Pure Cycle Corporation (NASDAQ:PCYO) recently delivered better-than-expected quarterly returns together with new completion of projects expected for 2024. I believe that the incoming increase in capacity may soon trigger the interest of new investors. Additionally, the company delivered impressive expectations about recurring customer growth from now to 2030. With this in mind and even considering a certain decrease in demand as well as risks from concentration in Colorado, Pure Cycle does look undervalued.

Pure Cycle Corporation

Pure Cycle Corporation is a company with diversified businesses within the provision of water distribution and aquatic waste collection services, to which is added the offer of land development projects and rental of single-family homes. The activities are concentrated mainly in the Denver Colorado region, in which the company has, in the last 30 years, accessed different rights over the distribution of water access to lands that have become the core of the business.

Regarding the land development business area, currently, the most valuable asset that the company has under its ownership is SkyRanch in the same region named above, which has the potential to operate more than 3,200 homes for commercial and commercial purposes, families as well as open spaces, parking spaces, schools, and other buildings. The home rental part is currently in a nascent stage since the company only maintains 14 properties under rent, of which it predicts a growth of more than 200% in the short term.

The operations are divided between segments, where each segment responds to the type of activity that the company carries out: water services, land development, and the rental of family homes. The first of these segments is the historical core of the company, and according to Rangeview district, by mid-2023, there were more than 1,100 families connected to the distribution network with another 800 connection points in terms of waste treatment. The company has the infrastructure required to operate within the legal frameworks regarding the collection, production, distribution, and treatment of water.

Regarding land development, activities are mainly concentrated in the Sky Ranch complex, where the company had, by August of the current year, developed more than 740 homes, among which it was left with 14 to put into operation in the most recent segment, which is the income of family housing.

The decision to diversify the company’s business into real estate came about due to the large increase in home and land values that has occurred in the Colorado region in recent years, which is accompanied by an increase in the population concentrated in this area as well as the increase in interest rates throughout the United States.

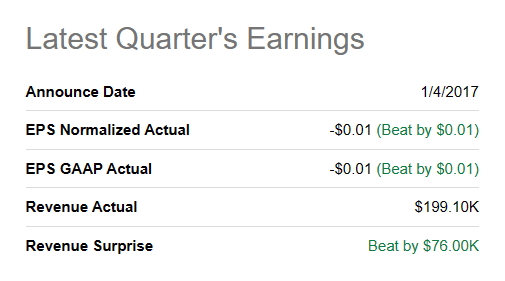

With that about the business model, it is worth having a look at the most recent quarterly results earnings. The company reported better-than-expected EPS GAAP, and revenue surprise was also a bit better than expected.

