In China, the largest market for electric two-wheelers, Niu Technologies (NASDAQ:NIU) has become symbolic of premium e-vehicles – those with better performance and advanced tech features. But the going has not been easy, first with Covid lockdowns and shortages, then inflation and now a possible slump in economies abroad along with a fitful recovery at home.

Niu is just emerging from a down period. And with the long-term potential of electric micromobility unchanged, including its nascent premium segment, the stock is priced at a discount it does not deserve.

Sales update

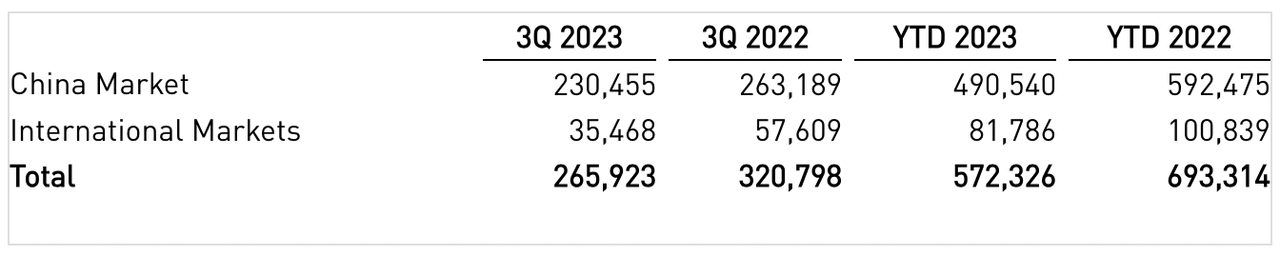

Although the quarterly results will only be reported on November 20, the sales data for the latest Q3 of 2023 is out. The total number of units sold decreased 17% year-over-year, more so in International Markets (-38%) and less in China (-12%).

Niu

The comparison quarter-to-quarter, versus Q2 of 2023, is more favorable: +28% for China (179K units) and +6% for International Markets (33K units). That said, year-to-date sales are still down 17% so far. It is probable then that the outlook for full year’s volume (1-1.2M units adding 20%-45% vis-a-vis 2022) may not be realized.

The guided revenue for Q3 of CN¥1.15b-CN¥1.37b, which would keep the momentum from the beginning of the year (Q1:CN¥417m; Q2:CN¥829m) positive and add 0%-15% year-over-year, looks like a stretch.

Stakes

In 2022, Niu sold 831,593 units in total and generated CN¥3.1b in revenue, which placed it among the top names in the two-wheeled electric vehicles space in Mainland China as compiled by Frost & Sullivan. In 9th place, it accounted for 2.7% of the market.

That may not look all that impressive until one considers that these top nine account for over 80% of the entire lot of about a hundred makers. Not only was Niu – the youngest company on the list founded in 2014 – able to beat this competition but about two thousand more manufacturers operated before the implementation of new certification rules in 2019.

|

Ranking |

Company |

Profile |

Revenue |

Market share |

|

1 |

Yadea |

Founded in 2001; Hong Kong listed |

CN¥31.1b |

26.9% |

|

2 |

Aima |

Founded in 1999; Shanghai listed |

CN¥20.8b |

18.0% |

|

4 |

Sunra |

Founded in 1999; Shanghai listed |

CN¥4.9b |

4.2% |

|

5 |

Luyuan |

Founded in 2003; Hong Kong listed |

CN¥4.8b |

4.2% |

|

9 |

Niu |

Founded in 2014; NASDAQ listed |

CN¥3.1b |

2.7% |

Note: The missing positions are held by private companies whose financials have not been publicly disclosed.

Source: Frost & Sullivan, Luyuan

Niche

Niu, whose current capacity does not exceed 2 million units, clearly pales in comparison to the likes of Yadea Group (OTCPK:YADGF) and Aima Technology (SHA:603529), behemoths producing and selling tens of millions of electric two-wheelers every year. Since such a vast scale is unattainable, Niu has set up a niche in the premium segment. And it is doing pretty well for itself.

The unique selling points of Niu’s brand – mostly electric scooters and motorcycles – have been performance, design and smart features. Its new launches continue to gather outsized attention even through the thick of China’s consumer slump. The growth trend in overseas markets, although still a small percentage of overall business, has been encouraging.

Revenue grew at a compound annual rate of 15.6% between 2018 (CN¥1.5b) and 2022. Profitability has suffered just recently: Niu slid into the red in 2022 after three years of making profits. Analysts predict the company to get back to profitability as early as the end of this year or 2024.

