Dividend growth stocks are my favorite type of stocks to invest in because they offer both growth potential and dividend growth, which puts the power of compounding into overdrive.

I consider a stock to be a “dividend growth stock” when the company has shown their ability to increase their dividend on a regular basis and they have a 5-year dividend growth rate of at least 10%.

Today, we are going to take a look at 3 Dividend Stocks that are great for those investors looking for both income and growth, as all three stocks have dividend growth rates above 10% and all three offer some great growth potential as well.

3 Dividend Growth Stocks For Income & Growth

Dividend Growth Stock #1 – Oracle Corporation (ORCL)

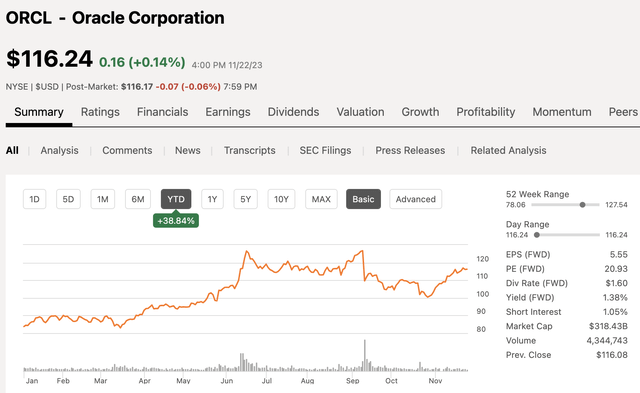

Artificial Intelligence has been all the hype in 2023 propelling the likes of Nvidia (NVDA), Microsoft Corp (MSFT), and Oracle to great returns in 2023, and these are just a few of the AI related stocks to be impacted.

Oracle has a market cap of $318 billion and in 2023 alone, shares of ORCL have increased nearly 40%.

Seeking Alpha

The intrigue with Oracle is their software products that produce high margins and AI will further boost results for a number of years. The company’s cloud services segment, which is by far its largest segment, generated revenues of $4.6 billion in Q1, which grew 29.5% year over year. Oracle generated operating profit margins of 27.6% during the quarter.

In terms of free cash flow, Oracle generated FCF of $5.66 billion during the quarter, which grew 21.1% year over year. This equates to a FCF per share of $2.00 for the quarter and a FCF yield of 45%. Last year, ORCL generated FCF per share of $3.06.

Oracle pays an annual dividend of $1.60 per share, which equates to a dividend yield of 1.4% and a FCF payout ratio of 52% which means the dividend is plenty safe and has room to continue growing in the near-term. Speaking of growth, ORCL has a five-year dividend growth rate of nearly 15%, having increased their dividend for nearly a decade straight.

Seeking Alpha

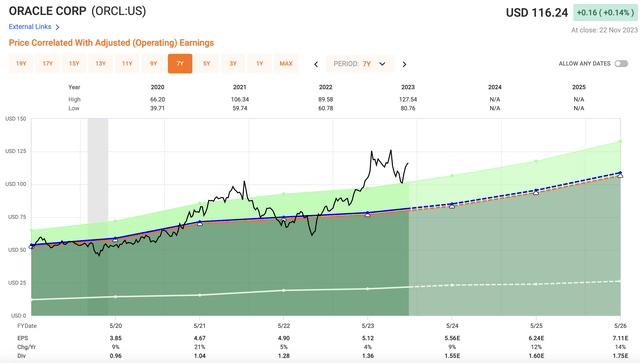

In terms of valuation, analysts are looking for 2024 EPS of $5.56 per share which equates to a P/E ratio of 20.9x. Over the past 3 years, shares have traded around 17.5x, which seems a little cheap given the expected AI growth moving forward

Fast Graphs

EPS is continually growing each year which leads to the intrigue with the company. Here is a look at EPS growth expectations moving forward:

