Against my expectations from last year, business development company Bain Capital Specialty Finance, Inc. (NYSE:BCSF) performed better than expected, which has led to the BDC’s stock sell for a lower discount to net asset value.

The business development company profits from higher net investment income and debt yields in a rising-rate environment, which has yielded a couple of dividend increases for passive income investors.

Taking into account the improved dividend coverage in particular, I am modifying my stock classification from Sell to Buy.

My Rating History

My rating history on Bain Capital Specialty Finance is blemished, primarily because my reservations about the business development company’s poor dividend coverage last year led to a Sell rating.

However, Bain Capital Specialty Finance has performed rather well since October 2022 when I called BCSF a yield trap. The BDC’s stock has since increased 25% and Bain Capital Specialty Finance handed passive income investors a decent number of dividend raises as well. My stock classification is changing primarily because of Bain Capital Specialty Finance’s much better pay-out metrics.

Bain Capital Specialty Finance’s Portfolio

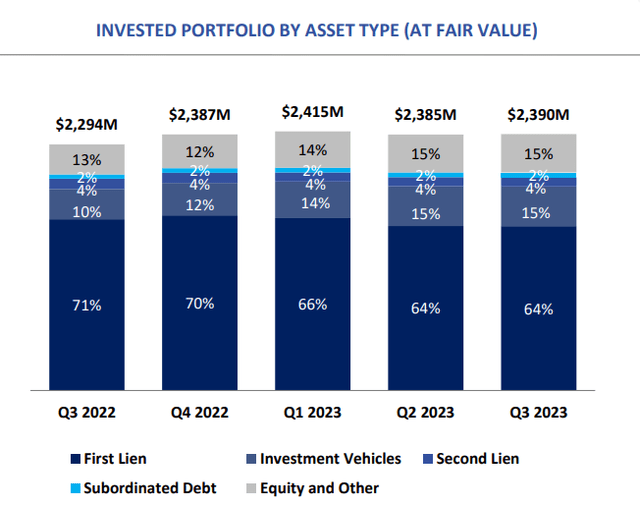

Bain Capital Specialty Finance’s investment portfolio continued to consist primarily of highly secured First Liens (64%) at the end of the third quarter. Other instruments include investment vehicles (15%), Second Liens (4%), Subordinated Debt (2%), and Equity investments (15%).

Bain Capital Specialty Finance’s investment portfolio was valued at $2.39 billion in 3Q-23 compared to $2.29 billion in the year-ago quarter, which implies an increase in the total portfolio value of approximately $96 million.

Invested Portfolio By Asset Type (Bain Capital Specialty Finance)

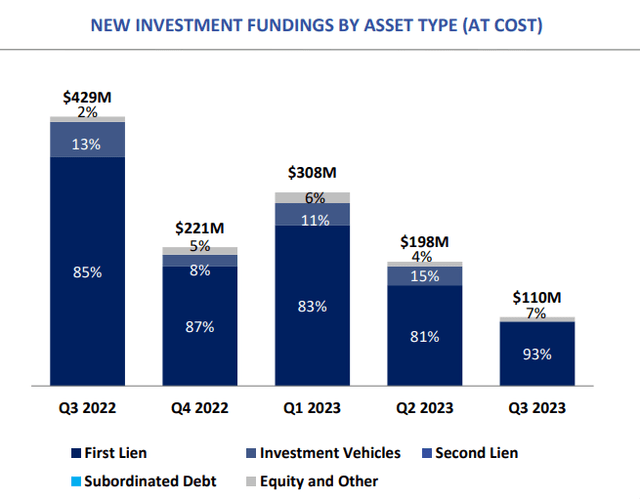

Across all investment categories, Bain Capital Specialty Finance made $616 million in new investment commitments in the first three quarters of 2023. Of this investment volume, 84% went to First Liens.

New Investment Fundings By Asset Type (Bain Capital Specialty Finance)

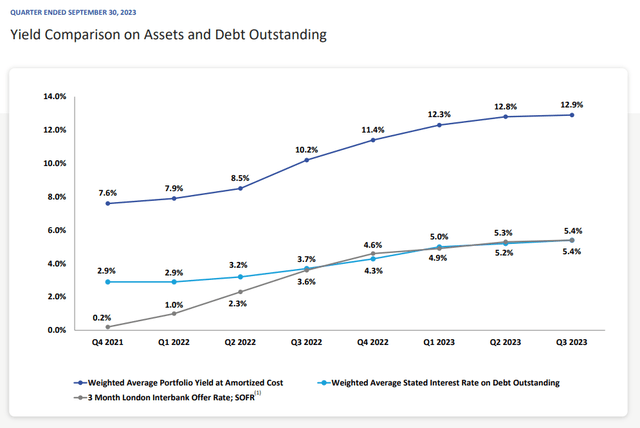

Bain Capital Specialty Finance profited from an increase in key interest rates in the last year, which triggered a rather substantial uptick in portfolio yields.

