Investment thesis

Our current investment thesis is:

- Polestar has a great market offering, underpinned by its high-quality design philosophy, battery technology, and its relationship with Volvo Cars/Geely.

- This has allowed the company to grow well, although this has slowed in recent quarters. We are concerned that the coming months will be more of the same, slowing the company’s progression.

- We do broadly expect revenue growth to be strong in the coming 5 years, with new vehicle launches, an increase in production, and tailwinds from the EV transition. We believe this will contribute to share price appreciation, although given economic conditions, now is not an appropriate time.

Company description

Polestar (NASDAQ:PSNY) is a Swedish automotive company, founded in 1996 as a subsidiary of Volvo Cars and Geely Holding. It specializes in the design, development, and production of electric performance cars. Polestar operates independently while benefiting from the technical and financial support of its parent companies. With its headquarters in Gothenburg, Sweden, Polestar has a global presence, including operations in Europe, North America, and Asia.

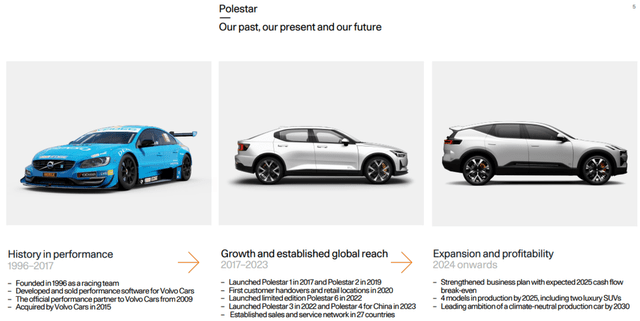

Evolution (Polestar)

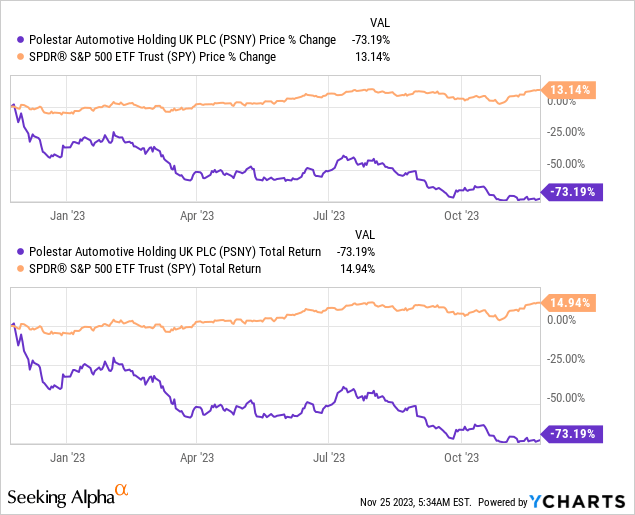

Share price

Polestar’s share price performance has been disastrous, losing over 70% of its value in a short space of time. This is a reflection of changing investor sentiment around the business, and a broader view of the EV transition as a whole, as investors seek to identify what the value proposition is (and who will “win”).

Financial analysis

Polestar financials (Capital IQ)

