AT&T (NYSE:T) offers a high-dividend yield that is sustainable due to its good earnings and cash flow coverage, plus its shares are trading at an undemanding valuation, being therefore a good pick for income-oriented investors.

However, since my previous article, AT&T’s share price has been relatively weak due to the lead cable issues, thus in this article I analyze AT&T’s recent financial performance and update its investment case, to see if it remains a good income play or not.

Recent Financials & Dividend

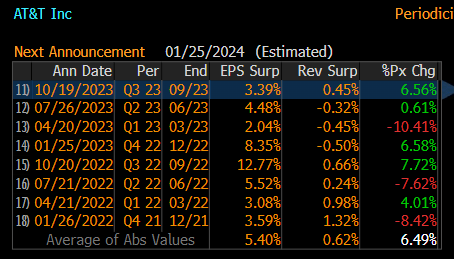

Regarding its most recent financial performance, AT&T has reported about one month ago its Q3 earnings, which were above estimates both on revenues and the bottom-line, as shown in the next graph, being the best quarter compared to expectations over the past year, and led to a positive share price reaction in the day.

Earnings surprise (Bloomberg)

Its revenues in Q3 amounted to $30.4 billion, up by 1% YoY, boosted by subscriber growth due to the company’s rollout of 5G and fiber that is making it more competitive in the marketplace. In Q3, AT&T was able to add on a net basis some more 468,000 customers, which is a quite positive outcome given the fierce competition from T-Mobile US (TMUS) and Verizon (VZ).

Indeed, as the U.S. telecom industry is broadly mature, customers gain came mainly at the expense of market share increases, making it quite hard for the three largest players to gain customers on a recurring basis from quarter to quarter.

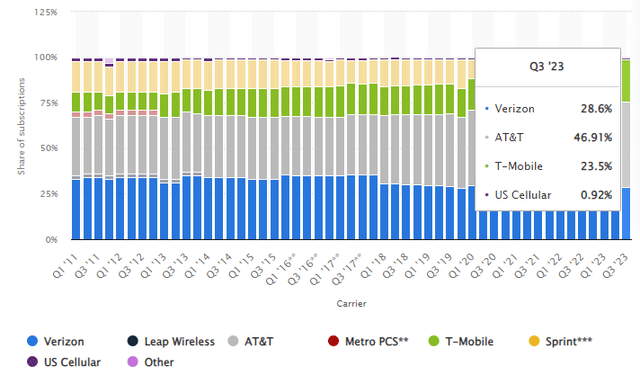

In recent years, T-Mobile US has delivered higher customer growth in the wireless segment due to strong investment in 5G rollout and some other perks for new subscribers, while AT&T has also reported positive numbers, while Verizon has been the main loser. As shown in the next graph, AT&T is the market leader with a market share of close to 47%, followed by Verizon and T-Mobile.

Wireless market share (Statista)

While there is a fourth operator, US Cellular Corp (USM), the market may eventually concentrate into three operators, taking into account that Telephone and Data Systems (TDS) has put some months ago its stake in US Cellular under strategic review, and a potential sale may happen in the near future, as I’ve analyzed recently.

Given that US Cellular has a very low market share, of less than 1% in the wireless segment, it’s likely that an eventual sale to a larger competitor is approved by regulators, which will be positive for established players by reducing competition.

On the other hand, if US Cellular is eventually sold to a foreign telecom company that may use this acquisition to enter the U.S. market, this could be a negative factor for larger players as a new competitor would most likely be competitive on service offerings, especially on pricing, which could lead to pricing pressure for the three largest operators.

While at this stage there is nothing confirmed and an eventual transaction may not occur, this is a risk that telecom investors should be aware and should not overlook.

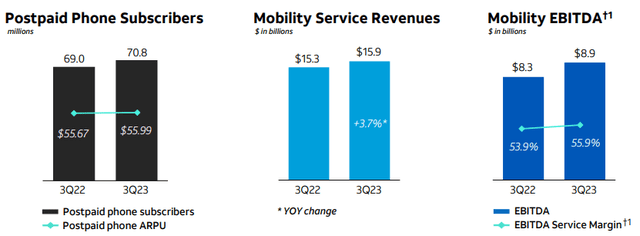

In Q3, AT&T was able to increase average revenue per user (ARPU) and reported low levels of customer churn, which is a very positive sign of its good competitive position in the industry and makes me less worried about, potentially, more competition in the future. Due to this positive backdrop, its mobility service revenues increased by 3.7% YoY in the last quarter, to $15.9 billion, and its EBITDA margin improved by 200 basis points compared to the same quarter of last year.

Wireless trends (AT&T)

Beyond positive operating metrics in the mobility segment, AT&T also reported positive figures regarding its broadband segment. In Q3, it added 296,000 net new customers in fiber, being a major growth driver for revenues in this business unit.

