Federal Reserve rate hikes have led to higher yields on most bonds and fixed-income securities, from T-bills to long-term treasuries and high-yield bonds. For the most conservative income investors, T-bills are a perfectly fine choice. Those looking for slightly more income without significant increases to risk or volatility, have several other choices too. The Vanguard Short-Term Corporate Bond Index ETF (NASDAQ:VCSH) is one such choice, with the fund offering investors diversified exposure to short-term, investment-grade corporate bonds. Risks are marginally higher than those of T-bills, as are yields.

Although VCSH is a perfectly fine choice, it compares unfavorably to several of its peers in most key metrics. Chief among these is the Janus Henderson AAA CLO ETF (JAAA), which yields more than VCSH, and is slightly less risky. As VCSH compares unfavorably to some of its peers, I would not be investing in the fund at the present time.

VCSH – Basics

- Sponsor: Vanguard

- Dividend Yield: 2.98%

- Expense Ratio: 0.05%

- Total Returns CAGR 10Y: 1.62%

VCSH – Overview and Analysis

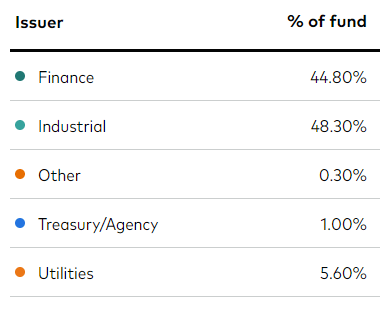

Holdings and Index

VCSH is a bond index ETF investing in short-term, investment-grade corporate bonds. It tracks the Bloomberg Barclays U.S. 1-5 Year Corporate Bond Index, an index of these same securities. It is a simple index, which includes all U.S. dollar-denominated, investment-grade securities issued by industrial, utility, and financial companies, with maturities between 1 and 5 years. The fund invests in 2,481 different securities, with most issuers accounting for less than 1.0% of the value of the fund. Asset allocations are as follows.

VCSH

Although VCSH only invests in three industries, these account for around 90% of the relevant investment universe, and provide more than sufficient, diversified exposure to the same.

VCSH is a bit less diversified than the larger, more well-known bond index ETFs, including the iShares Core U.S. Aggregate Bond ETF (AGG). These tend to invest in more industries and bond sub-asset classes, and tend to hold more bonds.

VCSH is more diversified than some of the more niche bond ETFs, including my favorite, JAAA. Nevertheless, most of these funds are diversified enough, especially those focusing on investment-grade securities. Which brings me to my next point.

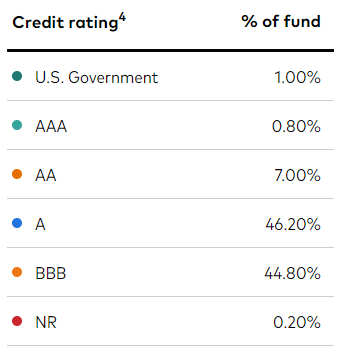

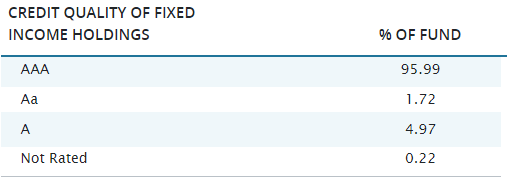

Credit Quality

VCSH almost exclusively invests in investment-grade bonds. Investments in high-yield bonds tend to be temporary, and negligible. Credit ratings for the fund are as follows.

VCSH

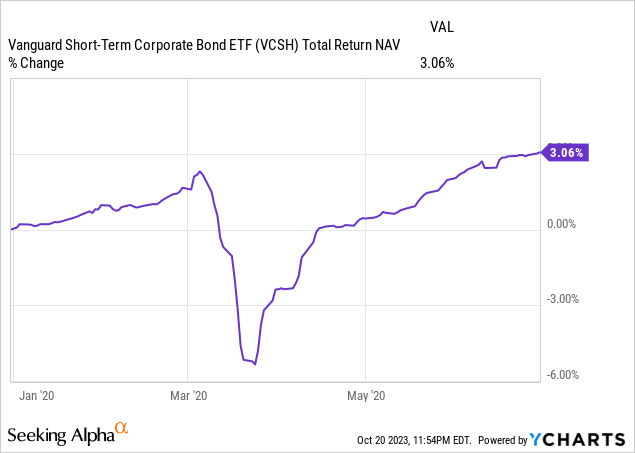

As can be seen above, VCSH’s overall credit quality is reasonably high on an absolute basis, with the fund focusing on bonds rated A and BBB. These securities have low default rates, even during downturns and recessions. Expect small losses during these, as was the case in 1Q2020, the onset of the coronavirus pandemic.