- FY 2023 EPS growth: 4%

- FY 2024 EPS growth: 9%

- FY 2025 EPS growth: 12%

- FY 2026 EPS growth: 14%

Dividend Growth Stock #2 – UnitedHealth Group Inc (UNH)

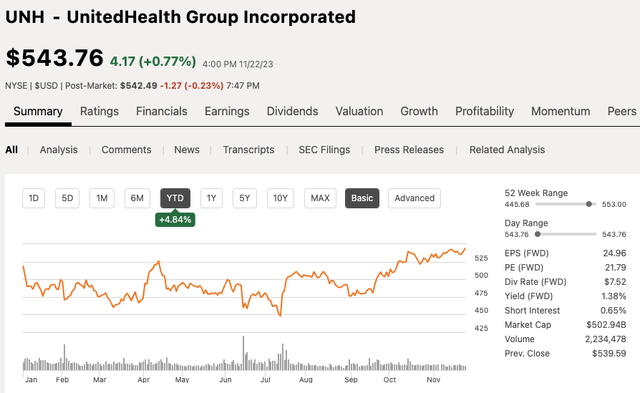

UnitedHealth Group is a diversified managed health care company, working with both individuals and companies of all different sizes to cover their insurance need.

UnitedHealth Group has a market cap of $503 billion and on the year, shares are up only 5%, as the healthcare sector has been one of the worst performing sectors in the market this year. However, over the last 2 months the stock has caught some momentum as shares of UNH have increased by nearly 15%

Seeking Alpha

If you are a believer that the US will dip into a recession, healthcare is typically a defensive sector that investors flock to because regardless of the economic backdrop, people have healthcare needs.

During the company’s most recent quarter, UNH saw revenues grow 14% year over year to $92.4 billion with cash flows generated by the company coming in at $6.9 billion.

Through the first nine months of the company’s fiscal year, UNH generated FCF of $31.8 billion, which equates to a FCF yield of 11.5%.

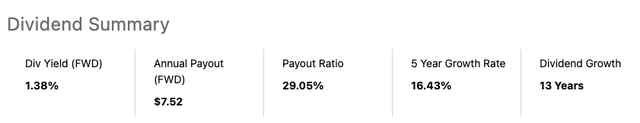

In terms of the dividend, UNH pays an annual dividend of $7.52 per share which equates to a dividend yield of 1.4%, making those two stocks in a row with the same exact dividend yield. However, the dividend growth is a little faster with UNH as they have a five-year dividend growth rate of 16% and they have increased the dividend for 13 consecutive years and counting.

Seeking Alpha

Turning our attention to valuation, analysts are looking for UNH to generate EPS of $27.88 next year equating to a price to earnings multiple of 19.5x, which is below their five-year average of 21.4x.

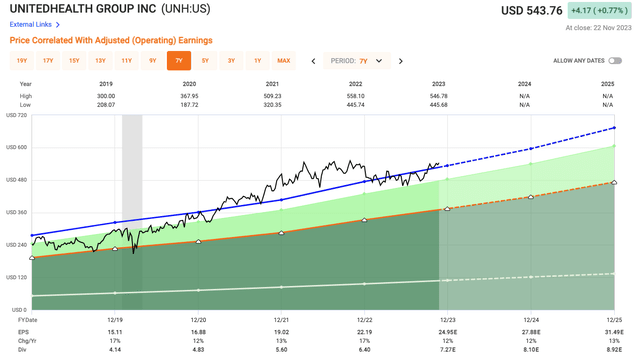

Fast Graphs

Dividend Growth Stock #3 – Prologis, Inc. (PLD)

This final stock we are looking at is a REIT, or a Real Estate Investment Trust that operates within the industrial sector. Being an industrial REIT, Prologis is an indirect way to play the growth in e-commerce.

Right now, e-commerce sales account for roughly 15% of all retail sales, and that number is expected to grow each of the next three years as e-commerce sales continue to grow and penetrate further.

