Investment Thesis

The Hershey Company (NYSE:HSY) is the leading U.S. confectionary manufacturer and the second largest snack business. Their portfolio of iconic and well managed brands generates real pricing power for the firm which helps Hershey consistently earn outsized returns on their invested capital.

A recent selloff in shares has brought prices back into a range somewhere between a 20% undervaluation and a fair valuation of the company.

Given the firms excellent management team, wonderful economics and strategic pivot towards a more diverse set of snacking products, I believe Hershey could make for a compelling buy-and-hold opportunity.

I have initiated a position in the stock and rate Hershey a Strong Buy at present.

Company Background

Hershey FY22 10-K

The Hershey company is the largest and perhaps the most well-known confectionary manufacturer in the U.S. The firm employs over 19,000 people across multiple brands and operating units with the firm now boasting over 100 brand names of snacks and confectionary being sold in approximately 80 countries worldwide.

Since the firm’s founding way back in 1894, Hershey has become a packaged treats powerhouse with the confectionary giant now producing a variety of chocolates, sweets, salty snacks and an increasingly large range of healthier snack alternatives.

Through multiple acquisitions, licensing agreements and food innovation, Hershey now owns and sells iconic brands such as Hershey chocolates, Reese’s, Milk Duds, Dot’s Pretzels, Twizzlers and even Pirate’s Booty. The firm even sells Kit Kat products in the U.S. thanks to a licensed production agreement with Nestle.

Michele Buck is the current CEO, President and Chairman of the Board after being appointed back in 2017 after a short tenure in the COO position. Buck joined Hershey back in 2005 and was the architect behind the firm’s expansion into the broader snacking market while simultaneously overseeing the acquisitions of Krave and barkThins into the brand in the early 2000s.

Given her extensive and proven ability to successfully expand Hershey’s businesses by investing in both their core confectionary segment and through further diversification into new markets, I believe that Buck is well suited to lead the firm moving into the mid- to late 20’s.

Furthermore, I believe her extensive experience managing Hershey’s operations will provide Buck with an acute understanding of cost-control and strategic capital allocation which should allow the firm to perform well in a higher interest rate environment and even through bearish macroeconomic periods.

Economic Moat -In Depth Analysis

The confectionary and snacking market environment is an incredibly difficult market for firms to build tangible economic moats in. The high levels of competition, relatively low barriers to entry and the challenge of constantly changing consumer tastes and preferences makes it difficult for firms to establish reliable and robust relationships with customers.

Despite the characteristics of this tough and competitive industry, Hershey appears to have found the secret recipe behind building brands with lasting pricing power through continued resonance with consumers while simultaneously exhibiting a real manufacturing cost advantage.

Hershey has grown significantly from their humble beginning of being just a chocolates and confectionary manufacturer. Over the last 20 years Hershey has established themselves as the leading confectionary manufacturer in the U.S. while being the second most dominant force in the snacking industry too.

Hershey Investor Relations | Brands

The key to Hershey’s growth has been their incredibly well managed and diverse portfolio of brands. Iconic treats such as Kisses, Reese’s, Milk Duds and Twizzlers are all brands owned and sold by The Hershey Company.

Furthermore, the brands expansion into the snacking business with more well-known brands such as Pirate’s Booty and Dot’s Pretzels has been executed excellently.

Hershey Investor Relations | Homepage

While these household names are iconic, they arguably have no particular advantage per say compared to competitors such as Snickers or M&M’s. However, what Hershey has managed with their brands is a truly unique ability to maintain their image among consumers.

Hershey manages to maintain their brands in the limelight thanks to strategic marketing campaigns, special editions of their products and through a wide mix of retail partnerships.

Brand such as Reese’s, Kisses and Twizzlers regularly have Halloween, easter, and Christmas special editions of their products which helps drive consumer engagement, increase impulse buying and maintain brand awareness for their products.

Hershey also has an incredibly broad set of channels through which their products are marketed to consumers. The firm sells their products through their online store, massive partnerships with essentially all major U.S., Canadian and U.K. retailers and even through localized deals with smaller retailers serving smaller areas or transiting customers.

Furthermore, Hershey occasionally signs deal with more budget-oriented retail outlets such as Aldi and Lidl to further increase the reach and awareness of their brands into a wide range of consumers. Not to mention, Hershey also has a long-lasting supplier relationship with Costco through which they sell greater volumes of their products.

Fundamentally, the strength of Hershey’s brands is what creates moatiness for the firm. By selling products that resonate with consumers, Hershey is able to enjoy significant pricing power that enables the firm to grow the size of their margins on the products sold.

