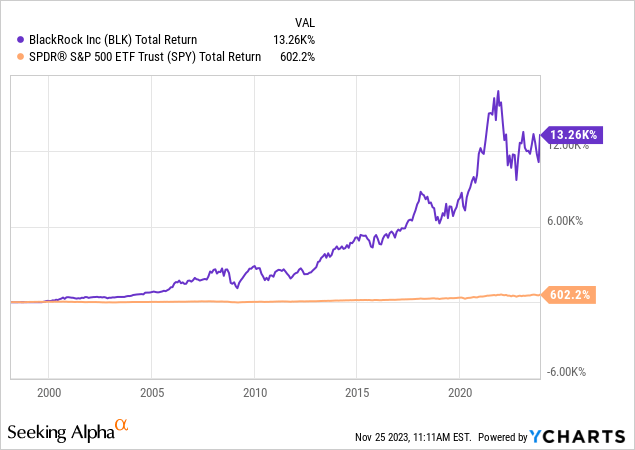

BlackRock (NYSE:BLK), the world’s leading asset management company, has proved an excellent investment since going public in 1999. Since its IPO, BLK has delivered a total return of 13,260%. Comparably, the S&P 500 has delivered a total return of 602%.

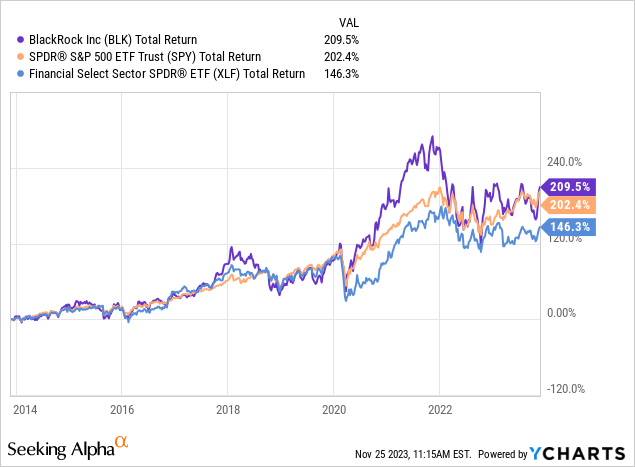

BLK has also performed well over more recent time periods. Over the past 10 years, BLK has delivered a total return of 210% compared to a total return of 202% delivered by the S&P 500. BLK has also significantly outperformed the financial services sector over the same time period with the Financial Sector Select SPDR ETF (XLF) delivering a total return of 146%.

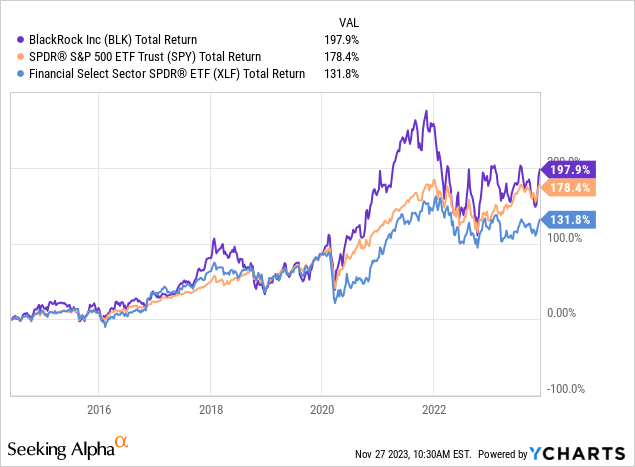

In June 2014, I initiated BLK with a buy in my piece titled BlackRock: My Favorite Financial Services Investment. Since then, BLK has delivered a total return of 198% compared to a total return of 178% and 132% for the S&P 500 and XLF during the same period.

BLK enjoys a substantial competitive advantage due to its scale. Despite the strength of its business, BLK currently trades at a valuation which is inline with the broader market. For these reasons, I believe BLK is poised to continue outperforming other financial services companies and represents a very attractive investment opportunity at current levels. Thus, I am upgrading the stock to a strong buy.