Though the debt yield curve has started to flatten in the last two quarters, Bain Capital Specialty Finance’s portfolio yield stood at 12.9% at the end of the third quarter, up from just 10.2% in the year-ago period.

The increase in interest rates and the BDC’s positioning towards floating-rate debt (94.2%) have been the two drivers of growing net investment income and improved dividend coverage.

Yield Comparison On Assets And Debt Outstanding (Bain Capital Specialty Finance)

Underlying Credit Quality Remains Solid

Bain Capital Specialty Finance had three portfolio investments on non-accrual, which reflected a non-accrual ratio of 1.0% based on fair value, at the end of the third quarter.

In June, two portfolio companies were on non-accrual status and the business development company reported a non-accrual ratio of 0.0%, also based on fair value. Overall credit quality remained good, in my view, despite the slight increase in non-accruals in 3Q-23.

BCSF Is Now Delivering A Substantial Margin Of Dividend Safety

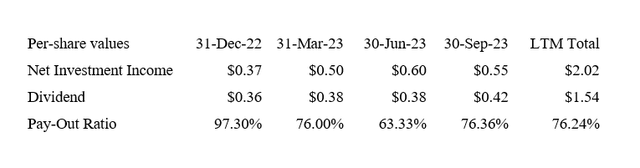

Bain Capital Specialty Finance earned $0.55 per share in net investment income in the third quarter compared to a dividend pay-out of $0.42 per share. The dividend pay-out ratio in 3Q-23 as well as in the last twelve months was 76%, which is much improved compared to the 100% pay-out ratio last year.

Furthermore, Bain Capital Specialty Finance has handed passive income investors three dividend raises in the last year, reflecting total growth of 24%. Despite the increase in the BDC’s dividend, the dividend pay-out metrics improved substantially compared to last year.

Dividend (Author Created Table Using BDC Information)

Still Selling At A Discount To Net Asset Value Of 14%

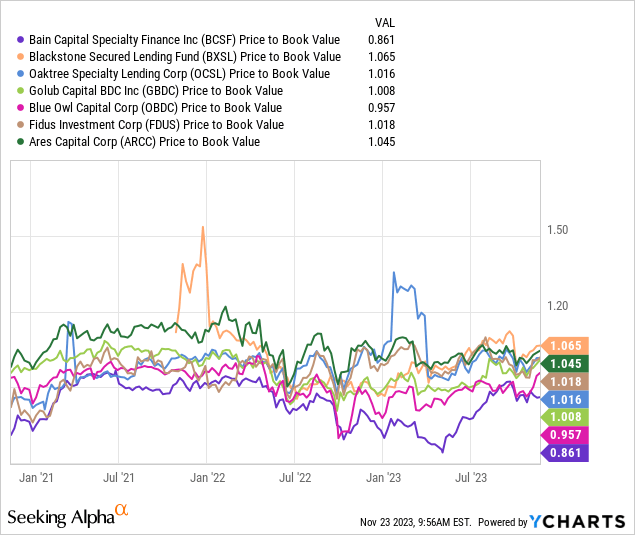

Bain Capital Specialty Finance’s discount has lowered substantially as the company’s dividend raises attracted new buyers. However, the stock is still selling at a 14% discount to book value and has a compelling risk/reward relationship, in my view.

Most business development companies that I own in my passive income portfolio are trading near or at net asset value, which means that BCSF implies a higher-than-average margin of safety.

Investment Headwinds And Fed-Related Risks

Bain Capital Specialty Finance is primarily a floating-rate business development company, meaning an end to the present rate-hiking cycle strongly suggests that its net investment income would be set for a contraction next year. The discount to book value may already reflect this expectation, however. Inflation declined to 3.2% in October, which makes the case for declining key interest rates next year.

My Takeaway

Bain Capital Specialty Finance has performed much better than expected due to the company’s exposure to floating-rate debt investments, which has provided powerful net investment income fuel in the last year.

As a consequence, Bain Capital Specialty Finance has handed passive income investors three dividend raises in the last year.

Taking into account the much-improved dividend coverage metrics for the business development company and the fact that a discount to book value is still available, I am upgrading my stock classification for Bain Capital Specialty Finance to Buy.

Read the full article here