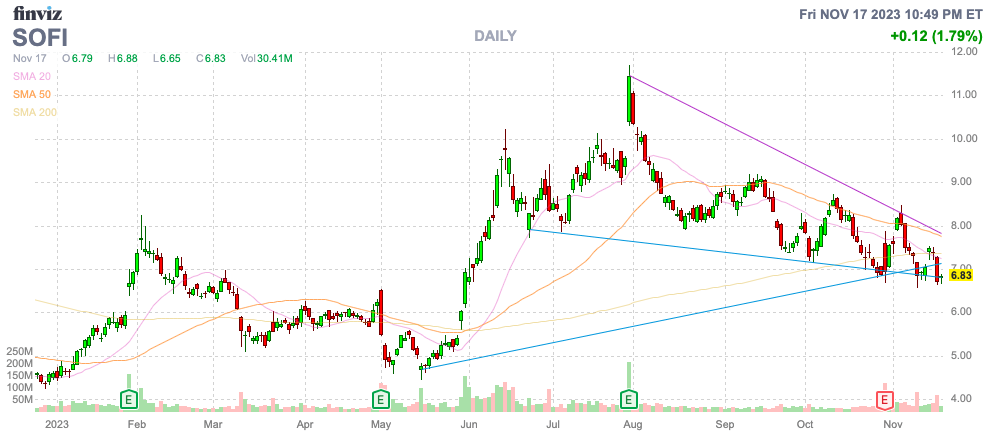

Despite persistently strong growth, SoFi Technologies (NASDAQ:SOFI) still trades closer to the lows after going public via a SPAC at $10. The digital bank continues to report impressive growth disconnected from the stock movement where every quarterly beat is sold off. My investment thesis remains ultra Bullish on the secular growth story trading at a massive discount.

Source: Finviz

Even More Profitable

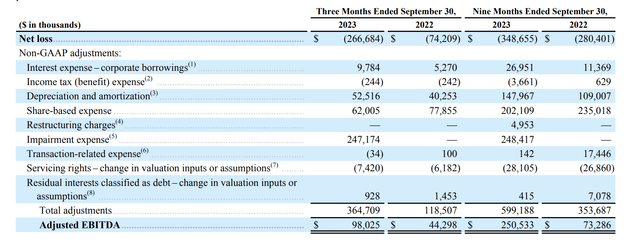

The big bearish thesis is that SoFi isn’t GAAP profitable, but the company is a fintech with aggressive non-cash stock-back compensation expense and amortization costs from acquisitions. The company just guided to a massive boost in adjusted profits for 2023, yet the stock market has only yawned since the numbers were hiked back on October 30.

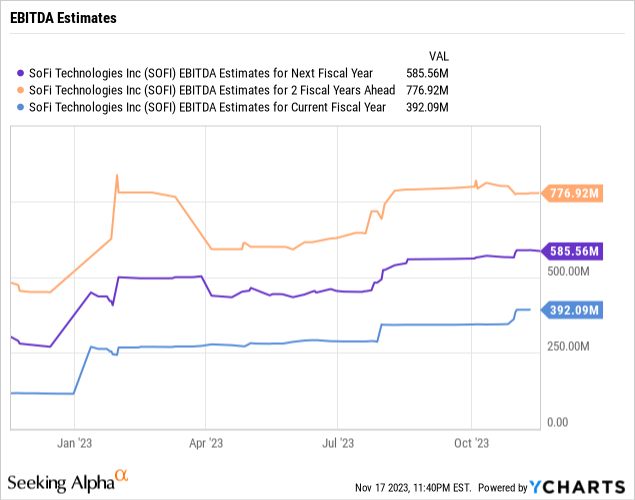

SoFi beat analyst estimates by a wide margin again. While the revenue beat was impressive at $21.6 million for 27% growth, the key was the massive guide-up in the adjusted EBITDA (profits) by over $50 million for 2023. Management now forecasts adjusted EBITDA of $391 million at the midpoint, up from only $338 million.

