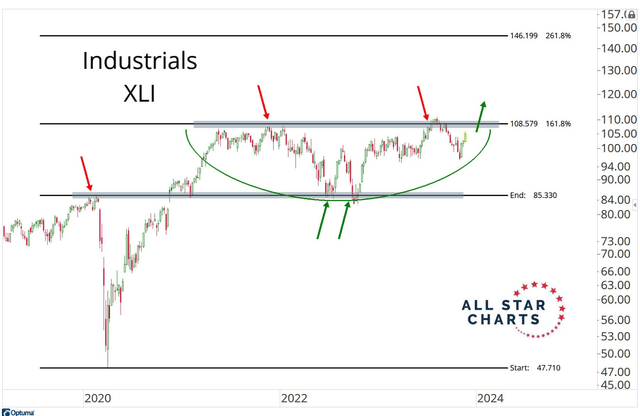

I was on Stock Market TV with JC Parets last week, and we discussed a range of topics. One chart he has been eyeing is the performance of the Industrials sector. Full credit to JC on this one, but there’s significant upside potential in the Industrial Select Sector SPDR Fund ETF (XLI) as we approach year-end and 2024. After pausing at a key Fibonacci level, the fund could have eyes on the mid $100s on a breakout.

That’s just a high-level technical view. Let’s home in on Caterpillar (NYSE:CAT). I have a buy rating on the stock based on valuation, strong profitability trends, and decent momentum. Still, global growth risks are significant over the coming quarters.

All Star Charts: On Watch for an Industrials Sector Breakout

JC Parets

According to Bank of America Global Research, Caterpillar, the largest manufacturer/marketer of construction equipment worldwide, is also a leading manufacturer of engines and turbines for transport, energy, and industrial applications.

The Texas-based $126 billion market cap Construction Machinery & Heavy Transportation Equipment industry company within the Industrials sector trades at a low 12.3 forward price-to-earnings ratio and pays an above-market 2.1% dividend yield. Following its earnings report last month, shares trade with a low 22% implied volatility percentage, and short interest on the stock is low at just 1.3%.

Back on the morning of Halloween, CAT issued strong results, but the stock-price reaction was a trick, not a treat, for investors. Non-GAAP net income per share verified at $5.52, beating the Wall Street consensus estimate of $4.79. That marked yet another positive EPS surprise that dates back to at least January of 2021. CAT fell more than 6% that session – the worst earnings-date reaction in at least two years. Top-line growth of 12% from year-ago levels also topped expectations, due in part to better sales volumes, despite unfavorable changes in dealer inventories.

The primary culprit for the weak stock reaction was an 8% sequential drop in its backlog, but that should not have come as a surprise to analysts given constant industry warnings amid improving supply chains. While cyclical headwinds are many looking ahead to 2024, healthy free cash flow trends and EPS growth expected should warrant a higher stock price.

Key risks include a weaker global macro picture and poor investment outcomes with its capex spending projects. Furthermore, pricing pressure could hurt margins if competition increases on the global stage. Adverse FX moves can pose near-term profit challenges, too.

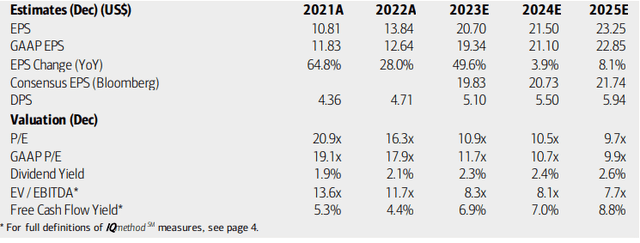

On valuation, analysts at BofA see earnings rising nearly 50% this year while per-share profits are expected to continue higher in 2024, of course much depends on the global growth situation. EPS should rise at a faster pace by 2025, though. The current consensus outlook, per Seeking Alpha, calls for non-GAAP net income per share to hover near $20.60 over the ensuing quarters (annualized) while sales growth slows to the low-single digits.

Dividends, meanwhile, are expected to rise at a steady clip through 2025, which could result in a significant yield compared to the S&P 500’s. With earnings multiples that are now in the low teens, there is a significant value case here. Additionally, CAT’s EV/EBITDA ratio is significantly below that of the broader market. Finally, the company has produced nearly $17 of free cash flow per share over the last 12 months, allowing for healthy shareholder accretive activities.

Caterpillar: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

BofA Global Research

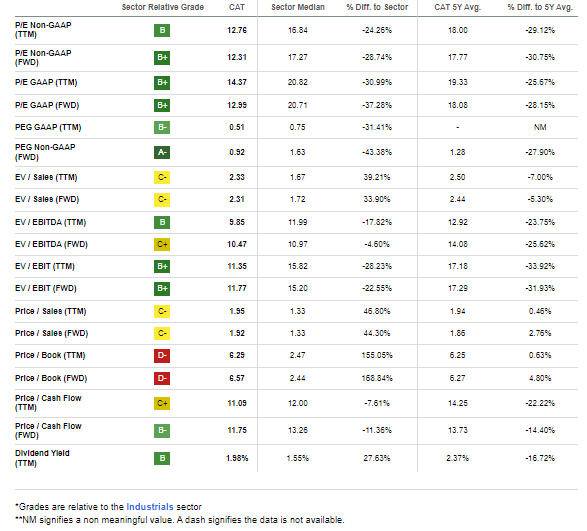

If we assume just a 14x multiple on 2024 EPS, below its historical 15-16x P/E range and 5-year average just shy of 18, then we are talking about a stock price that should be close to $290, making it attractively valued today. CAT’s modest 15x free cash flow multiple is also compelling, though it is not particularly cheap on a price-to-sales basis.

