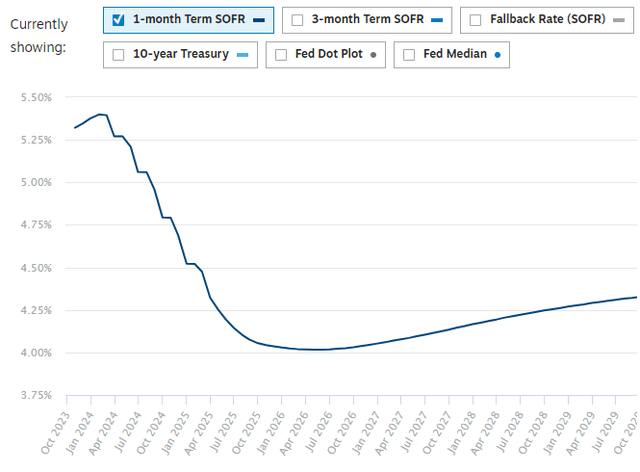

The reality is closer to a market call – ARCC likely believes that SOFR will be lower than the forward rate of 4% by the maturity of the bond. In other words, by swapping it out to 1M SOFR + 2.585%, ARCC expects to pay less on the bond overall than if they had left it at 7% fixed. However because the market views it as very likely that short-term rates will move lower, ARCC is required to pay 7.9% on the bond/swap package at the start or nearly 1% above the bond’s fixed rate.

Chatham

On net, as a result of this situation, ARCC’s interest expense has risen marginally for four reasons. One, they are refinancing a 3.5% bond with a 7% bond.

Two, the yield curve was inverted when the bond was priced meaning the company chose to pay around 0.25% more by issuing a +3-year bond than the typical 5-year bond.

Three, they are moving borrowings from the credit facility to an unsecured bond. This will be more expensive as the credit facility is secured and soaks up commitment fees. For instance, the bond is swapped out to SOFR + 2.585% whereas its largest facility carries a rate of SOFR + 1.75%.

And four, net interest expense increased further on day 1 by around 0.9% because of the interest rate swap.

Ares is clearly aware of the economic impact of these choices so it is interesting that they have made them anyway. Overall, Ares remains a BDC with one of the lowest levels of interest expense, in part due to its investment-grade rating as well as an unusually large proportion of unsecured fixed-rate debt, much of which was issued at favorably low rates.

Portfolio Quality

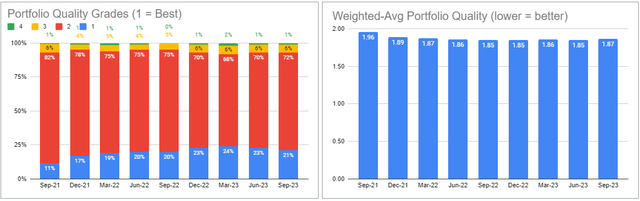

Portfolio quality, as indicated by internal ratings, worsened slightly, however, this was due to holdings moving from the highest rating bucket to the second-highest bucket.

Systematic Income BDC Tool

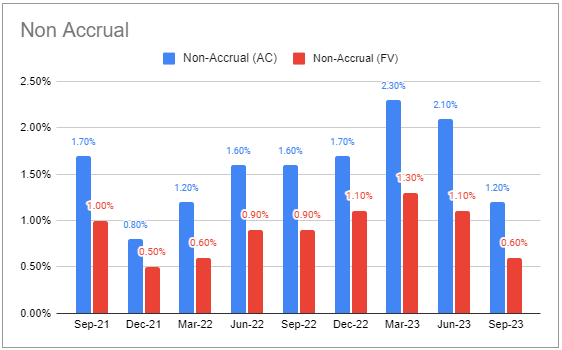

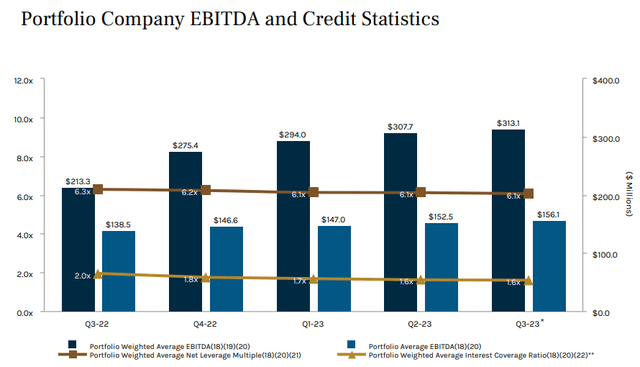

Non-accruals fell further as a result of a couple of restructurings and charge-offs.

