In January, Pure Storage, Inc. (NYSE:PSTG) drew my interest due to its data storage solutions tailored to growing data needs, with forecasts projecting an 8.5% growth in the next-gen data storage market, reaching $81 billion by 2025. Its storage-as-a-service model boasts robust gross profit margins and their easy to scale solutions are less space and energy-intensive than legacy companies. Investors have realised a 41.23% return since my initial coverage. The company’s steady revenue and profit growth over the past five years, coupled with positive FY 2024 projections, reinforce my positive outlook.

Stock trend history (Seeking Alpha)

I remain optimistic about this company despite FY2023 marking its first and only profitable year. The ongoing investments in its solutions, rising demand, and consistent double-digit annual recurring revenue growth suggest promising long-term potential, reinforcing my bullish outlook.

Company updates

In my earlier article, I give an overview of Pure Storage, highlighting its focus on addressing the urgent need for data storage with its innovative pure flash storage solutions. Year to date, the company’s customer base has expanded impressively to over 12,000 clients, with a substantial 59% comprising Fortune 500 companies.

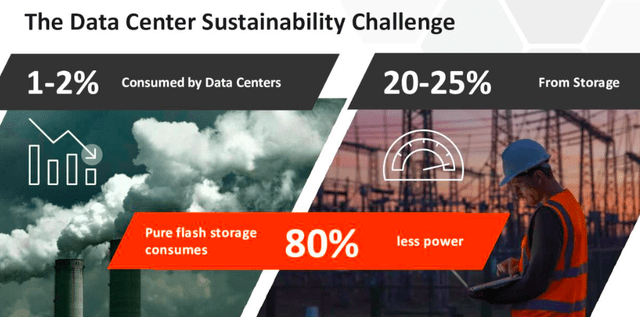

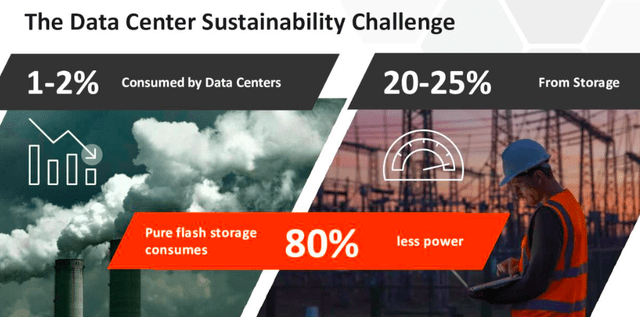

Data challenge (Investor presentation 2023)

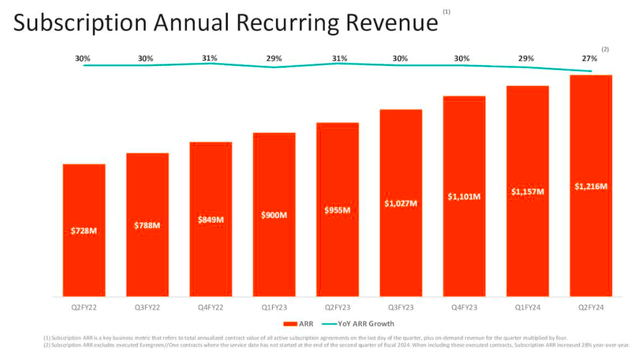

Its annual recurring revenue has shown robust year-over-year growth, climbing by 27% to reach $1.22 billion. Such significant growth is a positive indicator of the company’s ability to attract and retain clients, laying a solid foundation for future revenue streams and overall business stability.

Annual recurring revenue growth (Investor presentation 2023)

Moreover, it maintains its industry dominance by offering a cutting-edge, dependable storage solution that not only demands less power and space but also requires fewer operational resources, streamlining labor requirements.

Competitive advantage (Investor presentation 2023)

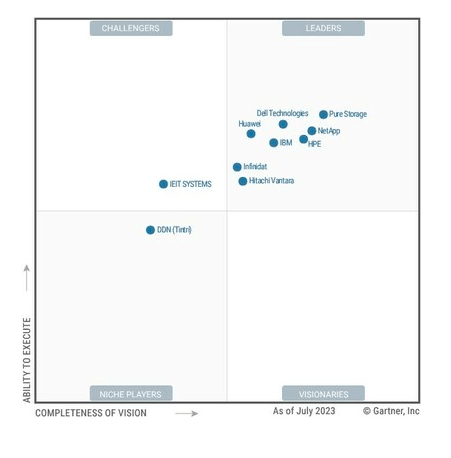

One area that has been key to the company is its focus on enterprise-scale AI initiatives, considering AI applications’ energy needs and data requirements. Notably, according to Gartner’s Magic Quadrant, for ten consecutive years, it has secured the top position in distributed file systems and object storage. While competing against giants like Dell Technologies (DELL), Hitachi (OTCPK:HTHIY), Hewlett Packard Enterprise (HPE), IBM (IBM), and NetApp (NTAP). Pure Storage believes it holds a significant advantage over these rivals in the market landscape due to its scalable and easy-to-use solutions.

