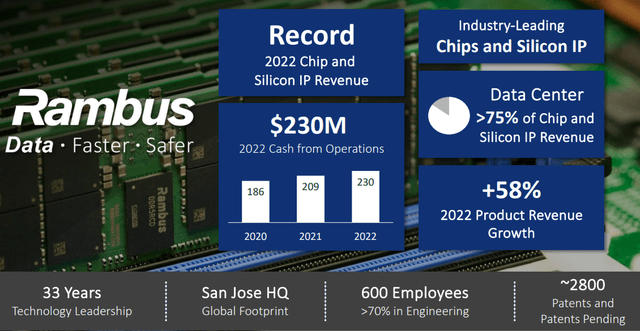

Rambus (NASDAQ:RMBS) is a San Jose, California-based hardware technology company which focuses on the design, development, and licensing of chip interface technologies and architectures across digital electronics. The inventor of RDRAM, Rambus principally focuses its portfolio on random access memory- RAM, interface and security intellectual properties, and other R&D and IP.

Additionally, to avoid confusion, Rambus refers to its Q3’23 earnings in its Q4’23 presentation.

Rambus Q4’23 Presentation

Through these activities, Rambus has achieved a Q3’23 revenue of $105.30mn- a 6.19% decline- alongside a net income of $103.20mn and a free cash flow of $43.62mn.

Introduction

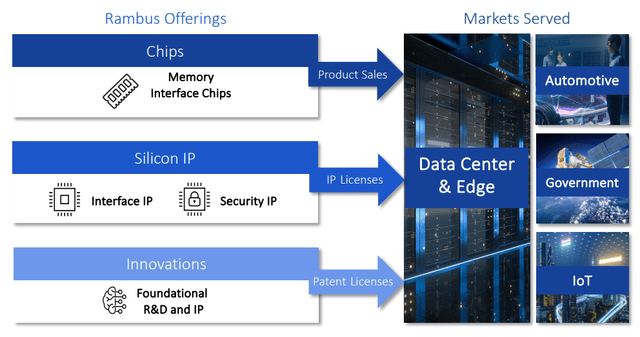

As aforementioned, Rambus’ principal offering continues to be its memory products, which it directly sells on a B2B basis, typically to data centers and for edge computing cases, automotive companies, government, and for IoT projects. Additionally, Rambus engages in the higher margin activity of IP licensing, throughout its interface and security products, as well as foundational R&D patenting.

Rambus Q4’23 Presentation

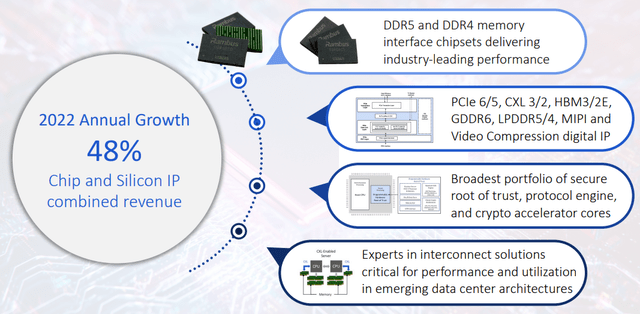

While all three of Rambus’ primary segments pursue extensive growth, driven by technology growth megatrends, the company has seen the greatest growth in chip and silicon IP licensing, with Rambus introducing interfaces central to forward data center demand, such as state-of-the-art video compression IP, broad portfolios of designs which leverage megatrends across technology, and architectures core to emergent interconnected solutions within data centers.

Rambus Q4’23 Presentation

As such, although I do believe Rambus trades above its fair price purely on a financial basis, I believe the company’s operational strength and extremely strong moat in terms of intellectual property and R&D will enable rapid growth and justify its higher price.

Therefore, I rate Rambus a ‘buy’.

Valuation & Financials

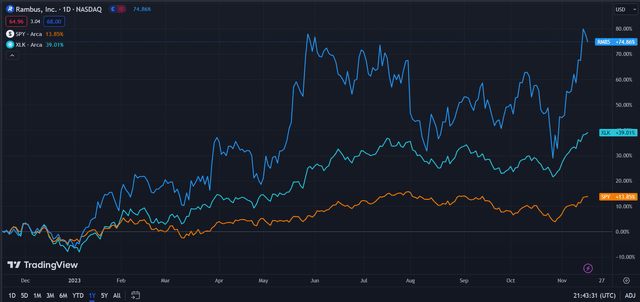

Trailing Year Price Action

In the TTM period, Rambus’ stock- up 74.86%- has seen superior price action to the technology industry, as represented by the Technology Select Sector SPDR Fund (XLK)- up 39.01%- and the broader market, as represented by the S&P500 (SPY)- up 13.85%.

