Introduction

When a stock of a company the likes of Mercedes (OTCPK:MBGAF) (OTCPK:MBGYY) – the seventh most valuable brand in the world – drops by 25% in a few months and then, as soon as its earnings report is out, immediately falls another 8% on the same day, then something is going on and we need to understand whether investor fears are justified or not.

Summary Of Previous Coverage

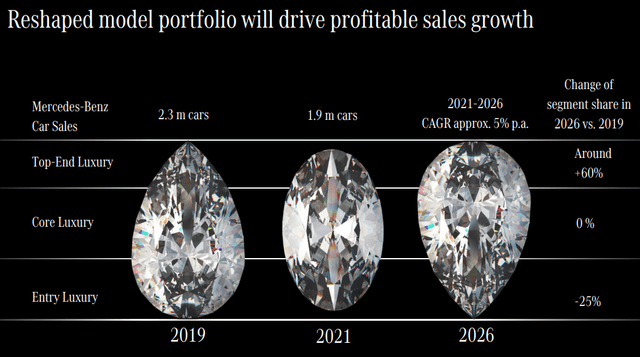

Beware of the auto industry. This is what I have written quite often. And yet, as many may know, I own a few selected stocks in the industry. One of these, though a smaller position of mine, is Mercedes. I bought into the company because I saw the company executing its plan to exit from lower margin segments and reshape the model portfolio towards core and top-end luxury vehicles. Though Mercedes will lose a bit of volume, it will increase its profits.

Mercedes 2023 Capital Markets Presentation

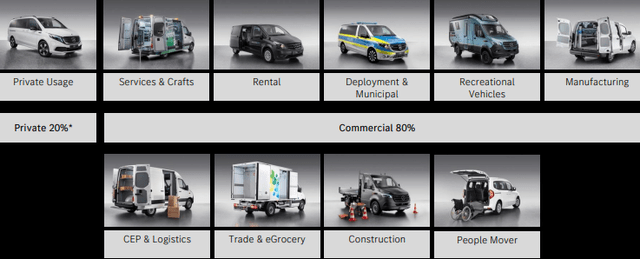

So, though is still positioned well below Ferrari (RACE) and a bit below Porsche, it is part of my three luxury picks I own. But Mercedes also is a niche player because it is the market leader in vans, where margins are actually higher.

For those who are unfamiliar with this business, below is the current portfolio of commercial vehicles.

Mercedes-Benz Q3 Presentation

In the case of Mercedes, what is even more striking is its cheap valuation, aligned with many lower quality peers.

Q3 Earnings Report

While many automakers are still reporting very good results, Mercedes disappointed the market because all its main metrics went down:

- Revenue was €37.2 billion, down 1% YoY

- EBIT was down 7% to 4.8 billion

- FCF of the industrial business was down 22% to €2.3 billion

- Top-end vehicle unit sales were down 11% to 70k

If we break-down the results per business segment, we see Mercedes Cars saw sales decline by 4% to 510k units, with revenues also down 4%, EBIT down 18% and CFBIT adj. down 38% to €2.2 billion.

However, net pricing was able to partially offset this top-line slow-down so that RoS came in at 12.2%, down from the 14.5% achieved a year ago. Still, a double-digit margin is a very solid return, making Mercedes one of the most profitable automakers in the world. One of the assets making it so is its strong brand. Why is it an asset with an impact on margins? Because, in a certain way, Mercedes do sell themselves. In fact, the company was able to announce lower marketing expenses this year, while many other automakers are needing to increase their marketing budget to support slowing sales.

Why were margins lower, given the fact raw material prices are down? During the earnings call, Mercedes-Benz management talked about “disproportionate inflation charges and supply chain-related costs compared to previous quarters”. This isn’t exactly great to hear. I mean, I expect a company like Mercedes to be able to correctly handle its relationships with its suppliers. During the earnings call, it was clear the company was at odds with some of its suppliers because they are not lowering prices once raw materials decreased. However, the company also tried to explain how “the worst is behind” and 2024 should see a more normalized supply-chain.

Mercedes Vans, on the other hand, saw unit sales increase by 1% to 105k, with battery electric vehicles increasing by 105% to 6.3k. Its revenue was up 15% to €4.9 billion, adj. EBIT was up 36% to €743 million. Return on sales was up significantly from 12.7% in Q3 2022 to 14.5% now. This was mainly due to mix and pricing.

Mercedes-Benz gave its new guidance, which actually sees revenue and EBIT at prior-year levels, while R&D expenditure is seen “significantly above” the prior-year level. Free cash flow from the industrial business is expected to be flat YoY at €7.8 billion.

However, this year, GLC and E-Class models have been constrained by the 48-volt issue, with many batteries being quickly drained. Therefore, 48-volts batteries were not available during Q3, slowing down GLC and E-Class sales. This, though it is hitting Mercedes’ margins and volumes, may create a future tailwind, pushing forward some demand and sales into 2024.

Since there is not much to do about this issue in 2023, investors can take the current hit while being aware 2024 will see easier comps with this unexpected tailwind.

Valuation And Conclusion

Mercedes scores an A+ as its Seeking Alpha valuation grade. In fact, it trades at a TTM PE of 4.3 and a fwd PE of 4.6. Considering we are talking about the seventh strongest brand in the world that I am not expecting to go out of business anytime soon, we see a compelling valuation.

Its fwd EV/EBITDA is cheap, as well, currently at 6.1. If we look at the fwd P/FCF ratio we see a 3.8. Its dividend yield is at 9%, which shows a very depressed valuation.

What may be of concern here is its F as its growth grade. However, the company’s top-line as well as its EPS have been growing, especially after the new strategy launched in 2019.

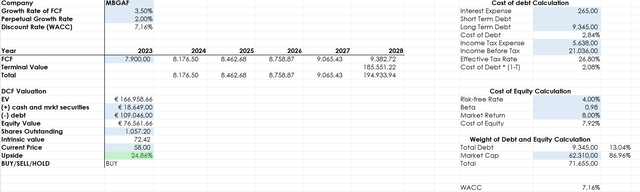

If I run a discounted cash flow model with the TTM data and I expect a FCF growth of 3.5% for the next five years and then moderate it to a 2% perpetual growth expectation, we have an intrinsic value of €72.42 per share in the Frankfurt Stock Exchange.

Author, with estimates based on Mercedes guidance

This is enough to prove that the current stock price shows that very low expectations are baked in. As soon as Mercedes shows it can sail through the few issues it had to face this year, it should be rather easy to understand the company is highly profitable within its industry and is able to print more cash than it did in the past decade. This is why Mercedes is a buy, and I actually took advantage of the recent dip to buy some more shares.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here