Company Overview

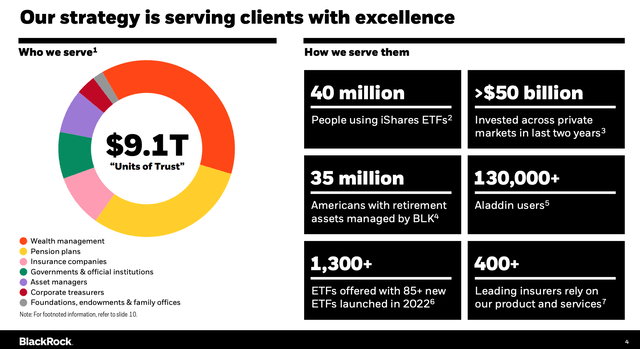

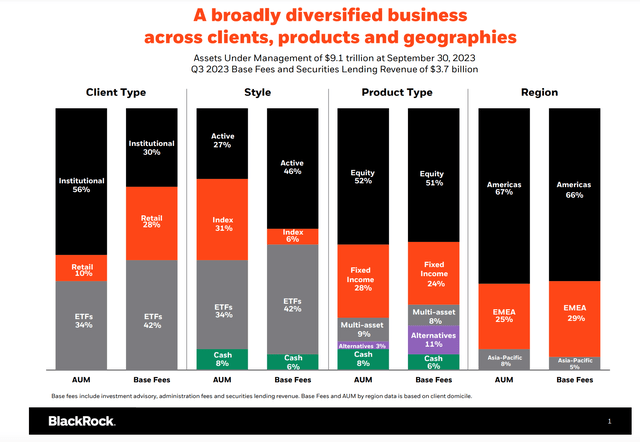

BLK is the world’s largest asset management company with ~$9.1 trillion in assets under management (“AUM”). BLK provides asset management services to both institutional and retail investors. The company has a wide range of products including equity, fixed income, multi-asset, alternatives, and cash.

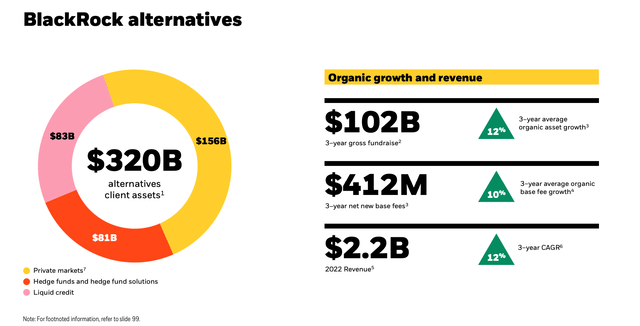

BLK is a market leader in the ETF business and ~42% of the company’s base fees come from ETF offerings. BLK is also a leader in the private investing space with ~$320 billion in alternative assets which includes ~$156 billion in private markets, ~$83 billion in liquid credit, and ~81 billion in hedge funds and hedge fund solutions.

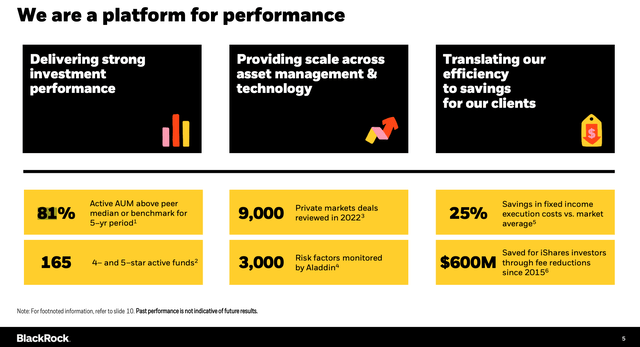

In addition to its leading asset management franchise, BLK has also developed a leading technology services business. The company offers technology solutions through its Aladdin product offering. Technology services accounts for ~8% of total revenue and the business has grown at a 15% CAGR over the past 5 years.

In terms of geographic positioning, BLK’s largest market is the Americas which accounts for ~66% of base fees but the company also has significant operations in EMEA which accounts for ~29% of base fees. Asia-Pacific is a smaller business for BLK accounting for ~5% of base fees.

BLK Investor Presentation

BLK Investor Presentation BLK Investor Presentation

Market Leader In A Highly Fragmented Industry

Asset management is a very competitive business. BLK competes with large traditional asset management firms such as Vanguard, Invesco (IVZ), Fidelity, T Rowe Price (TROW), Franklin Resources (BEN), PIMCO, AllianceBernstein (AB), Janus Henderson, Wellington Management, and many others. BLK also competes with asset management divisions of larger banks such as J.P. Morgan Chase (JPM), Goldman Sachs (GS), State Street (STT), The Bank of New York Mellon (BK), UBS (UBS), and many others.

