Investment Rundown

The oil market has been rather volatile as the war in Ukraine began in 2022 and caused commodity prices to increase rapidly. Since then there have been several cuts to production to raise the oil prices whilst still satisfying demand. This has meant that North American products have had to increase to fill some of the void left after these cuts. For Helmerich & Payne Inc (NYSE:HP) this has been largely positive as the net income have increased substantially to over $430 million in the last 12 months alone. The company has been a long-time dividend payer but has had to make cuts previously and I think it will be some time until we see the $0.71 quarterly dividend per share again.

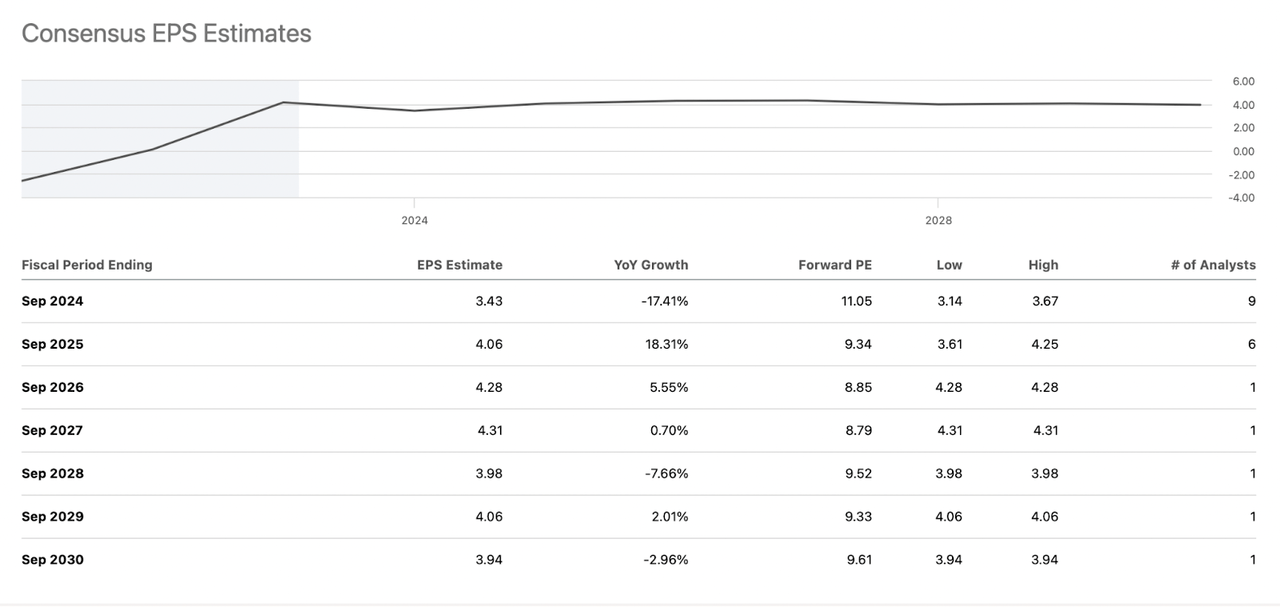

Where I think investors are seeing some value here is in the commitments that HP has made towards returning large amounts of capital to shareholders. 2024 is set to have a base dividend payout worth at least $100 million. Unfortunately, I don’t think the current price is that appealing to get in at, the 11x p/e is at a near 13% premium to the rest of the sector and that has me rating HP a hold instead. Should the price fall and reflect a 15% discount to the energy sector I would be more interested as the dividend yield would also be slightly higher than the current 2.6%.

