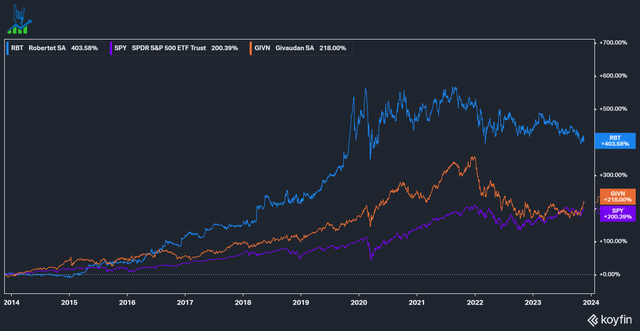

Robtertet (OTCPK:RBTEF), a leading fragrance and flavor industry player, has been a long-term outperformer compared to the S&P 500 and rival Givaudan (OTCPK:GVDBF). After the pandemic hit, both Robertet and Givaudan have been trading sideways (although Givaudan had a higher volatility).

In this article, I’ll take a look at Robertet, but Givaudan is benefiting from similar tailwinds.

Robertet SPY outperformance (Koyfin)

Who is Robertet?

Robertet is a French family business with a rich history. Founded in 1850, the company is still based in Grasse and operates globally, with 39% of sales out of Europe, followed by 35% sales in North America. 36% of sales are in fragrances, 35% in flavors and 26% in ingredients.

Robertet has an interesting ownership structure (slide 127): The Maubert family owns around 37% of the capital and 62% of the votes. Two competitors (privately owned Firmenich holds 21.8% and Givaudan 4.7% of the capital) own large stakes in the business. The F&F industry is constantly being consolidated, but due to the large family ownership, Robertet has little pressure to sell.

The fragrance and flavors industry

The fragrance and flavor industry was valued at $30 billion in 2022 and is expected to grow at 4.9% through 2032 to a size of $48.4 billion. The market is oligopolistic in nature with a lot of the market concentrated around a few key players:

International Flavors and Fragrances (IFF) ($11.6 billion in sales), Givaudan ($7.8 billion), Firmenich (around $5 billion) and Mane (around $2 billion) represent the majority of the industry. At just $780 million Robertet is a smaller player in the industry, representing just 2.6% of the industry. Flavors in particular are increasingly used in food to substitute salt, sugar and fats; one of the examples of growth trends in the industry.

The industry has large barriers to entry for several reasons. Fragrances and flavors are used in a vast amount of industries and often represent a small percentage of the customer’s cost of goods sold (COGS) between 0.5% (for most food) and 5% (for premium perfumes). While they only represent a small part of COGS, they are highly important, as customers recognize scents and flavors, binding them to the product. A company will be very reluctant to switch suppliers, leading to high switching costs and customer relationships often lasting decades. F&F companies invest a lot of money (Robertet invests around 8% of sales) into research and development to create and patent new molecules. The market is consolidating, because large players acquire small players to increase their product portfolio and acquire new customers. The more molecules a company has the better they can develop new ones as well.

A regulatory moat is also present in the industry, because F&F typically is used in products directly in contact with humans, so there are strict regulations. These overhead costs can more easily be absorbed by large players.

Robertet’s Competitive Advantage

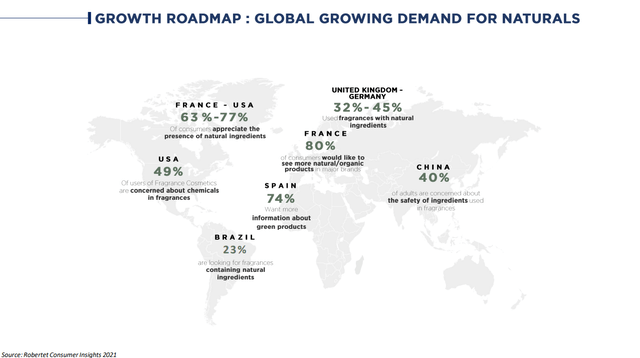

Besides the aforementioned industry dynamics and inherent moat, Robertet also has its own competitive advantage. Robertet plays into the sustainability/ESG trend with its product offering. Robertet is the leader in natural raw ingredients, according to itself (slide 5). Below you can see a slide with stats about the growing demand for natural F&F throughout the world. We can see that throughout the world there is different demand for F&F, like the presence of natural ingredients, fear of chemicals or simply the lack of information about the sustainability of products. These trends should increase with time to represent more of the population, providing above-market growth for the natural F&F niche Robertet plays within.

Global growing demand for naturals (Robertet Investor Presentation)

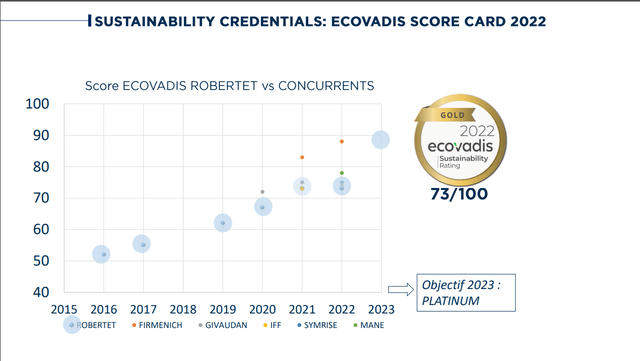

To be able to provide a sustainable product portfolio, Robertet has a vertically integrated business, starting from owning the farmland to harvesting critical ingredients. This allows much higher quality controls and opportunities to optimize operations as well as hedging against shortages or price volatility in critical components. Robertet is looking to become the world leader in certified sustainable sourcing and already has 48% of its strategic supply chain audited. Below you can see the development of Robertet’s sustainability rating. I believe that this approach offers them with a better growth potential than its competitors as the global demand for sustainable products is ever increasing. Robertet also looks to be a good employer with an average seniority of 11 years within the company.