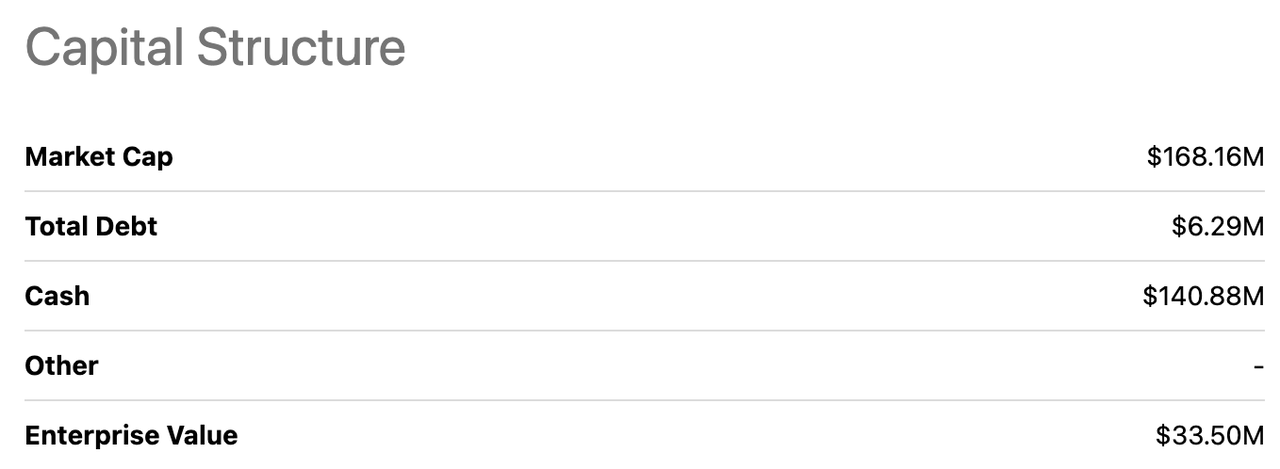

Low debt and ample cash have kept the balance sheet healthy. Debt-to-equity reduced from 98% all the way to 3.2% in the last five years. As of mid-2023, there was net cash of CN¥981m. Total liabilities amounting to CN¥1.1b are more than covered by liquid assets.

Valuation

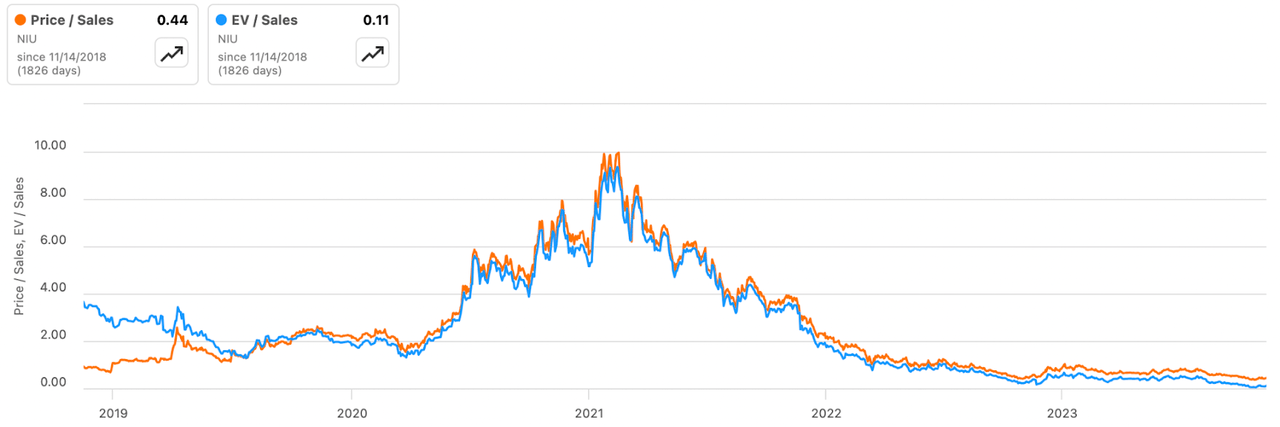

At this time, Niu’s valuation is a big draw. Current metrics are near an all-time low. Price to Sales (TTM) is 0.4; Enterprise Value to Sales (TTM) is a lowly 0.08 compared to median 1.1 of the Consumer Discretionary sector.

Given the company’s net cash position, the enterprise value is much smaller than the market cap. The resulting low Enterprise Value to Market Cap ratio is reflective of the relative safety of the investment. Since net debt is negative, enterprise value is also less than total equity of CN¥1.3b.

Seeking Alpha Seeking Alpha

Conclusion

Niu is now down 55% this year. For a quick comparison, look at Gogoro (GGR), the Taiwanese maker of electric scooters which has lost only 20%. Although Niu does not possess Gogoro’s moat in the form of a battery swapping network, it is attempting to increase its share of non-hardware sales (which make up less than 8% of total at present) through proprietary accessories, spare parts, general merchandise as well as app subscription services that focus on insurance and diagnostics.

More importantly, Niu has a wider appeal with a larger selection of electric vehicles. It is a more established player, selling many more units at a lower cost. That translates to better operating margins.

All in all, it does seem like Niu had been punished too harshly, for setbacks caused by external factors affecting costs (like batteries) and consumer sentiment (like currency fluctuations). These risks will remain but the company seems capable of resuming growth. After all, electric micromobility is an area with much left to offer, in China, surrounding Southeast Asia and beyond. And Niu already has its share carved out.

Read the full article here