In addition to these companies, BLK also competes with players such as KKR (KKR), Blackstone (BX), Apollo (APO), Carlyle (CG), and many others in its alternatives business.

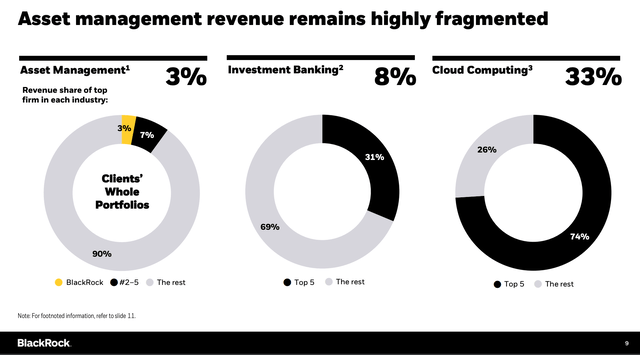

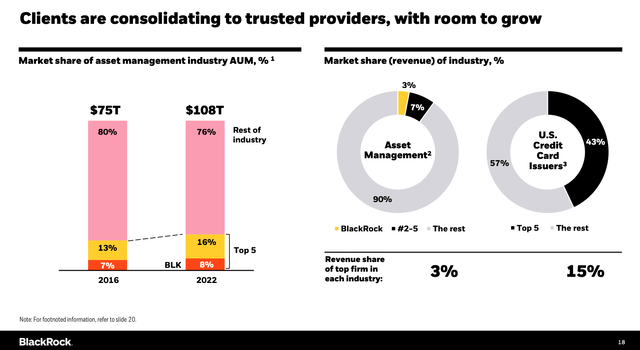

While BLK is very large, the asset management industry remains highly fragmented with BLK accounting for just 3% of total asset management industry revenue.

BLK Investor Presentation

Competitive Advantage Driven By Scale

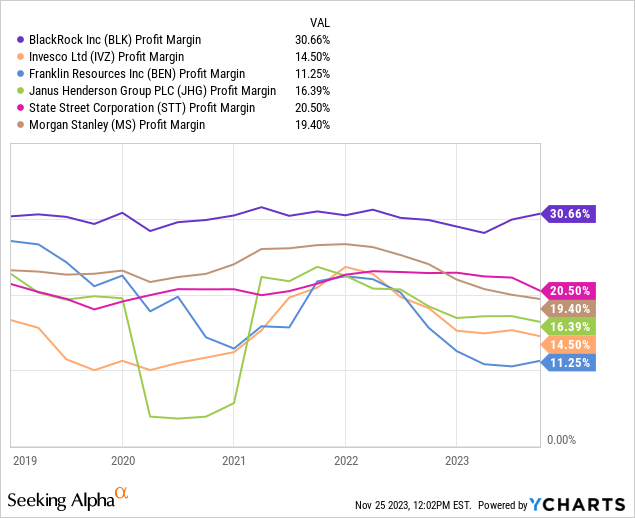

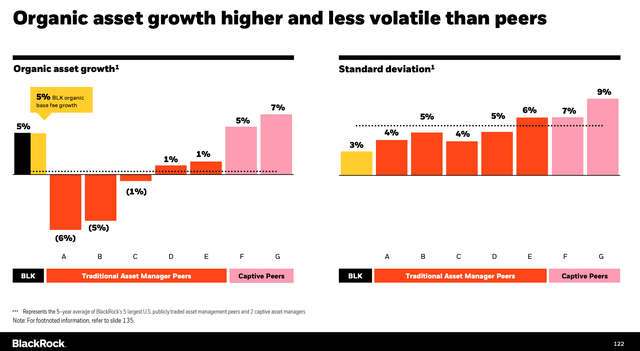

Given the relatively high level of competition in the asset management business, BLK stands out with above industry profit margins and growth.

The company has been able to achieve above industry growth and profit margins due to advantages related to scale. The primary cost in the asset management business is employee compensation and benefits which accounts for ~50% of total expenses. Other costs include direct fund expenses and SG&A.

