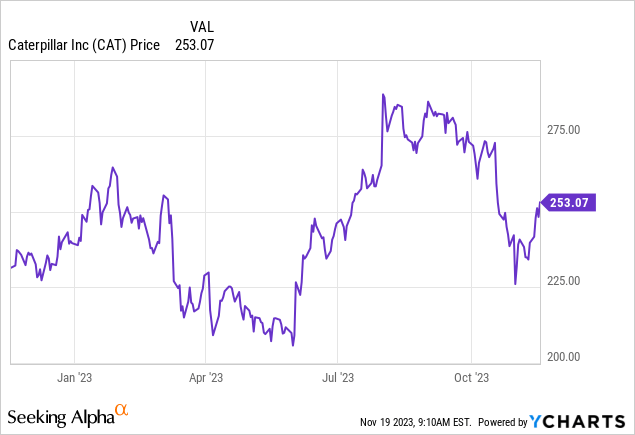

Caterpillar’s (NYSE:CAT) stock price has had a roller coaster ride this past year with another pullback in October that leaves the company trading at 14.3x TTM P/E and 14% off 52-week highs. The company continues to perform well with the latest quarter EPS up 40.8%, but a little stress from the economic weakness shrouding the globe is starting to show up in the order backlog and dealer inventories. This article will take a look at Caterpillars latest results, excellent profitability, and reasonable current valuation while exploring why long-term investors in this wide-moat company should not be intimidated by fears of short-term economic weakness.

Latest Quarterly Results

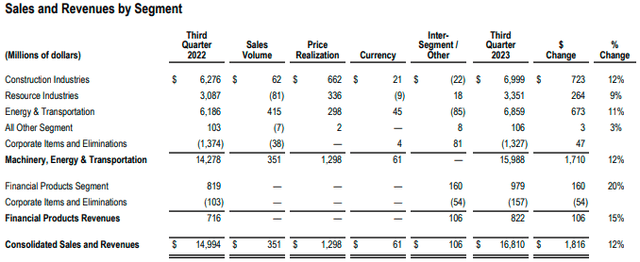

Caterpillar’s latest Q3 2023 results showed continued growth in a dynamic economic environment with revenues increasing 12% to $16.8 billion. GAAP EPS was $5.45 for the quarter, up 40.8% compared to Q3 last year, and management’s adjusted EPS of $5.52 showed similarly strong results. Driving the increase in revenues were Caterpillar’s Financial Products Segment (+20%), Construction Industries (+12%), and Energy & Transportation (+11%).

The order backlog decreased $2.6 billion YoY in a sign that sales growth is slowing down in the current economic environment. However, the $0.3 billion increase in backlog QoQ is a hopeful sign that things are stabilizing. Dealer inventories also signal a slowdown in future sales increasing $0.6 billion YoY and $0.7 billion QoQ.

Q3 Sales Breakdown (from Q3 2023 company financials)

While top-line revenues were higher across the board, within the CAT Financial division, Q3 2023 profit before taxes were $170 million, a decrease of $18 million (-10%) compared with $188 million in Q3 2022. The decrease was mainly due to a $51 million unfavorable impact from a higher provision for credit losses; partially offset by $24 million of favorable impact from mark-to-market adjustments on derivative contracts. As of quarter end, past dues at Cat Financial were 1.96% with the allowance for expected credit losses totaling $340 million, or 1.23% of finance receivables. This compares to $320 million of ECL as of the previous quarter ended June 30, or 1.15% of finance receivables. While creeping up slowly, these levels still are not anything to be concerned about in my opinion. Back in 2009, the expected credit losses reached 4.75%.

The company returned $1.0 billion to shareholders through $0.7 billion of dividends and $0.4 billion of share repurchases in the quarter. Caterpillar has great shareholder return policies which this article will touch on more later. With the TTM EPS figure now $17.64, Caterpillar is trading at 14.3x TTM P/E. This is a fair valuation for this great company which readers will start to understand when we discuss the growth figures.

A Profitable Growing Company, But Cyclical

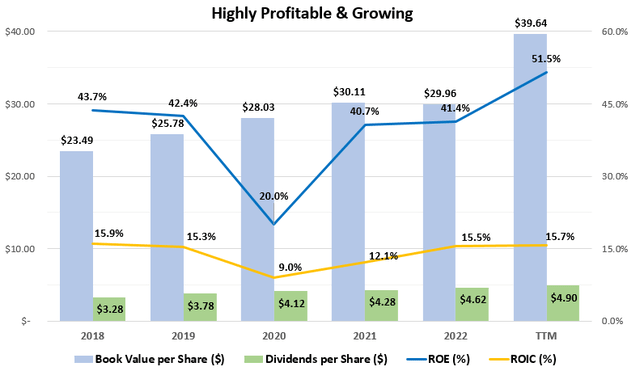

Caterpillar’s strong reputation for quality products with high productivity, long life and low operating costs has allowed the company to be the leader in heavy machinery across the world. The company is also nicely profitable for investors with return on equity and return on invested capital averaging 39.9% and 14.4% respectively since 2018 with positive trends still being seen since the 2020 lows.

