Investment Thesis

The iShares Core High Dividend ETF (NYSEARCA:HDV) offers an attractive 4.15% dividend yield and a low 0.08% expense ratio, two features crucial for income investors. While it’s been more than one year since I downgraded HDV based on my perception that energy risks were too high at the time, the Index has reconstituted several times since, and there are some meaningful changes I want to communicate. This article evaluates HDV alongside the Schwab U.S. Dividend ETF (SCHD), the Vanguard High Dividend ETF (VYM), and the SPDR S&P High Dividend ETF (SPYD). It highlights how HDV’s valuation and quality metrics are compelling, but its 22% reliance on volatile Energy stocks and questionable growth prospects are concerns. As a result, I’m maintaining my “hold” rating on HDV, but I think there’s a spot for HDV in an income portfolio, and I look forward to taking you through the numbers in more detail below.

HDV: A Brief Overview

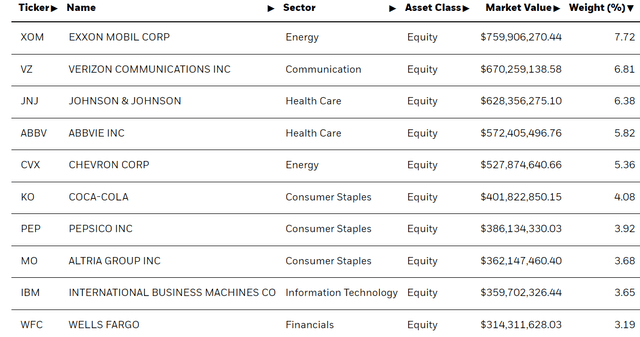

HDV is a concentrated play with over 40% of assets dedicated to Energy and Health Care stocks. The ETF tracks the Morningstar Dividend Yield Focus Index and holds 75 stocks based on proprietary Wide Moat and Distance to Default screens. Since it’s yield-weighted, you’ll find plenty of companies with yields above 4%, including AbbVie (ABBV) and Chevron (CVX).

iShares

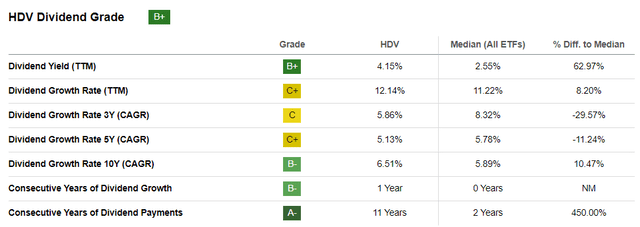

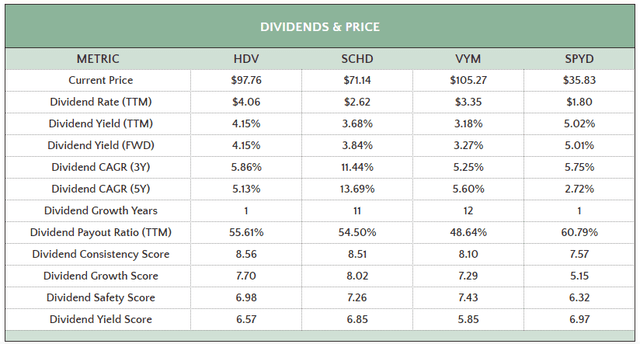

Verizon Communications (VZ) and Altria Group (MO) yield 7.34% and 9.60%, respectively, while the weighted average dividend yield for all constituents is 4.23%. After deducting HDV’s 0.08% expense ratio, shareholders net 4.15%, the ETF’s trailing twelve-month yield. It’s not unusual for high-dividend ETFs to have lower dividend growth rates, and HDV is no exception. Its 5.13% five-year dividend growth rate is rated poorly, but in fairness, it’s not too bad. VYM and SPYD have 5.60% and 2.72% five-year growth rates, while SCHD is the exception at 13.69%. SCHD has found that “sweet spot” of combining a relatively high dividend yield with solid dividend growth, but as I’ll touch on shortly, I doubt that will last long.

