Investment Thesis

Legal & General [LGEN] (OTCPK:LGGNY, OTCPK:LGGNF) is a UK-based financial services group. Both the UK market, and the life insurance and pensions sector have been under pressure in recent years, and yet LGEN has shown resilient performance. They pay an 8.8% dividend, which they are committed to grow at 5% p.a., with a reducing dividend to net income ratio. The valuation is compelling, and LGEN stands to benefit from several macroeconomic and social factors going forward. I assess LGEN as a buy for dividend investors as I expect the share price to increase over time.

Business Analysis

Founded way back in 1836, Legal & General is a leading UK financial services group and major global investor and one of the world’s largest asset managers. They are a global leader in pension risk transfer, in UK and US life insurance, and in UK workplace pensions and retirement income. Their primary listing is on the FTSE [LGEN], but they have ADRs LGGNY and LGGNF.

Legal & General is a household name in the UK (they helped me buy my first house in 1989) and is rated AA- by S&P.

Its business model is to generate assets through its pensions and retirement business, and invest in bonds and hard assets to generate low volatility long-term returns.

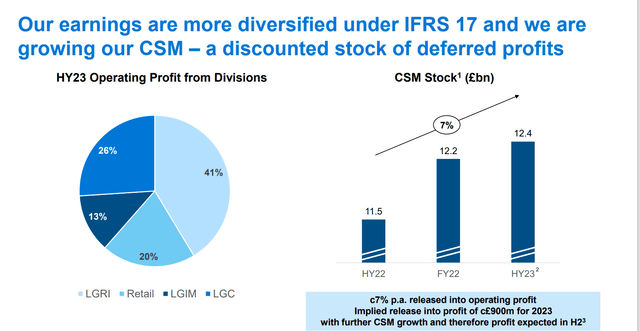

The company operates in four business segments across life insurance and asset management – Institutional Retirement (LGRI), Retail, Investment Management (LGIM) and Alternative Investments (LGC).

LGRI serves institutional pension funds via Pension Risk Transfer solutions mainly in the UK and US markets, PRT effectively buys the outstanding pension liabilities, typically defined benefits annuity streams, from the pension funds, enabling them to free up capital. The assets that are generated by this form investment float for the asset management arm.

LGRI also has a reinsurance business, which sells reinsurance protections to support pension funds in three areas, asset risk protection, mortality and longevity risk, and global pension transfer solutions.

Retail sells insurance and retirement solutions and mortgage solutions to individuals.

LGIM is the asset management arm, with GBP1.3 trillion (USD1.6 trillion) of Assets Under Management.

LGC is an alternative asset manager, with a focus on infrastructure and real assets.

Business Performance

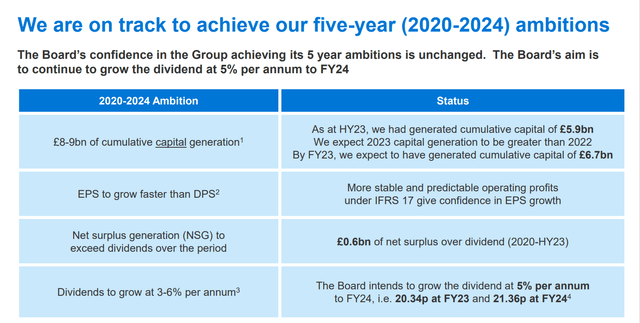

In the recent half year 2023 results, LGEN delivered good results and management restated their confidence in achieving their 5-year targets, and declared the targeted increase in their semi-annual dividend.

Investor presentation

Their goals are to grow the dividend between 3-6% over the period, with the dividend payout ratio to earnings to trend downwards. With GBP8-9bn of new capital generated, and reinvested in long duration assets to match the liability profile, this dividend growth should be sustainable long into the future.

Investor presentation

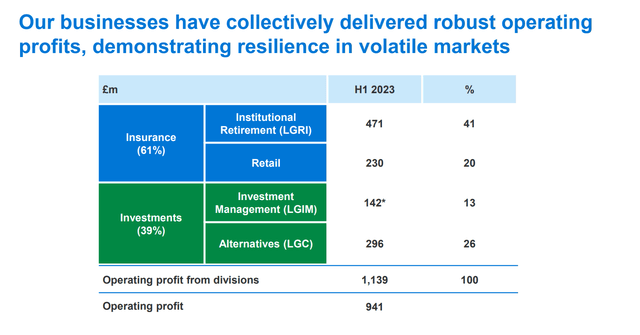

All four areas of the business performed well in H1 2023, generating GBP1,139m in operating profits that are quite well distributed between the business units. Group charges relating to debt servicing and business investments reduce the overall operating profit for H1 to GBP941m.

