Investment thesis

My initial bullish thesis about CrowdStrike (NASDAQ:CRWD) aged extremely well as the stock rallied by 35% over the last three months, compared to a one percent growth for the broader stock market. Even though my updated valuation analysis suggests the stock price is now traded at fair value after a massive rally, I still reiterate my “Strong Buy” rating for CRWD. To explain my thesis, let me cite the great Warren Buffett:

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

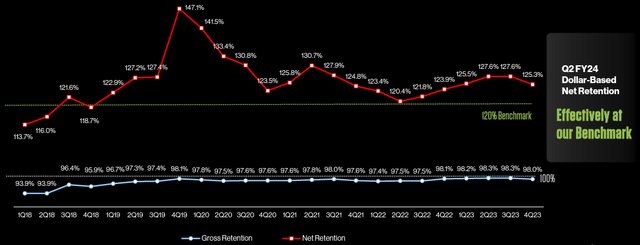

Recent developments suggest that CrowdStrike is indeed a wonderful company. Revenue growth and profitability expansion demonstrate stellar momentum, which is explained by the company’s cybersecurity platform. I am not a cybersecurity engineer, but the consistently delivered above 120% dollar-based retention rate suggests that CrowdStrike’s cybersecurity ecosystem is unmatched. The management is focused on delivering revenue growth, but not at all costs. Profitability metrics demonstrate rapid expansion rate, thanks to strong cross-selling and up-selling capabilities of the business model.

Recent developments

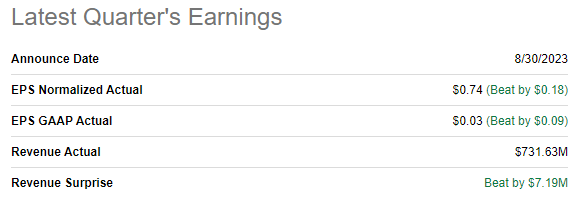

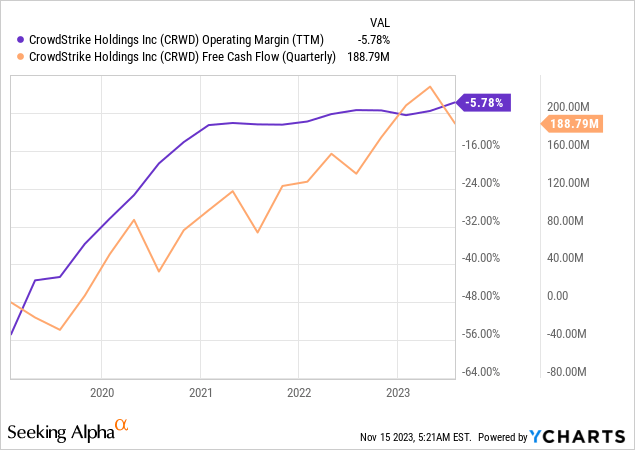

The latest quarterly earnings were released on August 30, when the company topped consensus estimates. Revenue grew YoY by a staggering 36.7%, and the adjusted EPS more than doubled. The EPS expansion was due to the improved profitability as the operating margin moved closer to the breakeven point at -2%. Almost seven percentage points YoY improvement in the operating margin was due to the significantly improved SG&A to revenue margin, not at the expense of R&D. Investments in innovation still comprise almost a quarter of the company’s sales, which is a strong commitment to building long-term value for shareholders.

