UiPath (NYSE:PATH), a robotic process automation or RPA leader, presents a compelling case for an upgrade to a BUY rating, in our opinion, supported by its innovative AI-powered automation platform and encouraging projections for future growth. The stock has declined about 74% since our sell rating in June 2021 and underperformed the S&P 500 by 80%. The following image outlines our initial note on the stock.

SeekingAlpha

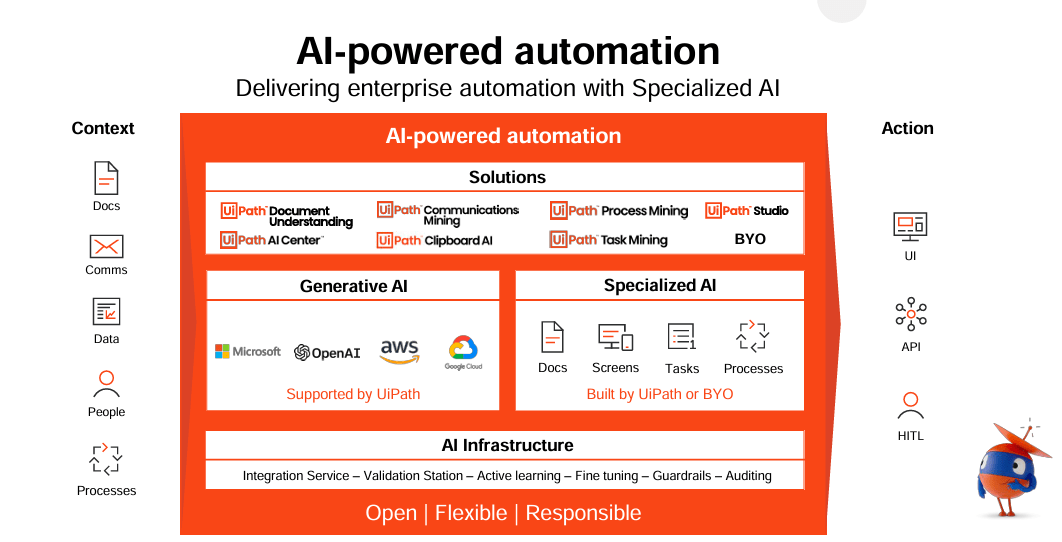

The company has significantly expanded its AI capabilities, introducing game-changing features that accelerate the ability to automate at scale; this includes Generative AI and over 70 Specialized AI models, enhancing operations across various business challenges. We expect PATH’s continued investment in R&D to expand its AI offerings will make it better positioned to rebound in 2024. We recommend investors begin exploring entry points at current levels.

Below is a slide from their last earnings deck showcasing various AI offerings:

PATH earning results

A recent McKinsey report underscores the impact of Generative AI, highlighting an increase in the theoretical automation potential from about 50% to 60-70% – this translates to an increasing rate of accuracy and automation through generative AI. We think we’re still in the early innings of the AI transformation and think UiPath is better positioned now to leverage Gen AI to expand its automation software platform and offerings further. We think UiPath’s unique competitive advantage lies in how the company is pursuing its AI and automation ambitions; its strategy has been leveraging gen AI on multiple fronts, including its Document Understanding and Communications Mining solutions and its “Wingman.” The former uses LLMs to accelerate classification, labeling, and training processes, while the latter uses natural language prompts by integrating OpenAI’s GPT. In early June, the company announced its latest AI-power automation features AI; its Business Automation Platform is already expanding more AI offerings with the general availability of OpenAI and Microsoft (MSFT) Azure OpenAI connectors with support for GPT-4. The platform’s ability to understand screens, documents, tasks, and processes, combined with Generalized AI, pushes the boundaries of enterprise automation and will extend visibility for the company’s offerings in 2024 once enterprise spending rebounds.

We’re constructive on UiPath’s financials as well. In 2Q24, UiPath reported a 19% year-over-year increase in revenue, reaching $287M, and a substantial 25% increase in its Annualized Recurring Revenue or ARR to $1.308B. We believe this growth is expected to continue, with promising revenue and ARR projections for the upcoming quarters driven by the company’s continuous investment in AI, prompting significant business outcomes.