Investor presentation

All in all, a pretty decent performance for a H1 2023, in an environment where the UK economy has been in the doldrums, generating little growth, and financial markets have been highly volatile.

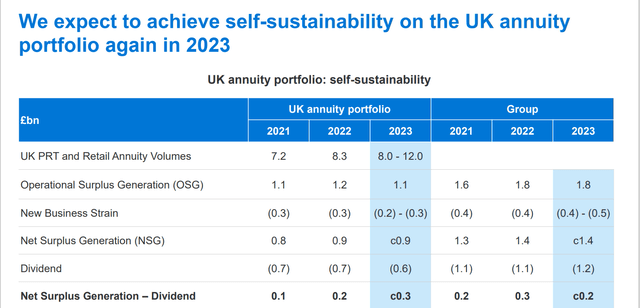

One challenge has been the UK annuity portfolio. This business model has a couple of risk factors which created a drag in recent years. Basically selling annuities involves bringing cash onto the balance sheet in exchange for a guaranteed return to the buyer over the policy lifetime, either a long-term fixed period, or the lifetime of the buyer.

A key issue is that the business is usually intermediated, and the intermediaries are compensated by a lump sum commission, which generally means the deal is cash flow negative until the upfront costs are amortised. So the faster the business grows the bigger the headwind of this ‘new business strain’.

The operational surplus has to be big enough to absorb the new business strain, and still leave enough to pay dividends. In investment markets with high volatility, the investment return comes under pressure, and the UK annuity book has only barely covered the dividend. Management expresses confidence that the UK book will return to sustainable earnings levels in 2023, with only 2/3 of the net operating surplus paid away as dividends.

Investor presentation

Macro Trends That Give Confidence In The LGEN Profit Growth Outlook

Interest Rates Higher For Longer

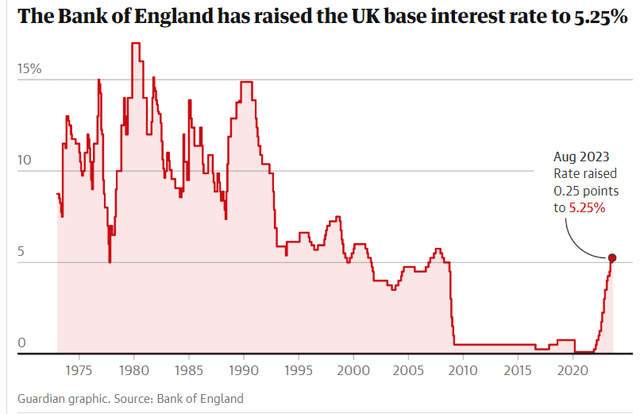

The BOE last raised interest rates in August 2023, to a level of 5.25%, and provided an outlook that rates would remain at this level for at least two years.

As can be seen in the chart below, the dramatic rise in rates really represents just a reversion to the long-term mean, rather than a short-term spike.

In a higher interest rate environment, the investment portfolio should be generating a higher spread, significantly improving the Return on Investment margins.

The Guardian

Ageing Population & Welfare Reforms

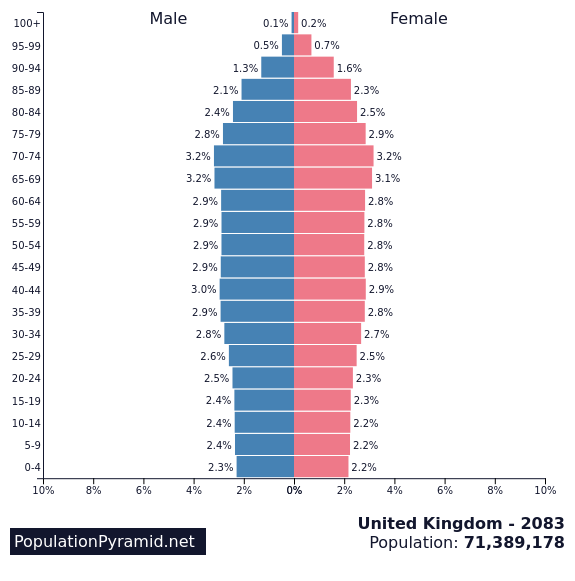

As can be seen in in the graphic below from PopulationPyramid.net The UK has a typical developed world demographic profile, with a large pipeline of upcoming retirees to fuel the growth of the LGEN retirement solutions business. Changes to the UK and other pension systems have created a greater pool of retirees seeking to self-manage their future income streams and increasing demand for personal retirement solutions.

