There is a compelling case to be made that the Federal Reserve’s strategy of raising short-term interest rates is actually exacerbating, rather than reducing, inflation. However, we believe that this is not the case and that the Fed’s policy of dramatically hiking interest rates is effectively beating down inflation. In this article, we will look more closely at both viewpoints and then share our approach to investing in the current interest rate environment.

Why Fed Rate Hikes Could Be Successfully Fighting Inflation

The view that rate hikes by the Federal Reserve successfully fight inflation is based on the premise that when the Federal Reserve raises interest rates, it becomes more expensive to borrow funds for investments, home and car purchases, and other major purchases. Moreover, it becomes more attractive to save rather than to spend money, further increasing the opportunity cost of purchasing rather than saving in these environments.

As a result, businesses and individuals tend to reduce their spending leading to a decrease in aggregate demand. This leads to a greater amount of supply relative to demand, pushing prices down. Additionally, higher interest rates tend to push the value of the dollar up relative to other currencies since it becomes more attractive to invest savings in dollars due to its higher yield. As a result, imports become cheaper for U.S. consumers and businesses, further suppressing prices.

Why Fed Rate Hikes Could Be Making Inflation Worse

The counterargument that Fed rate hikes are actually making inflation worse centers around a few key points:

- The impact of rising short-term rates is muted because many consumers and companies have locked in low long-term interest rates, meaning their balance sheets are not being significantly impacted by the Fed’s interest rate hikes.

- These higher rates have increased interest income for those companies and individuals with significant cash reserves, leading to more money circulating in the economy.

- A major consequence of increased mortgage rates is a housing supply shortage, as those with low-rate mortgages are less inclined to sell, thereby keeping housing prices high, significantly driving up inflation metrics (given that the cost of housing is heavily weighted in inflation indexes) in the process.

In fact, the overall impact of rate hikes on consumer finances has been relatively minor, with only a negative $5B estimated annualized net impact on annualized U.S. consumer spending thus far. As a result, it appears that the main impact of rate hikes thus far has been on reducing new real estate development, further exacerbating the supply-demand mismatch in the housing market and boosting inflation in the process. If the Fed were to slash interest rates, it would open up the housing markets, leading to a flood of new supply which in turn should help alleviate the inflationary pressures being felt in the segment.

Our Approach

Our view is that, while the argument that Federal Reserve rate hikes might exacerbate inflation is an interesting perspective, it is ultimately flawed when assessed from a broader economic perspective:

-

Ignores the Lag Effect: the argument that rate hikes exacerbate inflation focuses entirely on the immediate short-term impact of rate hikes, such as its minor estimated annualized net impact on consumer spending, but fails to take into account the fact that the effects of monetary policy often have a lag before their full impact is felt in the economy. As a result, it is crucial to consider the medium to long-term consequences of Fed rate hikes, as these policy changes will take time to have their intended effects on inflation.

-

Oversimplifies the Housing Market: the view that higher mortgage rates contribute to a housing supply shortage, which in turn drives up housing prices and inflation metrics. While it is true that higher mortgage rates can deter some potential homebuyers, it oversimplifies the complex dynamics of the real estate market where factors like housing construction, labor costs, and land availability also play significant roles in determining housing supply. Blaming rate hikes alone for a supply shortage overlooks these other crucial factors and fails to take into account the sharp decline in demand that higher mortgage rates are having as well.

-

Lacks Consideration of the Global Economy: the argument focuses primarily on domestic factors and ignores the interconnectedness of the global economy. Higher U.S. interest rates can attract foreign capital, strengthening the U.S. dollar and making imports cheaper, thereby fighting inflation by increasing the supply of cheaper imported goods.

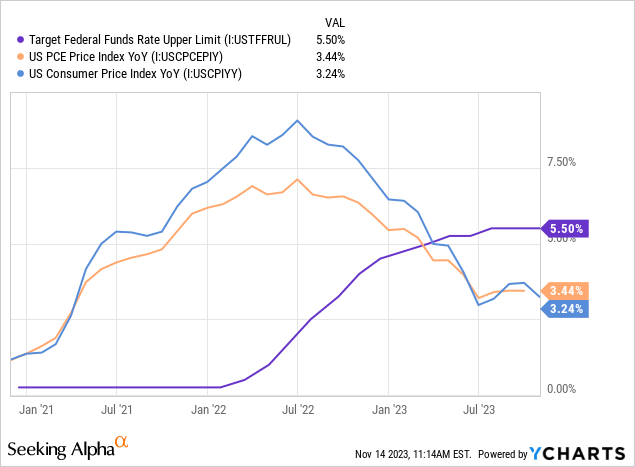

- Ignores the Evidence: Last, but not least, the evidence is clear that inflation is coming down meaningfully. After peaking in the summer of 2022, inflation has tumbled pretty consistently since then. Yes, it is still well above the Fed’s 2% long-term target rate, but it is definitely headed in the right direction even as the Fed has been hiking interest rates aggressively. If aggressive Fed rate hikes were actually fueling inflation, then we would expect to see a very different chart than the one below:

As a result, we fully expect inflation – including housing costs – to continue to subside in the coming months and years, leading to eventual interest rate cuts.

Investor Takeaway

The contrarian perspective on the Federal Reserve’s rate hike strategy – suggesting that it might be exacerbating inflation – sounds interesting, but is ultimately flawed in our view because it ignores the lag effect of Fed rate hikes, oversimplifies housing market dynamics, fails to incorporate the deflationary impact of a stronger U.S. dollar, and ultimately ignores the clear evidence that we are seeing from inflationary trends since the Fed began to raise interest rates.

As a result, we are weighting our portfolio towards investments that are poised to profit from falling inflation and interest rates while also weathering a recession should one hit the economy. In short, this means that we are avoiding high-flying tech stocks like the “magnificent seven” (AAPL)(META)(AMZN)(NVDA)(TSLA)(GOOG)(MSFT) as well as larger market indexes (SPY)(QQQ) that remain significantly overvalued.

Instead, we are aggressively investing in deeply undervalued utilities, yield cos, and infrastructure businesses (XLU) as well as REITs (VNQ) that remain fundamentally sound but have been beaten down due to concerns over rising interest rates. Some of our favorite picks of the moment include Realty Income (O), Crown Castle (CCI), Brookfield Infrastructure Partners (BIP)(BIPC), and Brookfield Renewable Partners (BEP)(BEPC). For more speculative investors, NextEra Energy Partners (NEP) (backed by its blue-chip parent NextEra Energy (NEE)) could potentially deliver exceptional total returns assuming that interest rates due indeed begin to subside in the coming years and management can successfully execute on its business and capital structure simplification plans.

Read the full article here