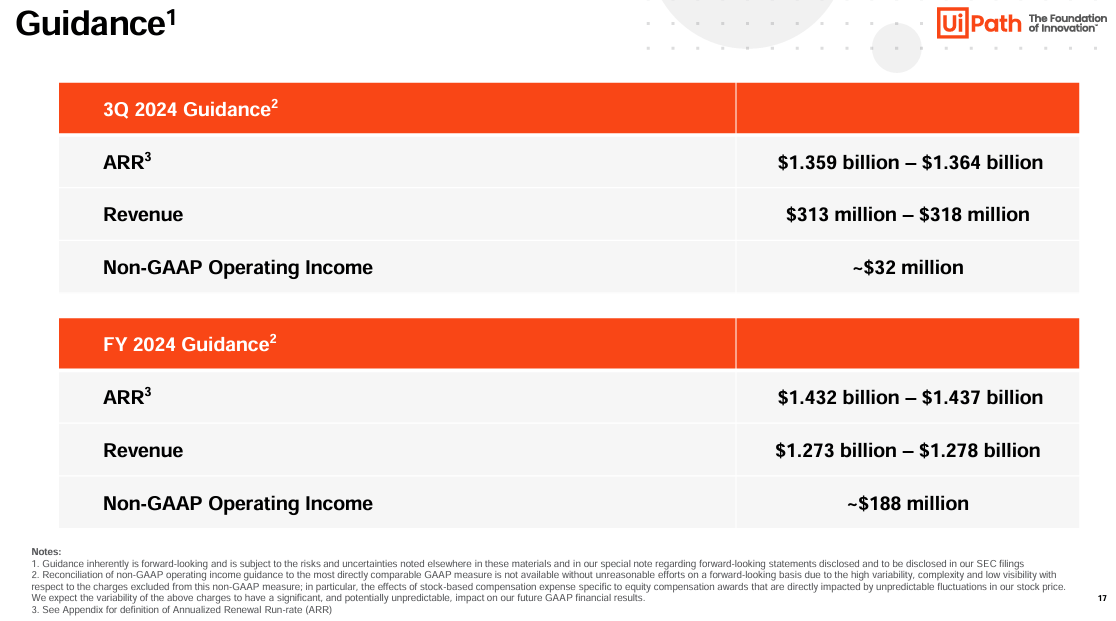

Looking ahead, UiPath has guided higher revenue and ARR for the third quarter and the full fiscal year 2024. The revenue is expected to be from $313M to $318M for Q3, and ARR will reach between $1.359B and $1.364B. For the full year, revenue is anticipated to be between $1.273B and $1.278B, with ARR ranging from $1.432B to $1.437B. We think this positive outlook is bolstered by a $500M stock repurchase program, showing the company’s confidence in its future and commitment to building shareholder value. We believe that with a robust overall IT spending environment, UiPath could easily beat and guide higher.

Below is a slide from PATH’s last earning deck showcasing guidance:

PATH earning results

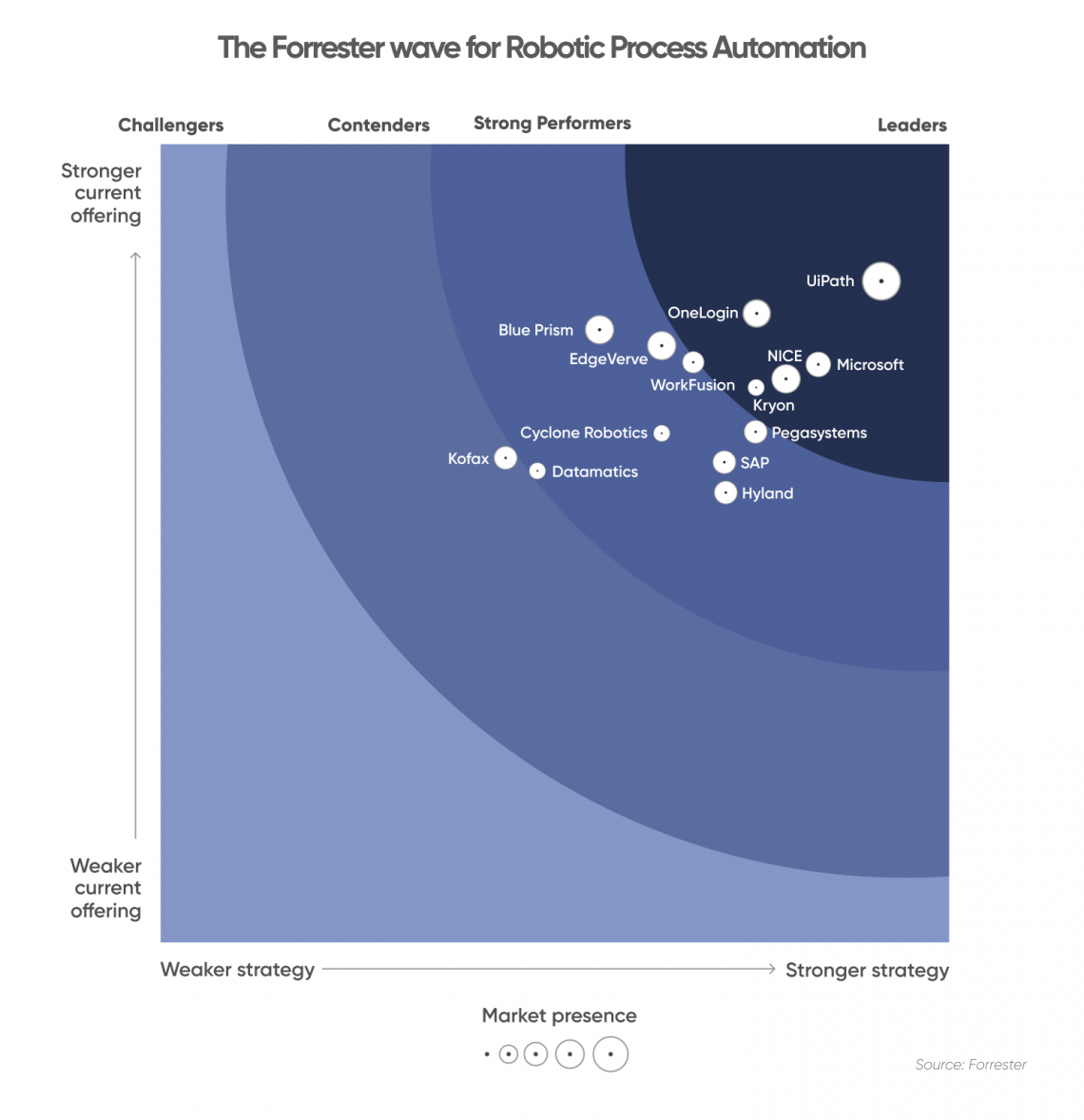

UiPath’s excellence in RPA is also recognized by Forrester, ranking it as a leader due to its strong strategy and current offerings. We think its solutions are particularly suited for large, global enterprises, positioning the company advantageously for when IT spending recovers. We think the company is well positioned for the rebound in enterprise spending coupled with the expansion of the AI penetration rate in 2024.

Below is the Forrester wave for Robotic Process Automation:

Forrester wave for Robotic Process Automation

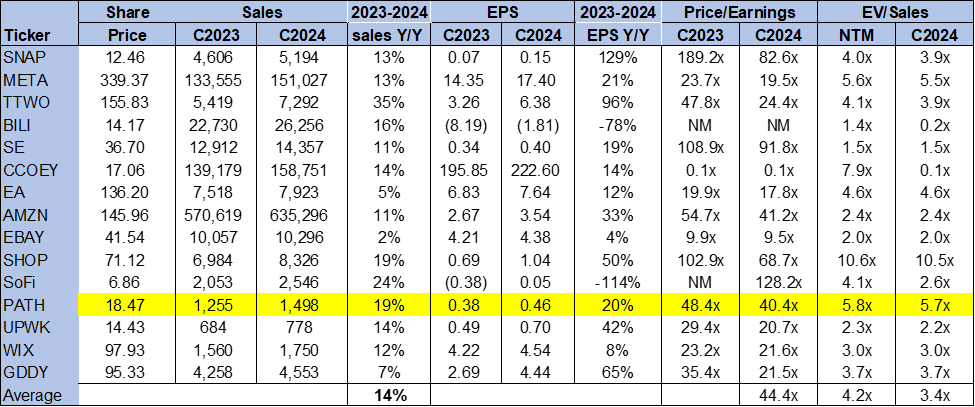

Valuation

The stock is trading above the peer group average, but the higher valuation is justified given the growth rate expected in 2024. On a P/E basis, the PATH is trading at 40.4x C2024 EPS $0.46 compared to the peer group average of 44.4x. The stock trades at 5.7x EV/C2024 Sales versus the peer group average of 3.4x. We understand investor concern about the higher multiple, but we think PATH is a growth stock. We believe the company’s exposure to AI will drive tailwinds next year once the AI penetration path expands from its current low single-digit rate, which we estimate to be around 2.5%. We recommend investors explore entry points into the stock at current levels to ride the upward trend in 2024.

The following outlines UiPath’s valuation against the peer group average.

TSP

Word on Wall Street

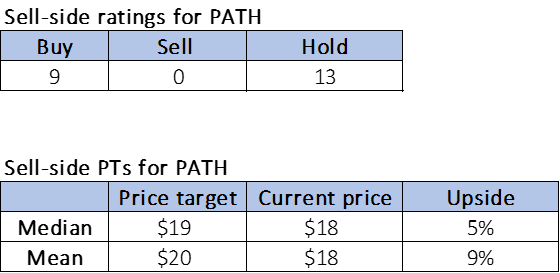

Wall Street has a mixed sentiment on the stock, leaning more toward a HOLD rating. Of the 22 analysts covering the stock, nine are buy-rated, and the remaining are hold-rated. The stock is currently priced at $18 per share. The median and mean sell-side price targets are $19 and $20, respectively, giving us an upside of 5% and 9%.

The following charts outline UiPath’s sell-side ratings and price targets.

TSP

What to do with the stock

We have upgraded UiPath to a BUY. We are optimistic about UiPath’s prospects, primarily due to its innovative AI-powered automation platform, which we believe is well-positioned to counterbalance the current downturn in overall IT spending. Although the near-term outlook suggests limited significant growth in ARR owing to macroeconomic challenges, we expect UiPath to likely show substantial outperformance in the second half of 2024 as IT spending rebounds. Thus, we advise investors to seize this opportunity and buy shares opportunistically.

Read the full article here