Rambus (Dark Blue) vs Industry & Market (TradingView)

A key factor behind the overvaluation of Rambus seems to be its outsized growth in the hyper-volatile macro environment of today, which has driven skepticism about the company’s ability to continue driving similar growth.

However, given the declining threat of inflation, the potential relaxation of monetary policy in a shorter time frame given lower core inflation, and continued, aggressive investment into IoT and cloud infrastructure, in my opinion, enables enduring growth for Rambus.

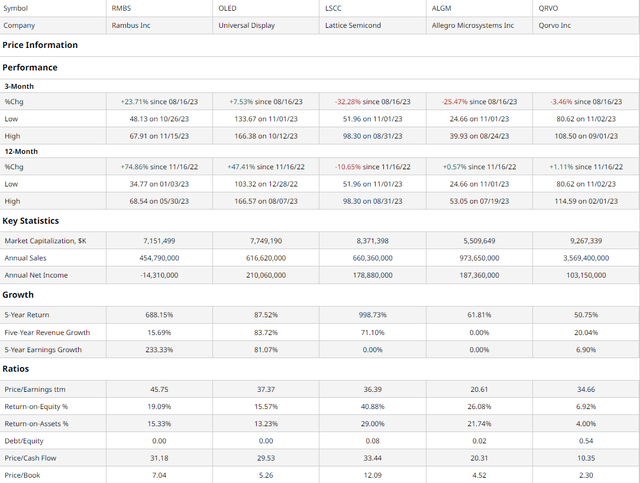

Comparable Companies

Since Rambus operates across such a specialized portfolio of companies many of its competitors tend to either be much larger companies or cater directly to retail consumers. As such, I sought to compare Rambus to similarly sized technology hardware companies, as seen on the ‘Peers’ tab of Rambus’ Seeking Alpha page. This group includes organic light-emitting diode manufacturer, the Ewing, New Jersey-based Universal Display (OLED), the Hillsboro, Oregon-based low power field-programmable gate array designer and manufacturer, Lattice Semiconductors (LSCC), the Manchester, New Hampshire-based semiconductor and application-specific algorithm developer, Allegro MicroSystems (ALGM), and Greensboro, North Carolina-based communications technology hardware developer, Qorvo (QRVO).

barchart.com

As demonstrated above, Rambus has experienced best-in-class quarterly and yearly price action, which has created gaps between it and its peers in terms of multiples-based value. Despite, this, I believe Rambus’ historic growth and present capabilities can enable continued growth.

For instance, although Rambus does not pay out a dividend owing to its growth-centricity, investors who held the company through the past five years would have seen 688.15% growth, the second-best of the peer group.

This growth is driven by the peerless earnings growth Rambus has seen, with aggressive demand growth for its products enabling trailing 5Y earnings growth of 233.33%, well above the second-best in the group, Universal Display, at 81.07% earnings growth.

However, Rambus does look overvalued when assessing multiples, with above-average P/E, P/CF, and P/B multiples.

Nonetheless, with the joint-lowest debt/equity of the group, Rambus is well-positioned to continue reinvesting and enable its historic growth trajectory.

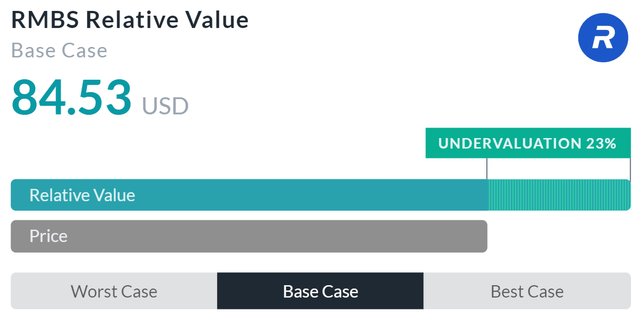

Valuation

According to my discounted cash flow model, at its base case, the net present value of Rambus is $64.69, meaning, that at its current price of $65.51, the company is overvalued by 1%.