Gartner’s magic quadrant (Pure Storage)

Financial updates

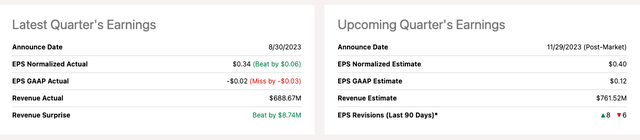

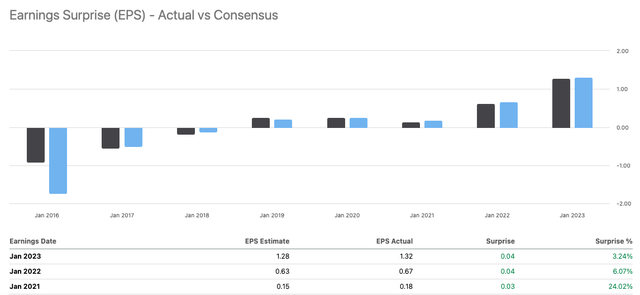

Pure Storage has maintained a consistent upward trend in revenue, reaching TTM $2.76 billion. Despite a TTM negative net income of $800,000, the company achieved its first positive bottom line in a decade, reporting $73.1 million for FY 2023. This positive bottom line after a sustained period of losses could indicate a turning point in profitability. Investors might find it encouraging that the company is moving towards profitability, but it’s crucial to monitor future financial reports to assess the sustainability of this positive trend. In Q3 2024, the expectation is for the company to post a positive EPS GAAP of $0.12.

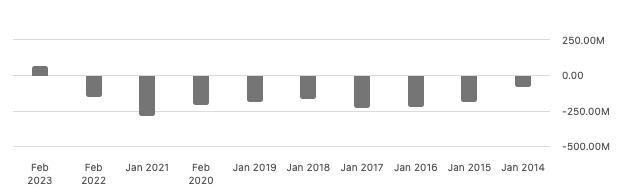

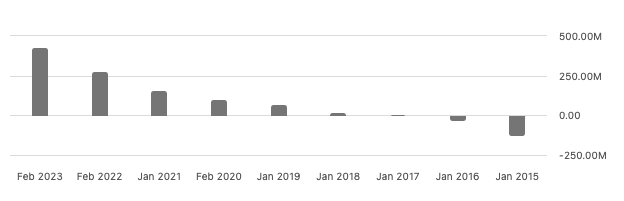

Annual revenue and gross profit (Seeking Alpha) Annual net income (Seeking Alpha)

Levered free cash flow TTM stood at $334.2 million, showing a slight dip from FY2023. Nonetheless, the consistent upward trajectory over the past nine years is notable. Investors might view this as a positive indicator of the company’s ability to generate cash after meeting financial obligations.

Levered free cash flow (Seeking Alpha)

Upcoming earnings

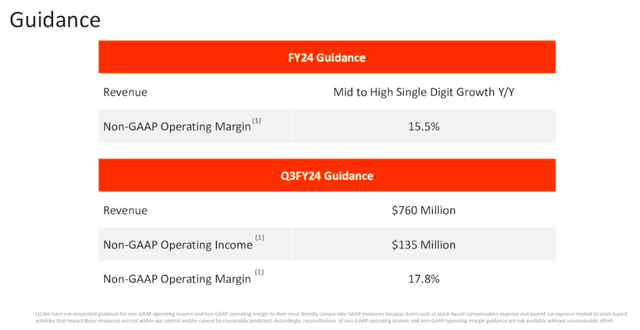

Pure Storage is set to release its Q3 2024 earnings on November 29. Analysing its historical performance, the company has shown consistent improvement in annual earnings per share [EPS] over the past eight financial years, reaching an EPS of $1.32 in FY2023. This trend might suggest a positive trajectory for earnings growth, although we cannot purely rely on historical results. We do know the company has reconfirmed its FY 2024 results with mid- to high-single digit revenue growth, which is slower than the year prior. Although its annual recurring revenue growth increase should give us some confidence in the company’s capability of being profitable in the future as it has greater profit margins and easy-to-scale business model. Annual revenue guidance maintains expectations for mid to high-single digit growth, especially in the latter half of FY 2024. Evergreen//One’s exceptional sales performance in the first half surpassed predictions, indicating continued momentum throughout the year.