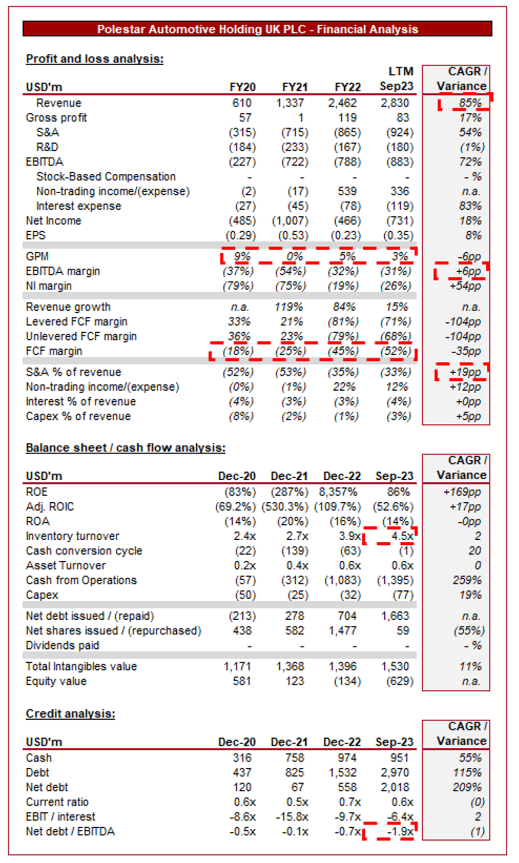

Presented above are Polestar’s financial results.

Revenue & Commercial Factors

Polestar’s revenue has grown incredibly well in the last 4 years, with a CAGR of 85% into LTM Jun23. This said, much of this growth occurred in FY21, with a material slowdown in the last 3 quarters (+20.7%, +16.3%, and +40.8%).

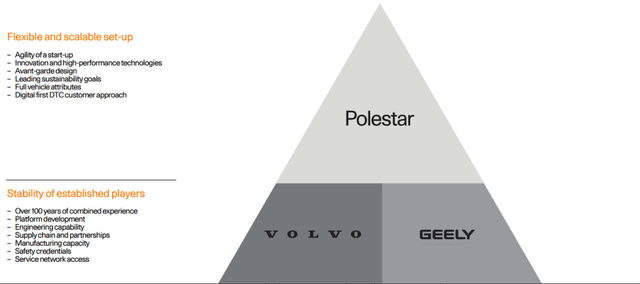

Business Model

Polestar is an automotive company that specializes in designing, manufacturing, and marketing electric vehicles. It focuses on producing premium electric cars, primarily competing in the luxury EV segment. Polestar is a spin-off from Volvo Cars (Owned by Geely), operating as a separate brand but maintaining a strong connection to Volvo and Geely, sharing technology, resources, and design elements.

Most countries have EV commitments in place, with this transition looking unstoppable at this point. As a standalone EV business, the company will inevitably face a difficult period to achieve scale, lacking the traditional expertise and customer base. This is why its relationship with Geely/Volvo is so important.

Business model (Polestar)

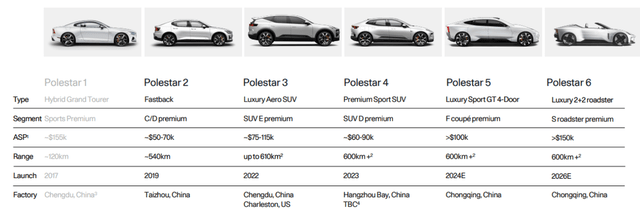

Polestar 2, the “electric performance fastback”, launched in 2019. Following this, Polestar 3, the company’s foray into SUVs, launched in late 2022. We have been hands-on with these cars and can attest to the luxury. The drive is great, the batteries offer a good range (ranked 6th in 2023), and (although subjective) the design language is incredibly relevant and tasteful.

Polestar intends to have a line-up of 5 high-end EVs by 2026. Polestar 4, the SUV coupé, is launching in phases through 2023 and into 2024. Polestar 5, an electric four-door GT, and Polestar 6, an electric roadster, are coming soon (forecast for 24 and 26, respectively).

Innovation and product design have been a strong suit for the company, developing a keen following. This is underpinned by Volvo and Geely but credit must be given to Management. This is a one-in-a-lifetime transition impacting this industry, and from a design perspective, we believe Polestar has nailed it.

Cars (Polestar)

Polestar employs a direct-to-consumer sales model, where customers can configure and order their vehicles online. This approach reduces the need for traditional dealerships and allows for a more personalized buying experience. The rise of e-commerce allows this to be a viable strategy in our view, allowing Polestar to operate an asset-light business model and cut out middlemen.

As the following illustrates, the company is expanding overseas rapidly, with its lack of dealerships not materially restricting its trajectory.