My model, calculated over 5 years without perpetual growth built in, assumes a discount rate of 10%, reflecting Rambus’ high equity risk premium. Additionally, remaining conservative, I projected a forward yearly revenue growth rate of 6%, lower than the trailing 5Y average of 7.49%.

Alpha Spread

On the other hand, Alpha Spread’s multiples-based valuation tool believes that Rambus has a base case undervaluation of 23%, positing a relative value of $84.53.

However, Alpha Spread’s valuation of Rambus is skewed by outlier companies it compares Rambus to and therefore, while informative, cannot be relied upon for valuation.

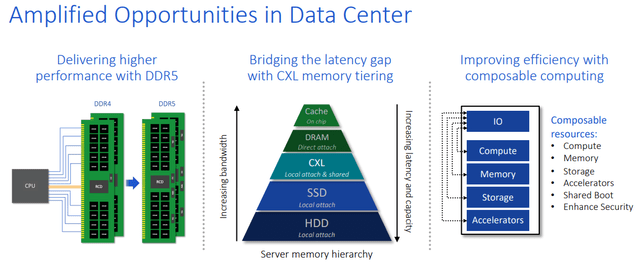

Rambus is Capitalizing on Computing Megatrends & Maintains a Moat of Superior Product Offerings

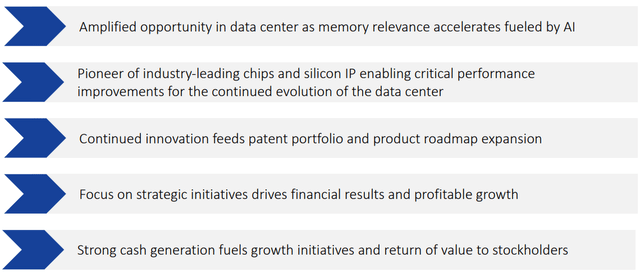

The primary megatrend driving Rambus’ growth orientation is the widespread number of opportunities in data centers and periphery markets. More specifically, data centers and cloud enterprises are increasingly aiming for higher speed and power, which can be delivered through Rambus’s proprietary DDR5 platforms. Additionally, Rambus leads the market on CXL- Compute Express Link, which seeks to promote a unified memory infrastructure to achieve higher speeds between host processors and accelerators- and enables rapid revenue growth and margin expansion.

Rambus Q4’23 Presentation

As such, Rambus remains in a strong product positioning to support its current growth objectives. Using the cash flow from this growth, Rambus aims to continue to reinvest and lead the industry in next-gen memory architectures, ensuring high-quality, secure and reliable memory systems, increasing the focus on security for novel AI procedures and quantum cryptography, all the while maintaining the company’s existing strategic customer and product roadmap.

Rambus Q4’23 Presentation

Risks & Challenges

Rising Competitive Intensity & Threat of Disruption is Constant

Although Rambus maintains a strong product-oriented moat, with a peerless pipeline of up-and-coming products, the company operates in a fast-paced environment with constant innovation. As such, as the number of entrants into the cloud hardware industry continues to increase, the ability of Rambus to maintain its growth capabilities diminishes and may lead either to price competition or accelerated R&D spending, either of which may compress margins and/or growth.

Resurgent Inflation May Impact Underlying Demand

As seen with the most recent CPI report, inflation seems to be slowing, by proxy meaning that interest rates likely will stay stagnant rather than rise. Thus, any reduced demand Rambus has seen in lieu of higher rates and spending cuts by customer companies is unlikely to continue. Yet, if inflation does return and/or rates subsequently rise, Rambus may see diminished demand from businesses.

Wall Street Consensus

Analysts are generally more optimistic about Rambus’ prospects relative to my valuation, estimating an average 1Y price forecast of $70.50, a 7.83% increase.

TradingView

Even at the minimum projected price target, analysts expect only a price decline of 0.58% to a price of $65.00, representing Wall Street opinion- echoing my own- that investors are underpricing macro growth and operational growth for Rambus.

Conclusion

In the long run, Rambus continues to leverage its innovative portfolio to capitalize on technology megatrends and ensure solid shareholder price appreciation for years to come.

Rambus Q4’23 Presentation

Read the full article here