Seeking Alpha

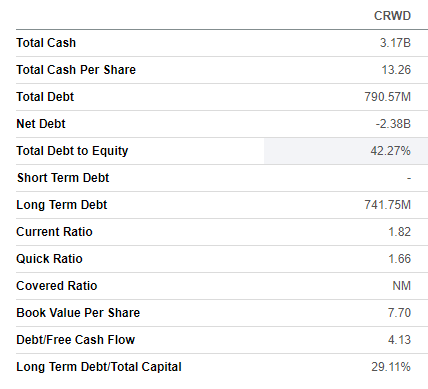

Strength in the P&L allowed CRWD to generate $232 million in levered free cash flow [FCF], representing a 45% YoY growth. The ex-stock-based compensation [ex-SBC] FCF was also solid at 9.3%. Having solid positive cash flow during the quarter enabled CRWD to continue improving its balance sheet. As of the last reporting date, the company had more than $3 billion in cash, as opposed to a total debt of below $800 million. The leverage ratio is low, and short-term liquidity metrics are in strong shape. Having almost $2.4 billion of net cash and low leverage firmly positions CRWD to continue investing heavily in innovation and promotion. This increases the chances for the company to sustain its stellar revenue growth trajectory for longer.

Seeking Alpha

The company demonstrates strong growth momentum as its offerings appeal to customers. I am not a cybersecurity professional to assess the quality of CrowdStrike’s products, but I believe that customer retention rates say it all. CRWD consistently delivers a staggering above 120% dollar-based retention rate, which speaks volumes about its customer base’s satisfaction and loyalty. The above 100% dollar-based retention rate means the company is successful in cross-selling and up-selling. This is a strong bullish sign because selling additional services to existing customers means additional revenue with no customer acquisition costs, positively affecting the bottom line.

CRWD’s latest earnings presentation

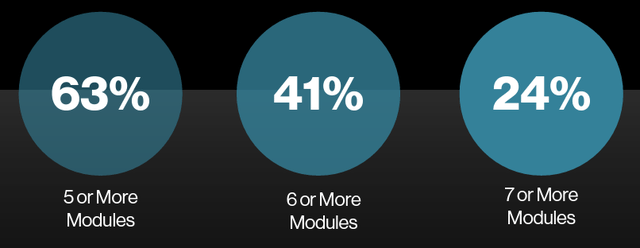

A significant part [63%] of CRWD’s subscription customers pay for five or more modules. What is more impressive is that every fourth customer uses seven or more modules. This indicates that CRWD offers customers an effective ecosystem, which helps retain customers because the more modules they use, the higher the switching costs will be to them.

CRWD’s latest earnings presentation

The above two screenshots speak for themselves about the high appeal of the company’s multi-module Falcon platform. But it is important to note that the management is unwilling to stop here. As I mentioned earlier, the company reinvests a quarter of its revenue in R&D. During the latest earnings call, the management highlighted its commitment to innovation, meaning that new cutting-edge features are expected. Given the company’s stellar track record of technological success, I am highly convinced that new features will help the company sustain impressive retention rates for a longer time. The platform’s modules, integrated with artificial intelligence [AI] capabilities, position CrowdStrike at the forefront of the technological landscape.

Apart from the high appeal of the company’s offerings, which allows stellar revenue growth, I also like the management’s focus on delivering value to shareholders. CRWD demonstrates strong operating leverage as the business scales up, resulting in rapid free cash flow growth. Given the company’s “land-and-expand” go-to-market business model and firm focus on innovation and constant product development, I have high conviction that profitability is poised to expand further as revenue grows.

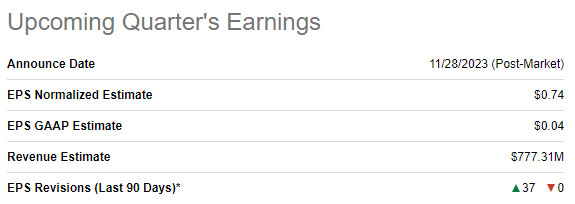

Stellar revenue growth and profitability expansion momentum are expected to be sustained in the near future. The upcoming quarter’s earnings release is scheduled for November 28. Quarterly revenue is expected by consensus at $777 million, which indicates a 34% YoY growth. The adjusted EPS is expected to follow the top line and expand from $0.40 to $0.74.