Data by YCharts

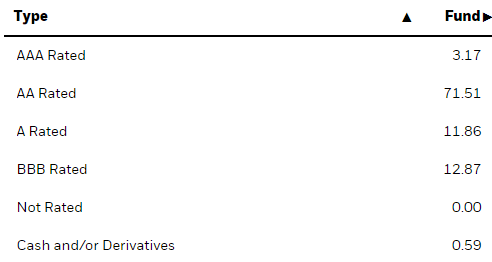

VCSH’s overall credit quality is somewhat lower than that of most investment-grade bond ETFs, with the benchmark AGG focusing on bonds rated AA.

AGG

The smaller, more niche JAAA focuses on CLOs rated AAA, of higher credit quality than VCSH.

JAAA

VCSH’s overall credit quality is reasonably high, but not as high as that of many of its peers. The fund seems like a reasonable choice for bearish or risk-averse investors, but so does AGG and JAAA.

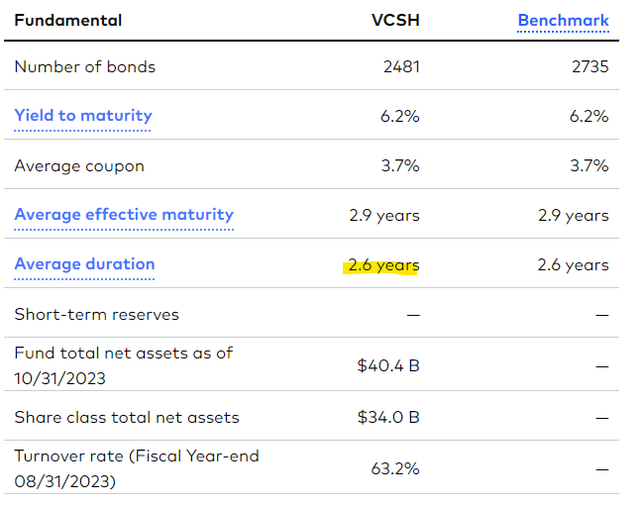

Interest Rate Risk

VCSH focuses on short-term bonds, with maturities between 1 and 5 years. Duration stands at 2.6 years, reasonably low on an absolute basis, and lower than that of most bonds and bond sub-asset classes.

VCSH

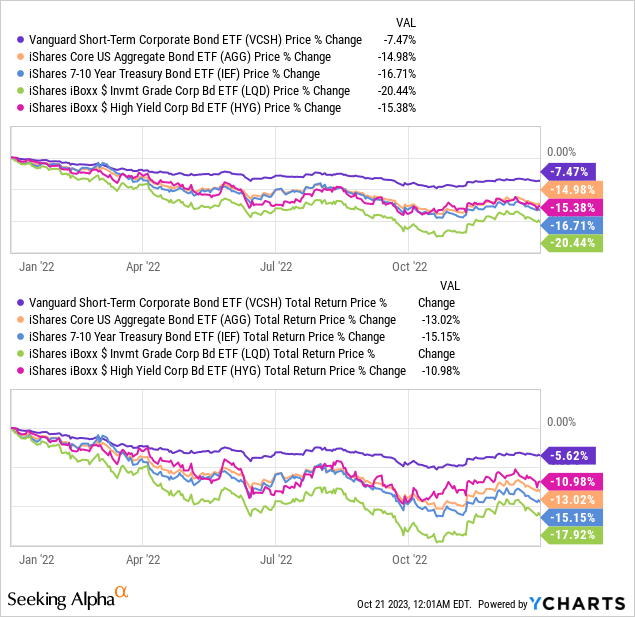

Low duration reduces capital losses / reductions in share prices when interest rates increase, leading to outperformance. As an example, the fund outperformed most of its peers during 2022, a period of rapidly rising rates.

Data by YCharts

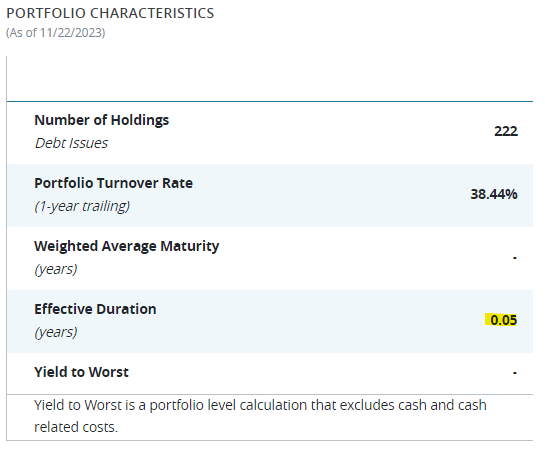

Although VCSH’s duration is low, the duration of several securities and funds is even lower. JAAA, for instance, focuses on variable rate securities, and so has negligible duration.

JAAA

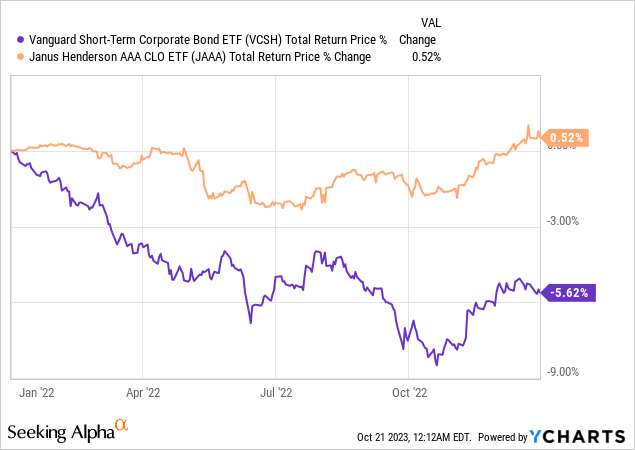

Due to the above, JAAA tends to outperform VCSH when interest rates rise, as was the case in 2022.