PopulationPyramid.net

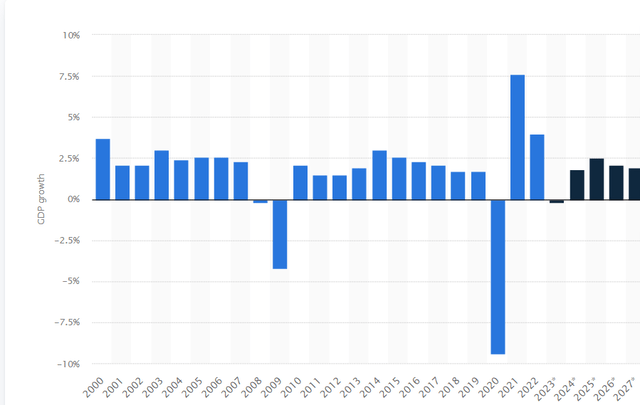

UK Economic Recovery Post-Covid, Brexit, And Inflation.

The UK Economy has been struggling to return to sustainable growth after the headwinds of Covid, Inflation, and the Brexit ‘own goal’. The economic policies of recent governments have arguably not helped the situation. Projections are for a slight contraction in 2023, but a return to GDP growth levels in the low 2% range from there onwards.

Source – Statista.com

UK Accounting Shift To IFRS 17

LGEN now reports on the new international accounting standard, IFRS 17, which has a significant benefit to businesses like life insurers, which have very long contract earn outs.

Basically IFRS 17 provides uniformity of the earning of profits over the lifetime of long duration contracts, allowing more transparency over the embedded value in the business, and a significantly reduced earnings volatility. The net present values of long duration contracts are reported as ‘Contract Service Margin’ or CSM which is then released as profit uniformly over the lifetime of the contract. IFRS 17 has further beneficial impacts on Solvency.

Investor presentation

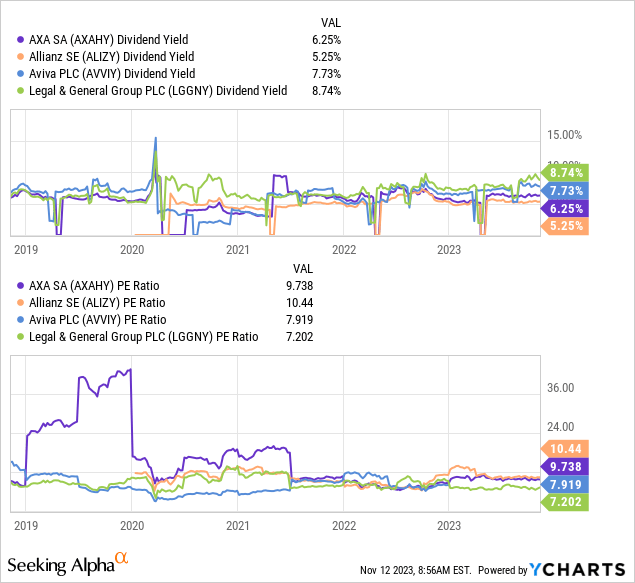

Valuation

LGEN valuation is quite compelling, both in absolute and comparative terms to peers. The table below shows the TTM Price Earnings ratio for LGEN alongside several European peers. At 7.2 times earnings LGEN is the bottom of the pack in terms of price to earnings, but sports the highest yield.

As a subscriber to Morningstar, I was able to access their current ratings for the cohort, and in their view, all are trading within 6.5% and 15.5% of fair value, with Aviva (OTCPK:AIVAF) and Allianz (OTCPK:ALIZF) given a slightly more positive outlook.

| Stock | Fair Value | Current Value | Discount to FV | |

| Legal and General | 2.41 | 2.26 | 6.64% | |

| Aviva | 4.8 | 4.15 | 15.66% | |

| Axa (OTCQX:AXAHY) | 32.4 | 30.33 | 6.82% | |

| Allianz | 2.5 | 2.25 | 11.11% | |

I conducted my own DCF analysis, with assumptions closer to management guidance, which produced a discount to Fair Value of 25%.

To understand the difference between this and Morningstar, I simulated more aggressive assumptions, as presented in the table below.

| Calculations | Author | M* Simulation | ||||||

| Revenue | £ bn | 89 | 89 | |||||

| Net Income | £ bn | 2.8 | 2.8 | |||||

| Fair Value Market Cap | £ bn | 22 | 18.13 | |||||

| Current Market Cap | £ bn | 17 | 17 | |||||

| Discount/Premium to FV | 29.41% | 6.65% | ||||||

| Assumptions | ||||||||

| Discount Rate | 15% | 15% | ||||||

| Tax Rate | 13.90% | 13.90% | ||||||

| Net Income Growth Rate | 5% | 2.50% | ||||||

| Terminal Growth Rate | 3% | 1% |

My interpretation is that the Morningstar analysis assumes that LGEN net income growth drops from the recent business performance, and the business basically stagnates going forward.