Robertet rising Ecovadis score (Robertet Investor Presentation)

To summarize Robertet has a lot of growth opportunities ahead:

- Global F&F growth trends

- Expanding sustainability movement, favoring the natural F&F niche Robertet plays in

- Global expansion of F&F

- Consolidating smaller F&F players

- Operating leverage through cost savings from the vertical integration

Robertet is fairly priced

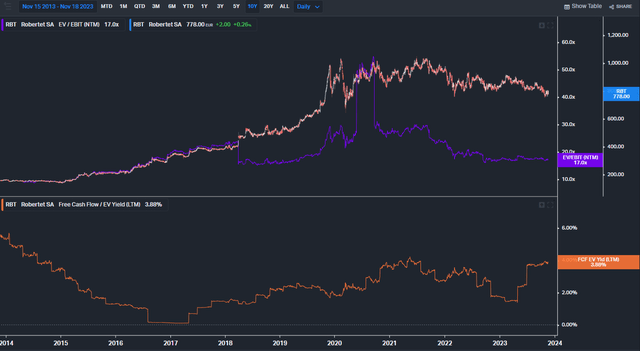

To value Robertet I will look at historic valuation multiples as well as an inverse DCF model. We can see that Robertet traded at significantly elevated valuation levels through the 20-30 times EV/EBIT pandemic. This has come down to 17 times forward EBIT now. Similarly, the FCF yield is also going up again close to 4%.

Robertet valuation multiples (Koyfin)

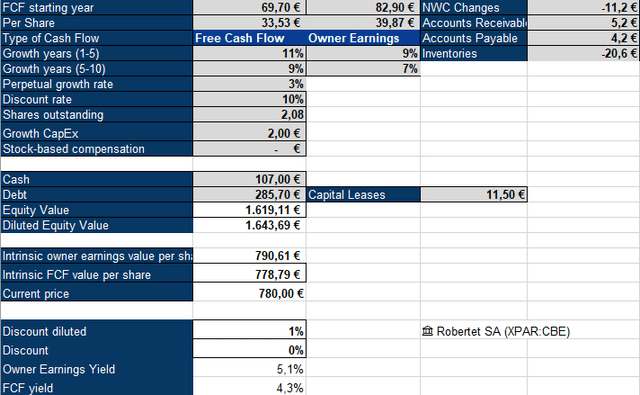

I am using my version of Owner Earnings (Free cash flow + growth Capex – Stock-based compensation +/- NWC changes) to value the business in this model. I used a 10% discount rate due to the safe nature of the business and a 3% perpetual growth rate in line with long-term GDP growth expectations. I added back 2 million in growth CapEx, representing roughly 11% of CapEx to be conservative. There is no stock-based compensation to add back, but we see changes in net working capital. We can see that the market expects Robertet to grow by 9% for the next five years, followed by 7% for the following five. This looks to be reasonable if we consider that the overall F&F market is expected to grow at 5% and the natural F&F niche is likely to grow faster. Additionally, Robertet is acquiring competitors and has a history of growing margins (EBIT margins grew from 10 to 14% within the last decade).

Robertet Inverse DCF model (Authors Model)

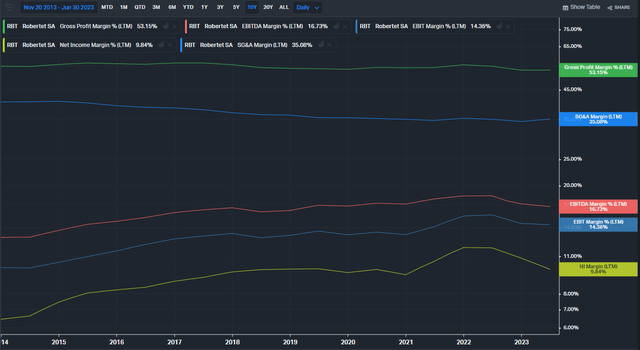

Historical 10-year growth rates are at 6.2% for revenue, 8.5% for EBITDA, 9.5% for EBIT and 11% for FCF. Over the last 10 years, Robertet has been able to grow its profit margins significantly (EBIT from 10% to 14%) by lowering S&GA expenses. Gross margins haven’t grown, in fact shrunk a little. At 35% of sales, SG&A still represents the majority of costs and there is room for operating leverage going forward, as the company scales and improves its vertically integrated supply chain.

Robertet Margins (Koyfin)

Conclusion

Robertet is a high-quality business as the leader in an industry with growth trends and large barriers to entry. A 170-year-long history under the Maubert family gives them a long-term-oriented owner. While the business is of high quality, considering the low growth rate, it is hard to see the current price as very compelling. If one is looking for a stable business without much disruption risk it could be worth to start accumulating Robertet here, but I don’t think it will yield much outperformance unless valuations rerate back to the elevated levels over the last years.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here