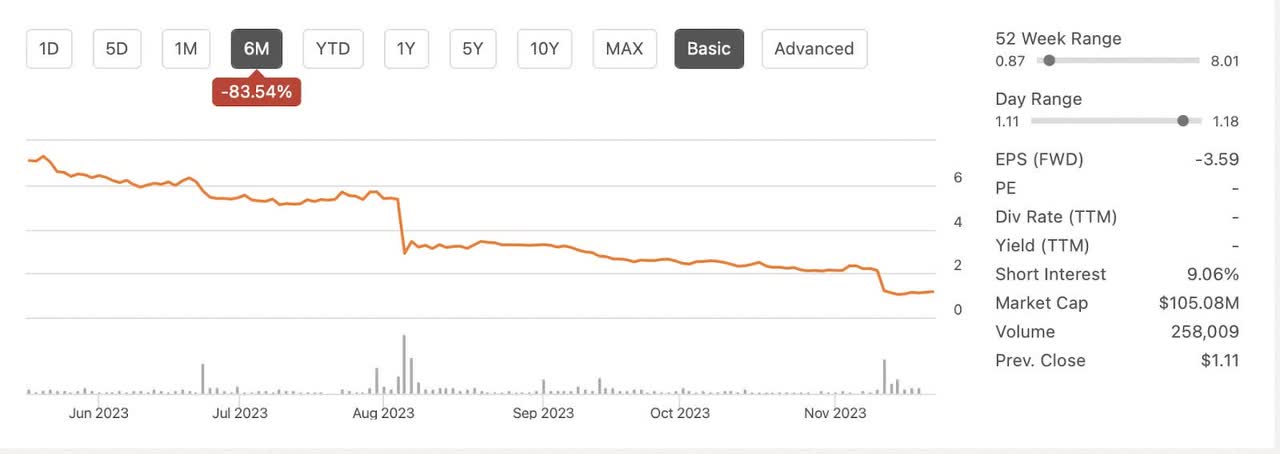

I first wrote about Assertio (NASDAQ:ASRT) back in September in an article titled Growth And Pain Make Assertio A Deep Value Buy. The article ended up being an editor’s pick. However, within days of writing this article, there was a slew of insider selling which I and others discussed deeply in the comment section. Proving once again that the comments on an article can often add more value than the article itself. Those that read the comments were able to avoid the deep drop in share price that recently occurred while those that didn’t possibly lost money. In the comments, I made it clear that I was selling my small position. I followed that up by taking a short position that has done reasonably well. In investing, knowing when you’re wrong is equally important to being right. I still believe ASRT is a sell although I believe that volatility could lead to sudden upswings.

Seeking Alpha

In the realm of speculative biotech ventures, we adhere to a stringent set of criteria, and for the sake of simplicity, let’s focus on three pivotal concepts. The first is a robust balance sheet, laying the foundation for resilience. Second, we keenly eye future catalysts that could propel the company forward. Lastly, and of particular interest in this context, is the aspect of insider activity, a cornerstone of our deep value investing approach.

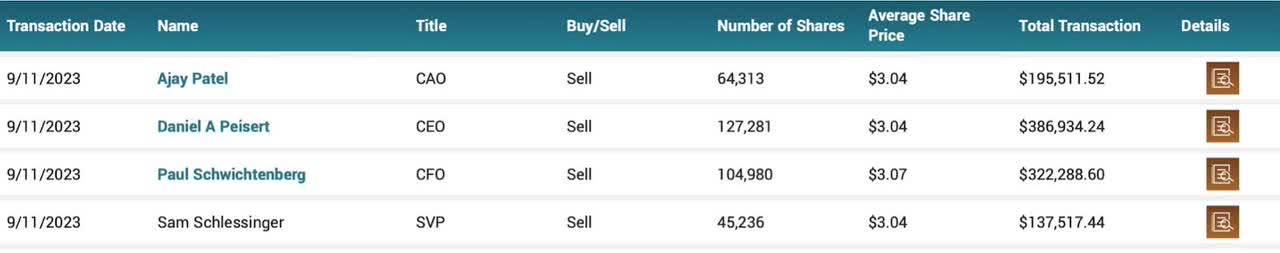

I admit that I was overly optimistic regarding ASRT shares on September 10th when my original article was published. Then September 11th happened. On September 11th, heavy insider selling was reported.

Market Beat

While insider selling isn’t always a big deal, when all the officers sell in such high amounts it’s a big red flag. Given the positive comments from the earnings call it also came as a big surprise. I personally have lost trust in what the management says during Assertio’s earnings calls. I can no longer take what they say at face value. In my humble opinion, it would have been better for ASRT to be forthright about their concerns and rip the band aid off instead of painting a pretty picture of their prospects.

This also demonstrates why investors need to follow all reports for a company they are invested in. As those that read the comments on my last ASRT article know, the information about insider selling was available before the massive drop in price.

This provides an important lesson for investors. When examining any company, listen to what they say, but more importantly watch what they do. In the case of ASRT, they were selling hand over fist which is a very big red flag.

The CEO, CAO, CFO, and SVP made substantial sells, with the CEO and CFO notably parting with more than half of their shares. This development spurred fervent debates and speculations, encapsulated in the comments section of our previous article’s analysis. While the motives behind insider selling remain elusive, a multitude of potential reasons comes into play.

