Thesis

iShares Core Dividend Growth ETF (NYSEARCA:DGRO) is a dividend growth focused ETF that has the potential to complement one’s dividend or broader market blend portfolio with its consistent dividend growth, but I’m not quite ready to start a position due to it lacking a clear edge amongst several positive characteristics it possesses.

Fund Strategy & Performance

DGRO seeks to track the investment results of the Morningstar US Dividend Growth Index. It is a broadly diverse ETF composed of US equities with a history of consistently growing dividends. It may serve as a core holding for those seeking dividend income. To screen, select, and weigh equity holdings, the following rules are applied:

- Eligible companies must pay a qualified dividend.

- Companies that are in the top decile based on dividend yield are excluded from the Underlying Index prior to the dividend growth and payout ratio screens.

- > 5 years of uninterrupted annual dividend growth.

- Earnings payout ratio < 75%.

- Dividend dollar weighted.

The Underlying Index may include large, mid, and small capitalization companies and is rebalanced quarterly, with no holding allowed to make up more than 3% at the time of the annual reconstitution.

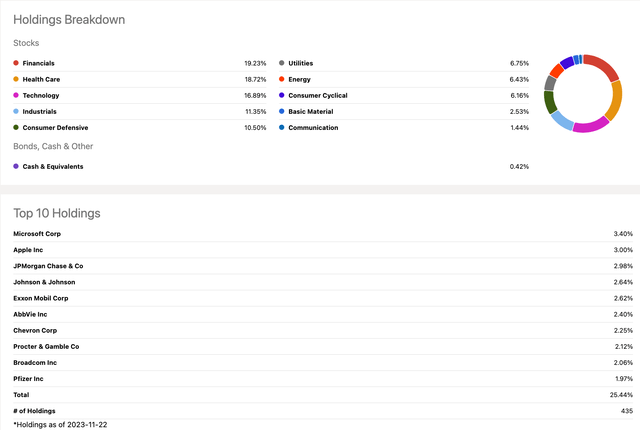

DGRO Holdings (Seeking Alpha)

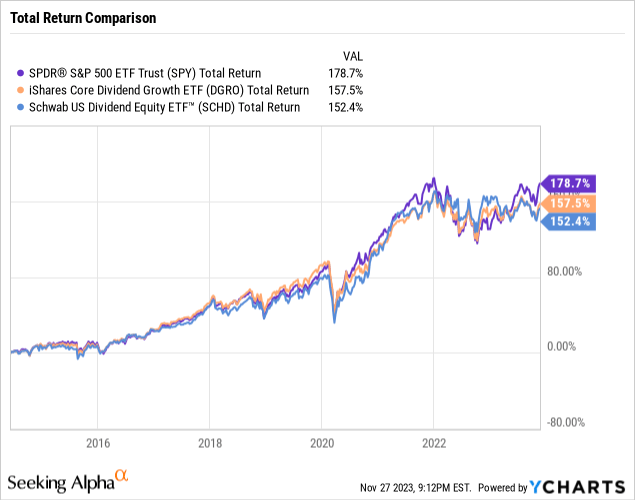

DGRO has a TTM dividend yield of 2.48% and a 5 year dividend growth rate of 9.66%. While the dividend yield is low, the name of the game with dividend growth is yield on cost, which DGRO is over 5% since inception. It is the equivalent of buying a 5% treasury or investing in a HYSA in today’s dollars. Since inception in June 2014, DGRO has provided a total return of 157.5%, in line with the broader S&P 500 market SPDR S&P 500 ETF Trust (SPY) and popular dividend growth fund Schwab U.S. Dividend Equity ETF (SCHD).

Complimentary Analysis

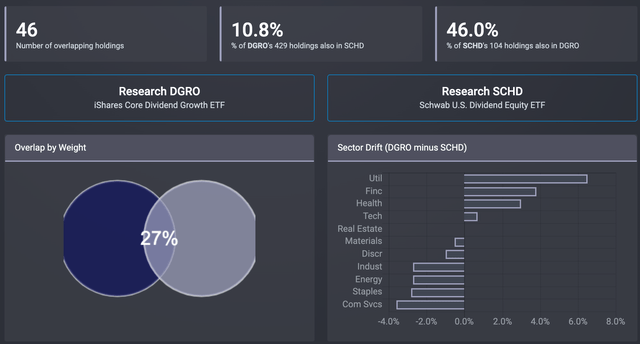

I’ve been searching and waiting, mostly waiting, to pair another dividend growth ETF with one of my favorite picks, SCHD. At a glance, DGRO seems like a great partner. It’s focused on dividend growth, has a few top tech holdings, and is more diverse with over 400 holdings compared to SCHDs 104.

DGRO-SCHD ETF Overlap (ETFRC)

While 46% of SCHD’s 104 holdings are in DGRO, only 10.8% of DGRO’s 429 holdings are in SCHD with 27% overlap by weight. This indicates at face value, DGRO is a good pairing with SCHD for a dividend growth focus play, since most of the holdings are not redundant. Though 27% isn’t as nice as 10.8%, it is indicative there are some stronger equity selections in both funds using two different screening methodologies. DGRO gives more weight to Utilities, Financials, and Health while including big tech names like Apple (AAPL) and Microsoft (MSFT) which are the top two holdings of the fund.