Given the various macro tailwinds presented above, management’s guidance, and resilient performance, I have a more optimistic outlook. My assumptions are that net income growth meets management guidance for the dividend growth rate, but their guidance for a lower dividend to income ratio is not achieved. I assume that the current effective tax rate is achieved, and the terminal growth rate implies that the business continues to grow margins in line with the long term inflation trend.

This leads to a close to 30% discount to fair value.

Risks

Macroeconomic And Market Risk

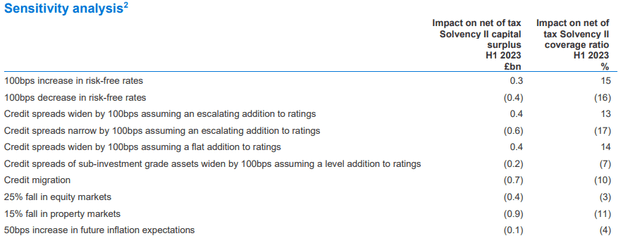

In assessing the risk profile, I find a good source of information is management’s own assessment. The following table is from the analyst pack accompanying the H1 results.

Key risks identified are mainly investment risks – decrease in yields, decrease in spreads, a major credit event, and a major drop in either equity or property markets.

While the sensitivity is conducted at the capital level, the scale of the impact on earnings would be material from yield and spread impacts. these are the key macro risks to earnings.

Investor presentation

Key Business Risks

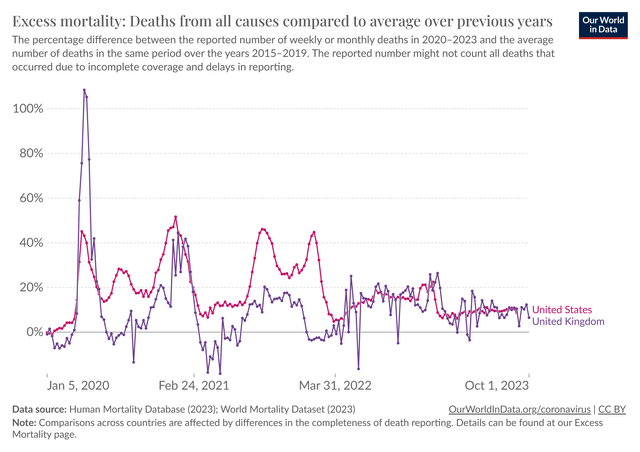

Assumptions around mortality, and policy lapse rates are the key risk factors in pricing life insurance in addition to market risk. In the UK and the US, Covid 19 created a surge in mortality rates, especially in the older population, which tends to be overweight in life insurance populations. This has the negative effect of increasing payouts for life protection products, but a positive effect on the payments of annuity benefits. Material deviations from pricing assumptions are a key risk for life insurance pricing, so reversion to a more normal state is a positive.

The following chart shows the significant volatility in excess mortality, which has now reduced dramatically.

Our World in Data

Lapse risk is the risk of policyholders surrendering their policies. As discussed above in the context of new business strain, life insurers acquire future revenue streams when they sell policies, and pay hefty commissions to the agents that sell them. If more policies lapse than expected, the future revenue is lower, but the commissions paid out are not clawed back.

Regulatory Risk

Key risks here are in how Solvency capital is assessed, taxation and pensions legislation.

For life insurers in the UK, Solvency II determines capital requirements. The UK government is still working through the details of how Solvency II will be implemented. There is the possibility of increased capital requirements from the current situation.

As a pensions provider, LGEN is sensitive to the prevailing legislation and taxation of pensions. As discussed above, pensions reforms have provided a boost to the sales opportunities for the LGEN retail business. A further tailwind is the recent change to taxation of pensions, which removed the long standing Lifetime Allowance, that effectively capped pensions contributions by individuals.

An election is due before the end of 2024, and the Labour opposition is expected to form the next government. They have vowed to reverse some of the recent changes to pensions taxation.

Country & Currency risk

LGEN has a heavy dependency on the UK, and as such is overweight to the UK economy. However, the US business has been a growing contributor, and the company is focused on accessing a global marketplace for new business opportunities, providing balance. Earnings are heavily weighted toward GBP, which provides some currency risk for non UK investors

To Conclude

As a dividend investor, I see LGEN as a strong income generator, which stands to benefit from some key macro trends.

The 8.8% yield is secure, and management are committed to continuing to grow this by 5% annually.

The business has proved resilient through some very critical challenges for both its key market and its business, and continues to deliver on its targets.

Valuation is at a low point, and discounted to peers, while the business outlook is steadily improving.

The company is exposed to several key risks, however, the outlook for most of these is positive.

I am adding to my position.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here