A foolish faith in authority is the worst enemy of truth.”― Albert Einstein.

Today, we put medical device concern SI-BONE, Inc. (SIBN) in the spotlight for the first time. The company is gaining traction in its core markets and delivering consistent sales growth. Analyst firms are positive on SI-BONE’s prospects and the company has a solid balance sheet. An analysis follows below.

Seeking Alpha

Company Overview:

This medical device concern is headquartered in Santa Clara, CA. The company is focused on developing implantable devices used to solve musculoskeletal disorders of the sacropelvic anatomy. Almost all of the company’s revenue comes from the United States. The stock sells just under $18.00 a share and sports an approximate market capitalization of $710 million.

February Company Presentation

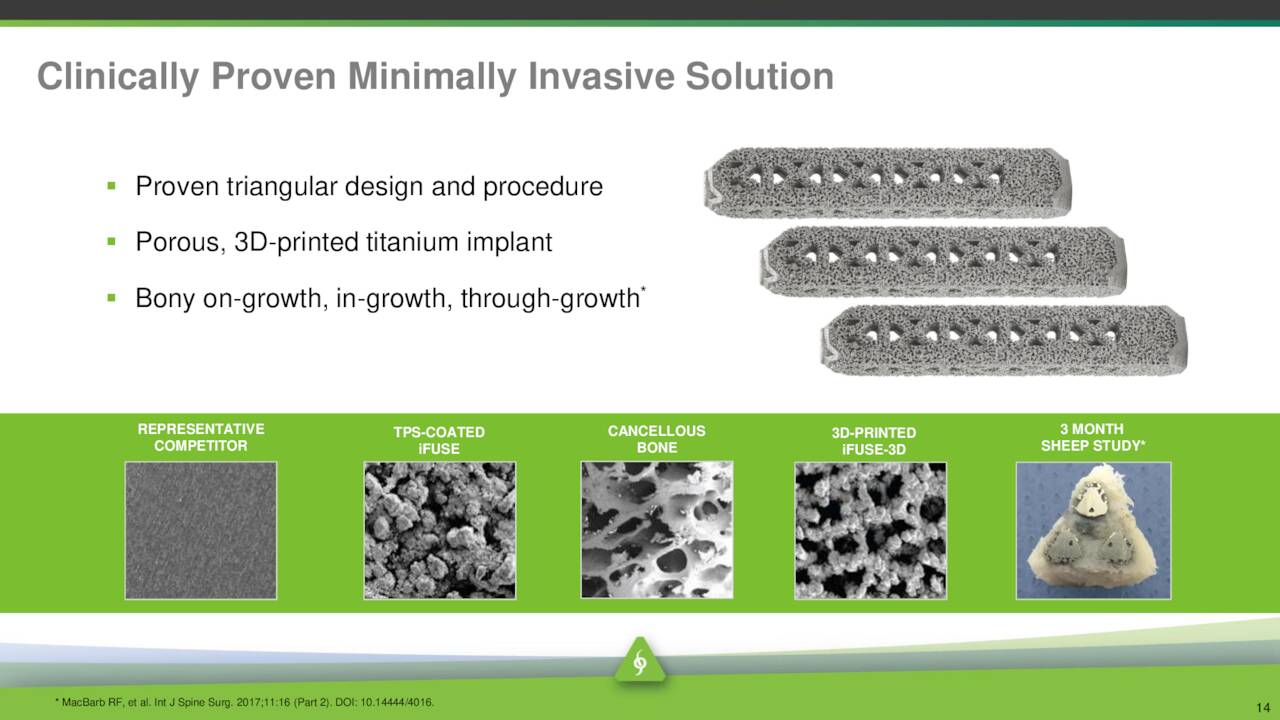

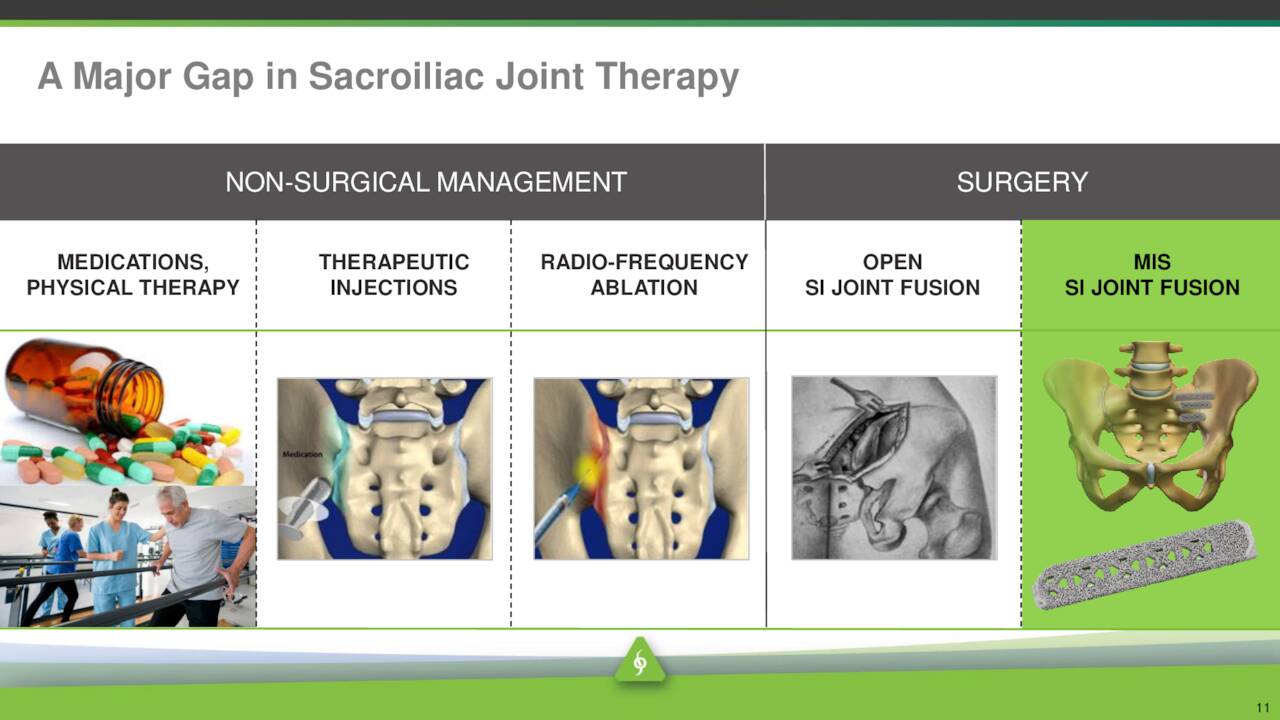

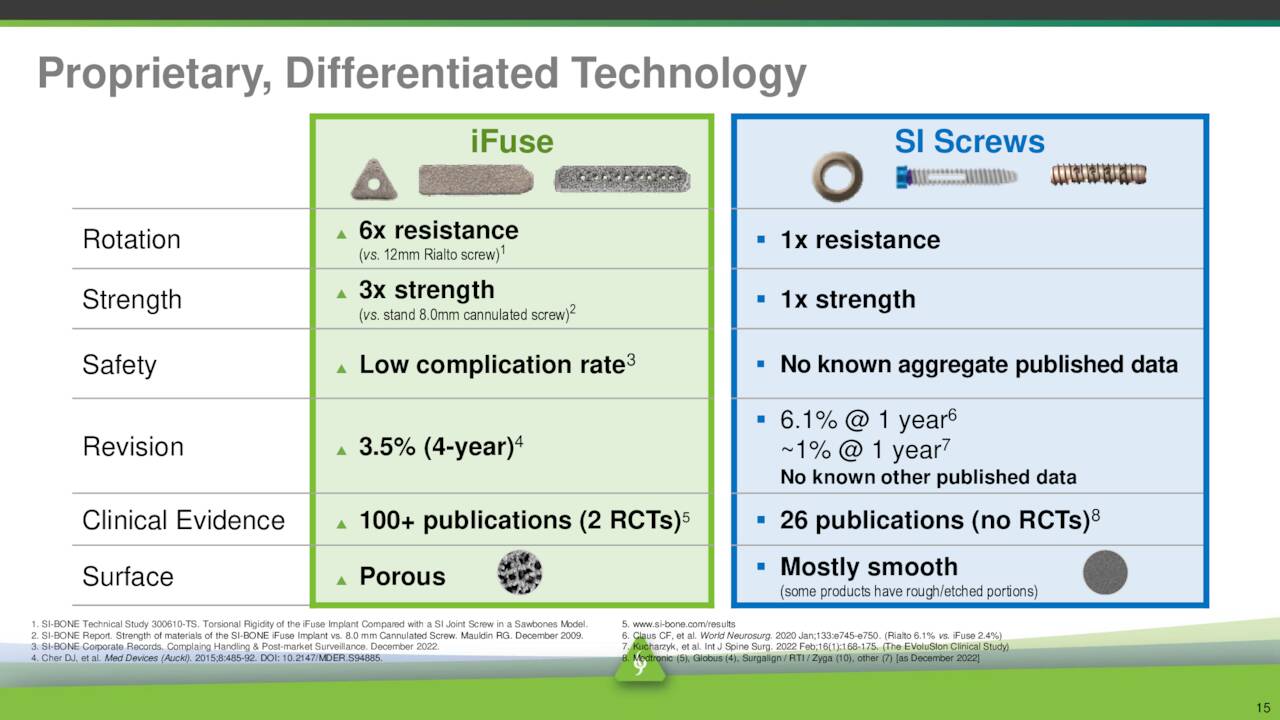

The company offers a variety of products urged in surgery including its proprietary minimally invasive surgical implant system to address sacroiliac {SI} joint dysfunction and fusion, adult deformity and degeneration, and pelvic trauma.