Systematic Income BDC Tool

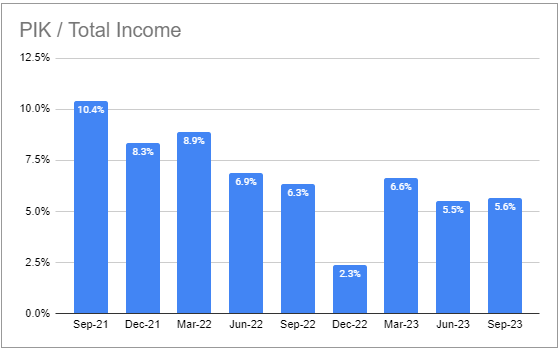

PIK remained stable.

Systematic Income BDC Tool

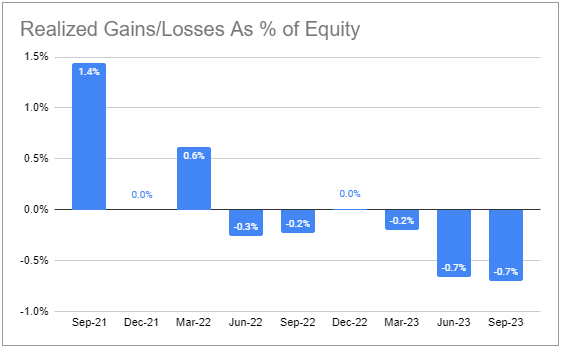

There was another modest amount of realized losses.

Systematic Income

Both weighted-average portfolio leverage and interest coverage remained stable.

ARCC

Amendment activity and modifications remained stable at historical levels.

Return And Valuation Profile

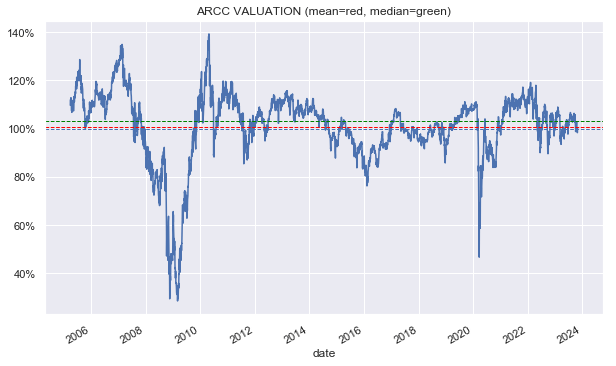

ARCC is trading slightly below its long-term average and a bit more below its long-term median valuation.

Systematic Income

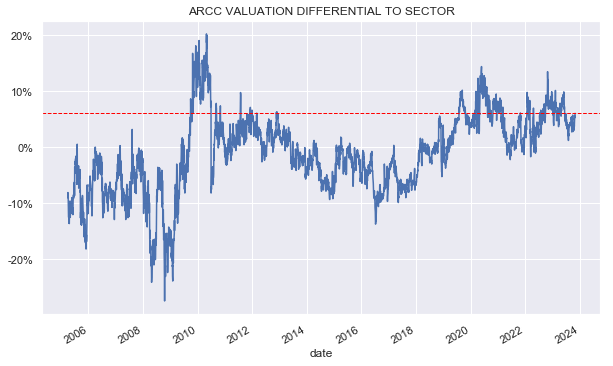

Its valuation is somewhat elevated relative to the sector historically however this is justified based on its track record for the last 3-5 years.