Asset management firms tend to charge fees based on a % of assets. The result of this is a fund with $10 billion in assets will bring in 10x the revenue of a fund with $1 billion in assets. However, the cost to operate a $10 billion fund is not much higher than the cost to operate a $1 billion fund. The primary reason for this is that an asset manager does not need 10x the number of portfolio managers, traders, and support staff to manage a $10 billion fund vs a $1 billion fund.

BLK also benefits from its scale due to the vast network it has with clients. BLK is able to offer clients a full suite of investment products ranging from actively managed public equity and fixed income funds to passive index products to private investments funds.

While competitors are strong in different segments of the asset management business (e.g. PIMCO in fixed income, Fidelity in active equities, and Vanguard in ETFs) there is no other firm that has anywhere near the level of strength that BLK has across all asset classes and investment vehicles.

Another way BLK benefits due to scale is the fact that the company is the top customer for many sell side trading desks. This allows BLK to drive the hard bargains with dealers to achieve lower transaction costs relative to smaller firms. Additionally, BLK is able to get better access to highly competitive opportunities such as hot IPOs or private market deals. These advantages have helped contribute to performance which has resulted in ~81% of active AUM currently above the peer median or benchmark over the past five year period.

Advantages to scale continue to accrue to top players. The total AUM share of the top 5 asset management firms has increased from ~13% in 2016 to ~16% in 2022.

BLK Investor Presentation BLK Investor Presentation BLK Investor Presentation

Growth Potential

Consensus estimates currently call for BLK to grow earnings by 1.4% in FY 2024 and 13.1% in FY 2025. One attractive feature of the asset management business is that asset management firms tend to benefit from rising asset prices over time. Asset prices rise and fall but over the long-term asset prices tend to raise as levels above inflation. BLK can experience significant earnings volatility from year to year based on asset price movements. However, it should be noted that public equities have returned ~10% each year on average while bonds have returned closer to ~5%. Over the long-run, rising asset prices will serve as a key tailwind for BLK in terms of AUM growth.

In addition to benefiting from rising asset prices and new investment flows, BLK also is poised to benefit from further market share gains as the company is well positioned to gain share from smaller firms due to scale.

Finally, Aladdin represents an additional key growth driver as the product has captured just 11% of its total addressable market.

Shareholder Friendly Capital Allocation Policies

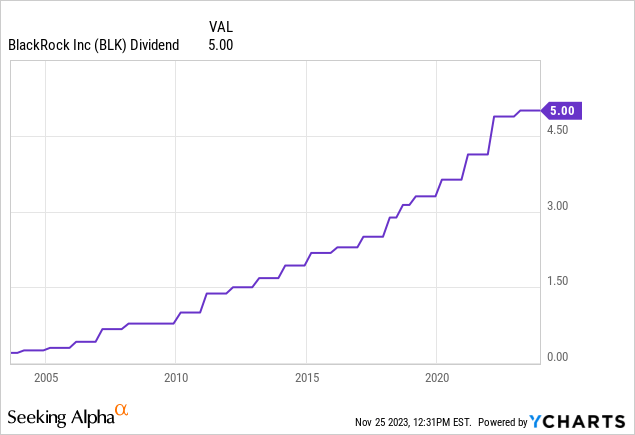

BLK has a strong history of increasing its dividend over time. Currently, BLK pays a quarterly dividend of $5 per share and the stock has a dividend yield of ~2.7%.

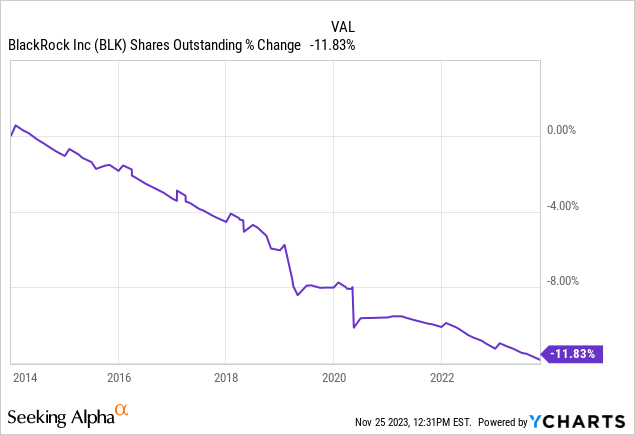

BLK also has a strong history of returning capital to shareholders via share buybacks. Over the past 10 years, BLK has used share repurchases to decrease its share count by ~11.8%. The company currently has ~6.3 million shares authorized to be bought back under its existing share buyback program.

