Investment Thesis

Company Overview

Advanced Semiconductor Material Lithography (ASML Holdings N.V.) (NASDAQ:ASML), founded in 1984 with headquarters in Veldoven, Netherlands, is a Dutch corporation specializing in developing and manufacturing photolithography machines that are used in producing computer chips. The company has one reportable segment in lithography solutions.

Strength & Weakness/Risks

Born out of the early technological developments from the US labs such as AT&T Lab, ASML started the commercialization of lithography machine production and soon expanded into a multinational business involving different partners of suppliers and manufacturers around the globe as part of its production and supply chain. Outside of the Netherlands, its major locations have five in the US, three in China, and three in Taiwan, which highlights the strategic importance of these three countries. It has one location each in Germany, Japan, and South Korea.

ASML: Worldwide Locations (www.asml.com)

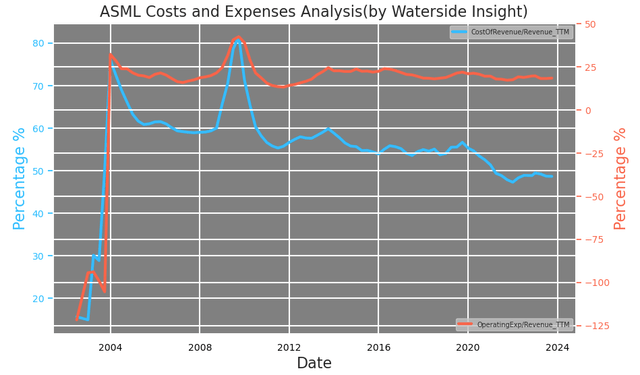

ASML considers itself a holistic lithography solution provider in ways that the development, production, marketing, sales, upgrading, and servicing of lithography, metrology, and inspection systems are all being monitored and consolidated as a whole to deliver results and performance. This makes sense as the precision-driven demand of its end products and systems requires all units to work closely together. Obviously, ASML’s prowess came from its ability to research and innovate, but in order to manage its systems and products, technical understanding comes first and foremost. This is demonstrated no less than seeing where its cost went – it recorded over 75% of its operating expenses as R&D expenses. So it is safe to say almost the entire company is viewed as a research department. The advantage of this approach with continuous product optimization without compartmentalizing among the units yields beneficial results even during the most challenging time in recent global supply chain challenges. Not only it has maintained a stable operating expenses ratio to revenue during the challenging times, but it has also reduced the cost-of-revenue ratio from 55% to about 45% since 2020, which has been a declining long-term trend for the past twenty years.

ASML: Costs and Expenses Analysis (Calculated and Charted by Waterside Insight with data from company)

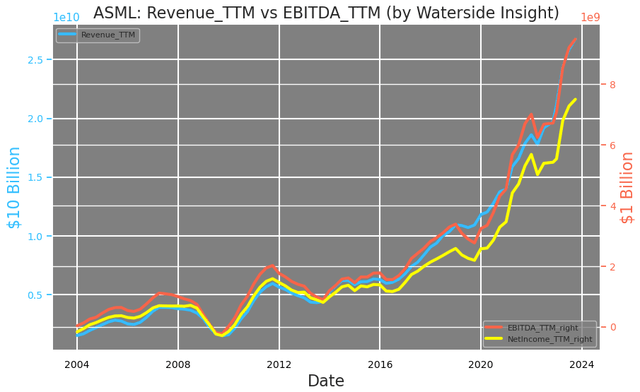

Most of ASML’s early innovation came from a few key areas: optical sensors, scanner dynamics and control, immersion technology, and system architecture. All of them are devoted to optimizing the Rayley Criterion, the resolution equation that determines how small the features on a chip can be printed. The company’s immersion lithography scanner solidified its technology leadership since the 90s, and continued making more innovations ensures its product is keeping up with Moore’s Law. In doing so, its revenue has been doubling almost every five years along with its net income and EBITDA.

