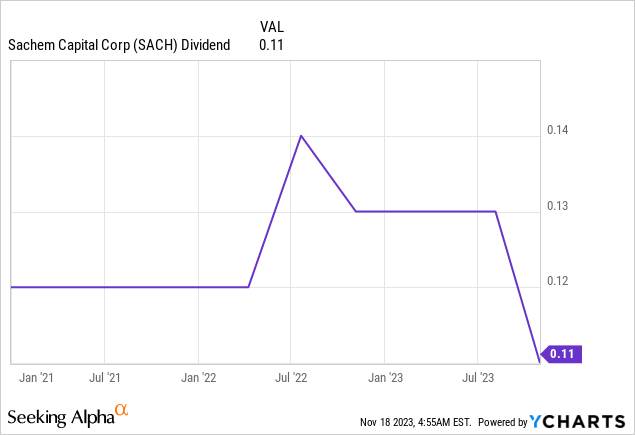

Whilst Sachem Capital’s (NYSE:SACH) total returns year-to-date are decent at 10%, forward returns are likely set to be more mixed as the long elusive dovish Fed pivot is realized to reverse the disruption of the spread the hard money lender earns on its loans. The mREIT’s third quarter dividend at $0.11 per share, was a substantial 15.4% decline from its prior distribution for what’s currently a 12.4% annualized forward yield. Critically, whilst Sachem’s near-term dividend history is punctuated by disruption, the current quarterly distribution is not as well covered by net income as the macroeconomic backdrop for hard money lending goes through another change. I last covered Sachem in the summer questioning whether the dividend was set for a cut.

The Fed’s 25 basis points hike in July is now likely to be the final of the current tightening cycle with 30-Day Fed Funds futures pricing in a 100% chance rates remain unchanged at the upcoming December and January Federal Open Market Committee meetings. Sachem is focused on underwriting several loan products including fix-and-flip loans, bridge loans, and foreclosure loans. The carrying value of the mREIT’s loan portfolio at the end of its fiscal 2023 third quarter stood at $496 million across 327 mortgage loans.

Sachem Capital November 2023 Investor Presentation

Loan Portfolio, Underwriting Quality, And Home Sales

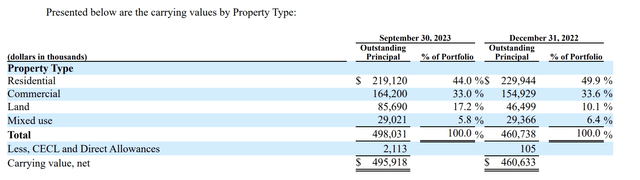

Sachem Capital Fiscal 2023 Third Quarter Form 10-Q

Underwriting quality is critical in the current macroeconomic environment as it drives the direction of non-performing loans and the underlying loan book asset base that supports the dividend. At the end of the third quarter around 95 of Sachem’s loans with an aggregate outstanding principal balance of $84.8 million, around 17% of mortgage receivables, had matured but have yet to be repaid in full or extended. Another 64 loans with an aggregate outstanding principal balance of $63.5 million, around 12.8% of mortgage receivables, are in foreclosure. It’s a difficult macroeconomic environment, but non-performing approaching one in five is unsustainable.

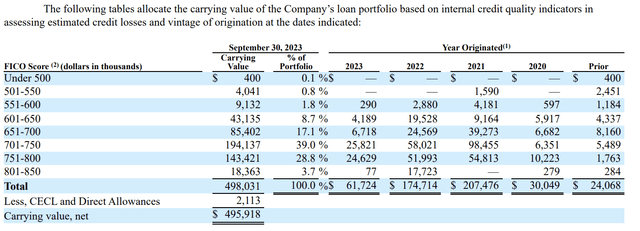

Sachem Capital Fiscal 2023 Third Quarter Form 10-Q

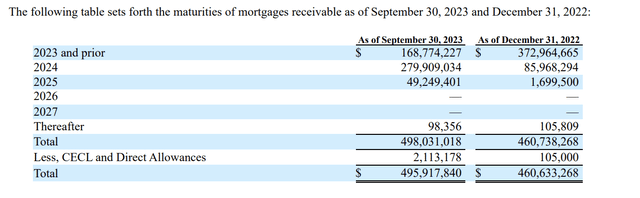

Sachem’s loan portfolio is geared towards higher FICO scores with 32.5% of the loan portfolio having a FICO score of 751 and above. Sachem is heavily focused on short-term loans with the bulk of its loan book, around 90.5%, maturing in 2023 and 2024. Lenders have two ways to pay these back, the refinance or sale of the underlying collateral property. The former exit is difficult as the Fed funds rate was hiked to a 22-year high at 5.25% to 5.50% over the last 1-year.