Valuation

BLK trades at 19.5x consensus FY 2024 earnings estimates and 17.2x consensus FY 2025 earnings estimates. Comparably, the S&P 500 is trading at ~18.8x consensus FY 2024 earnings. BLK is essentially trading inline with the S&P 500.

On a relative basis, I believe BLK is highly attractive as the firm has above market growth potential. BLK has multiple growth drivers including rising asset prices, addition investing inflows, and market share gains from smaller players. Thus, I believe BLK will be able to grow earnings at an above market rate for a long-period of time (though growth will be uneven due to asset price moves). Over the past 10 years, BLK has experienced an EPS CAGR of ~8.4%. I expect this to continue for many years into the future.

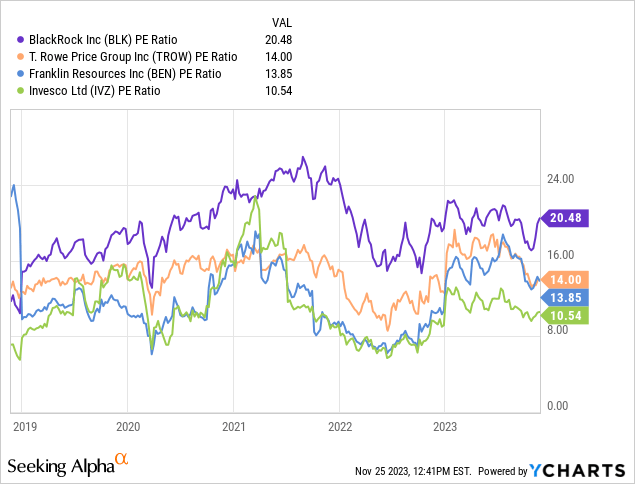

BLK trades at a premium valuation relative to peers such as Franklin Resources, T Rowe Price, or Invesco. This has been the case historically and I believe BLK’s premium is well deserved due to the company’s strong competitive advantages due to scale. Additionally, BLK is best positioned among peers in the ETF and passive space. Thus, BLK’s peers have more to lose from the ongoing shift from active to passive products.

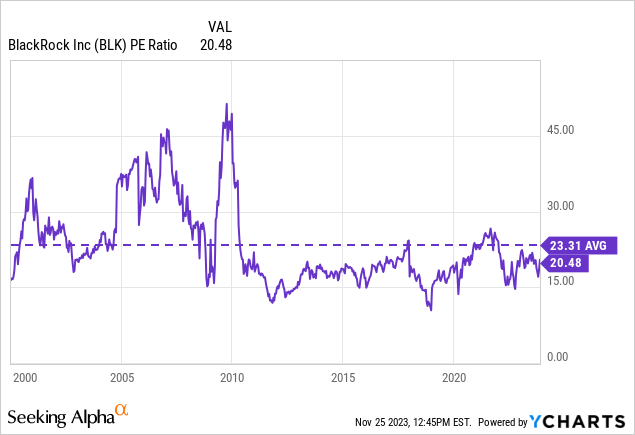

BLK is also trading at an attractive valuation relative to its own historical norm.

Risks To Consider

One potential risk to BLK comes from potential regulatory changes. The company has come under increasing scrutiny over the past decades due to its size. Regulators may determine that BLK’s size has become a threat to financial market stability and thus limit the firm’s ability to grow going forward. This seems unlikely given the fact that BLK controls just 3% of total asset management industry revenue.

Another potential risk to consider is that BLK may face revenue and margin challenges as investors shift from active to passive products. While BLK has a large ETF franchise which is poised to grow due to this change, fees tend to be lower on passive funds compared to active funds. While the shift to passive will continue to occur, investment dollars tend to be sticky and thus I believe this shift will be a slow process over many years.

Conclusion

BLK has built an excellent business with strong competitive advantages due to scale. The company has a strong long-term performance record of creating value for investors.

BLK is poised to continue benefiting from advantages related to its scale and has a number of key growth drivers.

Despite having a strong competitive advantages and a strong history of generating above market returns, BLK trades at a valuation which is inline with the S&P 500.

For these reasons, I believe BLK represents an excellent investment opportunity and I am initiating coverage with a strong buy rating.

Read the full article here