February Company Presentation

The company is focused on SI joint dysfunction which causes between 15% to 30% of all instances of significant and chronic back pain. The company’s iFuse Implant System® has been available since 2009.

February Company Presentation

This minimally invasive surgical option is designed to provide immediate SI joint stabilization and allow long-term fusion.

February Company Presentation

Third Quarter Results:

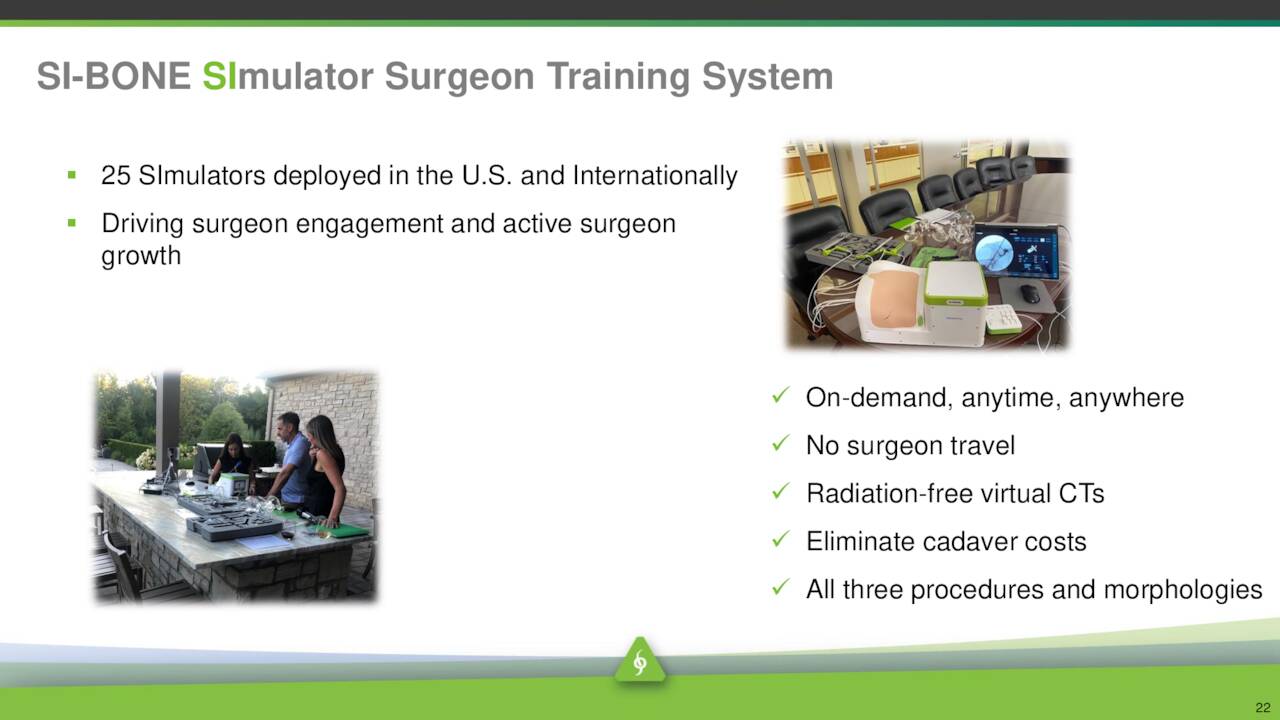

SI-BONE posted its third quarter numbers on November 6th. The company delivered a GAAP loss of a quarter a share, besting expectations by nine cents a share. Revenues rose nearly 29% on a year-over-year basis to $34 million, also beating the consensus. Over 1,040 surgeon used SI-BONE’s products during the quarter, an approximate 30% increase from the same period a year ago. Procedural volume rose 34% from 3Q2022. Management believes eventually 7,500 active surgeons will use its products. The company has an extensive training program to upskill surgeons in the proper use of its devices.

February Company Presentation

Leadership upped its FY2023 revenue guidance to $136 million to $137 million from $132 million to $134 million previously. Management also noted on its third quarter conference call that:

Widespread adoption of GLP-1 therapy and a resulting decrease in average BMI in the American population would have a significant impact on the incidents of SI joint dysfunction, trauma or deformity that would meaningfully impact demand for our products in the near or immediate term“

This worry has been a minor headwind for the shares recently.

