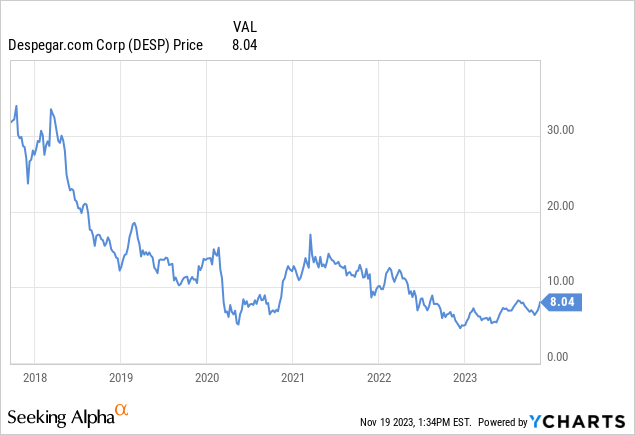

Despegar.com (NYSE:DESP) is one of those companies that went public at a lofty valuation, and has since experienced a massive reduction in its share price. Its IPO price was $26, and it finished the day at $32, showing an impressive 24% gain on its first day. At that price, it was valued at around $2 billion. Part of the excitement was the result of Despegar being a leading online travel agency in the Latin American market, and experiencing very strong growth at the time. Despite being an Argentinian company, its main markets are Brazil and Mexico.

We thought that the price decline could mean shares potentially being now attractively valued, but as we started to investigate in more detail, we reached the opposite conclusion. Despite the shares losing about three-quarters of their value, we still believe it is probably better to avoid them.

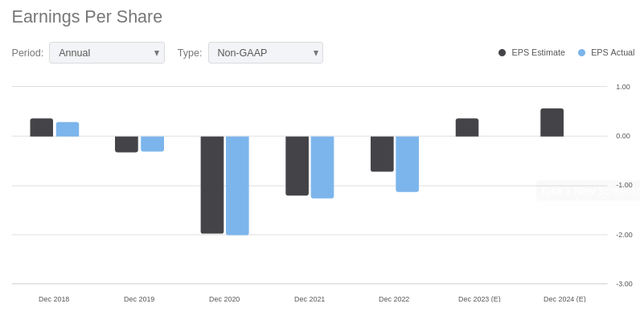

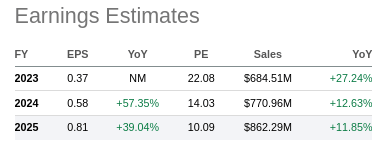

It seems many people are bullish on the shares given the low valuation, positive revenue growth, and that the company appears to be approaching sustainable profitability. Analysts are forecasting significant earnings growth, but it is important to note those estimates are non-GAAP. More importantly, we believe the Despegar brand is severely tarnished by relatively poor customer experience. Critically, it is becoming quite clear that companies like Airbnb (ABNB) and Booking (BKNG) are increasingly targeting this market, with a tailored marketing strategy, and quickly taking customers away from Despegar. Booking mentioned in an earnings call that they are expanding their offerings beyond accommodations, focusing on flights and aiming to provide a seamless booking and travel experience. This includes making their flight offering available in over 50 countries. For its part, Airbnb has acknowledged the importance of the Brazilian and Mexican markets, with the company’s revenues in Latin America growing faster than the company’s overall growth, according to an interview of one of Airbnb’s cofounders late last year. In fact, CEO and Airbnb cofounder Brian Chesky explicitly said in the Q3 2023 earnings call that “Latin America is a completely new market for us, emerging”. He later added, “we are investing in underpenetrated international markets and we’re seeing great results.”

