Overview

Kroger (NYSE:KR) has underperformed this year being down over 3% for the year. However, I believe this creates a great entry opportunity to pick up shares of a solid company. Kroger has an excellent business model that aligns with the trend of consumer spending. They also have an excellent dividend growth history while demonstrating growth even during economic uncertainty. The upfront dividend yield sits at 2.6% which sits above its five-year average.

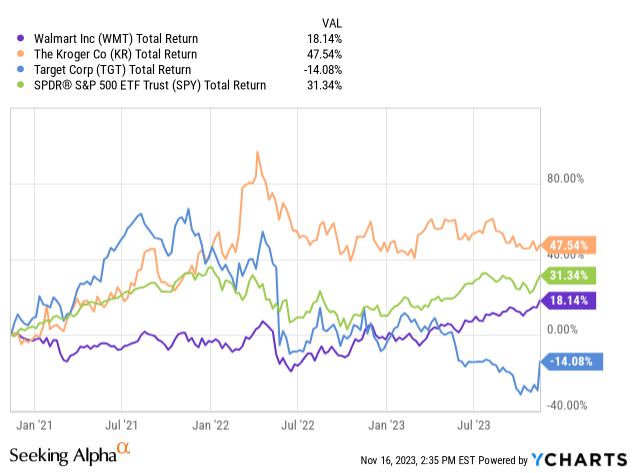

The Kroger Co. is a U.S.-based food and drug retailer. They run various types of stores, including combination food and drug stores, multi-department stores, and price impact warehouses. In their combination food and drug stores, they provide a range of products like organic food, pharmaceuticals, and general merchandise. In short, KR can be compared against Target (TGT) or Walmart (WMT). We can actually see that Kroger has held up much better compared to the TGT and WMT while also outperforming the S&P 500 (SPY) over the last 3 year period.

Consumer Spending

I’ve often perceived Kroger (KR) as an underrated player in the market due to its modest 2% average dividend yield and limited presence in the northeast. In my hometown, it’s likely that most people haven’t even come across a Kroger. Despite this, Kroger consistently surpasses $100 billion in annual sales, even without a strong foothold in densely populated regions like New York, New Jersey, and Florida, hinting at untapped growth potential.

Kroger’s expansive and continually expanding private labels business constitutes around 30% of its total revenue. Operating 35 food production facilities, Kroger manufactures a significant portion of its private label products in-house.

According to insights, as costs rise, 54%% of consumers are turning to store brand/private label items while shopping. Given that a third of Kroger’s revenue stems from private label items, the company enjoys increased control and can capitalize on higher profit margins. Looking ahead, the ongoing surge in grocery costs due to inflation positions Kroger for a sustained revenue uptick.

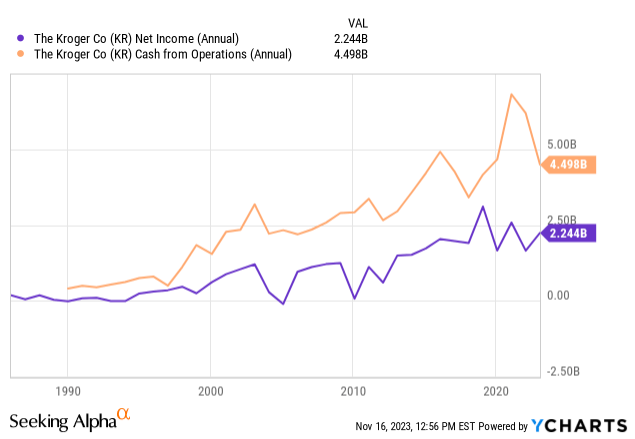

Examining historical trends, Kroger has not only weathered past recessions with climbing revenue but has also showcased consistent growth since its inception, despite minor net income dips during economic downturns.

Financials

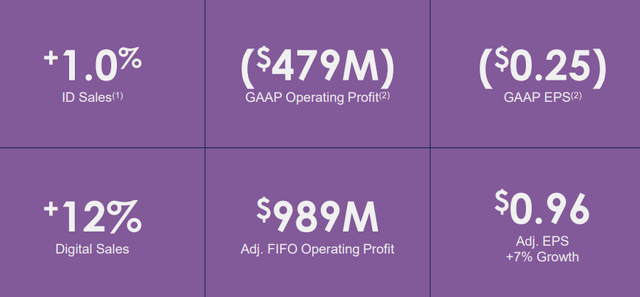

Kroger’s second-quarter earnings report reveals both challenges and strategic successes. Identical sales without fuel increased by 1.0%, showcasing underlying growth of 2.6%. However, the company reported an operating loss of ($479) million, with an EPS of ($0.25). Notably, a $1.4 billion charge related to a nationwide opioid settlement framework significantly impacted earnings.

Kroger Earnings Deck

On a positive note, adjusted FIFO Operating Profit reached $989 million, resulting in an Adjusted EPS of $0.96. Kroger focused on executing its go-to-market strategy, resulting in a 12% growth in digital sales. Despite a decline in total company sales from $34.6 billion to $33.9 billion compared to the same period last year, sales increased by 1.1%. The gross margin was 21.8%, with the FIFO gross margin rate rising by 35%.

