Is a stock market correction coming before the Santa Claus rally at the end of the year?

It is a fascinating turn in sentiment, given that investors were convinced of the bear market’s return just a month ago. Now, investors are “making their list and checking it twice.” Given the 10% advance over the past month, it isn’t surprising, as hope rises that the Fed will return to more accommodative policies next year. Earnings remain very “nice,” and the market views the economic risks as primarily priced in.

There are indeed “naughty” economic indicators, but the market seems convinced it will all be transient. Furthermore, companies seem to be able to pass costs along to consumers, at least for now. The hopes are high that profit margins will remain strong and earnings will eventually catch up to valuations.

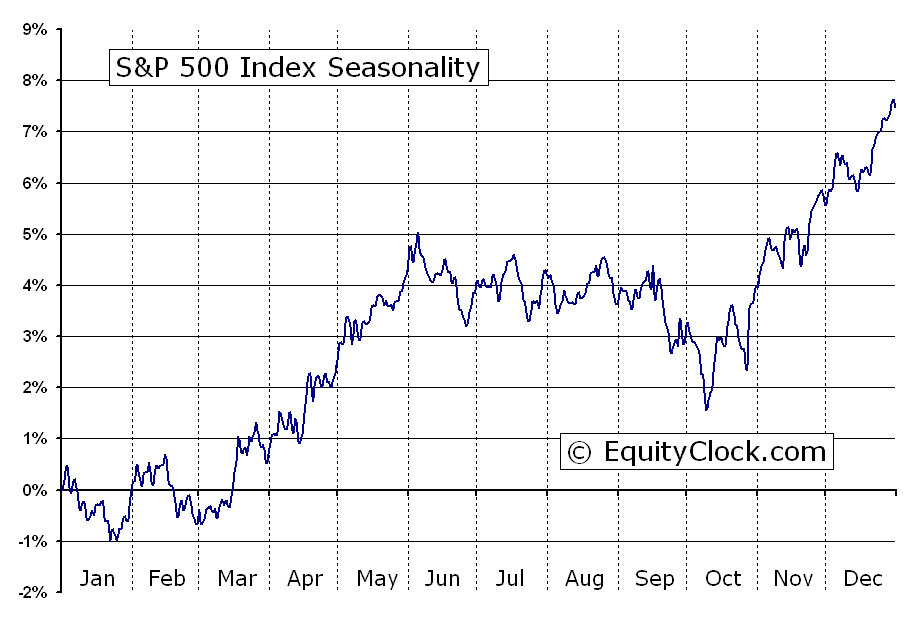

Investors’ “wish lists” are hung by the chimney with care, hopeful the “Santa Claus rally” will soon be there. While they remain “snug in their beds, the historical data dances in the heads.” The chart below from EquityClock.com shows the annual S&P 500 index “seasonality.”

There is little to worry about, and a significant stock market correction is unlikely.

However, notice that dip at the beginning of December.

Mutual Fund Distributions Come First

Before “Santa Claus” makes his anticipated visit to “Broad and Wall,” mutual funds must distribute their capital gain, dividends, and interest income for the year. These distributions start in late November, but a large number of distributions occur in the first two weeks of December. Again, notice that dip in the seasonality chart above.

Those distributions are why I get many emails from individuals every year confused by a sharp decline in their mutual funds. To wit:

“Lance, I don’t understand what happened to my fund. Yesterday, the fund was trading at $10.54 per share, and today it is at $9.78. There is no news to account for decline.“

There is nothing wrong with the mutual fund. They made their annual distribution. In this case, it was capital gains and dividend income.

When the distribution occurs, the fund price is immediately impacted. However, you will receive additional fund shares or a cash deposit in a day or so. That difference depends on how you have elected to take your distributions. Your portfolio value will decline by the distribution amount on that date. But your value will return to normal when that distribution is received and credited.

There is no need to panic.