While the pricing power enjoyed by Hershey is impressive, the firm also appears to harbor a clear cost advantage in the manufacturing processes involved with confectionary and snacking production.

This is evidenced by their outstanding five-year running average ROIC of around 21% which suggests that Hershey’s manufacturing processes and distribution networks are leaner than some of their rivals.

Overall, given the firm’s hugely popular and well managed set of brands and what appears to be a tangible manufacturing cost-advantage, I believe Hershey has built a wide economic moat that should allow the firm to continue earning outsized returns on their invested capital and assets.

Nonetheless, I must stress that I believe Hershey must continue the effective management of their brands to ensure any real ability to command premium prices for their products from consumers.

A recessionary period will also serve as a key indicator of how well Hershey’s products resonate with consumers as tighter pocketbooks will undoubtedly lead to consumers becoming more conscientious of purchasing choices.

Financial Situation

From an operating performance perspective, The Hershey Company is a truly remarkable and wonderful company.

Hershey has 5Y (FY22-FY18) average ROA, ROE and ROIC of 15.42%, 68.47% and 21.73% respectively. These returns are wonderful both from absolute and relative perspectives. Fundamentally, the ROIC in particular of 21.73% (which even on a 10Y average remains essentially unchanged at around 23%) illustrates just how well the firm has been operated over the past decade.

Considering that Hershey’s WACC is around 7.40%, this massive outperformance fundamentally supports the hypothesis that the firm has both significant pricing power along with a lean and cost-effective supply chain.

Furthermore, when compared to some industry peers such as

Mondelez (MDLZ) and Nestlé (OTCPK:NSRGY), Hershey 5Y running average ROIC is almost 15pp larger than both of these competitors.

The firm also has 5Y average (as measured from FY22-FY18) gross, operating and net margins of 44.94%, 22.25% and 15.72% respectively. The relatively high gross margin in particular illustrates that Hershey’s fundamental business model is profitable and healthy.

Considering these fundamental operational performance metrics, it is clear to see that Hershey’s has had a very profitable set of years over the past decade. These profitability metrics also support the hypothesis that Hershey’s products enjoy a sticky and lucrative position within the market which allows the firm to benefit from real pricing power compared to competitors.

Even when considering Hershey from an absolute perspective with regards to their fundamental margins and returns, the firm appears to be a wonderfully profitable enterprise.

FY23 has equally been a mostly positive year for the firm with solid YoY revenue growth of around 12% and 5% being achieved in Q1 and Q2 respectively. Income also grew around 10% and 29% YoY in the first two quarters respectively.

The firm’s most recent Q3 set of earnings reports and presentations from October continue to suggest that Hershey is firing on all cylinders.

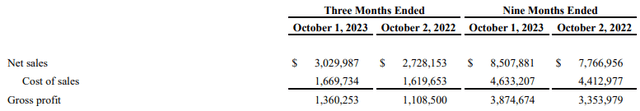

HSY FY23 Q3 10-Q

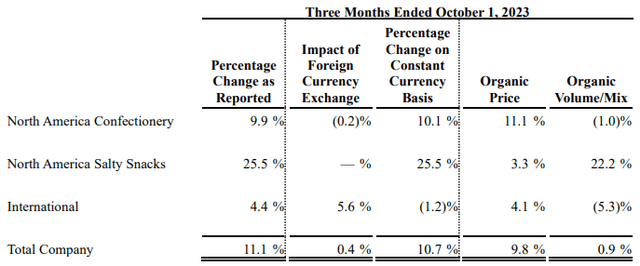

Net sales increased 11% YoY thanks to strong performance in the firm’s North American Confectionary (9% YoY growth) and Salty Snacks businesses (25% YoY growth). Relatively unaffected consumer demand for confectionary items meant total volumes were essentially flatline with stronger price realization leading to significant increases in total revenues.

HSY FY23 Q3 10-Q

The massive 25% YoY growth in the firm’s Salty Snacks business illustrates that Hershey is successfully applying their branding expertise to newer brands such as Dot’s Pretzels and Pirate Brands thus driving solid topline growth in this business segment.

The October quarter also benefitted from Halloween which traditionally is a significant seasonal driver for confectionary sales.