Sachem Capital Fiscal 2023 Third Quarter Form 10-Q

Existing home sales are dropping, falling 15.4% year-over-year to 3.96 million transactions in September. This was also down 2% over the prior month and was a 13-year low as housing affordability takes a hit from higher interest rates. Around 44% of Sachem’s portfolio was in residential loans at the end of the third quarter.

Dividend Coverage As Fed Pivot To Offer A Salvo But Headwinds Remain

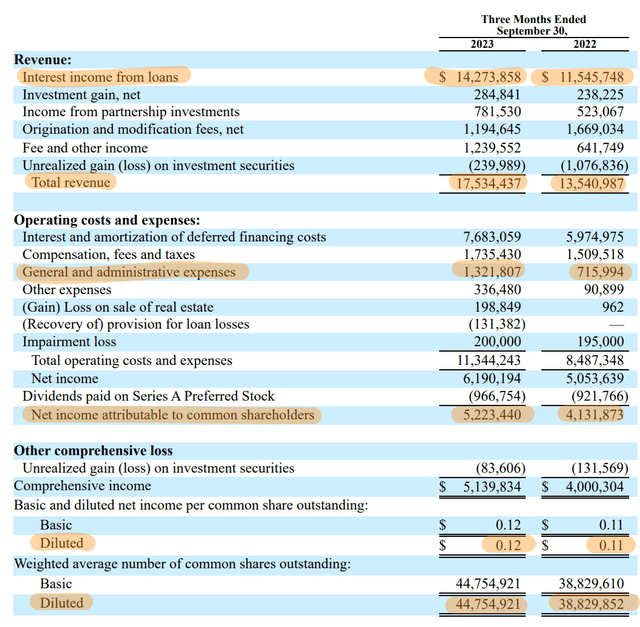

Sachem Capital Fiscal 2023 Third Quarter Form 10-Q

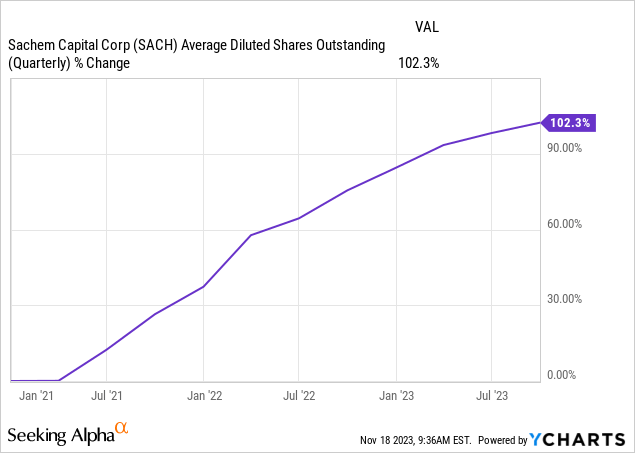

Sachem’s third quarter total revenue at $17.5 million was roughly 30% growth over its year-ago comp and a beat by $2.28 million on analyst consensus. The mREIT derives the bulk of its total revenue from interest on its loans but also earns revenue from origination and modification fees. Net income attributable to common shareholders at $5.2 million, around $0.12 per share, was up just 1 cent from net income per share of $0.11 in the year-ago period. This per share growth at 9% compared unfavorably to the net income increase of 28% on a nominal basis. This was due to Sachem tapping equity sales to raise capital.

The company’s diluted weighted average number of common shares outstanding at 44,754,921 at the end of the third quarter grew by 15% over its year-ago comp. This type of dilution is destructive to shareholders because it’s being conducted as the common shares are trading below their adjusted book value. The mREIT does not directly provide its book value figure but it can be worked out. Equity recorded on their balance sheet at $236 million, needs to be adjusted for $50 million of the 1,996,000 Series A preferred shares (NYSE:SACH.PR.A) that are outstanding at the end of the third quarter. Hence, Sachem’s book value stands at $186 million, around $4.10 per share. The company has traded below this level since September 2022 with the current stock price of $3.55 implying a near 14% discount to book. The current dividend is around 109% covered by net income per share, or a 92% payout ratio. This is far too tight for comfort and continued equity sales could see this coverage worsen especially if non-performing loans remain robust. I don’t have a position in the mREIT here but the dividend still sits under the specter of uncertainty.

Read the full article here