ASML: Revenue vs EBITDA (Calculated and Charted by Waterside Insight with data from company)

In the past ten years, ASML has moved to acquire other companies that can complement its core metrology and electron optics design capacity, such as HMI and Mapper. As the company’s system becomes increasingly more complex with massive engineering challenges, its latest attention also involved innovating in material science such as wafer table coating and corrosion solutions, and algorithmic optimization to enhance alignment and overlay metrology. Its computational lithography products offer another layer of accuracy for clients’ production. This path of innovation combining the in-house core innovation with complementary acquisitions is a proven strategy throughout its history. Even though it has about $5 billion cash-at-hand, one of the highest, its current ratio is only about 1.5x, one of the lowest it has had. On the debt side, even though it has the highest level of total debt, its debt-to-equity and debt-to-EBITDA ratios are both relatively low.

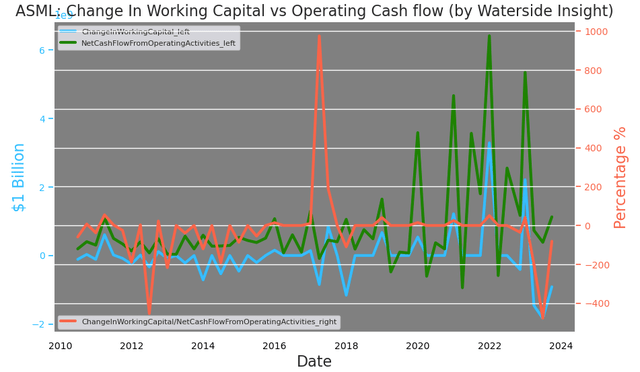

ASML’s change of working capital has had the largest decline into negative since the ’08. although it is within the context of its cash flow coming down from an all-time high. Most of the valuable targets also have gotten quite expensive due to the recent AI-driven boom. With the management’s usual prudent style, we are inclined to think it will not make a large acquisition. The pace of innovation will mostly rely on its in-house core research in the near term. According to Moore’s Law, 2024 should see 2.5 nm chips in application. The company’s answer for the next-gen product is the High_NA EUV(extreme ultraviolet lithography) platform, which increases the aperture in the Raylay Criterion from 0.33NA to 0.55 High-NA. According to ASML, this design will have a 70% higher resolution capability than its current EUV platform starting at 3nm Logic nodes and followed by Memory nodes. It is expected to utilize this new platform to make delivery by 2025. Behind such an effort is its R&D expenses increased by 100% since 2020, from about half a billion dollars a year to now $1 billion a year. Such a break-neck speed is hard to repeat without eroding its margin should its revenue growth be stagnant.

ASML: Change In Working Capital (Calculated and Charted by Waterside Insight with data from company)

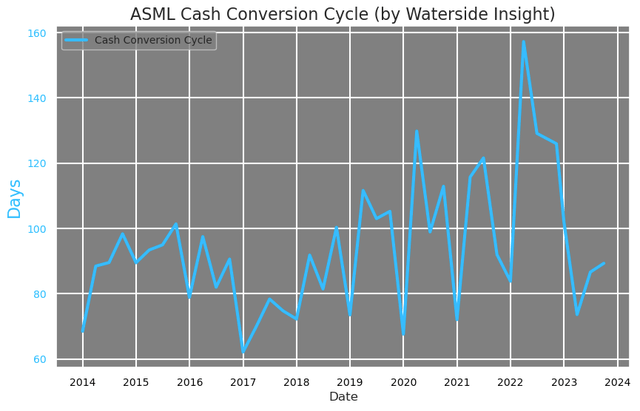

The company’s cash conversion cycle is currently at the average of the past ten years. But it has become more volatile in recent years. The yearly seasonality has become more pronounced and the longest days of could almost be double the shortest. This is another perspective of why the management will have the need to keep more cash at the end of the period.