Systematic Income

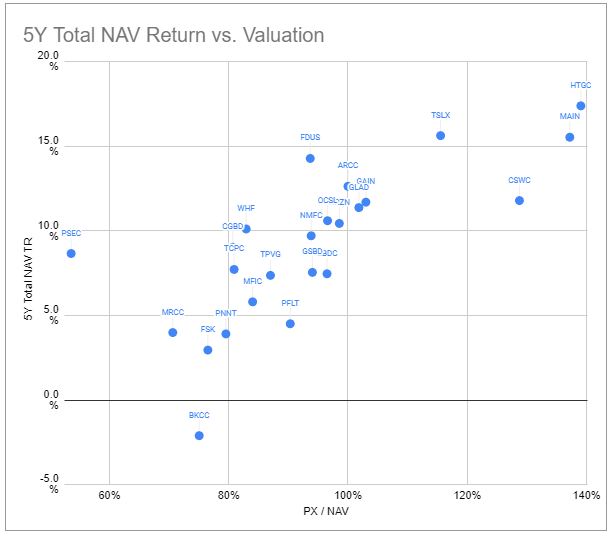

In our coverage, only one BDC with a higher 5Y total NAV performance is trading at a lower valuation than ARCC. However, quite a few BDCs with a lower return trade at higher valuations.

Systematic Income BDC Tool

Stance And Takeaways

ARCC remains an attractive hold in the sector for several reasons. It is highly diversified with 490 companies – well above a median of around 130. It is also focused on larger companies that provide good diversifiers to the traditional middle-market BDC borrowers.

In our last update, we suggested investors wait for a valuation pullback below 100% either due to market volatility or due to a secondary offering which ARCC frequently carries out when it trades at a premium. This time it was a broad market pullback which pushed the stock back to “par” and we view it as a decent time to add.

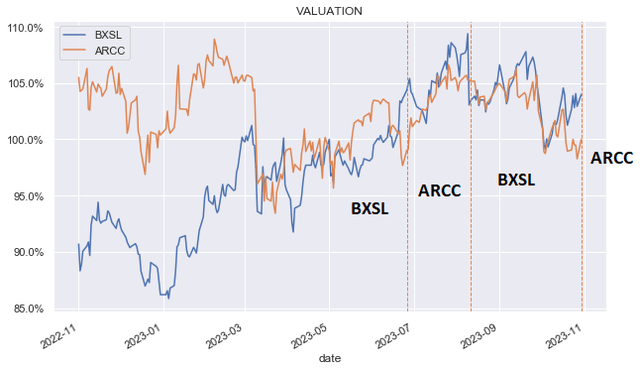

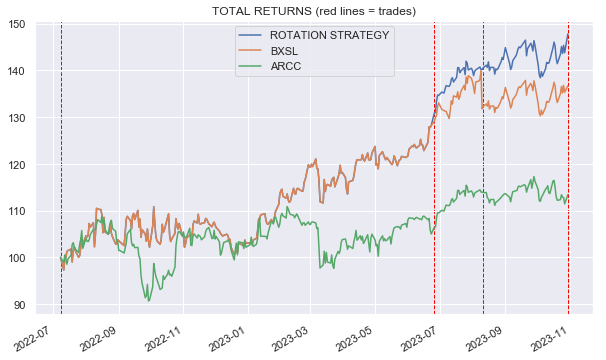

We also like to swap the stock against BXSL. The chart below shows the timing of the trades.

Systematic Income

This chart shows the time series results, highlighting that this simple rotation strategy has outperformed both stocks.

Systematic Income

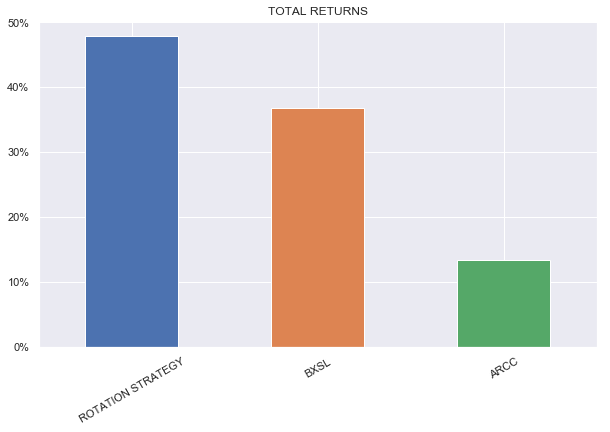

And this chart summarizes the overall performance.

Systematic Income

We have recently moved back to ARCC as its valuation remains quite a bit below that of BXSL. We expect ARCC to deliver a strong Q4 as deal seasonality kicks in and results in a jump in fee income.

One risk is that public credit spreads have widened since the end of the quarter and this poses some risk to the unwinding of Q3 unrealized appreciation. As the CEO highlighted, defaults are also likely to go up next year which can put pressure on both book value and net income. That said, ARCC remains an attractive hold in the sector at current valuations.

Read the full article here