Profitability & Growth Highlights (compiled by author from company financials)

This average level of ROE is well above my rule of thumb of 15% ROE and 9% ROIC, but the company is also cyclical, and the 5 year period does not include any recessionary periods in the global economy. In the 2009 fiscal year, during the depths of the global financial crisis, Caterpillar’s profits dropped 74.5% but the company continued to remain profitable. Below is a snippet from the 2009 annual report that touches on that once in a generation year which should reassure investors hesitant to consider this cyclical company for their portfolios.

Caterpillar’s 37 percent decrease in sales and revenues in 2009 was the largest single-year percentage decline in sales and revenues since the 1940s. Yet, we achieved our three foremost objectives: to maintain profitability, to hold our credit rating in the face of tightening financial markets and to maintain the dividend.

– 2009 Annual Report

Even if we conservatively include this once in a generation 2009 year with a 6% ROE in the average historical profitability, the average ROE drops to 35.1% which is still above my rule of thumb of 15%. This allows me to be confident that, in my opinion, Caterpillar will be able to maintain and even increase its intrinsic value over the course of a business cycle.

Growth is Impressive

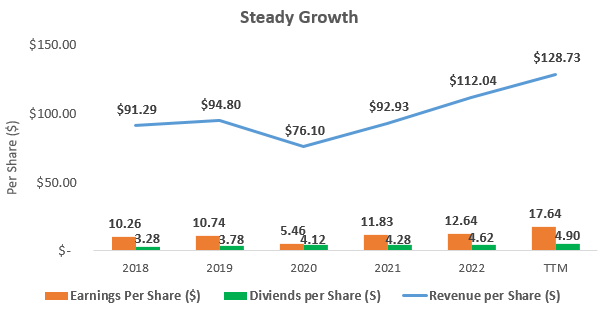

Caterpillar has great growth at both the top line revenue level and on a per share basis. Along with the great profitability, this shows a company with a wide economic moat which should continue to grow alongside the global economy. Since 2019, Caterpillar has managed to grow top line revenues per share at an average rate of 4.2%, and, due to the continuous share repurchases (to be discussed more later), revenue on a per share basis has grown an even more solid 8.4%.

Growth Rates Per Share at Caterpillar (compiled by author from company financials)

With net margins increasing from 11.2% in 2019 to 13.7% in the TTM period, growth in EPS has been even better, at an average rate of 13.6%. Dividend growth has been more modest at 9.9% with the dividend payout ratio decreasing slightly over the period to 28% in the TTM period. This low dividend payout ratio shows great potential for dividend growth over EPS or revenue gains going forward, even when considering share repurchases. Let’s analyze the potential for increased dividends more through looking at the cash flows.

Great Cashflows Highlight the Strong Moat

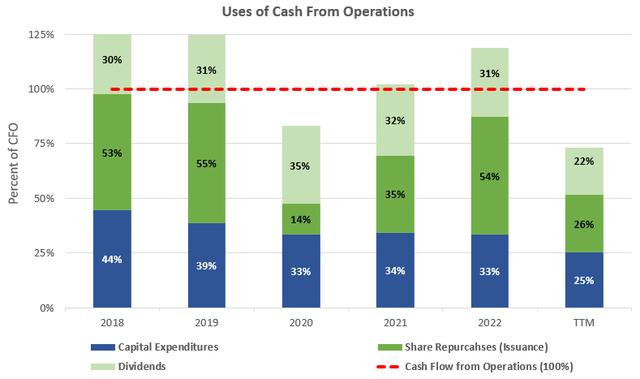

Caterpillar has great cash flow for an industrial manufacturer with capital expenditures only averaging 35% of cash flows from operations over the past 5 year period. Furthermore, the company has such a strong product portfolio and research and development team, that acquisitions are insignificant and basically nil over the period. This 35% spent on capex leaves approximately 65% to be returned to investors through the form of dividends and share repurchases, and that is just what Caterpillar does. With average cash flow from operations of $8.2 billion over the past 3 years and TTM period, this 65% would imply free cash flow available to shareholders of $4.5 billion for a respectable 3.5% free cash flow yield at the current $128.8 billion market capitalization.

