This year, the National Federation of Independent Business (NFIB), an association of small businesses that advances the interests of small companies in the U.S., celebrates 50 years of its Small Business Economic Trends survey. The NFIB Research Center started collecting Small Business Economic Trends data quarterly in 1973 and has done monthly surveys since 1986. Respondents are randomly drawn from NFIB’s membership.

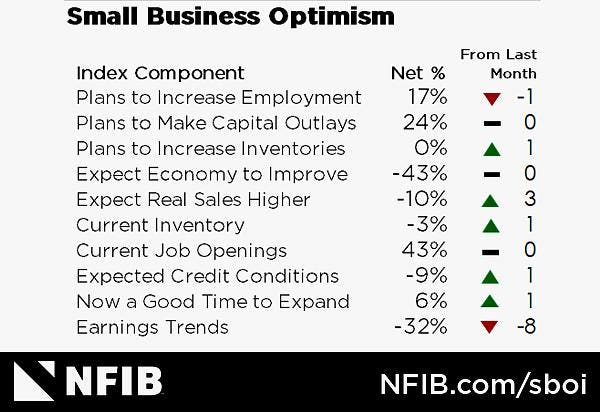

The research puts its finger to the pulse of small business owners, who according to the October 2023 study, are not feeling optimistic in the current economic environment. The NFIB Optimism Index decreased 0.1 points in October to 90.7, marking the 22nd month below the 50-year average. The last time the Optimism Index was at or above the average was December 2021.

Seasonally adjusted key findings include:

· 22% of owners reported that inflation was their single most important problem in operating their business, down one point from last month.

· Owners expecting better business conditions over the next six months were unchanged from September at 43%.

· Just 17% of all owners reported higher nominal sales in the past three months, the lowest reading since July 2020.

· 43% of owners reported job openings that were hard to fill, unchanged from September and remains historically very high. Meanwhile, 24% plan to raise compensation in the next three months.

“The October data shows that small businesses are still recovering, and owners are not optimistic about better business conditions,” said NFIB Chief Economist Bill Dunkelberg. “Small business owners are not growing their inventories as labor and energy costs are not falling, making it a gloomy outlook for the remainder of the year.”

The frequency of reports of positive profit trends was a net negative 32%, down eight points from September. Among owners reporting lower profits:

· 32% blamed weaker sales,

· 21% blamed the rise in the cost of materials,

· 14% cited labor costs,

· 10% cited lower prices,

· 7% cited the usual seasonal change, and

· 4% cited higher taxes or regulatory costs.

For owners reporting higher profits:

· 55% credited sales volumes,

· 20% cited usual seasonal change, and

· 7% cited higher selling prices.

Small Business Credit and Spending

NFIB reports that 23% of small businesses reported all credit needs met, and 64% said they were not interested in a loan at this time. Just 2% of company owners reported that their borrowing needs were not satisfied.

However, a net 22% of owners reported paying a higher interest rate on their most recent loan, and a net 7% reported their last loan was harder to get than in previous attempts. Among NFIB respondents, 24% plan capital outlays in the next few months, and 5% of owners said that financing was their top business problem.

Of those making expenditures:

· 37% reported spending on new equipment,

· 24% acquired vehicles,

· 18% improved or expanded facilities,

· 12% spent money on new fixtures and furniture, and

· 7% acquired new buildings or land for expansion.

Meanwhile, 57% of owners reported capital outlays in the last six months, unchanged from September.

Sales Figures

Some cause for concern: a net -17% of all owners reported higher nominal sales in the past three months, down nine points from September and the lowest reading since July 2020. The net percentage of owners expecting higher real sales volumes improved three points to a net -10%.

The net percentage of owners raising average selling prices rose to a net 30% (seasonally adjusted), while 22% reported that inflation was their single most important problem in operating their business.

Labor Cost Impact on Small Business

In NFIB’s monthly jobs report, a seasonally adjusted net 17% of owners plan to create new jobs in the next three months. Overall, 61% of owners reported hiring (or trying) to hire in October. Of those hiring or trying to hire, 90% of owners reported few or no qualified applicants for the positions they were trying to fill. Some 36% of owners reported raising compensation (unchanged from September), while 24% of owners plan to raise compensation in the next three months. Nine percent cited labor costs as their top business problem and 23% said that labor quality was their top business problem.

NFIB’s research confirms what experts who have been following small business economic trends have been saying in 2023: prices are up, but so are costs, and business owners are concerned about lingering inflation. With the Federal Reserve leaving open the possibility of further interest rate hikes to reach the target 2% inflation rates, borrowing costs are likely to go higher again as we approach 2024.

Read the full article here