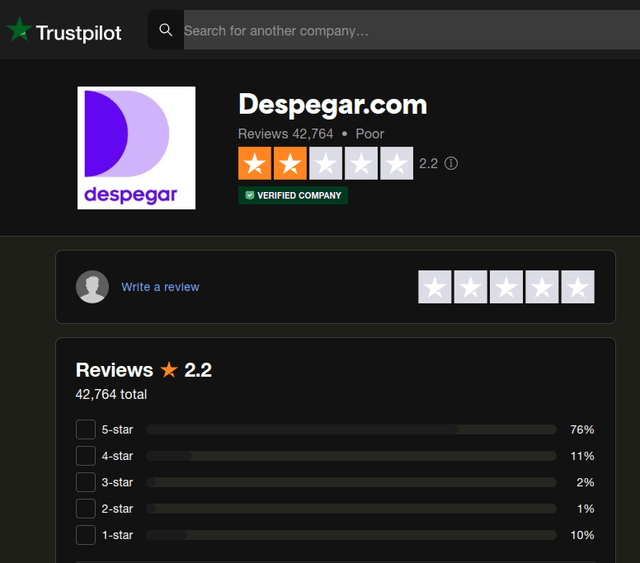

Customer Reviews

One of the main reasons we are so pessimistic about Despegar.com is that we’ve seen that companies that treat their customers poorly eventually pay the price. Looking at their Trustpilot reviews, it is clear a lot of people are unhappy with their experience. It is not only on Trustpilot that we see people complain about the company and its services, the same can be seen on Tripadvisor (TRIP) and local review sites like this one. Some of these complaints are very old, but some of the ones in Trustpilot and on their own app are relatively recent. In any case, the conclusion from the research we did is that the company has lost a lot of goodwill with customers, and that means it will probably be a lot easier for competitors to convince them to give them a try.

Trustpilot.com

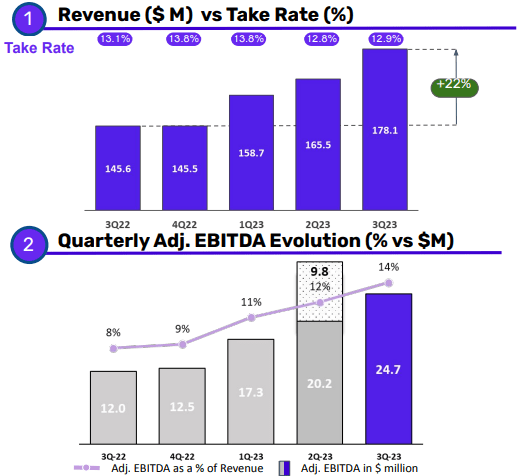

Q3 Results

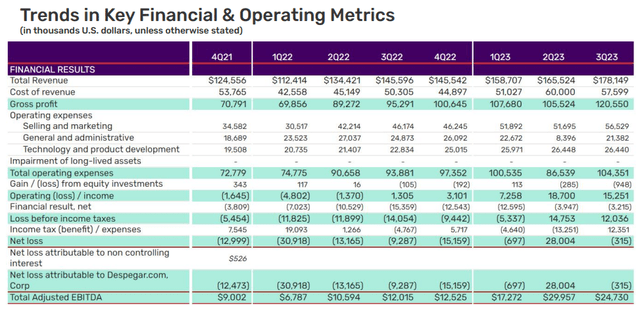

The company presented Q3 2023 results highlighting strong revenue growth of 22% year over year, and increased cash position of $256 million, and acceleration in app usage. They reported $24.7 million in adjusted EBITDA, the highest for a third quarter since their IPO. At the same time they raised their lower end guidance for FY23, with revenue now expected in the range of $670 million to $700 million, and EBITDA in the range of $90 million to $100 million.

At first look, things do indeed look relatively optimistic, with adjusted EBITDA rapidly increasing, and revenue posting solid growth. However, as we’ll see in the next section, things don’t look as good when analyzing GAAP numbers.

