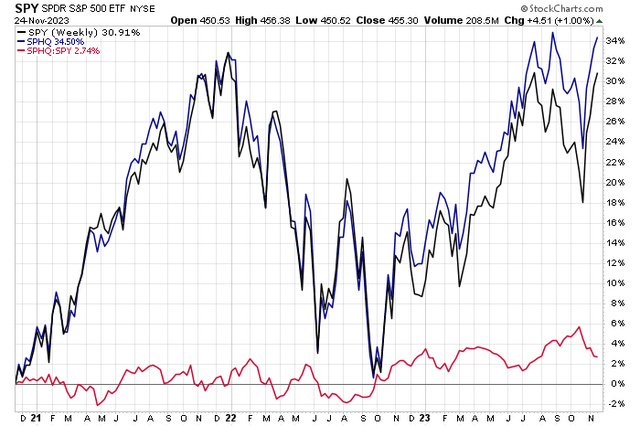

High-quality S&P 500 stocks have outperformed the broad US large-cap index over the past three years. On a total return basis, the Invesco S&P 500 Quality ETF (NYSEARCA:SPHQ) is just fractionally below its all-time weekly closing high, illustrated in the chart below. While SPHQ has given back some relative gains in the last month, considering the rebound led by riskier stocks as interest rates have turned lower, SPHQ has a solid track record.

I have a hold rating on the fund. While it doesn’t differ much from the SPX itself, a focus on several measures of quality can offer some benefit during periods of market turmoil, but its portfolio is not all that cheap today.

SPHQ: Small Alpha Produced Last 3 Years

Stockcharts.com

For background, SPHQ aims to track an index of stocks in the S&P 500 that have the highest quality score, which is calculated based on three fundamental measures: return on equity, accruals ratio, and financial leverage ratio. The fund and the index are rebalanced and reconstituted semi-annually on the third Friday of June and December, according to Invesco.

SPHQ is a large ETF with more than $6.5 billion in assets under management, and its trailing 12-month dividend yield is about on par with the S&P 500’s at 1.55%. The ETF sports an “A” ETF Grade from Seeking Alpha for its strong share-price momentum characteristics, while a low 0.15% annual expense ratio earns SPHQ a solid A- rating. The fund is not overly risky given its large-cap and quality construction methods and the ETF’s liquidity measures are robust considering the average daily volume of slightly more than one million shares and a 30-day median bid/ask spread of just two basis points as of November 24, 2023.

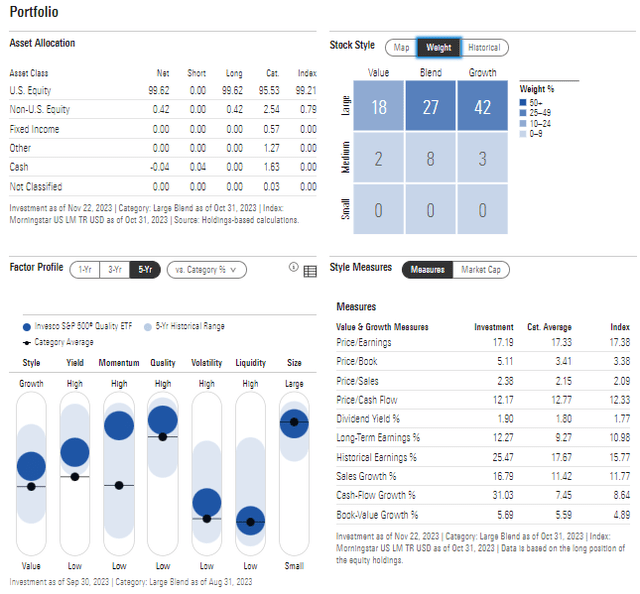

Digging into the portfolio, SPHQ is almost entirely a large-cap fund with just 13% of assets considered mid-cap by Morningstar. The 5-star, Silver-rated fund by that research firm shows a moderate 17.2 price-to-earnings ratio, though it is expensive on a price-to-book basis. It also trades more than 12 times cash flow, which is also somewhat pricey. Long-term earnings growth is quite strong, however.