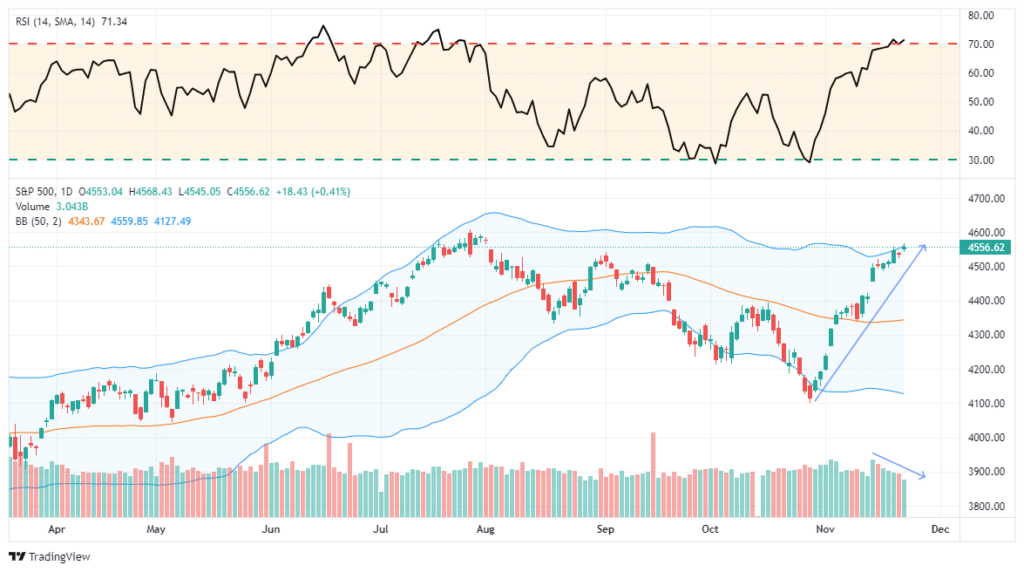

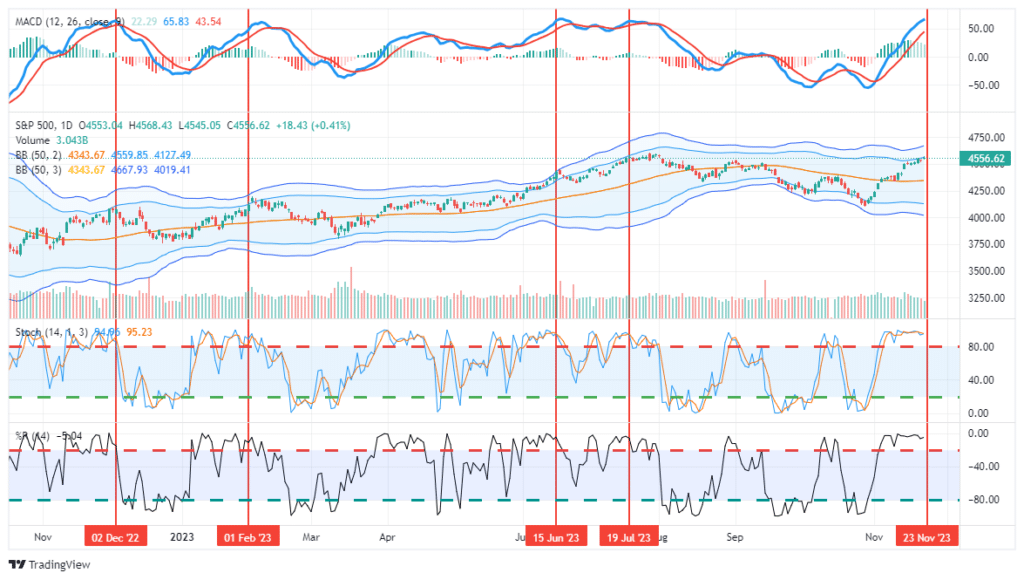

However, there is potentially a negative impact on the market as those distributions are made. Such is particularly true when volumes are light and markets are overbought. As shown, the volume has declined during the advance from the summer stock market correction. Furthermore, the market is now overbought and deviated from the 50-DMA.

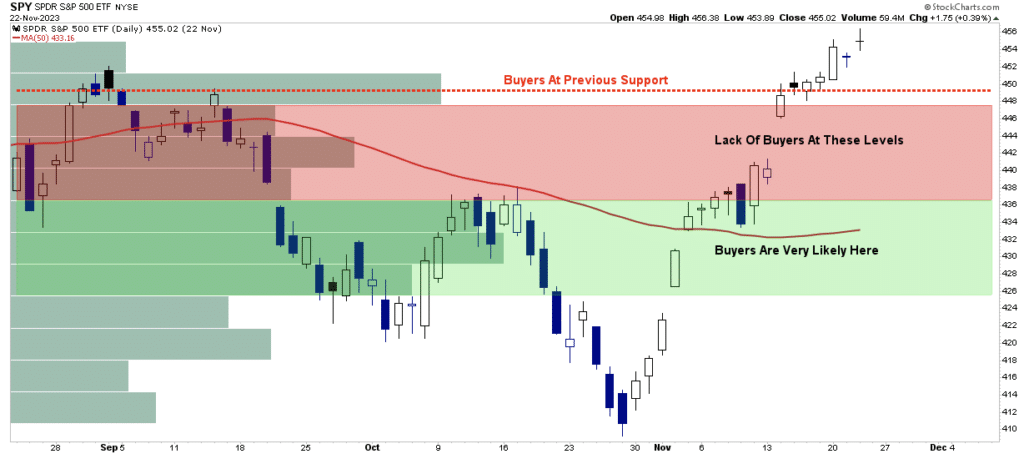

The problem is that “for every seller, there must be a buyer.” The chart below shows where volume exists at various price levels.