Despegar Investor Presentation

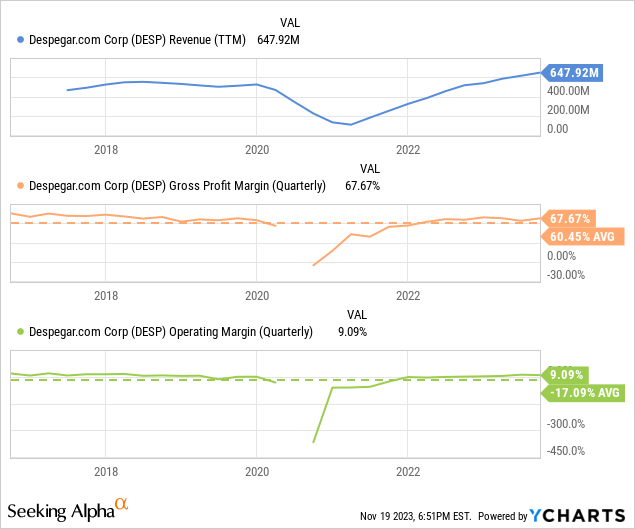

Financials

Despegar was significantly impacted by the Covid pandemic, and it is finally posting higher revenue compared to pre-pandemic years. Their gross profit margin is quite high, and their operating margin is now positive.

Despite these improvements, the company still managed to post a loss for the quarter on a GAAP basis. As can be seen, almost every quarter shown in the slide has delivered GAAP losses, with the exception of the previous quarter. Surprisingly, they even name the row “Net Loss” instead of “Net Income (Loss)” as most companies do. In any case, what we want to point out is that there is a huge difference between adjusted EBITDA and GAAP earnings. Even worse, the company currently has a negative book value. Some might argue that the negative book value is not much of an issue as long as the company remains cash flow positive. Still, we see it as a vulnerability, because it will make it much harder for the company to borrow money on good terms if it were needed, as there is no “equity cushion”, potentially forcing the company to raise capital by issuing shares.

Despegar Investor Presentation

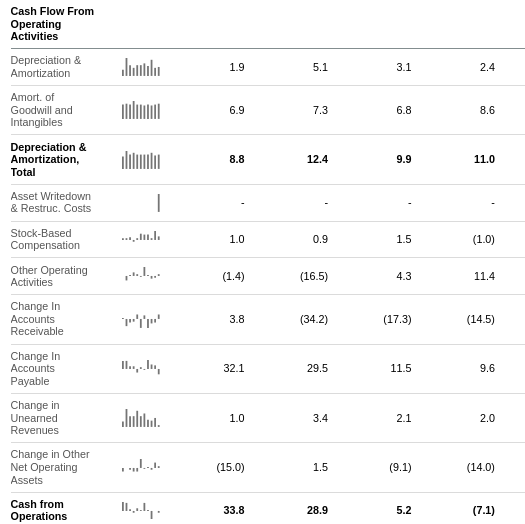

It is true that the company has reported positive operating cash flow for the last three quarters, according to the financials on SeekingAlpha. It is important to caution that a significant component of the positive operating cash flow has come from “Change in Accounts Payable”. In any case, this positive operating cash flow reduces the likelihood that the company might have to raise capital in the short to medium term.

SeekingAlpha

Strong Brand Awareness in Latin America

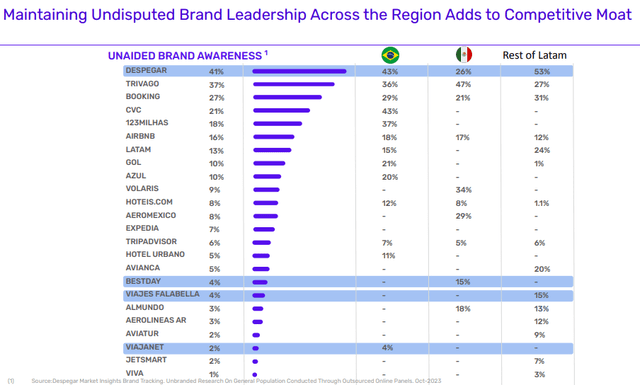

One of the biggest arguments the company uses with investors is that it has a huge brand awareness in the region that results in a competitive moat. We don’t know what methodology they used, but we are quite surprised by the results. We’ll investigate further by looking at the number of visits in the region to the website and mobile sites.

