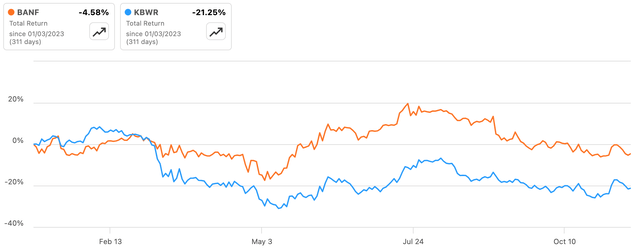

Shares of Oklahoma-based BancFirst (NASDAQ:BANF) have been relatively flat year-to-date, as a wave of potential issues continues to wash over the banking industry. Nevertheless, this ‘super community’ bank has still outperformed peers by a fairly wide margin this year – a continuation of a longer-term trend that has seen its stock compound nicely for investors over the years. While BancFirst is one of the more structurally profitable small banks and deserves a spot on investors’ watchlist, these shares are nonetheless a hard sell at their current valuation.

Source: Seeking Alpha

BancFirst primarily operates in Oklahoma, with its state-wide footprint ultimately amounting to a circa 7% deposit share. It also has exposure to the Dallas and Fort Worth metro areas via the acquisitions of Pegasus Bank (~11% of total assets) and Worthington Bank (~4%).

One point to like about BancFirst is its deposit base. Small banks obviously find it tough to stand out from the crowd given how commoditized their bread-and-butter businesses are, and funding costs are one of the few ways they can differentiate themselves. Despite balances coming under pressure, non-interest bearing (“NIB”) accounts still accounted for around $4.2 billion of BancFirst’s deposits as of Q3, which is good for a circa 40% share of the overall mix. Cumulative cycle-to-date deposit beta on overall deposits (i.e. the proportion of rate hikes passed through to depositors, including NIB deposits) was still around 35% as of Q3, which will stack up well against the peer group.

Now, margin compression has obviously been a massive headwind for the industry this year. Smaller banks in particular have been hit hard, with the failure of SVB and others significantly driving up funding costs as these banks battled to retain deposits. As of Q3, BancFirst’s deposits had fallen by around $440 million, or 4%, at the start of the year, with a steeper decline in NIB deposits (down circa ~15% year-to-date) offset by a rise in interest-bearing savings and time deposits. Average yields on its interest-bearing accounts have also increased sharply throughout the year.

Net interest margin (“NIM”) slipped 14bps sequentially in Q3, which represented an acceleration in Q2. Although the decline in NIB balances has continued to moderate – falling 2.6% QoQ versus 5.6% in Q2 and 8.2% in Q1 – annualized total deposit costs increased by around 40bps sequentially while loan growth also slowed. I expect that trend to compress NIM and net interest income again in Q4, albeit the Fed looks to be done hiking so pricing pressure should also begin to ease. Other than that, I don’t really have any concerns with the bank’s deposit base. Uninsured deposits are less than 30% of the total here and liquidity is ample, including over $2 billion in cash that is currently earning the effective Fed funds rate.

Where the bank is showing some additional softness is in its non-interest income generation. Like a lot of its peers, this is only around 30-35% of total revenue and comes from the usual sources. Those include treasury fees, trust services, non-sufficient funds fees, overdraft fees, and so on. The bank also has a nice line in P&C insurance brokering, which provides reliable commission-based income free from underwriting risk. However, its largest source of fee income is from debit card swipe fees. This is where the bank is facing an extra headwind as its recent crossing of the $10 billion total asset mark has opened it up to the Durbin amendment of the Dodd-Frank Act. This amendment essentially caps interchange fees for banks above that $10 billion total asset size.

For BancFirst, this came into effect at the start of Q3 and essentially amounts to a circa $22 million hit to annual income. This is also why pre-provision operating profit declined by high single-digits sequentially in Q3 despite reasonably resilient NII and operating expense performance. This is going to affect year-on-year comps for a few more quarters, and with deposit pricing pressure still feeding through, I also expect another quarter or two of sequential earnings declines before things begin to stabilize early next year.

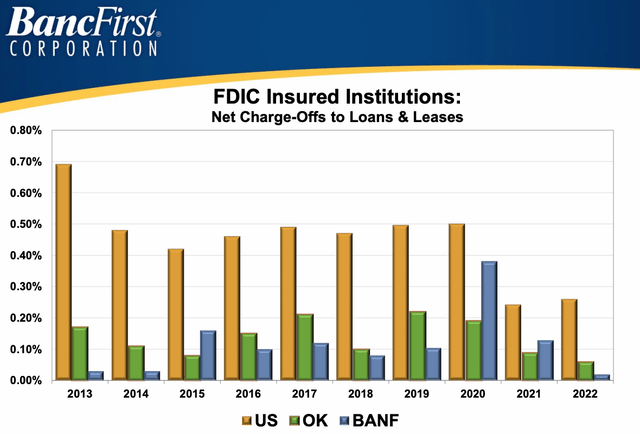

One area I am less concerned about is credit quality. Non-owner-occupied commercial real estate and construction loans together make up around 30% of the bank’s loan book (~2x tangible common equity), and these are areas of general market concern. However, I would point out that BancFirst has a very good track record and charge-offs have typically landed well below the peer group average. Nonaccrual loans still remain modest at circa 22bps, with loss reserves prudent at around 1.3% of total loans. Another point to note is that the bank is typically quite sensitive to oil & gas prices both directly (circa 8% of total loans) and indirectly due to the economy of its operating geographies. Oil is still hovering around the $80 per barrel mark which is providing nice support to credit quality.

Source: BancFirst Corporation Earnings Presentation

Aside from its soft income outlook, the main problem for the stock is that the valuation hasn’t really contracted enough to reflect its earnings outlook. At around $82.75 currently, BancFirst is still trading for around 2.4x tangible book value per share (“TBVPS”). Sure, it earned an 18% return on tangible common equity last year, and its through-the-cycle profitability is also typically very good. While that makes BancFirst a good small bank, EPS looks very likely to fall significantly next year and its ROTCE will likewise dip. Paying 2.4x TBVPS for that outlook doesn’t really point to much upside. Similarly, while the bank has paid growing dividends for 30 straight years now, its payout ratio is still only around 30%. The implied yield of around 2% is not going to entice investors when they can grab 5%-plus from short-term Treasuries.

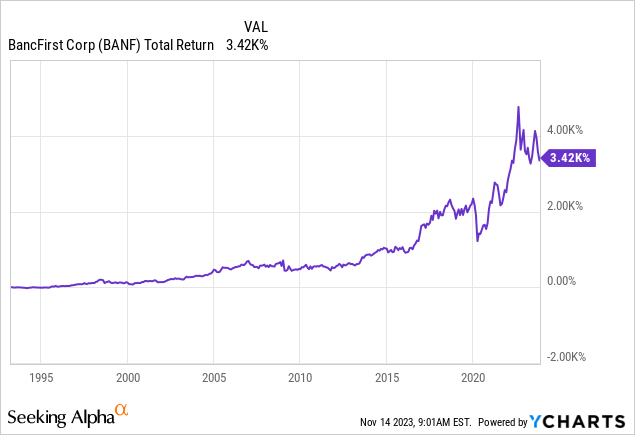

BancFirst is a real ‘Steady Eddy’ stock. It has a great track record through multiple cycles as you can see from the chart of its long-term total returns. But with its stock at 2.4x TBVPS and lacking near-term growth drivers, I think there will be better points to buy in 2024-2025. For now, I would keep this one on your watchlist.

Read the full article here