Source: SA

Balance Sheet: Little Debt, And Negative Net Debt

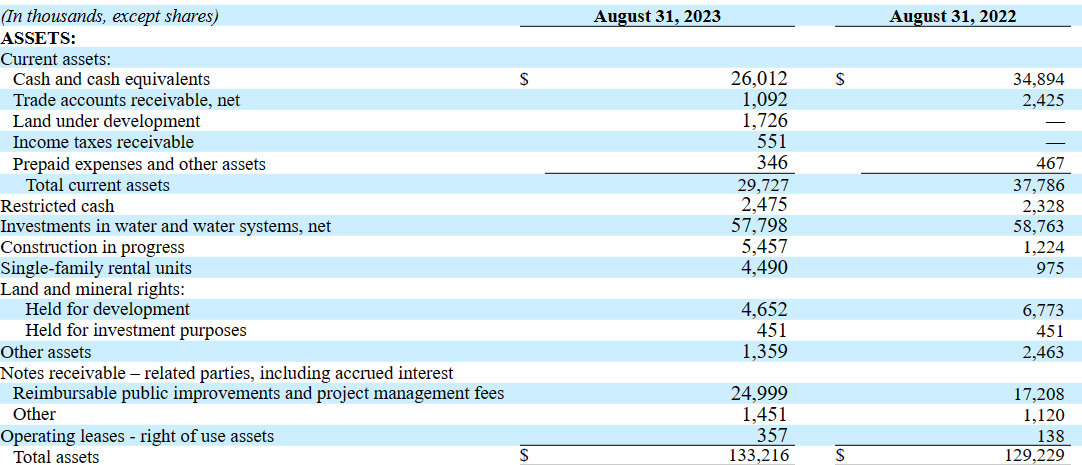

As of August 31, 2023, the company reported cash and cash equivalents worth $26 million, trade accounts receivable of $1 million, and land under development of $1 million. Total current assets stand at close to $29 million, significantly larger than the total amount of current liabilities. Given the liquidity ratio and the cash in hand, liquidity does not seem a problem here.

With restricted cash worth $2 million, investments in water and water systems over $57 million, and construction in progress close to $5 million, single-family units’ rental stands at $4 million. Finally, total assets stand at close to $133 million, and the asset/liability ratio is close to 9x, so I believe that the financial situation remains healthy.

Source: 10-k

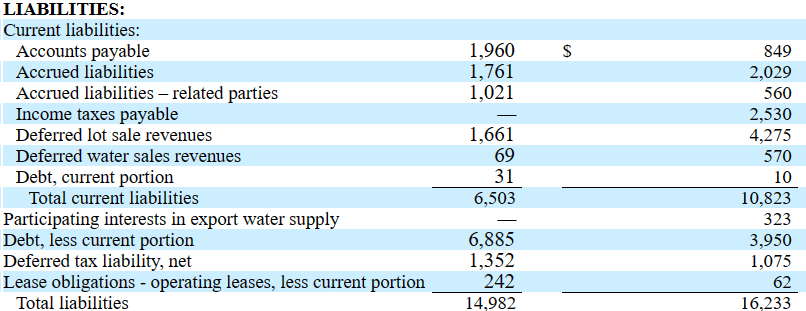

I would not really worry about the total amount of debt as net debt appears negative. Accounts payable stands at close to $1 million, with accrued liabilities of $1 million, non-current debt of $6 million, and deferred tax liability of close to $1 million. Finally, total liabilities stand at close to $14 million.

Source: 10-k

Debt Analysis, And Cost Of Capital

For the assessment of the cost of capital, I took a look at the debt agreements reported by Pure Cycle Corporation. The company signed note agreements including interest close to 4.9% and 3.75%. With these figures in mind, I think that assuming a WACC of close to 4.25% and 5.25% would make a lot of sense.

Floating per annum interest rate equal to the Western Edition of the “Wall Street Journal” Prime Rate plus 0.5% (4.25% as of August 31, 2023), which has a floor of 3.75% and a ceiling of 4.25%. In the event of default, the interest rate on the SFR Note would be increased by adding an additional 2.0%. Source: 10-k

The Lost Creek Note has a thirty-year amortization period and a fixed per annum interest rate equal to 4.90%. The Lost Creek Note is secured by the Lost Creek Water rights acquired with the note and any fees derived from the use of the Lost Creek Water rights. Source: 10-k

Demand Growth Of Rental Homes Within Colorado And New Acquisition Of Lands Could Bring FCF Growth Potential.

I believe that further efforts for the expansion of the segments related to construction and land development could bring net sales growth. In my view, the demand growth for rental homes within Colorado and the long-term contracts already signed for the development of housing and commercial establishments within the Sky Ranch complex under the company’s ownership could bring FCF growth. Additionally, acquisition opportunities for lands with potential added value in their development are a key part of fulfilling the strategy, and could also bring business growth.

Land Development And Water Assets Developments Are Expected To Be Completed From 2024, Which May Increase Capacity And FCF Growth Potential

Even taking into account that earnings were better than expected, I believe that the most interesting information reported recently was not financial figures, but information about the incoming new completed projects. From 2024, management may announce the completion of Phase 2A and information about Phase 2B of the Sky Ranch Master Planned Community. I also believe that the new wells on the Lowry Ranch in 2024 will most likely increase capacity, and may accelerate FCF growth capacity.