Data by YCharts

VCSH’s low duration reduces portfolio risk and volatility, and could lead to outperformance if interest rates were to rise, or if the Federal Reserve were to decide to keep higher rates for longer. The same is even more true for JAAA, however.

Dividend Analysis

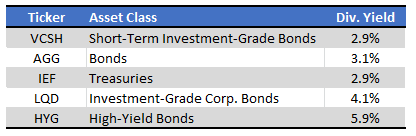

VCSH sports a 2.9% dividend yield, which is incredibly low on an absolute and relative basis.

Fund Filings – Chart by Author

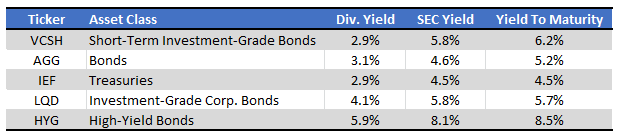

Although the fund’s dividend yield is accurate, it is based on dividends paid for the past twelve months, most of which occurred when rates and dividends were both lower. The fund’s 5.9% SEC yield and 6.0% yield to maturity are both more forward-looking metrics, and more indicative of the dividends that investors should expect moving forward. Both metrics look reasonably good.

Fund Filings – Chart by Author

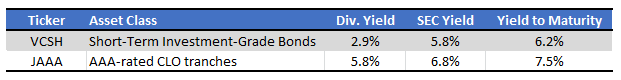

VCSH’s dividends seem fine, but they compare unfavorably to those of JAAA, across all three metrics.

Fund Filings – Chart by Author

JAAA’s stronger dividends are an important advantage relative to VCSH. Said advantage is particularly impactful considering JAAA’s higher credit quality and lower interest rate risk. JAAA yields more and is less risky, a very strong combination.

Performance Track-Record

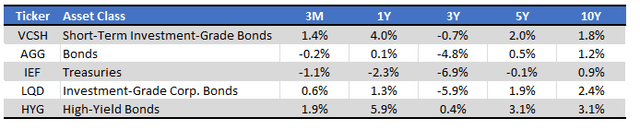

VCSH’s performance track-record is quite mediocre, but at least better than average. The fund tends to outperform relative to peers, almost entirely due to lower interest rate risk, and lower losses these past two years.

Seeking Alpha – Chart by Author

VCSH’s long-term returns are quite low, as interest rates were much lower in the past.

Three year returns are negative, as rates have risen significantly these past three years, leading to lower bond prices and bond fund losses. Low rate risk reduced these losses, but did not eliminate them.

One year returns are much higher than average, as interest rates have somewhat stabilized this year at a much higher level.

Future returns are strongly dependent on future Fed policy. Under current conditions, returns would more closely track those of the past year, than those of the past decade.

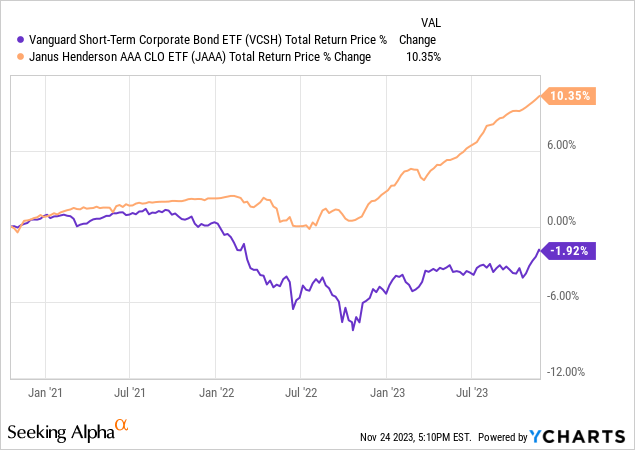

VCSH’s performance compares unfavorably to that of JAAA, with the former significantly underperforming relative to the latter since inception. Underperformance was due to VCSH’s higher rate risk, and lower yield.

VCSH is a reasonable investment, but JAAA seems plainly better, with a higher yield, stronger performance, and lower credit and rate risk. VCSH’s only important advantage is the fact that it should outperform if the Federal Reserve were to cut rates aggressively in the next year or two. Bear in mind, VCSH has low duration and already trades with a lower yield than JAAA. The fund should outperform if the Fed cuts, but not significantly so.

Conclusion

VCSH offers investors diversified exposure to short-term, investment-grade corporate bonds. Although the fund is a reasonable investment, it compares unfavorably to JAAA on most key metrics. As such, I would not be investing in the fund at the present time.

Read the full article here