Company Segments

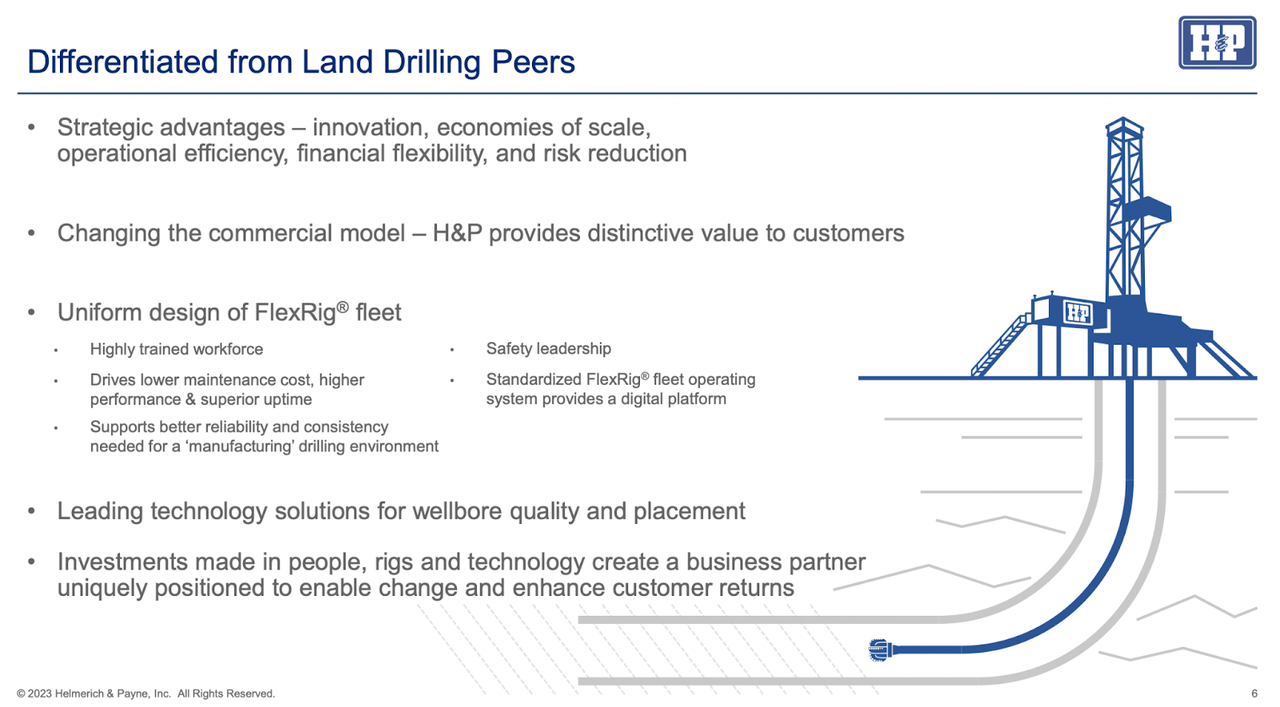

HP offers drilling services and innovative solutions for exploration and production companies. This industry-leading company operates through three pivotal segments: North America Solutions, Offshore Gulf of Mexico, and International Solutions. Beyond conventional drilling services, HP places a strong emphasis on the development, promotion, and commercialization of cutting-edge technologies. These technologies are specifically designed to elevate drilling operations, ensuring superior wellbore quality and precision in placement.

Company Overview (Investor Presentation)

HP employs an array of cutting-edge technologies and software solutions strategically designed to mitigate the risk of bottom-hole assembly (BHA) failures. These innovations not only enhance operational safety but also contribute significantly to the overall efficiency of drilling activities. HP’s commitment to automation is evident throughout its drilling rigs, where a multitude of advanced technologies are seamlessly integrated. These automation features play a pivotal role in optimizing drilling processes, ensuring precision, and maximizing overall efficiency. The company’s continuous investment in technology underscores its dedication to providing state-of-the-art solutions that drive advancements in the energy exploration sector.