Expansion (Polestar)

Polestar provides financing to consumers, ensuring it is positioned to capture all potential customers. Additionally, the company offers a packaged subscription service that covers services like insurance, maintenance, and even home charging solutions.

Sustainability is a core aspect of Polestar’s business model. It aims to produce climate-neutral cars by 2030, using recycled materials, reducing emissions, and offsetting carbon wherever possible.

Profitability transition

Polestar is currently in its expansion phase but is barely making money on each vehicle it sells (GPM of 3%, with little improvement since FY20). For this reason, it is important to explore how profitability will be achieved.

- Scale and Production Innovation – To transition to profitability, Polestar will need to scale up production significantly, although this will be offset somewhat as expertise develops and technological development drives production innovation. Polestar continues to maintain its strong double-digit deliveries, suggesting this is currently being delivered.

- Increased Market Share – As the EV market continues to grow, Polestar must capture a larger market share. This is the biggest challenge the company faces. Sales are not infinite and although deliveries can grow, the business will hit a wall unless it can do so by taking market share. The expansion of its fleet and access to new regions is an important way to achieve this.

- Research and Development – Investing in R&D will be critical to Polestar justifying its premium pricing and ability to gain market share, with both battery technology and design critical.

- Higher Subscription Adoption and Other Product/Services – Encouraging more customers to adopt its financing / additional services can provide a steady stream of recurring revenue, which is less susceptible to market fluctuations and provides attractive margins.

The following factors are broadly achievable in our view, although our biggest reservation is the extent to which production can increase in the medium term. The business is already benefiting from Geely’s Chinese production facilities and so is already ahead relative to many.

We also consider the following factors as impediments to achieving margin improvement:

- Price War – The EV industry is currently experiencing a price war, as leading brands such as Tesla (TSLA) cut prices aggressively. Polestar is not positioned to do this and so is essentially “blown in the direction the wind takes it”. In the near term, this could be damaging to growth.

- Entry of Chinese Producers – The Chinese EV producers are making waves, with substantial production and aggressive pricing. The fear for many of the Western producers is that if they turn an eye to home markets, they could gain market share rapidly through pricing.

- Loss of Grants – Governments may begin removing grants associated with the purchase of EVs, following on from China, which did so in Q1’23. This will discourage purchasing and make its EVs inherently more expensive.

- Marketing Efforts – Although we believe Polestar’s marketing has been good (being a European resident), the company has a long way to go before we would describe it as “well known”. Even in Europe, its image beyond those who actively know about Cars is low. Given its premium pricing and the fact that 50% of its current fleet is SUVs (traditionally a family vehicle), the company needs to do more.

- Economic Conditions – Current economic conditions are near-term headwinds for the company, with high inflation and elevated rates deterring substantial purchases. This is compounded by its core European market being particularly hit. We consider this the primary reason for the company’s slowdown, although the least important over the coming 5 years.

Competitive Positioning

We believe the following are key value drivers for Polestar, as the industry continues to transition toward EVs:

- Rising Demand for Electric Vehicles – We believe the EV transition will continue to encourage consumers to purchase EVs in the coming years, underpinned by a genuine societal shift toward creating a more sustainable lifestyle.

- Strong Brand Identity – Polestar has cultivated a strong brand identity associated with innovation, sustainability, and luxury. Interest in the brand is at an all-time high and continues to trend upward. With a distinct and modern style, we expect this to continue.

Brand (Google)

- Innovation in Manufacturing and relationships- The company’s approach to manufacturing, which includes a strong focus on sustainable materials and production processes, gives the business a unique production characteristic. Further, its expertise is underpinned by Volvo and Geely’s innovation. Finally, Polestar has developed strong relationships to promote its brand, including partnering with Google (GOOG) and Balenciaga.

- Direct Sales Model – By bypassing traditional dealership networks, Polestar reduces costs and can offer competitive pricing.

