Thales (OTCPK:THLEF) has been benefiting from idiosyncratic recoveries in commercial aviation. Backlog developments are decent all things considered, and we think that their uptick can last even through this downcycle in the economy. Finally, we like the Imperva acquisition just based on the PV of synergies. However, we think the valuation is a little steep considering economics and alternatives.

Notes On Earnings and Backlog

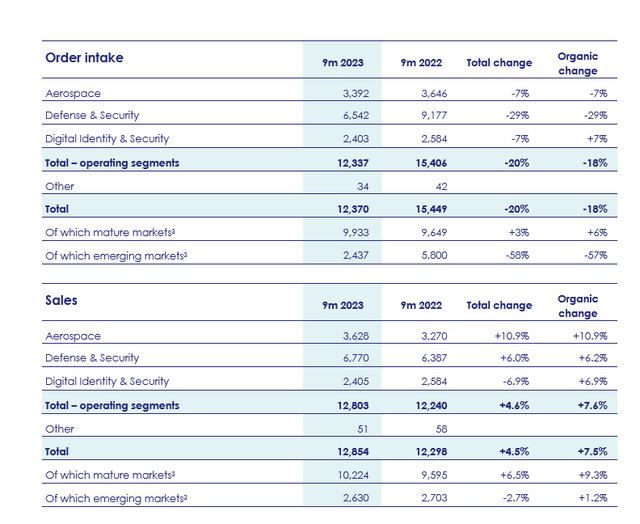

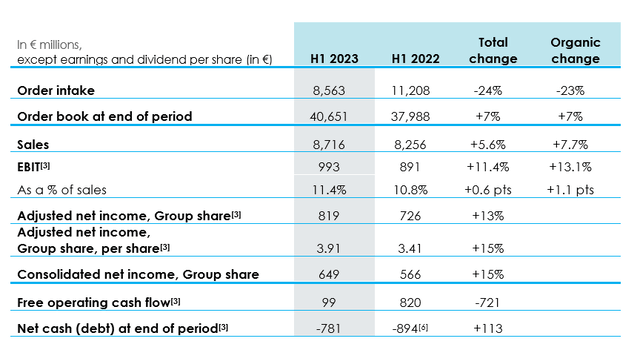

The last earnings were at the H1 mark, and it showed strong performance in the commercial aviation facing businesses that had been suffering massively over COVID-19 due to dramatic decreases in equipment investment, newbuilds, and general conservatism around recovery in the aviation business. Digital identity and security are also doing well, tackling next-gen problems like identity theft. We are also seeing backlog pickup in that business.

9M Order Intake (Order Intake disclosure) H1 IS Highlights (H1 PR)

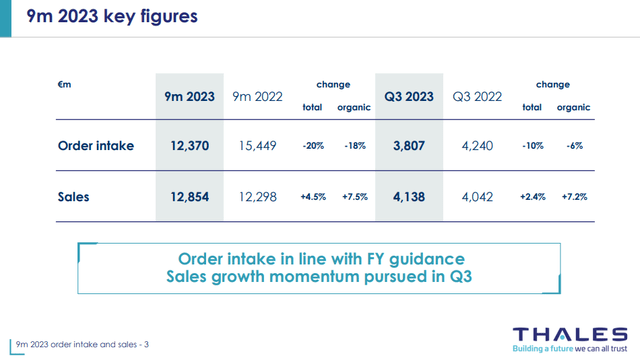

On order intake, while it is falling across the board, especially in defense, part of the reason is base effects as there was a lot of upfronted ordering directly following the outbreak of the Ukraine war, and also preceding it, as the Rafale had already started to sell astonishingly well among the Gulf Coast Countries, and Dassault is a major Thales customer. Already in Q3, there is a deceleration in order intake declines and it is setting up for a more solid sales environment over a secular horizon. Book to bill remains above 1x.

9M vs. Q3 Order Intakes (9M Report Slides)

There is expected to be a margin lift by the end of the year too, according to the latest 9m guidance, so earnings growth should continue, bolstered by a strong civil aviation recovery.

Bottom Line

In addition to organic earnings growth, there is the acquisition to mention of Imperva which we quite like. The multiple post synergies are around 17x EV/EBIT which is actually not too high. Of course, it does rely on substantial synergies above $100 million, including some revenue synergies, which ordinarily cannot be relied upon. But the acquisition will bolster the business with an additional $500 million in revenue, probably at very solid EBIT margins as is common in civil and government cybersecurity software and solutions companies.

While organic growth is high in these businesses, and there is a recovery ongoing in the rest of the businesses, with solid demand underlying defense, we don’t love the multiple at above 20x PE. Thales is a premier French company, it’s too well known, and there are just too many deals on the market with better yields than this at sometimes even lower risks with better economics.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Read the full article here