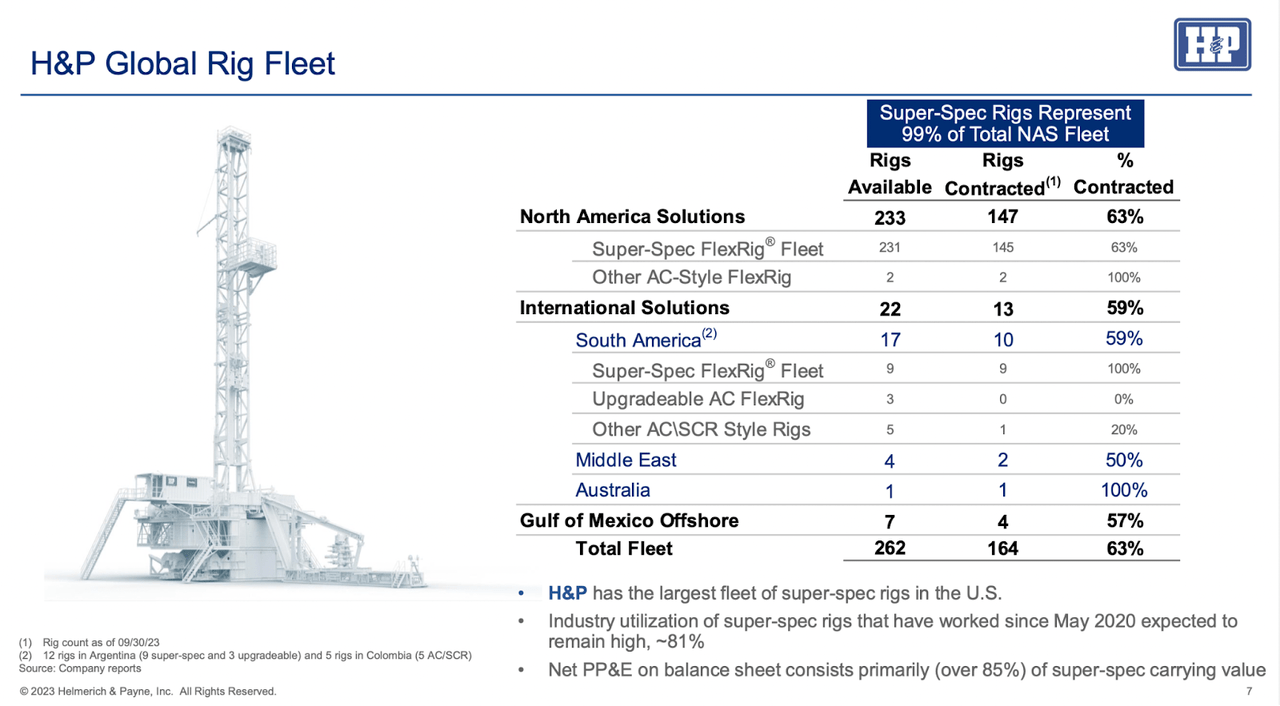

Rig Fleet (Investor Presentation)

The company has a rather large global rig fleet comprised of 262 in total. The collaborative efforts of OPEC and Russia to implement substantial production cuts have had a profound impact on the dynamics of the oil market, influencing the operations of companies like HP. These strategic production cuts, orchestrated to stabilize oil prices, have created a favorable environment for HP’s business. In response to reduced output from OPEC and Russia, U.S. producers, including HP, have experienced increased demand for their services. This surge in demand stems from the imperative for U.S. producers to compensate for the shortfall in global oil production, leading to enhanced opportunities for HP within the energy sector. Looking at the last 12 months for HP it has resulted in substantially stronger revenues ultimately leading to a quick rise from the $7 million in net income it had in 2022 to over $430 million TTM.

