Europe’s leading online fashion platform, Zalando SE (OTCPK:ZLDSF), released another disappointing quarterly trading update this month. To be fair, the company was operating in a challenging Q3 backdrop, with weather headwinds and continued consumer weakness hitting P&L numbers across the sector (note key online peer About You SE also posted a below-par guidance update in October). Admittedly, Zalando’s newfound commitment to cost cuts (to compensate for lower sales) implies it probably won’t be regaining anywhere near the kind of growth it delivered in the past (a factor I highlighted in my prior coverage).

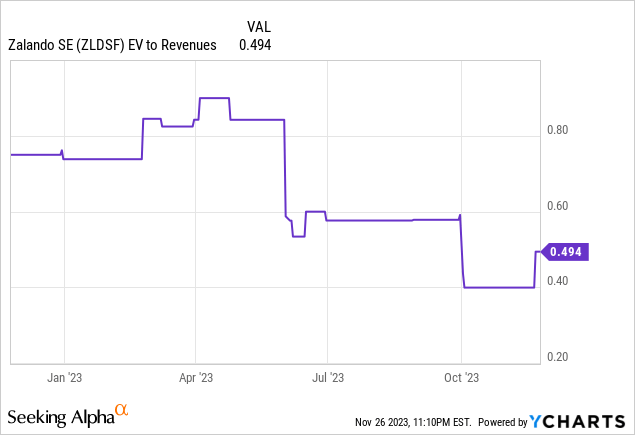

But a lot of the bad news has already been priced in at the current stock price – Zalando currently trades near its all-time low EV/Sales valuation at ~0.5x, while its EV/EBITDA multiple stands at a modest 8-9x (by online platform standards). And fundamentally, Zalando still retains the same competitive advantages that underpinned its top-line growth trajectory in the past. Also benefiting the investment case today is the added downside protection from a net cash balance sheet and positive free cash flow generation. Overall, the stock has been punished too harshly, in my view, and offers an attractive risk/reward here.

Transitory Headwinds Hit Q3 Top-Line Numbers

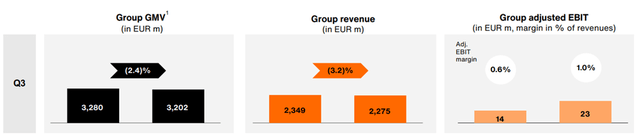

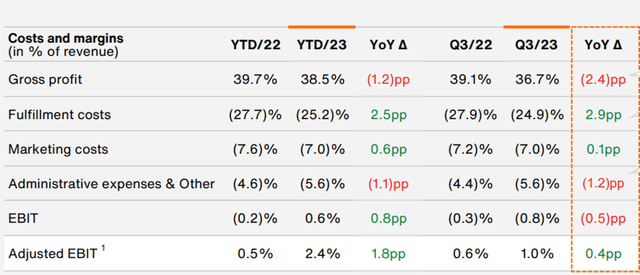

There weren’t too many positives in Zalando’s Q3 2023 release, which also came with a sizeable downgrade to its full-year revenue forecast. To recap, gross merchandise volume (GMV) was down for yet another quarter at -2.4% YoY to EUR 3.2bn, while group revenue fell by a larger 3.2% YoY to EUR 2.3bn – below consensus estimates in both cases.

Zalando SE

Regionally, DACH (Germany, Austria, and Switzerland) led the sales decline, the result of a challenging consumer environment (lower disposable incomes tend to hit discretionary spending hardest). Revenue from the ‘Rest of Europe’ segment was also down, albeit by a lower %. Also weighing on September numbers was a delayed fall/winter season start due to the warmer weather. Excluding the weather impact, we would likely have seen more resilient numbers – categories less dependent on weather conditions, such as footwear and accessories, relatively outperformed.