Cash Flow Analysis (compiled by author from company financials)

Debt Load Shows No Concern

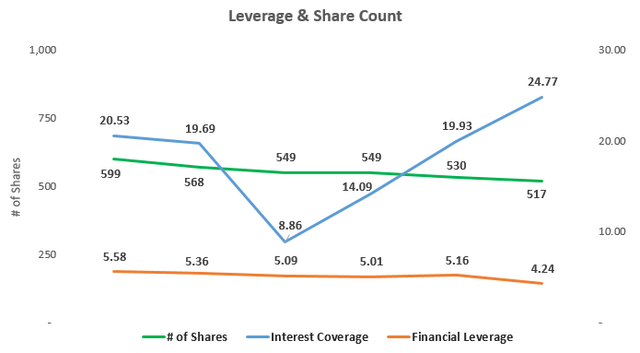

Caterpillar’s leverage remains quite healthy and has actually decreased over the past 5 years. Financial leverage now is 4.2x in the latest quarter compared to 5.6x back in 2018. Interest coverage remains a strong 24.8x and the CAT Financial division looks well capitalized with expected credit losses remaining in line with historical averages and well below the 4.75% reached in 2009. As can be seen in the graph below, the big part of the capital structure story is Caterpillar’s regular share repurchases.

Capital Structure Highlights (compiled by author from company financials)

Since 2018, Caterpillar has repurchased an impressive 13.7% of their outstanding shares to lower the share count to 517 million in the latest quarter compared to 599 million in 2018. In dollar terms, this has meant a net $18.0 billion of shares have been repurchased over the period. To put this significance into perspective, the amount of dividends paid out over the period has been $13.6 billion. To only talk about Caterpillar’s 2.05% dividend yield is telling less than half the shareholder return story as this amount annualized represents around 2.74% being returned to investors through share repurchases, for a total shareholder yield around 4.79%.

Comparison to Peers

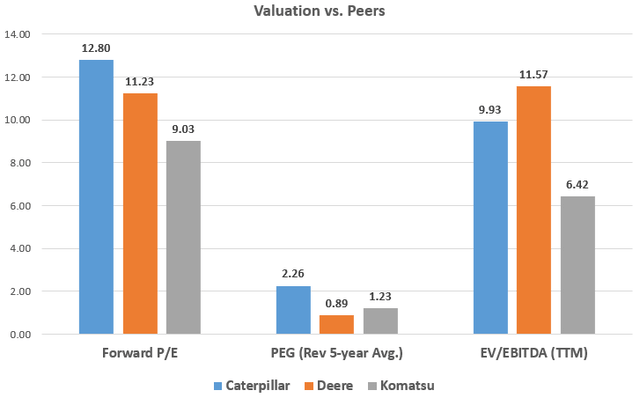

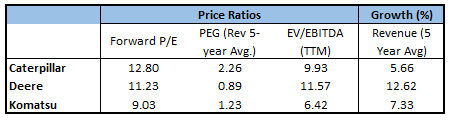

To get a sense of how Caterpillar’s valuation compares to industry peers Deere (DE) and Japanese rival Komatsu (OTCPK:KMTUY), I have highlighted a few main valuation metrics in the graph below. As can be seen, the whole industry is trading at reasonable valuations in the current uncertain economic environment. Industry leader Caterpillar commands a premium valuation at 12.8x forward P/E which is a significant 29.4% higher compared to Japanese rival Komatsu who also has a better 5-year average revenue growth rate at 7.3% compared to 5.7% for Caterpillar.

Peer Valuation Comparison (compiled by author from Seeking Alpha data) Peer Valuation Comparison (compiled by author from Seeking Alpha data)

Enterprising investors willing to explore international names might be interested in taking a further look at Komatsu and I will certainly be adding it to my watch list for a new company to explore. Caterpillar remains the industry leader between these two close competitors with higher gross profit margins and net income margins of 30.5% and 11.2% compared to 29.0% and 7.9% at Komatsu. Deere has more exposure to agriculture so is not a perfect competitor, but Deere also has the lowest PEG ratio at only 0.89x which is being helped by the 12.6% average revenue growth rate over the past 5 years with revenue growth of 23.9% and 19.2% seen in the latest fiscal 2021 and 2022 years, respectively.

Takeaway for Investors

Caterpillar is a great company with impressive profitability that has continued to trend upwards in recent years and more growth is expected this coming year as the lower 12.8x forward P/E shows. The company is handling the current economic environment just fine with the latest Q3 profits up 40.3% and the decrease in backlogs YoY showing signs of stabilizing in the latest QoQ period. With revenue growth per share of 8.4% over the last 5 years, Caterpillar looks like a great growth company at a reasonable valuation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here