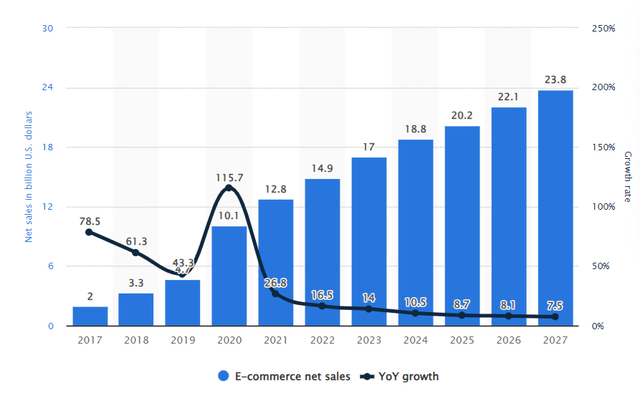

E-commerce has unexpectedly become a success story for Kroger, with projections indicating that it will be 20% of the U.S. grocery market by 2026. Over the past few years, Kroger has consistently seen growth in its online sales, starting from 2017 and culminating in an impressive $12.8 billion in 2021.

Statista

While traditional in-store revenues remain a cornerstone for Kroger, the upward trajectory of e-commerce sales suggests a pivotal role in the company’s future growth. Anticipated to reach an estimated annual net sales of $23.8 billion by 2027, the e-commerce segment is poised to play a crucial and expanding role in Kroger’s overall business strategy.

Albertsons Merger (ACI)

Kroger has a robust history of share buybacks, although they temporarily paused this strategy in anticipation of a potential merger with Albertsons Companies (ACI). The success of the merger could address previously mentioned location challenges and serve as a significant catalyst for growth, substantially improving their scale and infrastructure.

The proposed merger with Albertsons has the potential to create a formidable powerhouse by leveraging the strengths of both companies. The combined entity would feature an impressive scale, encompassing approximately 5,000 stores and employing over 700,000 individuals.

Kroger Earnings Deck

While there are uncertainties about the completion of the merger, if it doesn’t materialize, Kroger remains well-positioned to thrive. In such a scenario, I anticipate the company resuming its share buyback initiatives, further contributing to its financial strength and stability.

Dividend

As of the latest declared dividend of $0.29/share, the dividend yield sits slightly above 2.6%. Kroger has consistently demonstrated financial stability, boasting robust cash flows, solid liquidity, and manageable debt levels. KR has a commendable track record of increasing dividends for 16 consecutive years, with an average 5-year growth rate that surpasses inflation at 15.7%.

Over the years, Kroger’s revenue has surged by nearly 50% since 2013, accompanied by a corresponding increase in free cash flow. Importantly, the company presently carries lower debt levels than before the onset of the 2020 pandemic. The company maintains a highly conservative payout ratio of less than 30%, supported by its strong cash flow. Given these factors, I continue the dividend increase to continue into the future.

Something that reinforces the cash flow available to support a growing dividend is the cost saving initiatives that KR is prioritizing. CFO statements confirmed this cost saving initiative as well as planned dividend increases into the future:

Our cost-saving initiatives are focused on simplification and utilizing technology to enhance the associate experience without impacting the customer. We remain on track to deliver our sixth consecutive year of $1 billion in cost savings.

Kroger continues to generate strong free cash flow through consistent operating results and working capital improvements. At the end of the second quarter, Kroger’s net total debt to adjusted EBITDA ratio was a record level of 1.31. This compares to our net total debt to adjusted EBITDA target range of 2.3 to 2.5. The company expects to continue to pay its quarterly dividends and expect this to increase over time subject to Board approval. – Gary Millerchip, SVP & Chief Financial Officer

Valuation

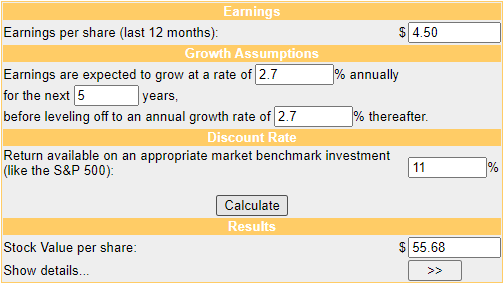

With a current Price/Earnings (P/E) ratio of 13.2, Kroger sits at a discount when compared to the sector median of 18.95. However, for further insight we can use a discounted cash flow model to determine an estimated fair value. Since the most recent year over year revenue growth came in at only 2.7%, we will use this as an input for our estimation. Combining a conservative estimated growth per year of 2.7% with an EPS (earnings per share) multiple of 4.5x, we come to the conclusion that KR is slightly undervalued.

Money Chimp

Using those inputs, we conclude that a fair value for shares of KR are about $55.68/share. This would represent a 30% price upside from the current levels. The Wall St. price targets range from as low as $42/share to as high as $65/share with the average price target sitting at $51.50/share. Our estimates fall within this range and as inflation cools and consumer spending on grocery related items continues to increase, we expect the YoY revenue growth to increase as well.

Despite the relatively low upfront yield and average revenue growth, I have been acquiring shares because I believe Kroger’s growth potential has not been fully reflected in its valuation compared to competitors. This is partly attributed to the company’s limited presence in densely populated areas.

Takeaway

Kroger (KR) presents a compelling investment opportunity despite its 3% decline this year. The company’s impressive business model aligns with consumer spending trends, and its dividend growth history, with a current yield of 2.6%, indicates financial stability and growth potential.

Kroger’s resilience during economic uncertainties and its consistent revenue climb, even in the absence of a strong foothold in certain regions, underscore its untapped growth potential. The company’s success in e-commerce, expected to constitute 20% of the U.S. grocery market by 2026, positions it for sustained growth.

Additionally, Kroger’s potential merger with Albertsons (ACI) and history of share buybacks further contribute to its growth prospects. The valuation analysis, including a fair value estimate of $55.68/share and Wall Street price targets, supports the notion that Kroger is undervalued.

Read the full article here