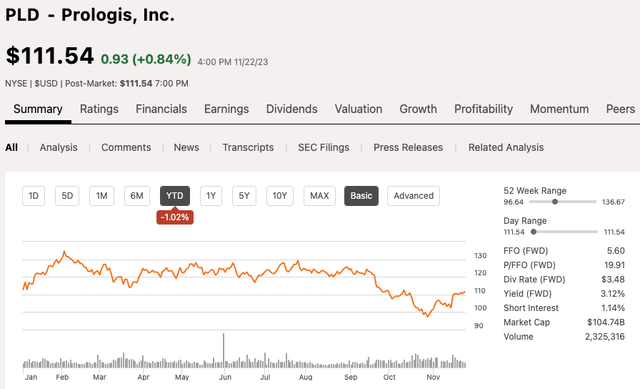

Prologis has a market cap of $105 billion and in 2023 the REIT sector has been hammered by high interest rates leaving the stock pretty much flat on the year.

Seeking Alpha

For REITs, investors focus more on FFO or Funds From Operations rather than EPS, largely due to the high amounts of depreciation that hit the books, but with real estate, this asset class actually appreciates over time so having depreciation expense is not necessary.

During the most recent quarter, PLD generated FFO of $1.30 per share and revenues of $1.92 billion, which beat analyst expectations on both the top and bottom lines. In addition, PLD management increased their full year guidance slightly, bringing up their low end of the range.

Although rates have been high it has not slowed the growth of this company as their development starts is expected to be between $3.0 to $3.5 billion, higher than the prior guidance of $2.5 to $3.0 billion.

As e-commerce grows, these tenants spend much more than traditional brick and mortar tenants, so as e-commerce grows it will further increase demand for industrial and warehouse properties. The largest tenant for PLD is Amazon (AMZN).

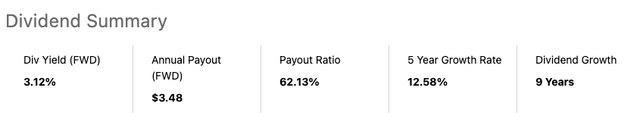

With REITs, they usually have higher yields and lower dividend growth, but PLD is an anomaly as they have both a nice size yield at 3.1% to go along with strong growth with a five-year dividend growth rate of 12.5%.

Seeking Alpha

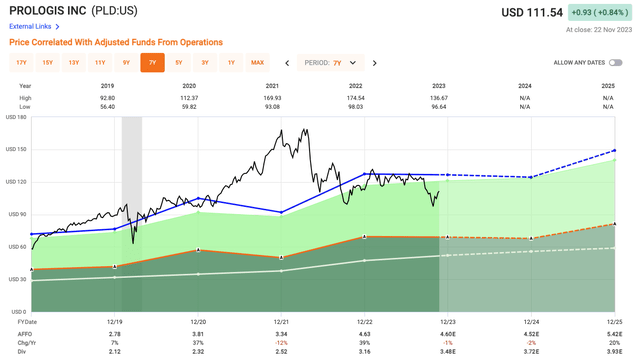

In terms of valuation, analysts are looking for PLD to generate 2024 AFFO of $4.52 per share which equates to a P/AFFO of 24.6x which is below their 10-year average of 27.5x.

Fast Graphs

Investor Takeaway

Dividend growth stocks are usually intriguing to both growth and income investors alike as they provide a little of both. However, the dividend growth aspect can compound much faster overtime which compounds your wealth as well. As dividends grow, you can reinvest that income to increase your share count.

All three of these stocks pay growing dividends of nearly a decade or more and all three have dividend growth rates above 10%.

In the comment section below, let me know which of these three dividend growth stocks you like best.

Disclosure: This article is intended to provide information to interested parties. I have no knowledge of your individual goals as an investor, and I ask that you complete your own due diligence before purchasing any stocks mentioned or recommended.

Read the full article here