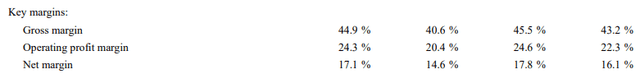

HSY FY23 Q3 10-Q

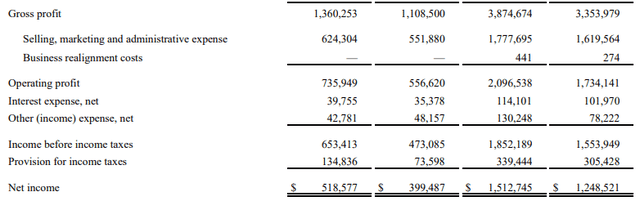

Gross margins for Q3 increased a whopping 430bp YOY to 44.9% up from just 40.6% in Q3 FY22 thanks to the aforementioned price realizations.

HSY FY23 Q3 10-Q

While selling, marketing and administrative expenses increased 13% YoY along with a massive 20% YoY increase in advertising costs during the autumn quarter, these were more than offset by the strong revenues achieved in Q3.

Nonetheless, Hershey notes that supply chain inflation, increased brand capability investment and potentially harsher cocoa prices may lead to slight margin contraction moving into 2024.

Still, total Q3 operating profit was $735.9M which represents a massive 32.2% increase YoY and an operating margin of 24.3%, up 390bp YoY.

An interesting tidbit from Hershey’s Q3 results was the massive 500bp increase in effective tax rate to 20.6% witnessed by the confectionary giant. This way reportedly due to a decrease in renewable energy tax credits versus the year previous which while not overly concerning, was intriguing to see.

Fundamentally, Q3 for Hershey was another great quarter in a pretty solid FY for the firm. I am happy with the firm’s ability to maintain revenues despite mostly flatline volume growth. I also see the strong growth in their snacking business very positively as this diversification strategy fundamentally underpins Hershey’s overall objective to become the largest confectionary and snacking business in the United States.

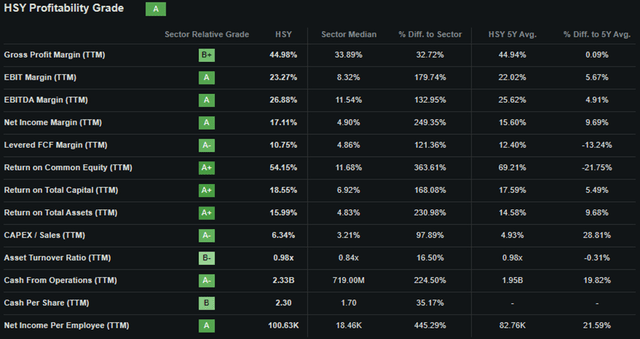

Seeking Alpha | HSY | Profitability

Seeking Alpha’s Quant calculates an “A” profitability rating for Hershey which I believe to be an accurate relative evaluation of the firm’s current fiscal situation.

I must admit however, that while Hershey’s levered FCF margin is 13% lower than their 5Y average along with a 21% drop in ROCE relative to their 5Y average, I still believe Hershey is truly an A+ company from a profitability perspective.

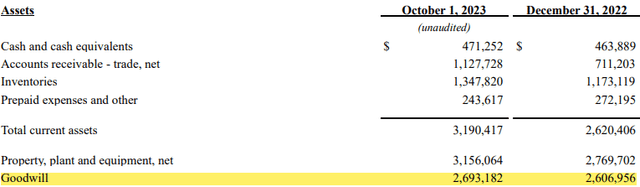

When considering Hershey’s balance sheets, it is clear that the firm is an incredibly well managed and conservatively operated enterprise.

The firm has $3.19B in total current assets while total current liabilities amount to just $2.94B. This solid short-term liquidity leaves Hershey with quick ratio of 0.54x and a current ratio of 1.09x.

These liquidity metrics are particularly impressive when compared to Mondelez’s quick and current ratios of just 0.31x and 0.61x respectively or Nestlé’s of 0.38x and 0.83x.

Total assets for Hershey amount to $11.94B with total liabilities just $7.97B. The firm has $3.97B in total shareholders’ equity. This leaves the firm with an excellent debt/equity ratio of 1.32x and a financial leverage ratio of 3.32x for FY22.