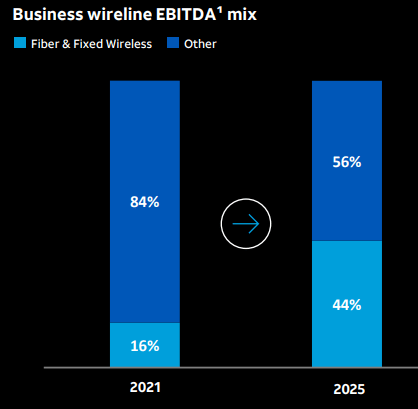

Indeed, its consumer broadband revenues increased by 9.8% YoY, of which fiber revenues were up by 26.9% YoY to $1.6 billion in the last quarter. While fiber is still relatively small within the group, its growth path is quite good, having doubled its customer base in less than four years to more than 8 million subscribers in the last quarter. This means that AT&T seems to be on track to achieve a more balanced income from fiber and fixed wireless in its broadband business, which is key to offset structural decline in its legacy wireline operations.

Wireline mix (AT&T)

Indeed, its commercial wireline business continues to be its major weak point, reporting lower revenues in the last quarter, a trend that is likely to persist in the short term and should continue to be a drag on AT&T’s top-line growth over the coming years.

Regarding its expenses, AT&T’s operating expenses were $24.6 billion in Q3, up by 2.5% YoY, a higher growth rate than revenues. This means its operating margin declined compared to the same quarter of last year, as inflationary pressures are leading to higher costs despite the company’s restructuring efforts and measures to improve efficiency over the past few quarters. Its operating income declined to $5.8 billion, a decline of 3.3% YoY, representing an operating margin of 19.1%.

For the full year, AT&T raised its guidance, expecting adjusted EBITDA growth of 4%, while previously was expecting 3%, and also raised its free cash flow guidance to $16.5 billion.

This was well received by the market, as it shows management confidence on the business outlook during a challenging economic period, and is also positive for its dividend.

Following its dividend cut last year, the company now offers a sustainable dividend, even though it has been unchanged since May 2022. Its current quarterly dividend is $0.2775 per share, or $1.11 annually, which at its current share price leads to a dividend yield of close to 7%.

While in some cases a high-dividend yield may be a warning sign of poor dividend sustainability, this is not AT&T’s case, given that its dividend is well covered both by earnings and cash flows.

Indeed, its dividend payout ratio related to 2023 earnings is expected to be only 49%, based on current EPS estimate of $2.25, which is a very conservative payout ratio for a mature company like AT&T. Moreover, its annual dividend outflows are about $8 billion, while its free cash flow generation is expected to be around $16.5 billion, thus AT&T generates plenty of cash to maintain its dividend and eventually grow it over the next few years.

However, I’m not expecting a growing dividend in the next twelve to eighteen months, because AT&T also wants to reduce its balance sheet leverage and is using a good part of its free cash flow to reduce debt. At the end of Q3 2023, its net debt amounted to $128.7 billion, a reduction of more than $3 billion since the beginning of the year, and AT&T is targeting a net debt-to-adjusted EBITDA ratio of about 2.5x (vs. 2.98x expected in 2023), to be reached in the first half of 2025.

While AT&T may decide to start delivering some dividend growth in the coming quarters, I think it’s more likely that meaningful dividend growth will only start in 2025, when AT&T is expected to reach its desired leverage ratio. The street seems to agree with this view given that, according to analysts’ estimates, its dividend is not expected to grow much in the coming quarters given that is 2025 dividend is expected to be $1.12 per share, practically unchanged compared to its current dividend.

Regarding the lead cable issues, this is a potential risk that investors shouldn’t overlook as potential costs are quite significant. Responding to a Wall Street Journal report that lead telecom companies could have to remediate thousands of lead-insulated cables that may be leaching the toxic metal to the environment, AT&T said that only about 10% of its copper cables could be exposed to that issue, which can eventually cost the company some $10 billion to fix according to some estimates.

While the exact cost to fix this issue is impossible to know, it seems to be a manageable issue that is not likely to hurt the company’s dividend. Indeed, in 2023, dividend payout based on free cash flow is expected to be around 50%, thus there is plenty of room to maintain its dividend and still have financial resources to address the lead cable issues. Moreover, this issue is likely to be fixed during the next few years, thus its cos will most likely be spread in time and doesn’t seem to be a major threat to AT&T’s current annual dividend.

Conclusion

AT&T has reported improved operating metric in recent quarters. and its business prospects in the short term seem to be positive due to its strategy for growth in mobile and fiber, which is bearing fruit through net customer additions and price gains.

Despite that, its shares continue to trade at a relatively undemanding valuation, given that AT&T is currently trading at only 6.4x forward earnings, at a discount to its historical average over the past five years. Furthermore, its dividend yield of close to 7% is a great play for income-oriented investors, as the dividend is clearly sustainable in the short to medium term, even considering potential risks like the lead cable issues.

Read the full article here