Despegar Investor Presentation

According to SimilarWeb, Aeroméxico has almost 3x the number of visits that Despegar has in Mexico. This is despite the graph above showing similar levels of brand awareness. Despegar did show a significant month over month increase in visits, after a decline the previous month.

SimilarWeb.com

Still, Despegar’s 2.3 million visits per month are lower compared to Airbnb’s local site airbnb.mx which received 6.3 million visits, and lower than Expedia’s 3.9 million visits to expedia.mx. Surprisingly, Expedia’s local site also showed a higher monthly growth rate compared to Despegar’s.

SimilarWeb.com

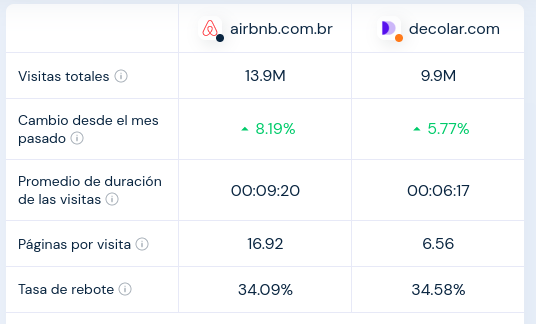

We can see something similar happening in Brazil, where the local Airbnb version already has more visits compared to Despegar’s, and had a higher month over month growth. Decolar.com is Despegar’s brand in Brazil.

SimilarWeb.com

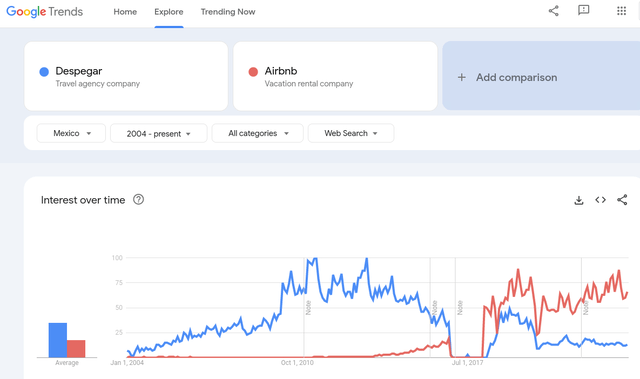

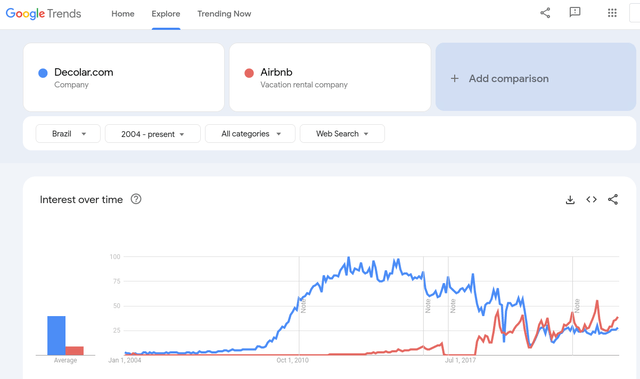

Something that we have seen many times is that brands that do well in the US also tend to perform well in Latin America, although often with a time lag. It is difficult to estimate the exact values of unaided brand awareness for each of these brands, but at least looking at Google Trends for Mexico, it appears to confirm that search interest for Airbnb has significantly overtaken that of Despegar.

Google Trends

This is impressive, especially when Airbnb’s CEO recently described Latin America as a “completely new market” for them. We can see something similar when looking at Brazil, with Airbnb now getting more searches compared to Decolar.com.