Our land development segment was negatively impacted by construction delays in the continued development of our Sky Ranch Master Planned Community. Phase 1 is now complete, with Phase 2A at approximately 93% complete, and Phase 2B at approximately 31% complete. We continue to work on projects to expand our water assets by completing two new wells on the Lowry Ranch that we expect to be placed in service during the second quarter of fiscal 2024. Source: 10-k

We expect to substantially complete the next 211 lots in Phase 2B in fiscal 2024 and expect to realize additional tap sales in fiscal 2024 relating to the delivery of the Phase 2B lots. Source: 10-k

Pure Cycle’s Inventory And Business Model Appear Well Positioned To Navigate The Current Market Environment

Given the current environment of growing interest rates and lower demand, Pure Cycle appears well-positioned because its inventory includes reasonable pricing. In theory, low-price assets can be sold a bit easier than those that are expensive. In the last annual report, the company made several comments about this assumption.

We believe our reasonably priced (entry level) lots and the low inventory of entry level housing in the Denver market will help Sky Ranch navigate the changing market better than other surrounding and significantly higher priced communities. Source: 10-k

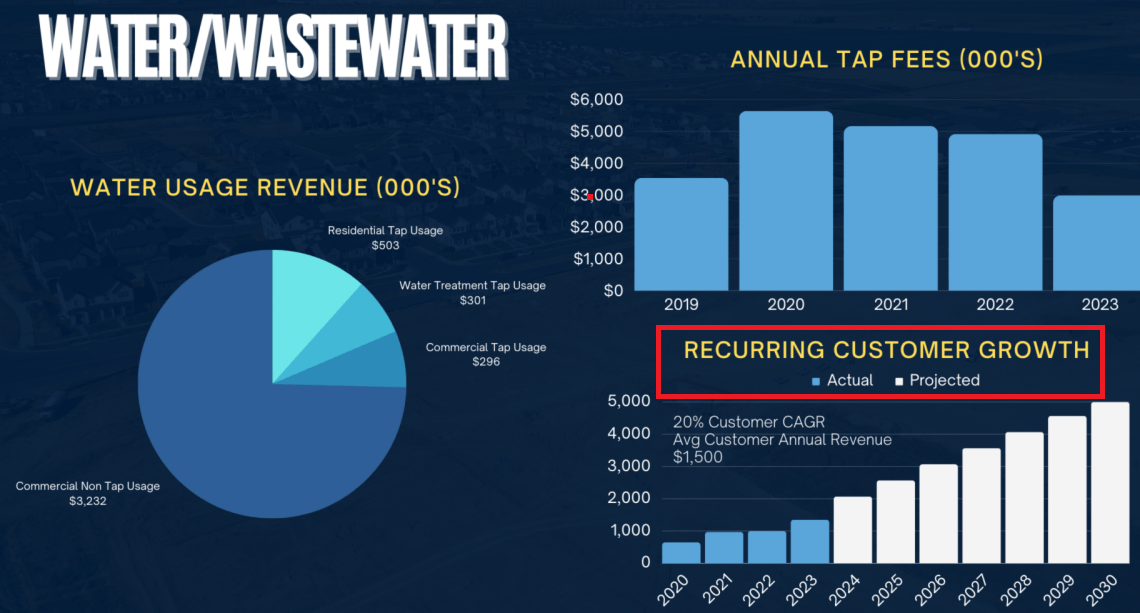

Recurring Customer Growth, Which Is Expected To Trend Higher From 2024 To 2030, Could Accelerate Demand For The Stock

Among the slides delivered in November, I believe that the expectations about future recurring customer growth could bring significant attention from investors. With more than 4k customers in 2030, in my view, Pure Cycle Corporation could bring significant net sales growth potential and FCF growth. As a result, I believe that stock demand and increased expectations could push the stock price up.