Buyers appear closer to the 50-DMA when mutual funds start making distributions. I am not saying the market will correct to that level. It is where the most volume occurred previously and is the most likely support area.

As the Wall Street axiom goes: “Sellers live higher. Buyers live lower.”

A Lump Of Coal

The one thing the market does well is doing precisely the opposite of what you would expect.

However, there is a strong likelihood that with the market short-term overbought, deviating from the 50-DMA, and volume declining, any additional selling pressure from mutual fund distributions could pressure prices short term. As shown, a correction generally occurs whenever most indicators are as overbought as they are currently. That does not mean the bull market is over. It only means that before the market can move higher, it needs a healthy reset to bring buyers back into the market.

Does that mean the market cannot move higher first? No. However, if you feel pressure to chase the market higher into 2024, a pullback would provide a much better opportunity to increase exposure on a risk/reward basis.

While there are no guarantees, a stock market correction in the first few weeks of December increases the odds that “Santa does visit Broad and Wall.”

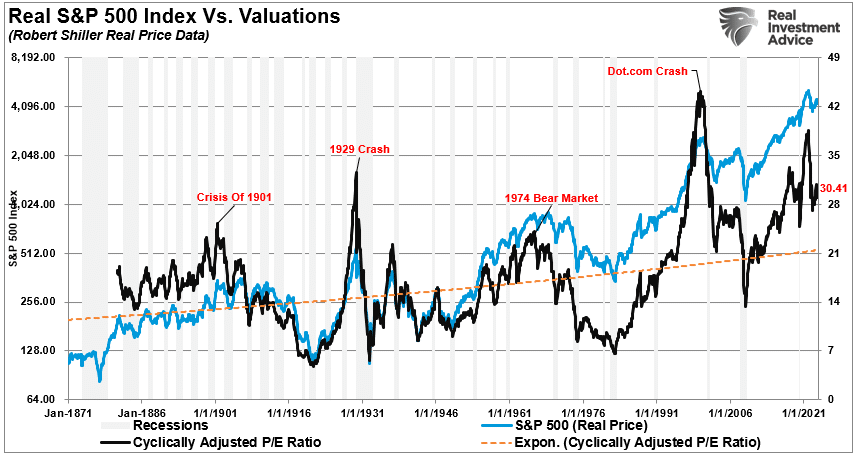

However, beyond that, in 2024, I don’t have a clue. Wall Street analysts are optimistic that the economy will avoid a recession, earnings will expand to support current valuations, and the Federal Reserve will start cutting rates. Anything is possible, but I am a bit more sanguine on outcomes when looking at the market on a longer-term basis, with economic risk to earnings.

But we will delve into that more with the turn of the calendar. That is when we will better understand what to expect as portfolio managers return from their winter slumber.

A Stocking Stuffer

Since we have our “stockings hung by the chimney with care,” we can stuff them with a few essential investment guidelines to navigate as we head into year-end.

- Investing is not a competition. There are no prizes for winning but severe penalties for losing.

- Emotions have no place in investing. You are generally better off doing the opposite of what you “feel” you should be doing.

- The only investments that you can “buy and hold” are those that provide an income stream with a return of principal function.

- Market valuations (except at extremes) are inferior market timing devices.

- Fundamentals and Economics drive long-term investment decisions – “Greed and Fear” drive short-term trading. Knowing what type of investor you are determines the basis of your strategy.

- “Market timing” is impossible – managing risk exposure is logical and possible.

- Investment is about discipline and patience. Lacking either one can be destructive to your investment goals.

- There is no value in daily media commentary – turn off the television and save yourself the mental capital.

- Investing is no different than gambling – both are “guesses” about future outcomes based on probabilities. The winner is the one who knows when to “fold” and when to go “all in.”

- No investment strategy works all the time. The trick is knowing the difference between a bad investment strategy and one temporarily out of favor.

While anxiously anticipating the arrival of the “Santa Claus Rally,” we must remember the lesson taught in 2018.

Nothing is guaranteed.

But that is why we pay attention to risk and manage our portfolios for the probabilities versus the possibilities.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here