CAT: Compelling Earnings Multiples

Seeking Alpha

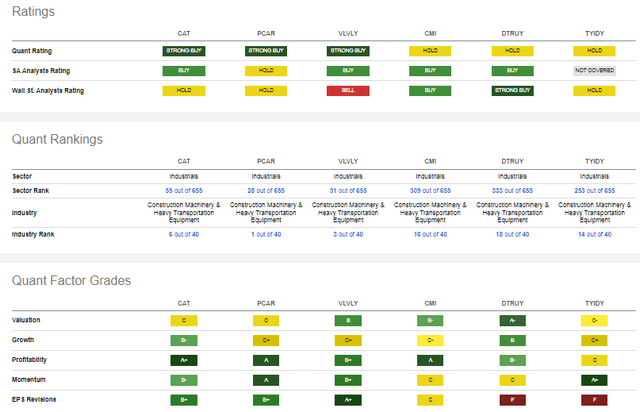

Compared to its peers, CAT features decent growth prospects, but where the company really stands out is with its profitability strength. Share-price momentum has been decent, but I will highlight key risks and price levels on the chart readers should monitor. Finally, after a strong Q3 report, EPS revisions are trending well, which is not true of all its primary industry peers.

Competitor Analysis

Seeking Alpha

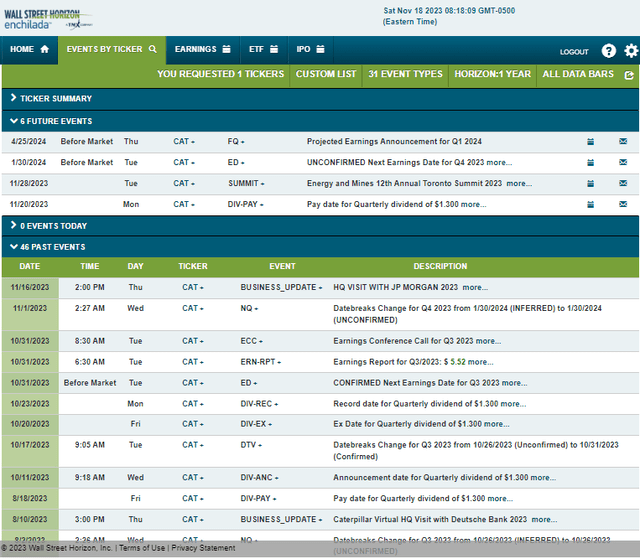

Looking ahead, corporate event data provided by Wall Street Horizon shows an unconfirmed Q4 2023 earnings date of Tuesday, January 30 BMO. Before that, the firm’s management team is slated to present at the Energy and Mines 12th Annual Toronto Summit 2023 later this month on the 28th and 29th, so there could be volatility then.

Corporate Event Risk Calendar

Wall Street Horizon

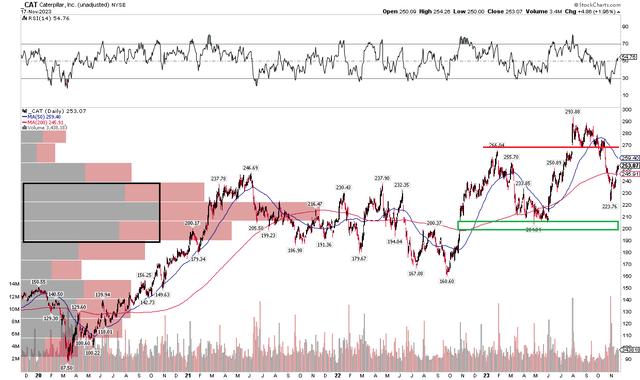

The Technical Take

Readers might recall a near-term bearish view I had on shares in advance of its Q3 earnings report in October last year. The stock’s price action did not pan out as I had thought, but that’s how it goes sometimes with near-term outlooks. Longer-term, notice in the chart below that CAT has key support in the $200 to $204 range. A strong gap-higher nearly a year ago sent the stock through its 200-day moving average, and though the bears brought CAT back under that trendline indicator for a time in Q2 this year, the overall pattern of higher lows is encouraging. I see upside resistance near $266 – that was the peak from earlier this year and about where shares broke down from in October.

Amid this trading range, the RSI momentum indicator is lackluster near 50 without a clear trend, though it has broken a downtrend from the previous few months. What’s more, the flat 200dma is not a positive sign compared to other stocks with more pronounced uptrends. Finally, take a look at the volume by price indicator on the left side of the chart – there should be an ample number of natural buyers on pullbacks to the $190 to $240 zone.

Overall, the technical view is not all that positive, but the series of higher lows and higher highs of the Q3 2022 nadir is encouraging.

CAT: Upside and Downside Price Point to Monitor

StockCharts.com

The Bottom Line

I have a buy rating on CAT. I see the stock as undervalued while healthy international profitability trends should be enough to weather the domestic economic slowdown.

Read the full article here