Google Trends

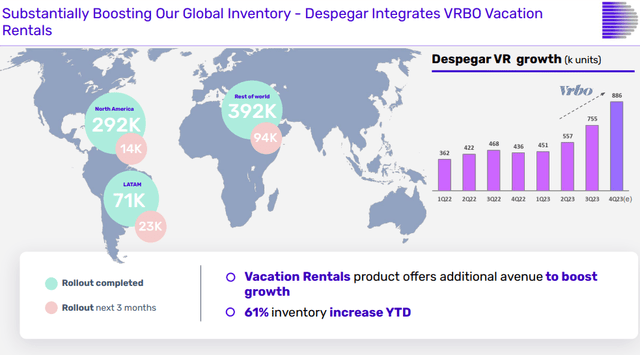

Partnerships

Despegar is attempting to fight back against the rise of Airbnb by boosting its vacation rentals inventory. In 2015 Expedia (EXPE) bought ~16% of Despegar for about $270 million, making it a strategic investor in the company. We believe this comes with benefits and disadvantages too. On the one hand it makes it easier to negotiate agreements like giving access to Despegar to vacation rental inventory from Expedia, on the other hand it will make it more difficult for someone else to try to buyout the company.

Despegar Investor Presentation

Valuation

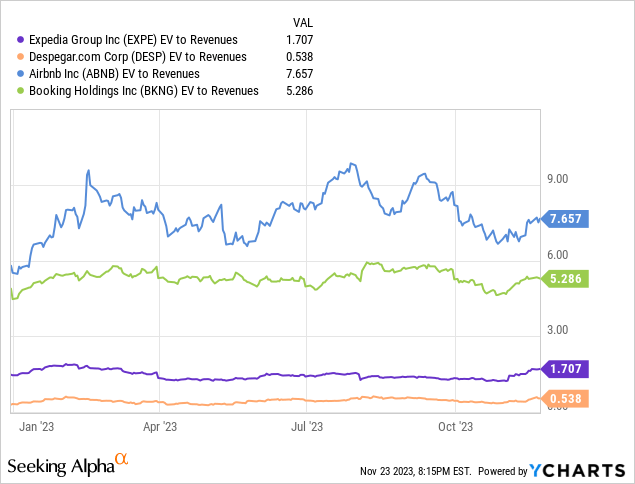

Shares definitely look cheap when looking at the EV/Revenues multiple, with Despegar trading at a fraction of some of its competitors. Still, we believe Despegar could be a value trap, as it has struggled to deliver GAAP profitability in the past and we believe competition will intensify as the global incumbents like Booking and Airbnb increase their focus in the region. We believe Despegar to be particularly vulnerable given that it appears to have many dissatisfied customers, and competition increasing in the region.

According to SeekingAlpha, the average analyst EPS estimate for FY2024 is $0.58. This would put the forward P/E ratio at ~14x.

SeekingAlpha

This price-to-earnings multiple makes the shares look cheap, but it is important to remember it is a non-GAAP estimate. Given the competitive threat that we believe Airbnb, Booking, and other international rivals represent, we prefer to avoid the shares. Perhaps the best hope for Despegar shareholders would be a take-over offer from Expedia.

SeekingAlpha

Risks

We see many risks for investors in Despegar, from the damage to the brand from negative online reviews from dissatisfied customers, to increasing competitive pressure from dominant brands like Airbnb and Booking which are now starting to pay more attention to the Latin American region. There is also risk in the balance sheet, with the company having a negative book value, and a history of significant losses.

Conclusion

It is clear that Despegar shares look cheap at first sight, and Q3 2023 results had a number of positives. Still, after looking more closely, there were several things that made us worry. This include a negative book value, a lot of negative online reviews from customers, and increased competition from the likes of Airbnb and Booking. For these reasons we are rating Despegar as a ‘Sell’, as we think the risk/reward is not great for investors, and we believe there are better alternatives in the market.

Read the full article here