ASML: Cash Conversion Cycle (Calculated and Charted by Waterside Insight with data from company)

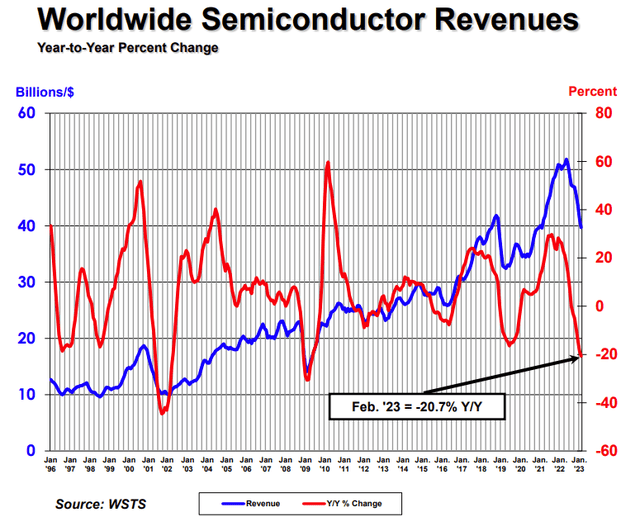

The biggest risks to ASML’s continuous success come from the industry cycle, partners, and customer dependency, with geopolitical risks underlying each one of them. The volatile cash conversion cycle at the company coincides with the current semiconductor product cycle of near-term weakness and long-term bullish trends. We expect such a volatile cash conversion cycle will continue for the next 12 months for ASML.

Worldwide Semiconductor Revenues (World Semiconductor Trade Statistics)

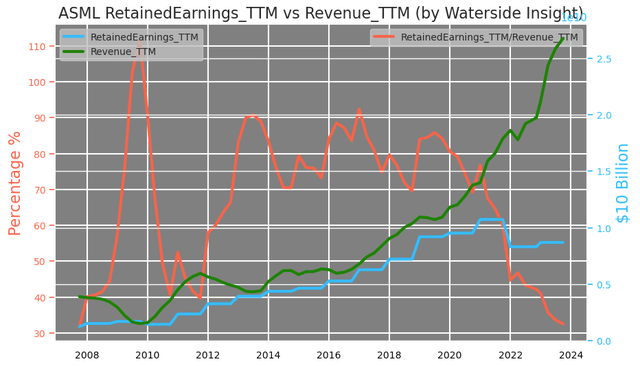

Also, the company’s retained earnings as a percentage of revenue have declined to the lowest on a TTM basis. This weak ratio came when its revenue was at an all-time high while its retained earnings have been stagnant since late 2021. The average ratio for the company is about 70% before 2020. On one hand, it shows the potential the company can improve and on the other hand, it could stay at this level for a while should its topline continue to face a weaker macro environment and industrial trends.

ASML: Retained Earnings (Calculated and Charted by Waterside Insight with data from company)

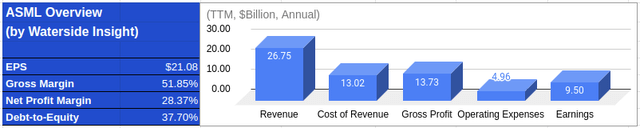

Financial Overview & Valuation

ASML: Financial Overview (Calculated and Charted by Waterside Insight with data from company)

Due to the political and geographical risks, the near-term picture of ASML’s growth is expected to be weak. The AI-driven demand is a long-term growth trend but a large portion of the visibility has already been priced in. We think the current price is in the upper range of ASML’s fair valuation. It is not only expensive for the company to maintain its dominance, but it is also expensive for investors to buy into its shares right now.

Conclusion

ASML holds the strings of every important corner of the semiconductor industry, with a massive global network in both supply and demand sides. Its leading position and dominance are maintained with laser-focused innovation. But to maintain this position, the company has to either ramp up its in-house research or make acquisitions by paying premium prices. Confronted with a weak industrial cycle and macro environment underpinned by geopolitical risks, it has near-term growth pressure. With most of the long-term potentials priced in, its stock is a hold for now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here