Normally a stock would soar on news that adjusted profits are now targeted at $53 million higher, especially when the target is 16% above the previous estimate. SoFi is now generating 48% incremental adjusted EBITDA margins on new revenue.

The company again forecast a GAAP profit for Q4, but the market is again stuck on this concept of SoFi needing GAAP profits, and the company constantly highlighting this metric versus adjusted EBITDA isn’t helping investor confidence. Instead of focusing on revenues doubling from $1 billion in 2021 to $2+ billion in 2023, the stock is actually down again below $7.

As highlighted in the past, the prime reason the market is confused about the profits picture is probably due to SoFi using the adjusted EBITDA metric versus adjusted profits. All of the costs the company excludes from the GAAP losses are non-cash other than the interest expenses.

Source: SoFi Tech. Q3’23 earnings release

Outside of the big impairment charge, the major expenses excluded are non-cash as follows:

- Amortization – $52.5 million

- SBC – $62.0 million

- Total – $114.5 million

The only real charge to include in the actual adjusted profit is the $9.8 million for corporate interest expenses. The actual adjusted profit would be $88.2 million, but a lot of investors assume EBITDA is excluding a lot of real charges.

The great part about investing is that individuals can decide which metric is valid to use in valuing a stock. Investors just need to understand the adjusted EBITDA or profit metrics above are the traditional metrics used to value a growth stock like SoFi with such charges.

The stock has a market cap of only $6.5 billion with 2023 adjusted EBITDA targets of nearly $400 million. The stock only trades at 16.6x 2023 EBITDA targets and just 11.0x 2024 estimates of $586 million.

Note that SoFi only generated 18% adjusted EBITDA margins in the last quarter. The goal remains to double the margins with a likely avenue for revenues to also double in the next 3 years on 25% growth to reach $4 billion. The ultimate adjusted EBITDA target would be $1.4 billion in 2026, close to the original goal at the time of the SPAC deal to hit just above this EBITDA level in 2025.

Again, the stock only has a market cap of $6.5 billion and the rapid secular growth will continue driving massive profit growth.

Major Catalysts

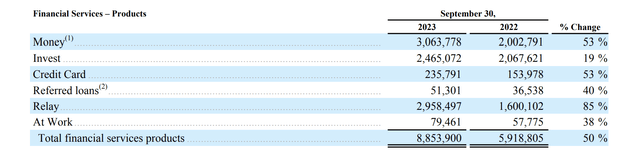

While growth is slowing as SoFi has expanded and the macro economy weakness has lowered general loan demand, the company is still forecast to maintain over 20% growth. The major growth vector is the Financial Services products, even with all of the focus on the re-start of student debt payments.

SoFi grew Financial Services products by 50% YoY to 8.9 million versus only 1.6 million in the Lending products category. A lot of teeth gnashing has focused on the lending financials over the last year, but the future is actually in the Financial Services segment.

This segment saw revenue soar to a record $118.2 million for a massive 142% growth in the quarter, up from only $49.0 million last Q3. The Financial Services products finally turned profitable with a contribution profit of $3.3 million, up from a massive $52.6 million loss last Q3. SoFi only grew attributable expenses in the category by 13% to $115.0 million.

A lot of the weak adjusted EBITDA profits in the last year were related to investing in new products in this division. As products like Credit Card and Money have matured, the profit picture has vastly improved.

Source: SoFi Tech. Q3’23 earnings release

These products now contribute a massive $53 per product, up 61% YoY. Not only are the products surging but also the monetization per product is surging.

All the while, SoFi is still originating student and home loans below the 2021 peak despite buying the new home lending business. The peak loan origination combination for student/home in Q4’21 was over $2.1 billion with the amount down below $1.3 billion in the last quarter.

Takeaway

The key investor takeaway is that SoFi continues to not rally due to either the negativity from going public via a SPAC or a major misunderstanding of the distinction between GAAP losses and adjusted EBITDA profits. An investor rarely has the opportunity to buy a growth stock with a proven strong management team at this cheap of a multiple. The market disconnect won’t last forever.

Read the full article here