Note:

I have covered ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) previously, so investors should view this as an update to my earlier articles on the company.

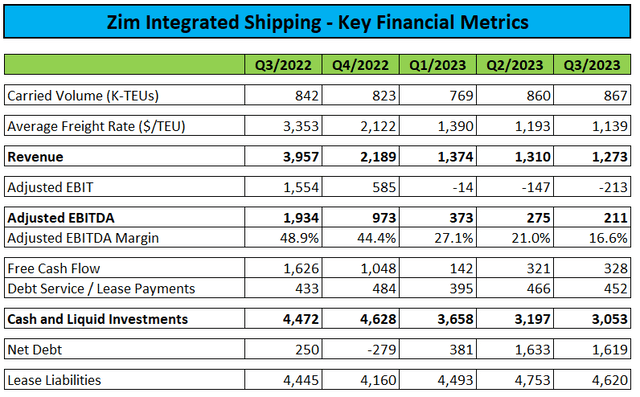

On Wednesday, Israel-based liner company ZIM Integrated Shipping Services Ltd. (“ZIM”) reported weak quarterly results and lowered its profitability outlook for the second time this year due to ongoing erosion in container freight rates:

Company Press Releases and Regulatory Filings

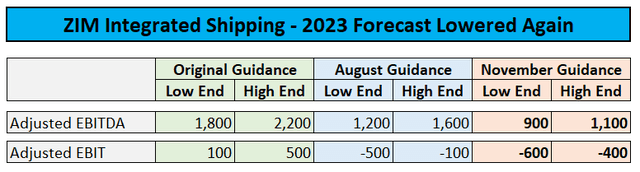

The company’s EBIT outlook would have been even worse without future depreciation benefiting from a massive $2.1 billion non-cash impairment charge of which $2.0 billion was related to the company’s vessels, containers and handling equipment.

Company Press Releases

While ZIM does not own the vast majority of these assets, lease accounting requires the company to record lease liabilities on the balance sheet in combination with corresponding right-of-use assets which are depreciated over the term of the respective leases.

Consequently, decreasing the value of the company’s right-of-use-assets does result in lower depreciation going forward.

Based on ZIM’s previously reported quarterly depreciation numbers, I would estimate the Q4 EBIT benefit at approximately $150 million.

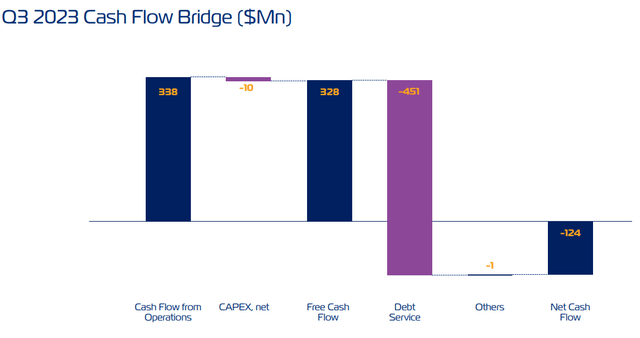

The company ended the quarter with more than $3 billion in cash and liquid investments, down just slightly from the end of Q2:

Company Presentation

However, cash flows benefited from approximately $100 million in working capital releases and another $100 million in lease payments slipping into early October.

Also remember the positive effect of lower depreciation on the company’s full-year EBIT guidance.

Given these issues and assuming no major working capital movements, I would estimate Q4 cash burn to be between $300 million and $500 million.

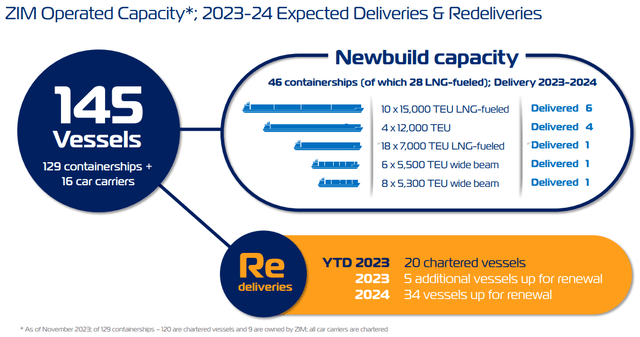

On the conference call, management updated investors on the company’s current fleet and the status of newbuild deliveries as well as redeliveries of vessels upon charter expiration:

Company Presentation

Until the end of next year, ZIM expects to take delivery of 33 newbuildings while 39 vessels are coming up for renewal/redelivery.