Seeking Alpha

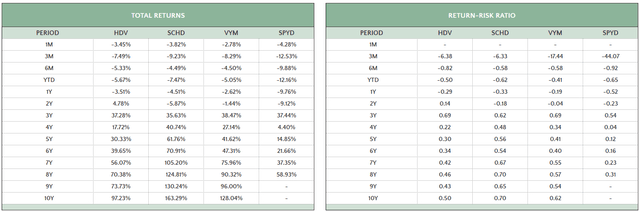

Finally, consider these two summary tables highlighting performance differences between HDV, SCHD, VYM, and SPYD over the last ten years through October 2023. HDV has excellent two-year returns, but its one-year returns could be better, indicating that only last year was strong. Also, HDV has lagged SCHD and VYM by 66% and 31% in the previous ten years, with correspondingly weak risk-adjusted returns, but has consistently beaten SPYD.

The Sunday Investor

I was bullish on HDV throughout 2021 based on growing inflation fears but reasoned the energy risks were too high in June 2022, especially as inflation appeared to peak. You’ll find that getting the “macro-level” view right is crucial due to HDV’s high concentration. High-yielding stocks have cheap valuations, and since stocks within the same sector and sub-industries typically correlate well, HDV could end up holding a cluster of stocks with poor fundamentals, i.e., they are priced low for good reason. To mitigate this risk, I suggest HDV as a complementary rather than core holding. This Fund Overlap tool can help you make efficient capital allocation decisions, but I caution that only approximately 16% of U.S. stocks yield over 4%, so if you mix two high-yielding ETFs, expect overlap. For example, HDV and SCHD’s overlap by weight is high at 42%.

HDV: Fundamental Analysis

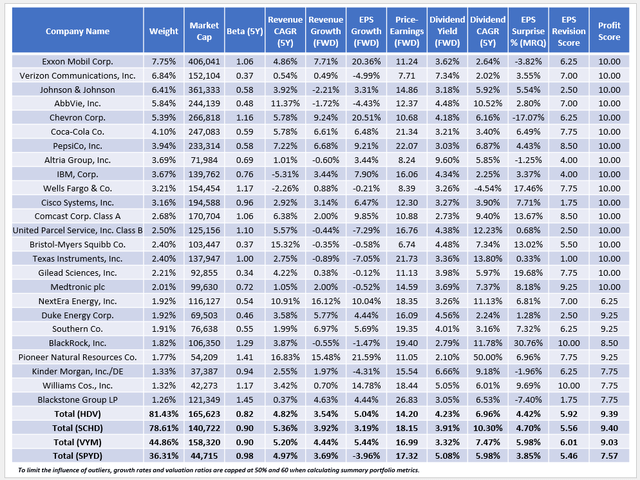

The following table highlights selected fundamental metrics for HDV’s top 25 holdings, totaling 81.43% of the portfolio. SCHD’s concentration figure is also high at 44.86%, while VYM and SPYD are low at 44.86% and 36.31%.

The Sunday Investor

Here are some additional statistics to consider:

1. HDV is the only yield-weighted ETF of the four. SCHD and VYM are market-cap-weighted, while SPYD is equally weighted.

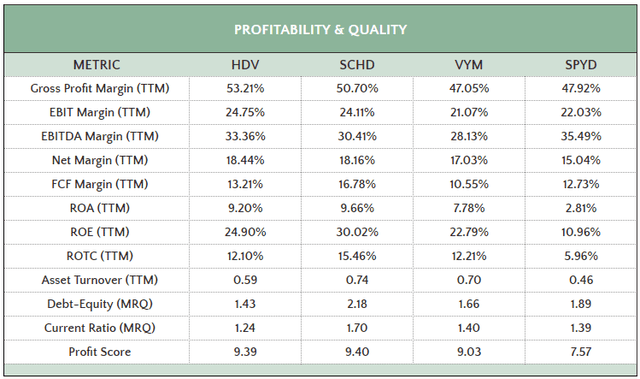

2. SPYD is the most straightforward of the four, as it simply selects the top 80 S&P 500 stocks by dividend yield. In contrast, HDV and SCHD have quality screens, resulting in significantly higher profit scores of 9.39/10 and 9.40/10, respectively. For me, it’s the #1 reason why they’ve outperformed SPYD, and I encourage any long-term investor to place profitability at the top of their list. Here’s a closer look at some additional profitability and quality metrics:

The Sunday Investor

Except for SPYD, all ETFs have strong ROE and FCF margins, but HDV’s 1.43 debt-equity ratio is the most attractive. I mention this because this is an area where many dividend ETFs run into trouble, which could be a problem should interest rates stay higher for longer. HDV’s increased allocation to Energy stocks is the primary reason, as its Energy holdings average just 0.42. Exxon Mobil’s (XOM) total debt figures are trending downward and are $31 billion below its peak three years ago. Chevron’s balance sheet history paints a similar picture.

These two companies are excellent insurance against high inflation and interest rates. While 22% is about twice my preferred allocation, HDV could complement your existing holdings well without sacrificing quality.

3. HDV’s constituents yield 4.23%, or 4.15% after fees. Coupled with a 6.96% five-year dividend growth rate and an excellent profit score, I’m confident HDV will continue growing dividends reasonably. However, I want to highlight how its payout ratio is slightly stretched at 55.61%. It’s one metric that feeds the Dividend Safety Score, and HDV’s 6.98/10 score is just third-best. Other ETFs that score well on dividend safety include the iShares Core Dividend ETF (DIVB) and the Fidelity High Dividend ETF (FDVV).

The Sunday Investor

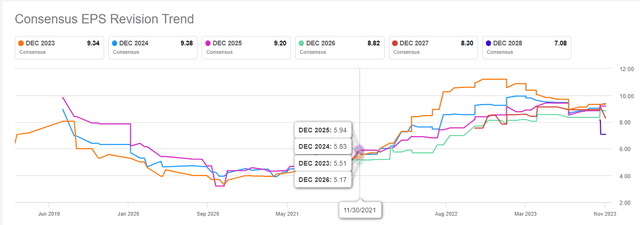

4. HDV trades at 14.20x forward earnings and features 3.54% and 5.04% estimated sales and earnings per share growth. Unfortunately, these low growth rates are standard for dividend and value ETFs nowadays and don’t support high dividend growth moving forward. Interestingly, by excluding Energy stocks, HDV would only have 1.36% estimated earnings growth, so optimistic Energy forecasts are responsible for a good chunk of HDV’s growth potential. I don’t have insight into where Energy prices are headed, and I don’t think most analysts do, either. To quickly illustrate, Exxon Mobil’s consensus EPS for FY 2023 was $5.51 in November 2021 but is now $9.34, or 69.5% more. In contrast, more defensive holdings like Verizon Communications and Coca-Cola (KO) have deviations of -14.4% and 3.1% over the same period.

Seeking Alpha

For this reason, HDV’s growth projections have a lot of uncertainty. Failure to achieve the 20%+ earnings projections for Exxon Mobil and Chevron will likely negatively impact HDV’s dividend growth and share price. That uncertainty is a risk I recommend balancing by holding other high-quality ETFs with less energy sector exposure.

Investment Recommendation

HDV is a solid, low-cost, high-yielding dividend ETF. I like that it’s a high-quality fund, evidenced by a 9.39/10 profit score and a relatively low debt-equity ratio. Its 14.20x forward earnings valuation and 4.15% expected dividend yield are other positive features. The downsides are weak diversification and a high reliance on Energy stocks to achieve even moderate earnings growth. A 22% allocation is too high for me, so I’m remaining cautious. However, I can see how income investors can slide this ETF into their portfolios to improve yield while maintaining quality. Therefore, while I’ve only rated HDV a hold, there’s a lot to like, and I look forward to learning how you’ve decided to use HDV to meet your short- and long-term goals. Thank you for reading.

Read the full article here