Source: Presentation To Investors

Income Expectations Based on Previous Assumptions And Previous Income Statements

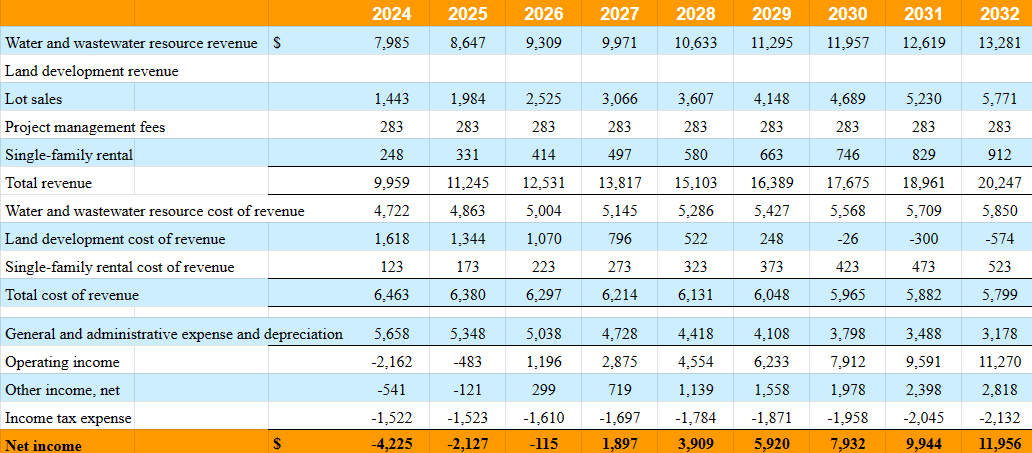

Given my previous assumptions, my income statement expectations include 2032 water and wastewater resource revenue close to $13 million, with lot sales close to $6 million and total revenue worth $20 million.

Besides, with water and wastewater resource cost of revenue of about $5 million and land development cost of revenue close to -$1 million, the total cost of revenue would be close to $5 million. I obtained a net income of close to $11 million.

Source: My Expectations

Given Previous Assumptions, My FCF Expectations And DCF Model Resulted In a Valuation That Is Higher Than The Current Fair Price.

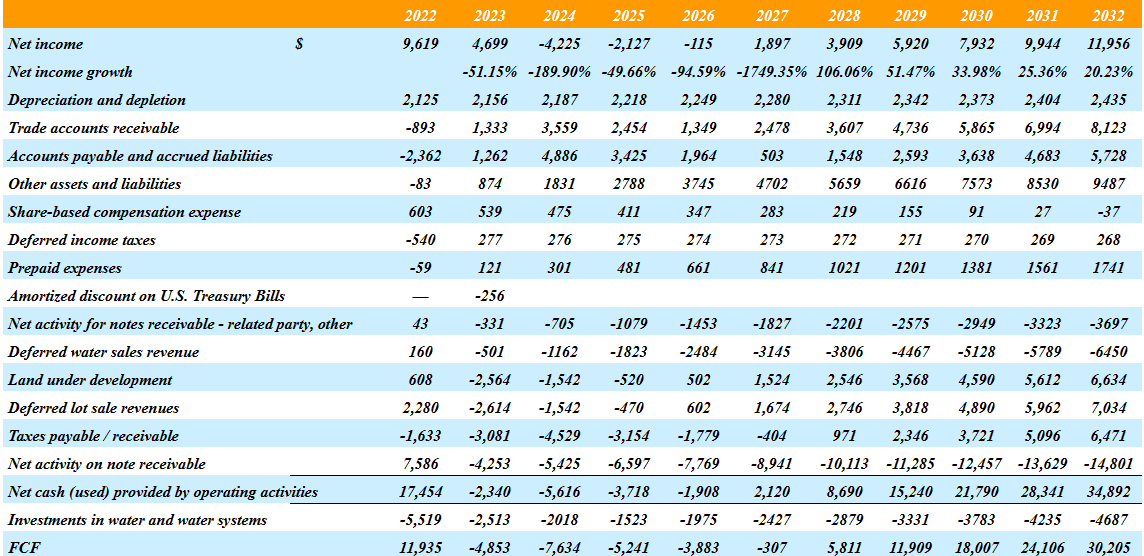

My numbers also include 2032 depreciation and depletion of close to $2 million, changes in trade accounts receivable of about $8 million, changes in accounts payable and accrued liabilities of about $5 million, and share-based compensation expense of -$1 million.