Earnings Highlights

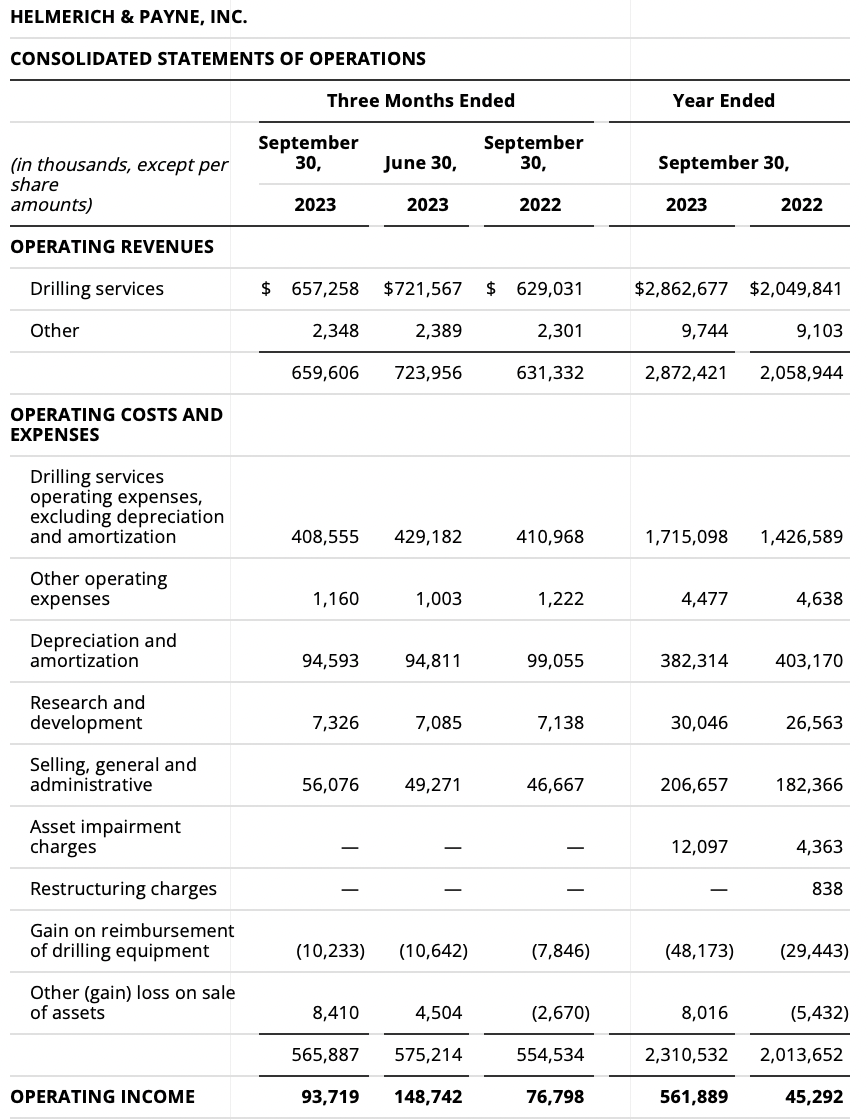

Operating Expenses (Earnings Report)

From the last earnings report that the company held there was a decent YoY growth to the revenues by 4.4%, but on a QoQ basis the revenues fell somewhat largely due to lower drilling services revenues. The company still managed to keep its rigs at a higher level than previously estimated as it existed in the fourth quarter with 147 rigs. The contract churn is noted to be higher going into the Q1 FY2024 quarter and I do think this will be positively shown on the next report by revenues reaching higher and growing sequentially. Supporting this has been the relative stability the market has experienced as of late as activity has not been volatile. The management thinks this will be carried on into the next couple of quarters. What I find further positive is that HP is expecting to add 3 – 9 rigs in the coming quarter and exit at 150 – 156 rigs.

What has been a key achievement for the company in FY2023 was the completion of its hub in the Middle East. I think this will be a long-term driver of growth for the business as they can more readily be able to capture demand and opportunities in the region now.