Seeking Alpha

Valuation update

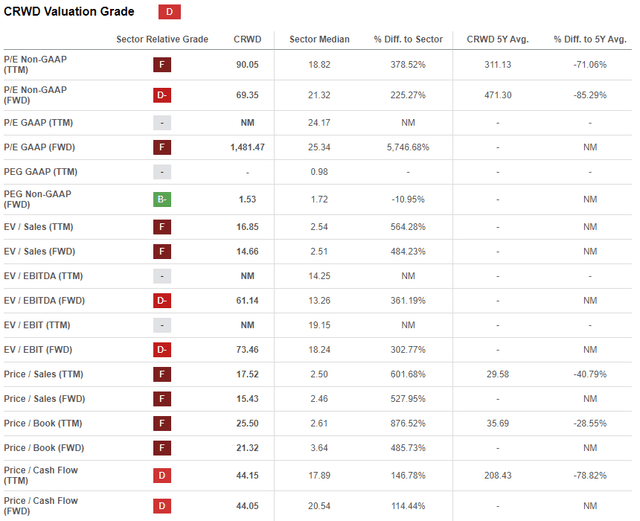

The stock rallied by 101% year-to-date, significantly outperforming the broader U.S. market. Current valuation ratios are substantially higher than the sector median but much lower than the company’s historical averages. Given the company’s strong revenue growth momentum, I believe that a comparison to historical averages is more appropriate. That said, the stock looks attractively valued based on the valuation ratios.

Seeking Alpha

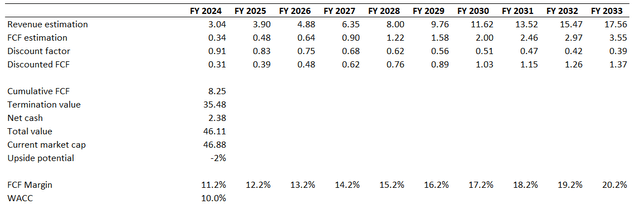

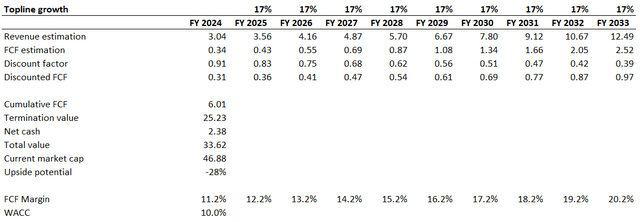

I want to proceed with the discounted cash flow [DCF] simulation. I use a 10% WACC for discounting. Consensus revenue estimates project a 22% CAGR for the next decade, which I incorporate into my DCF model. I use an 11.2% TTM FCF margin ex-SBC for my base year and forecast a one percentage point yearly expansion.

Author’s calculations

According to my DCF simulation, the business’s fair value is close to the current market cap. That said, the stock is fairly valued at the current stock price level.

Risks update

CRWD is an aggressive growth stock, and the valuation significantly depends on aggressive revenue growth assumptions. While the stock looks fairly valued with a 22% revenue CAGR for the next decade, if I downgrade revenue CAGR projections by five percentage points, the company’s fair value nosedives to $33.6 billion. It is essential to underline that 17% revenue CAGR for the decade is still an aggressive assumption. That said, potential investors should be aware of the high sensitivity of the company’s valuation to revenue growth projections. A guidance downgrade, earnings miss, or any other deviation from market expectations will likely lead to a steep pullback in the stock price.

Author’s calculations

As an internet security company, CrowdStrike faces substantial cybersecurity risks. In case of a security breach at a customer or within CRWD’s systems, the company will face significant reputational risks. Losing the trust and confidence of customers will highly likely lead to losing market share and deteriorating the company’s financial performance.

Bottom line

To conclude, CrowdStrike is still a “Strong Buy”. I think the company’s stellar revenue growth together with the management focus on profitability expansion and innovation deserves generous premium for the stock price. The stock is fairly valued despite rallying year-to-date by more than a hundred percent.

Read the full article here