However, given the much larger average size of the new containerships, management expects capacity to increase by more than 15% to approximately 700,000 TEU by the end of next year.

Please note that the company has committed to substantial down payments upon delivery of newbuilds leased from Costamare Inc. (CMRE). In 2024, ZIM expects to make $339 million in additional down payments.

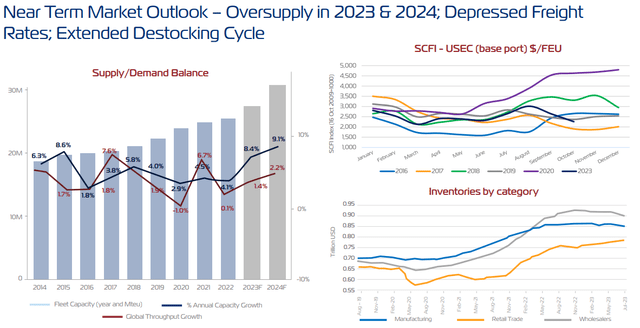

With shipowners still reluctant to scrap or at least idle vessels and the majority of newbuild deliveries still ahead of the industry, management expects market conditions to remain weak for the foreseeable future.

Company Presentation

With the new vessels providing for much better unit economics, analysts on the call were eager to learn about these state-of-the-art containerships potentially being profitable even in the current environment but this apparently depends on the company’s ability to sufficiently utilize capacity:

Sam Bland

(…) if you look at the — where rates are today, you said, they’re obviously low, but the newbuilds are quite cost competitive. How would you sort of characterize whether sort of current spot rates are profitable or not for the newbuild ships with their cost base? Thank you.

Xavier Destriau

When you asked the second question in terms of the rate today would cover the cost of the new capacity that we are bringing in, that’s a difficult question to answer because it is also very much a function of our ability to fill the ships, obviously. So, if we are in a situation where the ship do sail because the capacity — the filling factor is satisfactory, then we are in a better — in a much better position with the new capacity.

To give an indication, I think I already used this illustration on a couple of occasions, but the 15,000 TEU LNG ships that we are now gradually deploying on our Asia to the U.S. East Coast trade lane, around — it will cost the same to operate the 10,000 TEU ship that they come and replace. So we get a 50% additional intake at the same — more or less the same cost of a given voyage. So that illustrates the magnitude of the benefit that we expect to get from those vessels that come in in terms of charter at competitive price. But on top of it, we expect to get additional savings by running them on LNG, which today is a source of fuel, which is more cost-effective than even a heavy fuel.

Clearly, it will take time for the market to digest the outsized capacity additions from new vessels ordered during the 2021/2022 containership bonanza.

However, even when assuming the company burning approximately $300 million in cash each quarter going forward, ZIM would have runway until late 2025.

Bottom Line

Zim Integrated Shipping Services Ltd. reported weak Q3 results and lowered full-year guidance for a second quarter in a row.

In addition, assumptions of the challenging market environment to persist for the time being resulted in the requirement to record a massive $2.1 billion asset impairment charge related to the company’s vessels, containers and handling equipment.

While a number of one-time benefits resulted in Q3 cash usage being surprisingly low, cash burn is likely to increase substantially in Q4 as the company faces higher losses from operations and catches up on lease payments.

With the majority of newbuild capacity not yet delivered, I would expect 2024 to be a very challenging year for the industry.

However, remaining cash and liquid investments are likely to provide the company with runway into late 2025.

While I don’t see any near-term catalysts, I am upgrading the company’s shares to “Hold” on valuation.

Read the full article here