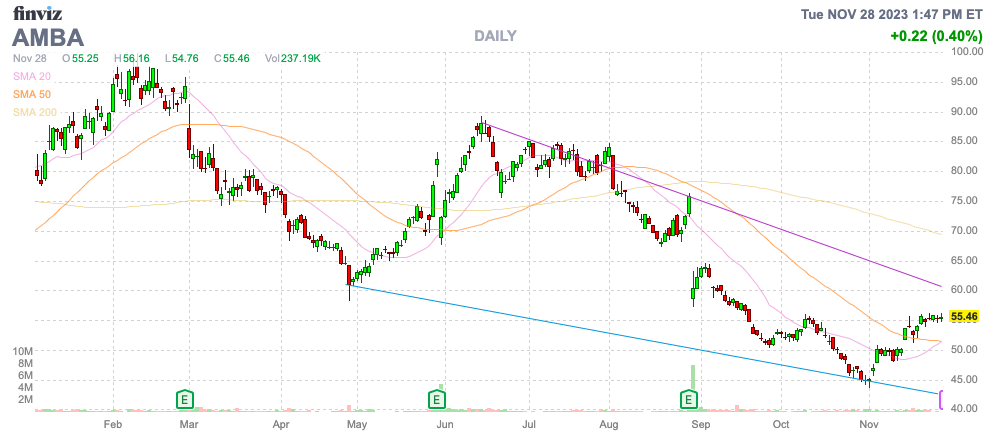

Ambarella (NASDAQ:AMBA) has always been a conundrum with promising image technology, but a business model that never stacks growth on past years. The company continues to have promising orders in the automotive sector along with new edge AI chips, but actual revenues are again back to cyclical lows. My investment thesis is more bullish after the massive dip in the stock back into the mid-$50s heading into FQ3 results.

Source: Finviz

Muted FQ3

Ambarella just announced the retirement of CFO Brian White after only joining the chip company is 2022. The executive plans to retire at the end of the fiscal year on Jan. 31, 2024.

The company reiterated the FQ3 results it’s set to report on Nov. 30 after the market closes. The chip company provided the following guidance with just a few weeks left in the quarter:

- Revenue is expected to be $50.0 million plus or minus 4%.

- Gross margin on a non-GAAP basis is expected to be between 62.0% and 64.0%.

- Operating expenses on a non-GAAP basis are expected to be between $46.0 million and $49.0 million

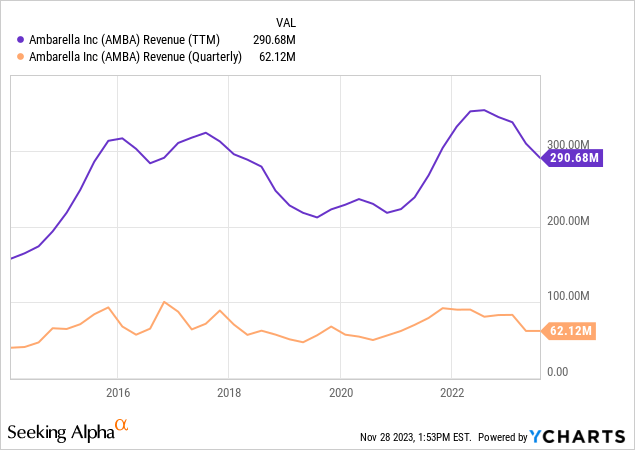

The issue really isn’t whether Ambarella hits these reduced revenue targets of ~$50 million. The question is whether the business can ever reported sustained growth. The chip company reported quarterly revenues approaching $100 million back in 2015 and 2016 when the focus was on drones and again in 2021 when computer vision was all the rage.

Ambarella has now shifted to a focus on edge AI computing despite what was supposedly a massive automotive opportunity. As the above chart highlights, the company constantly shifts to new imaging technology without building upon the existing product offering.

A prime example is the current dip in video processor revenues, primarily from security cameras, dropping dramatically due to the shift in focus to AI inferencing. On the FQ2’24 earnings call, CEO Fermi Wang highlighted the shift as follows:

First, Video Processors are human viewing, I expect it to be about 40% of total revenue this year, down from 55% last year and they typically come in a single-digit ASP. For several years, we’ve been prioritizing our limited resource on AI technology and products and for this reason we anticipate our video processor revenue to continue to contract.

Morgan Stanley pretty much sums up the issue with the stock in the short term as follows:

Given the headwinds, scale challenges, and supply chain issues, we expect it will take more time for the company to return to profitability. While revenues are going down, the importance of the technology is increasing, with growing demand for AI inference at the edge with low power.

The question for years now is whether Ambarella can actually capitalize on the growing demand for their chips.

Big Opportunity

Ambarella constantly rallies due to the impressive opportunities in multiple growth areas. The problem is the questionable execution from a mostly Chinese company.

Analysts only forecast revenues rebound to $257 million in FY25. The stock currently have a market cap of $2.2 billion leaving the valuation stretched based on currently revenues.

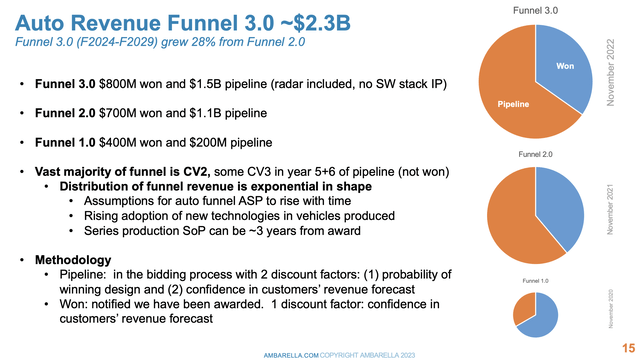

Ambarella now lists an automotive funnel of ~$2.3 billion though FY29. The problem is that a lot of the funnel is part of the pipeline and extend out into FY28/FY29, not the original expectation for a huge auto ramp in the next few years when these numbers were first reported years ago.

Source: Ambarella Investor presentation

The big auto opportunity leads to major stock rallies with Ambarella rallying from current levels to $100 multiple times. With a Chinese CEO, the company constantly runs into issues with disconnects with the investor community and the CFO leaving won’t help this scenario.

Takeaway

The key investor takeaway is that Ambarella has dipped to a level where the stock is attractive. The best outcome for investors is to prepare for the next major rally while understanding the inability of the company to build upon large wins will likely lead to a repeat of past cycles. The current market weakness is unlikely to provide Ambarella with the numbers to spark a major rally following FQ3 results, but the opportunity likely builds heading into the start of 2024.

Read the full article here