Upcoming EPS estimates (Seeking Alpha) Annual EPS performance (Seeking Alpha)

If we look at the company’s balance sheet, in Q2 2024, the company held $1.2 billion in cash and investments, generating $102 million in operating cash flow with $55 million in capital expenditures. Nearly 600,000 shares, amounting to almost $22 million, were repurchased, benefiting shareholders.

Looking to Q3 2024, revenue is projected at $760 million, marking over 12% year-over-year growth, driven by robust Evergreen//One subscription services. The company furthermore anticipates an operating profit of $135 million, and its focus remains on aligning costs with demand.

Q3 2024 and FY 2024 guidance (Investor presentation 2023)

Valuation

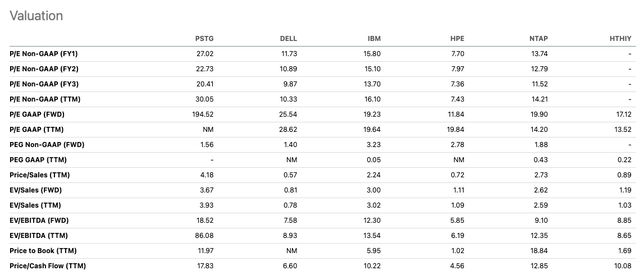

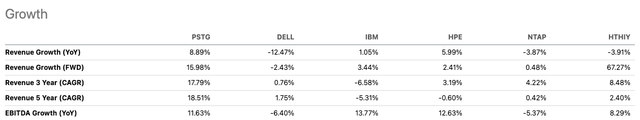

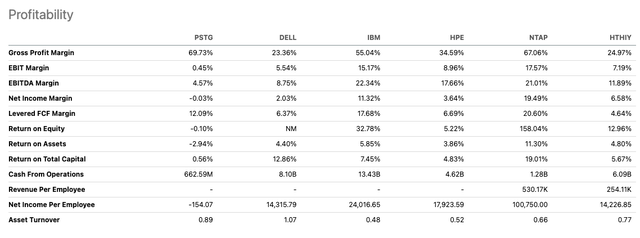

When comparing Pure Storage to its industry peers, its TTM price-to-earnings ratio at 30.05 appears less attractive due to significant stock growth in the past year. This might signal overvaluation, but it’s important to note the company’s recent attainment of profitability, making the price-to-earnings ratio less conclusive about its performance. The price-to-sales ratio also appears higher than its peers, warranting attention. However, it’s crucial to consider the premium solution Pure Storage offers, gaining traction among established clients like Microsoft and Nvidia. These partnerships could potentially drive future growth for the business, offsetting some concerns about current valuation metrics. Furthermore, if we look at the company’s YoY revenue growth it exceeds the performance of its larger peers and its gross profit margin is significantly higher at 69.73%.

Relative peer valuation (Seeking Alpha)

Growth versus peers (Seeking Alpha) Profitability versus peers (Seeking Alpha)

Risks

Pure Storage has achieved its first positive earnings year in FY 2023; however, we can see that the TTM net income is negative. Furthermore, the company has increased its interest expenses by borrowing $100 million in April 2023, incurring significant interest expenses of $1.7 million and $2.1 million in the second and first two quarters of fiscal 2024, respectively. Furthermore, regarding the product, we should be aware that its solution is a business-critical solution to major enterprises; any technical glitches or security breaches could harm its reputation and future growth. Regulatory changes in data storage laws add complexity to this dynamic market. Furthermore, sustaining progress in a competitive landscape requires constant innovation, and its performance could change if newer technologies enter the storage space.

Final thoughts

Pure Storage holds a crucial role in our data-driven world. It’s not just about being pivotal in managing data; the company’s consistent improvement in both revenue and profit, coupled with positive cash flow and ample reserves for reinvestment and shareholder rewards, reaffirms my bullish stance on this stock leading up to its Q3 2023 earnings. The company’s growth projections for revenue and earnings in the imminent Q3 2023 report further solidify this optimistic outlook. Therefore, I maintain a bullish stance on this stock.

Read the full article here