9M’23 results

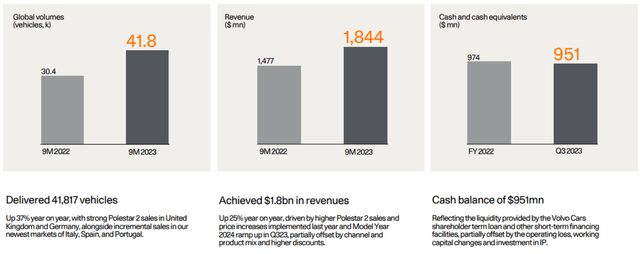

9M’23 (Polestar)

Presented above is Polestar’s most recent quarterly results.

The company continues to progress well, with +37% delivery growth and +25% revenue growth. This is a clear slowdown from its historical levels but given the current conditions, we consider this positive.

Balance sheet & Cash Flows

Polestar is currently burning cash at a substantial rate, with an FCF margin of (52)%. This has only worsened in recent years, with an eye-watering CFO of $(1.4)m. Based on this current trajectory, the company will be raising debt / equity in the near future. Geely and Volvo are committed to bankrolling the company and so we are not overly concerned about solvency.

Outlook

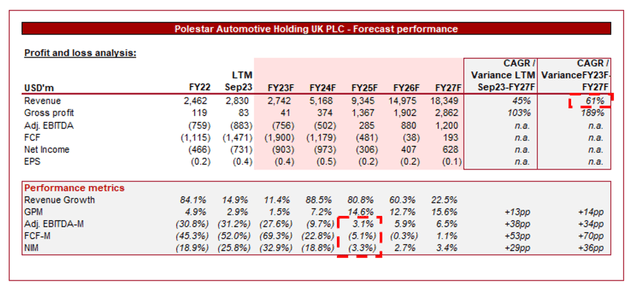

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 5 years.

Analysts are forecasting a continuation of its strong growth trajectory, improving following FY23F, with a CAGR of 45% into FY27F. In conjunction with this, margin improvement is expected to be gradual, although the company is not forecast to reach FCF positivity.

Given the high-growth nature of the company, it is difficult to pinpoint an average rate. This said, mid-double-digits should be a key target, and we consider this achievable. The gradual margin improvement appears reasonable given the level of competition in the market.

Valuation

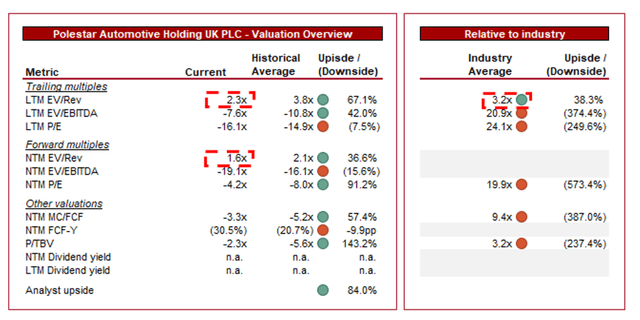

Valuation (Capital IQ)

Polestar is currently trading at 2x LTM revenue and 2x NTM revenue. This is a discount to its historical average and parity with its peer group (as defined by Seeking Alpha).

The discount to its historical average is undoubtedly warranted, as the company’s growth trajectory has already slowed (even if we think this is macro-related), creating execution risk associated with reinvigorating this subsequently.

Polestar’s valuation relative to its peers is difficult to assess, as its revenue multiple will inevitably contract faster due to growth. The key is how profitability develops, which as our analysis suggests, will occur but slowly. For this reason, we believe the attractiveness of Polestar will be at a time when momentum is positive (both the share price and financial performance), which is not the case currently

Final thoughts

Polestar sells a fantastic product and has done well to develop thus far, although much of this credit is due to its owners. We believe the company will broadly execute its strategy, which means strong growth and margin improvement, although we are not convinced this will be sufficient. Further time will be needed to assess if Polestar has the staying power to be successful long term.

With strong growth will likely come share price development so there is value here it timed correctly. However, we do not consider now the current timing due to economic conditions and the current price war weighing heavily on Polestar’s growth.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here