Cutting Its Way to Margin Improvement

At the gross margin level, Zalando hasn’t been spared from an overly promotional market environment – the company’s early discounting in Q3, worsened by the delayed fall/winter season, led to increased gross margin pressure (down 2.4 % points YoY to 36.7%). On the flip side, the company is also gradually gaining more accretive ‘Partner Program’ revenue (i.e., a gateway for brands and retailers to sell directly on-platform), helped by differentiated platform services like Zalando Fulfillment Solutions (ZFS) and Zalando Marketing Services (ZMS).

Zalando SE

The key positive in Q3 was at the adjusted EBIT level, where management continues to unlock margin upside. The EUR23.2m posted in Q3 represents ~40 bps of adj. EBIT margin expansion to 1.0% was particularly impressive, given that sales declines are limiting operating leverage gains. Of note, the key cost lever has been improved fulfillment economics, which resulted in a 2.9 percentage points gain YoY and more than offset higher administrative costs and one-off lease asset impairments.

Top-Line Guidance Reset Lower; Potentially Conservative

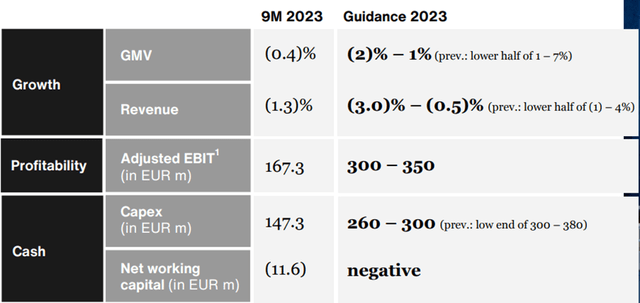

As a result of the underwhelming Q3 report, management has revised its sales guidance lower to a -0.5% to -3.0% YoY range (down from -1% to +4% YoY growth previously), implying EUR 10.2bn of sales at the midpoint. In tandem, the company’s full-year GMV growth guidance has also been cut and now stands at -2% to +1% growth (down from +1% to +7% previously).

The significant top-line revisions come despite management citing a sales rebound in October on the back of colder weather. In all likelihood, the October numbers weren’t enough to fully offset September’s sales decline, and thus, management is keeping expectations low heading into the seasonally important November/December period. Yet, the implied Q4 path (GMV growth of -5% to +4%) seems fairly conservative, particularly with management also citing that it should reach the top end of its full-year GMV guidance if October trends hold firm. A lower bar also means an easier path to a beat and raise in Q4 reporting next year – just what management needs after a poor 2023.

Zalando SE

Zalando’s margin guidance was less of an issue – management expects stable gross margin numbers in Q4, while its adj EBIT guidance of EUR 300-350m remains unchanged. Without operating leverage, achieving this guidance rests on unlocking an incremental ~100bps margin from fulfillment cost savings in Q4. While some of this will come out of existing efficiencies, a large chunk will also come from delayed investments – most notably, into new distribution centers in Western Europe, a key driver of the lower capex outlook to EUR 260-300m (vs EUR 300-380m previously). Given the capital crunch is also slowing the rest of the European online retail landscape, management likely still has room to pull back on additional investments (e.g., brand assortments and marketing) without losing its edge. Hence, the current adj EBIT margin target seems well within reach, in my view.

Down but Not Out

While Zalando suffered another quarterly miss and downgrade, the stock didn’t sell off quite as badly, indicating a lot of bad news has likely been priced in. The silver lining is that the Q3 result was down more to sector-wide headwinds than anything company-specific, with October numbers also trending in the right direction. Plus, Europe’s extended rate hike cycle is finally at an end and an eventual consumer recovery should eventually boost Zalando’s financials.

For now, though, the stock price (~0.5x EV/Sales) indicates the market is already underwriting Zalando as a self-help margin story rather than a high-growth one. Alongside its net cash position and positive cash flow generation, the current bar seems far too low, leaving ample room for upside once the European consumer recovers. Over the mid to long-term, Zalando still retains the right competitive advantages to capitalize on a secular consumer spending shift online, having built up a best-in-class partnership and distribution network, as well as a massive customer base. On balance, I like the risk/reward here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here