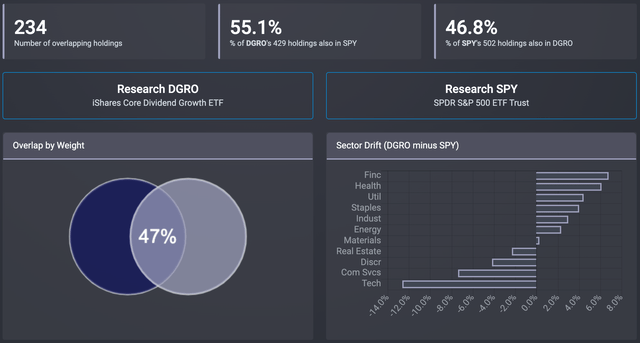

DGRO-SPY ETF Overlap (ETFRC)

It’s interesting to note in regards to the S&P 500, around 50% of holdings and weighting are the same for DGRO and SPY, further giving some conviction to a dividend growth strategy different from just holding the S&P. This is because DGRO also includes equities from the small and mid cap space, making it an interesting play on the total market investment philosophy. DGRO is also more balanced, particularly in the tech sector with 12% less drift.

My main interest is of course, the dividend growth metrics of DGRO. So, I took to it to compare the annual dividend growth data of DGRO, SCHD, and SPY. We know DGRO has a 5 year dividend growth in between SCHD and SPY, but it’s nearly 10% 5 year dividend growth rate is still quite attractive if it means more diversification. What I’m more interested in is the consistency of their screening methods and if these funds’ dividend growth metrics are different from one another by using a few statistical tests. Of note, I omitted 2015 and 2013 from DGRO and SCHD respectively due to the late inception of the funds, the growth percent is misleadingly high.

Both DGRO and SCHD’s dividend growth rates vary less compared to the S&P 500 as reflected in their standard deviations, which are also similar. I’m not expecting most readers to know or go recall what f and t tests are so I will summarize what this data table says verbally. I’m mainly interested in the f-test results, as they indicate if the annual dividend growth data is significantly different or not from one another given by the value < 0.05 or > 0.05 respectively. I reference the t-test results just to double check and get a different perspective using the same rules.

| Annual Payout Growth YoY | DGRO | SCHD | SPY |

| 5 Year Dividend Growth Rate | 9.66% | 13.69% | 5.35% |

| Standard Deviation | 5.06% | 4.39% | 9.25% |

| f-test | 0.67 | 0.02 | 0.14 |

| t-test | 0.08 | 0.04 | 0.26 |

- DGRO vs. SCHD results in 0.67, meaning there is no statistically significant difference between their annual dividend growth rates, this is good because we have two different funds, with different holdings, and different weightings yet we’re still getting strong dividend growth, meaning we are sourcing something new into the dividend growth by holding both funds.

- SCHD vs. SPY results in 0.02, meaning there is a meaningful difference in their annual dividend growth, which is good because they are very different funds with different objectives. If they were similar, it would suggest that investing in SCHD may not give an edge over SPY for dividend growth.

- DGRO vs. SPY results in 0.14, meaning there may not be a meaningful difference between their annual dividend growth rate data. This is not good, since these funds are only about 50% similar with DGRO being geared toward dividend growth, this can indicate their annual dividend growth data are not different enough at this point. Simply put, SCHD has demonstrated enough consistency and outperformance of dividends to show it’s methods are distinguished from the S&P screening but DGRO has not.

Don’t let the 5 Year Dividend Growth Rate fool you, there are plenty of years where SPY dividends are growing much like DGRO which is why it’s having such a profound impact. So, one could argue to pair SCHD and SPY instead of SCHD and DGRO. I personally think we need more data from DGRO to prove it to more distinguished as I believe it will be in the long run. Along those same lines, DGRO has a 5 year Beta of 0.88 vs. SCHD’s 0.84, so while both are less correlated to the S&P, you can see DGRO is a little more tilted toward tracking the S&P 500.

Risk Analysis

A few concerns I have with DGRO’s indexing methodology a rule from the index it’s based on

If a current index constituent fails to raise its dividend but does not decrease its dividend and executes share repurchases in the preceding 12 months, resulting in a net decrease in its shares outstanding, the constituent will remain in the index.

This strikes me as odd for a dividend growth strategy, I feel like the year there’s no growth, we should replace it with the next stock in line that can contribute, while the total return contribution from buybacks are nice, investors in DGRO won’t be looking to sell shares to generate income when they need it, so this defeats the purpose.

Another screening methodology I’m concerned with is that they omit the top 10 yielding stocks before they even look at the payout ratio. I personally feel the < 75% payout ratio criteria is enough to filter stocks they are concerned won’t grow their dividends. There could be some higher yielding stocks with appropriate payout ratios that could boost the overall yield and potentially dividend growth of the fund.

Forward Looking Sentiment

Overall, I like most of DGRO’s screening methodology, diversity, and its total returns. It certainly has earned a spot to be put it in the ranks for consideration in my portfolio. I also really like that it includes small and mid cap stocks, as a sort of alternative play on the total US stock market focused on companies with growing dividends, no matter how big their market caps are. Despite how emotionally compelling DGRO is dangling Apple and MSFT and more diversification with strong dividend growth, I think I’m going to hold off for now and do a few more deep dive comparisons and monitoring before starting a position. While there’s some great characteristics as discussed, none are really standing out at this time for me to start a position. Still, I think it’s a compliment to this fund to at least be considered alongside our beloved SCHD.

Read the full article here