SPHQ: Portfolio & Factor Profiles

Morningstar

The portfolio breakdown reveals that the fund closely resembles the S&P 500, making me not overly excited to stray from the index by going overweight this ETF. Tech is fully a third of SPHQ but notice the top holding – it isn’t Apple (AAPL) or Microsoft (MSFT), but rather NVIDIA (NVDA). In general, however, the allocation looks similar to the SPX. There is a bit of an added risk in that almost half the fund is invested in the top 10 stocks.

SPHQ: Holdings & Dividend Information

Seeking Alpha

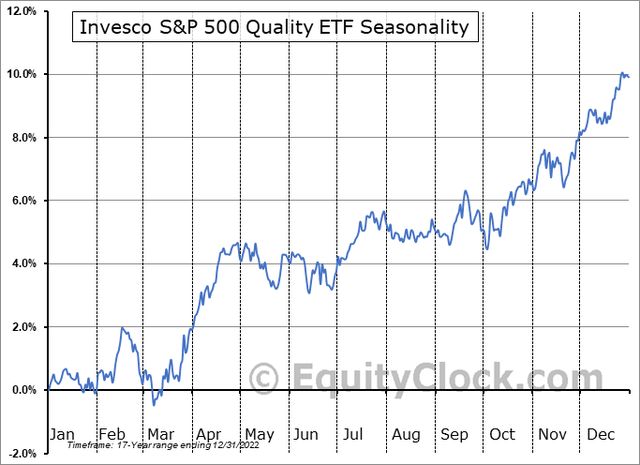

Seasonally, SPHQ tends to rally into year-end, but then sputter over the first handful of weeks of the new year, according to data from Equity Clock. Still, December has been positive 82% of the time over the past 17 years, per the data’s history, and the typical return in the final month of the year is 1.4% with a 0.0% average gain in January.

SPHQ Seasonality: Bullish Trends Into Year-End

Equity Clock

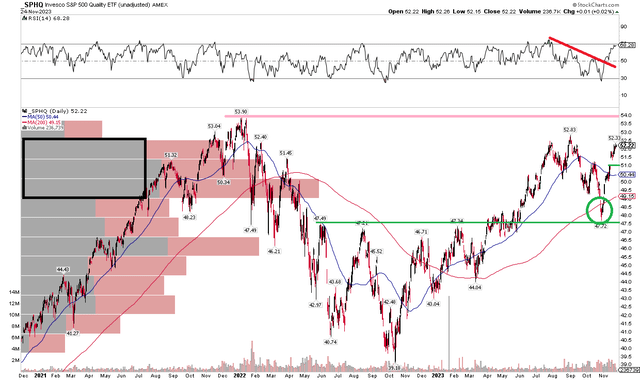

The Technical Take

With an allocation and performance that both look close to the S&P 500, the technical chart is likewise comparable. Notice in the chart below that shares are encroaching on all-time highs – a modest outperformance versus domestic large caps. I think new highs are in play over the coming months now that the long-term 200-day moving average is positively sloped.

Also, take a look at the RSI momentum oscillator at the top of the graph – it broke a downtrend line a few weeks ago, confirming the snapback in price. A climb above the August peak of $52.83 would likely help bring about all-time highs before the end of the year amid positive seasonal trends right now. On the downside, be mindful of a gap near $51 – that could get filled if we see troubling macro data soon, but I see long-term support at $47.50 which held perfectly during the August to October correction.

Overall, the technical situation is generally solid, much like that of the S&P 500 today.

SPHQ: RSI Breakout Confirms the Price Rebound, All-Time Highs In Play

Stockcharts.com

The Bottom Line

I have a hold rating on SPHQ. Its very close resemblance to the S&P 500 is somewhat unappealing if you are looking to sharply beat the market over time, but with modest alpha produced over the past few years, it’s also not a bad choice if you want to modestly tweak your US large-cap weighting style.

Read the full article here