EPS Estimates (Seeking Alpha)

As far as estimates go for the company, it’s expected to be that 2024 will see EPS of $3.43, which would be a 17% YoY decline, but that is also the nature of the industry and commodity prices are a large culprit as to why this occurs. Furthermore, the valuation is not quickly declining that much in the coming years which would result in a buy here. I look for value now, not necessarily in 2026. I want to invest money to start appreciating and for HP I don’t think that would occur until after 2026 as that is when it’s expected to generate EPS of $4.28 and have a p/e of 8.8, which is closer to where the energy sector is valued. Because of this, I landed at a more neutral rating, which is a hold.

Risks

While the recent production cuts initiated by OPEC and Russia have positively impacted HP, it is crucial to acknowledge the potential risks associated with the opposite scenario. In the event of increased output from these regions, there exists the possibility of a surplus in global oil supply, leading to a downward pressure on oil prices. Such a scenario may diminish the economic incentives for U.S. companies to escalate production, thereby posing challenges for HP’s future financial performance.

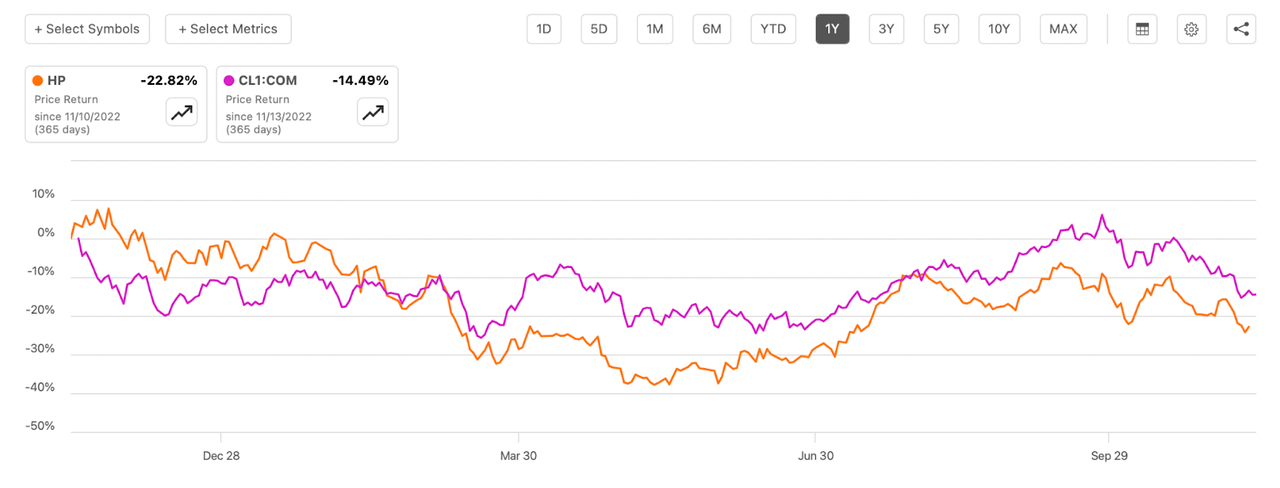

Price Return (Seeking Alpha)

The company’s fortunes are intricately tied to the price of oil, and any volatility in this market could reverberate through HP’s stock price. A potential decline in revenues, coupled with shifts in market sentiment, might contribute to fluctuations in the valuation of HP. Therefore, it becomes imperative for investors to monitor global oil market dynamics closely, as they significantly influence the operating environment and financial prospects of companies like HP.

Final Words

The oil industry has been quite volatile following the invasion of Ukraine in early 2022. It has caused a lot of turmoil in the commodity markets, with oil included. The revenues are trending higher for HP as they expected the coming quarters to result in higher rig counts. Should this trend see further continuation I think HP could offer a decent amount of value. However, the current price does not equate to an adequate discount that I am looking for and a more neutral rating will be applied as a result. I am rating HP a hold.

Read the full article here