Insiders may opt to sell for various reasons, including diversification, financial planning, stock options, or perceiving overvaluation. Distinguishing signals from noise is imperative, especially considering the intricacies of biotech stocks. It’s crucial to recognize that insider selling, in and of itself, is not an inherently negative signal. Founders, executives, and employees may have valid reasons for divesting shares, from financial planning to regulatory compliance.

However, the sheer magnitude and frequency of these insider sales, coupled with the timing immediately following our initial analysis, cast a looming shadow over our initially bullish thesis. The reasons behind the sell-off might range from tax considerations to potential concerns about the company’s trajectory. As staunch proponents of deep value investing, we approach this development with a measured perspective. While the future remains uncertain, this substantial insider selling prompted a cautious reevaluation and the juxtaposition between words and actions should not be forgotten.

CEO Dan Peisert

-

“I am not pleased by our results in the third quarter. We did not meet the expectations nor the goals we set for our business and these results. These aren’t the results that we know you as shareholders have come to expect from us.”

The CEO’s acknowledgment of the disappointing results demonstrates transparency and accountability. The reference to business transformation and diversification suggests a long-term perspective, emphasizing the challenges inherent in such processes. It would have been nice to acknowledge these issues earlier in the year before the shares lost half of their value. I personally can’t justify investing in the company at this time. Trust is everything in business and at this time I personally don’t trust Assertio but I would argue I have learned what to expect.

-

“Even though the reported sales for ROLVEDON are significantly below our internal expectations in the quarter, when viewed with the launch of a generic competitor indomethacin, the rationale for the merger and our commitment to diversification are evident.”

The strategic rationale behind recent mergers, emphasizing enhanced competencies and market access need to be reflected in the company’s growth. The mention of positive income on a non-GAAP basis amid disappointing top-line results aims to underscore resilience and financial stability. As a deep value investor this definitely raises some warning flags.

-

“In addition, our balance sheet and liquidity position are the strongest it has been since I’ve joined the company… we’re well positioned from both a balance sheet and platform perspective to take advantage of this environment.”

The focus on financial strength, providing specific details about the company’s balance sheet and liquidity shows that the company does have some positives. The mention of pursuing external growth opportunities can align with a deep value strategy, if it causes long-term value creation. However, it also highlights that growth will probably not come from within the company. Given Assertio’s recent history of acquisition this could be viewed as concerning.

-

“Today, we’re also announcing some changes to our management team that will help us both for the short and long term…Paul Schwichtenberg will be handing over the CFO duties to Ajay Patel, our current Chief Accounting Officer, and Paul will be taking on a new role in the organization with direct oversight for market access, pricing, trade and distribution. In addition, on an interim basis, while we’re recruiting for a new team leader, Paul will oversee the oncology commercial team.”

Management changes to enhance the company’s ability to achieve both short-term and long-term objectives demonstrate adaptability and responsiveness to challenges. One unwritten concern is how much these new hires and expansion activities will impact costs. Over the short to medium term it appears that Assertio’s costs will rise.

-

“With respect to INDOCIN… we’re pursuing all available remedies to have this product removed from the market… With respect to ROLVEDON… we’re committed to maximizing ROLVEDON potential.”

Offering a detailed analysis of challenges with specific products, showcasing a commitment to addressing issues is good business. It would have been nice to share some awareness of these problems at the last conference call. The strategic approach includes legal actions, market analysis, and adjustments in commercial strategy, demonstrating a comprehensive response to challenges. This also seems to prove that Assertio does not have control of the situation and competition could continue to take market share.

-

“Beyond the commercial strategy and tactics and life cycle development of ROLVEDON is also being entertained.”

A proactive approach to optimize ROLVEDON’s performance is rather obvious. The need to adapt commercial strategies and explore additional applications for the drug highlights the concerns that Assertio has regarding Rolvedon’s current sales strategy and future prospects.

-

“We will not be providing our guidance today. However, we will try to provide some general commentary on how we’re internally projecting the business…”

The decision to withhold guidance may be a reflection of uncertainties. I personally find it concerning to see the dramatic pessimistic shift in management’s communications. It also makes the prior earnings call seem rather overoptimistic and means investors should be cautious when considering investing in Assertio. If the management says they can’t speak about future guidance, that is rarely a good thing.

Final Thoughts

In the realm of deep value investing, a balance of art and science is necessary, the alignment of a robust balance sheet, catalysts, and insider activity are key data points. ASRT, while still within the purview of our cautious optimism, warrants a prudent reconsideration.

As we downgrade our rating to a sell, it’s a reminder that deep value investing demands a continuous reassessment in the face of evolving market dynamics. We like to hold strong opinions very weakly. In this case, this allowed us to make a quick pivot and turn a bad situation into a profitable one. As always, meticulous due diligence is encouraged for any investment.

For my readers, I will always update my ideas in the comment section. The market is a fluent, always changing place. While I enjoy set and forget investing, this is rarely the case in biotech swing trades. As a biotech investor, mitigating losses, sizing positions accordingly and diversifying is key to success. As always, do your own due diligence prior to buying positions, good luck investing, and make sure you always read the comments.

Read the full article here