Analyst Commentary & Balance Sheet:

Since third quarter results were posted, a half dozen analyst firms including Needham and Bank of America have reissued Buy-Outperform ratings on SIBN. Price targets proffered range from $22 to $32, and half these buy reiterations contain minor downward price target revisions. Several insiders have been frequent and consistent sellers throughout 2023. Most of these transactions have been small, with an exception of a $6 million disposition in May. Overall, insiders have sold just north of $10 million worth of equity collectively this year. There have been no insider purchases in the stock so far in 2023.

Just over two percent of the outstanding float in the shares is currently held short. $2.7 million worth of cash was used to fund operations in the third quarter, and the company ended the quarter with just over $165 million worth of cash and marketable securities on its balance sheet. The company listed just over $36 million in long-term debt on it third quarter 10-Q.

Verdict:

The company lost $1.79 a share in FY2022 on just over $176 million in revenues. The current analyst firm consensus has SI-BONE paring losses to $1.15 a share in FY2023 as sales rise to $136 million. In FY2024, they see losses falling to a buck a share on a mid-teen increase in revenues.

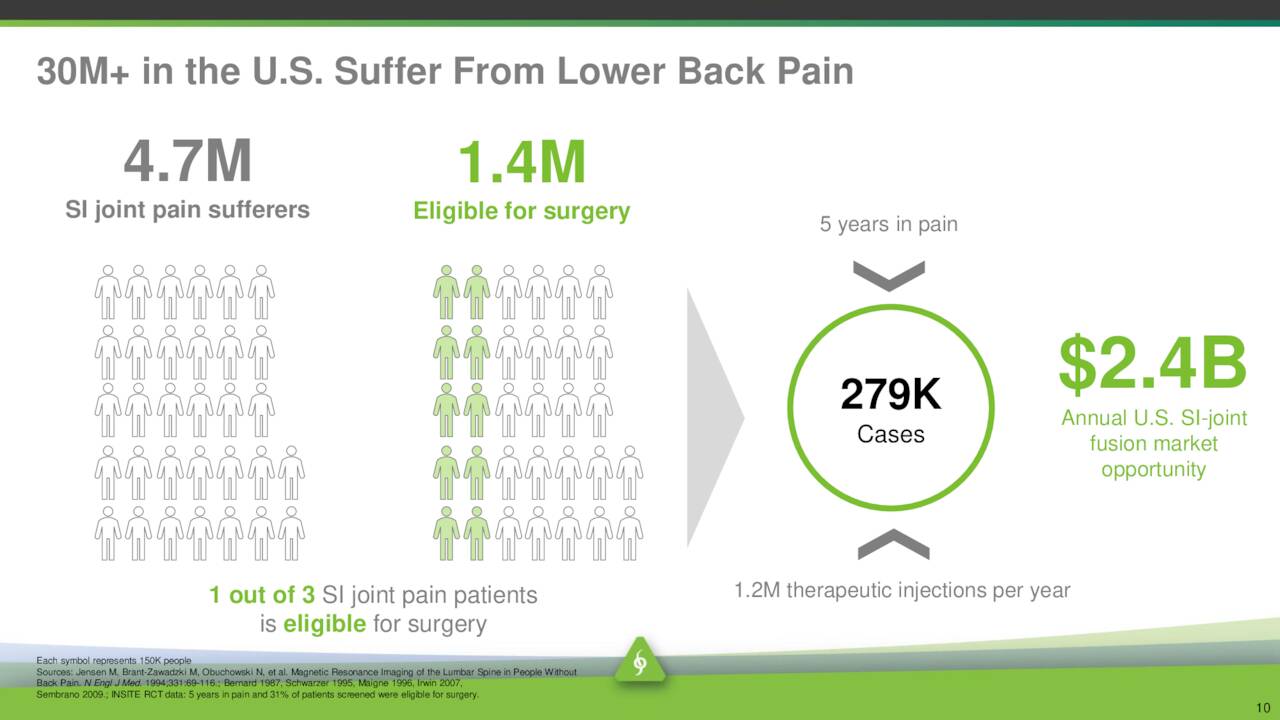

SI-BONE is a solid company and is seeing consistent revenue growth while bringing down annual losses. The company also has a solid balance sheet and should be able to avoid any sort of shareholder dilution until SI-BONE becomes profitable based on the firm’s quarterly burn rate. SI-BONE is targeting a significant market.

February Company Presentation

That said, until the recent rally in the Russell 2000 (RTY) in recent trading sessions, unprofitable small cap companies have largely been out of favor since the Fed starting hiking rates back in March of last year. The consistent insider selling in SI-BONE, Inc. shares this year is also somewhat concerning.

Therefore, until SI-BONE, Inc. gets closer to being a profitable concern and/or the central bank starts to cut the Fed Funds rate, I am on the sideline around the stock. That said, SI-BONE is an intriguing enough company to keep an eye on and we will circle back on this story at some point in 2024 to follow up on it.

We can only see a short distance ahead, but we can see plenty there that needs to be done.”― Alan Turing.

Read the full article here