Additionally, with changes in deferred water sales revenue of -$7 million, changes in land under development of $6 million, and changes in deferred lot sale revenues of $7 million, 2032 net cash provided by operating activities would be close to $34 million. Finally, taking into account investments in water and water systems of about -$5 million, 2032 FCF would be $30 million.

Source: My DCF Model

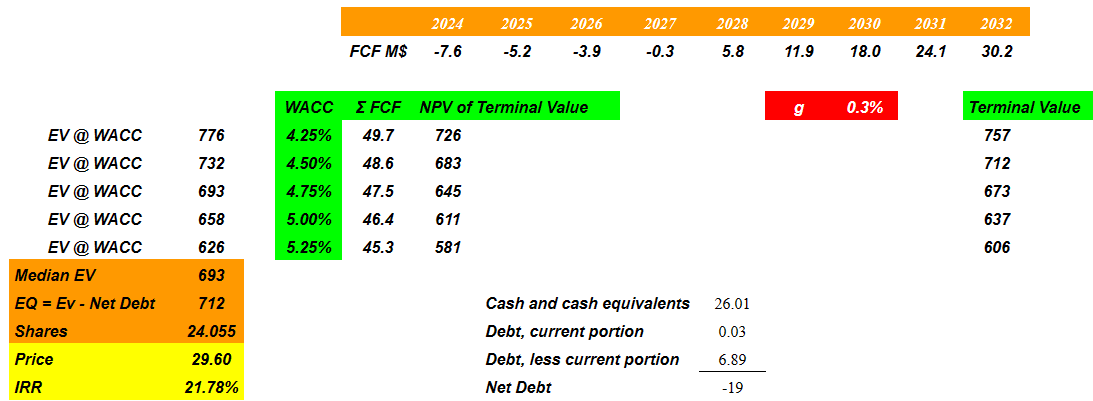

Given recent changes in the interest rates, I used a WACC that ranges from 4.25% to 5.25% with a conservative long-term growth rate of 0.3%. The implied forecast enterprise value would stand between $726 million and $581 million, and with net debt close to $19 million, the forecast equity would not be far from $29 per share. The internal rate of return would be close to 21%.

Source: My DCF Model

Competitors

Regarding competition in the water distribution segment, the competitive framework is particular since this competition is mainly for access to tenders and contracts with public entities that regulate this type of business, and is not about price or product development as in other markets. In this sense, the company reports that its biggest competitor is the city of Aurora in the region of Colorado, and has to do with access to water reserves and mainly the minority costs that Aurora offers in relation to its services.

If we talk about land development, we must say that in this case the competition is highly fragmented since there is a growing number of real estate developers in the region, and this competitive landscape is made up of companies with national reach as well as a large series of independent developers. They see specific business opportunities in the purchase and sale of lots and land.

Risks

It should be noted first of all that the company’s operations are concentrated in the Colorado region, therefore the company depends directly on the economy in this area. Another risk factor to consider is that the company is not in a position to generate the amounts of capital necessary to carry out its projects, especially if we consider that the majority of income at present is through the water distribution treatment segment, and this income must be allocated to the development of real estate projects that require large initial capital investments.

At this point, the growth and success projections regarding the development of Sky Ranch play a fundamental role in the short term of the company’s activities. Along with this, it is necessary to mention that some of the water distribution activities are linked to exhaustible reserves, adding risk in relation to the financing of real estate activities.

Conclusion

Pure Cycle Corporation delivered better-than-expected quarterly earnings in November, however, the most interesting piece of information is related to the new projects to be completed in 2024. The completion of Phase 2A and information about Phase 2B of the Sky Ranch Master Planned Community could improve expectations about future capacity increases. Besides, the indication of recurring customer growth expected for the next 5 to 6 years is also quite impressive. Even considering the recent decrease in demand driven by increases in interest rates and the concentration of assets in Colorado, Pure Cycle appears quite undervalued.

Read the full article here