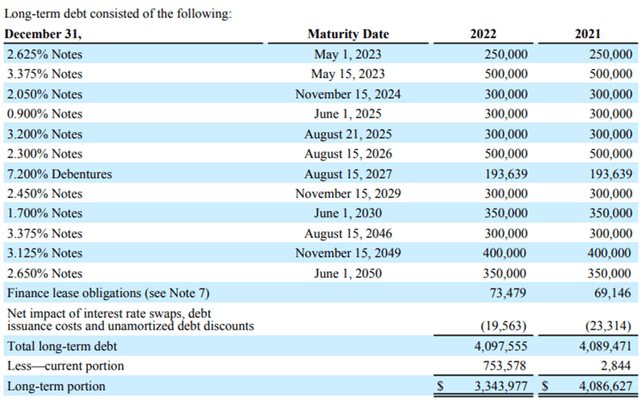

HSY FY22 10-K

At the end of FY22, The Hershey Company had $3.34B in long-term debt. While this is a relatively large sum of debt relative to their total assets, the firm has consistently been paying off maturities as they have arisen which has proven easy fiscally given their robust FY22 unlevered FCF of $1.30B.

Furthermore, their staggered debt profile consisting of mostly fixed-rate notes illustrates managements conscientious approach to growth. Harshey should be well protected against the higher for longer interest rate environment while their cashflows should allow the firm to easily service the debt maturing to 2024.

The majority of Hershey’s long-term debt has arisen from the multiple acquisitions the firm has accomplished particularly of salty-snack businesses such as Pirate Brands and more recently, Dot’s Pretzels.

HSY FY23 Q3 10-Q

This has left Hershey with around $2.7B in goodwill on their balance sheet. This is a pretty massive sum relative to total assets and certainly elevated from the $474M of goodwill present in FY17 just before the Pirate Brands acquisition.

While this does suggest Hershey may have slightly overpaid for their recent acquisitions, I believe their continuously declining financial leverage ratio, solid current liquidity and well staggered debt profiles illustrates that these acquisitions were performed very strategically from a capital allocation perspective.

Furthermore, the strong YoY growth in Salt Snack revenues suggest that Hershey is managing and building these brands successfully which should allow the firm to reap massive rewards from these brands relative to the initial capital required to acquire them.

Moody’s credit ratings agency affirmed a wonderful A1 LT issuer credit rating for Hershey with their unsecured domestic notes also affirmed at an A1 rating. The outlook remains stable. Moody’s classifies “A1” credit ratings as being of “upper-medium investment grade”.

Considering The Hershey Company as a whole it is clear that the firm is very profitable, well managed and focused on long-term sustainable growth.

Their very healthy balance sheets, smart capital allocation strategies and solid credit scores support my earlier hypothesis and initial reaction to the core profitability metrics that The Hershey Company appears to be a truly wonderful firm.

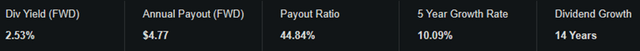

Seeking Alpha | HSY | Dividend

To further sweeten the deal for investors, Hershey also pays an impressive dividend. The firm has a great 14-year dividend growth streak with a dividend yield FWD of 2.53% and an annual payout FWD of $4.77.

Furthermore, the 10.09% 5Y growth rate is nice to see while the 44.84% payout ratio is also truly remarkable.

While an acute economic downturn would almost certainly lead to Hershey pausing or decreasing their dividend, I believe management’s fundamental desire to reward shareholders is excellent to see.

I eagerly await the Q4 earnings report which will hopefully provide investors with more guidance regarding FY24 expectations and further data regarding Hershey’s reaction to consistently rising cocoa costs.

Valuation

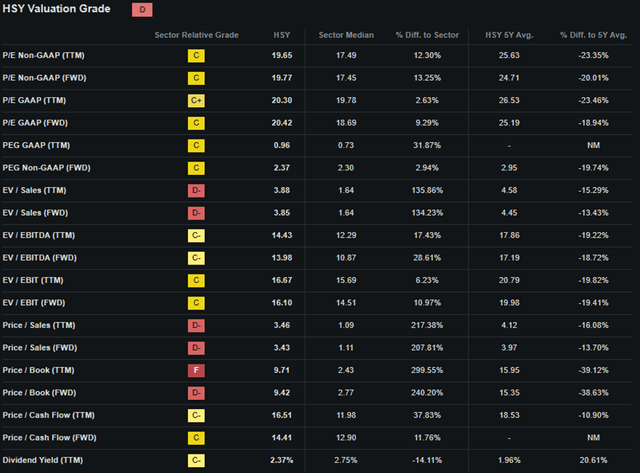

Seeking Alpha | HSY | Valuation

Seeking Alpha’s Quant assigns The Hershey Company with a “D” Valuation grade. I believe this is an excessively pessimistic representation of the value present within the firm’s stock and illustrates how very accurate relative quant ratings can sometimes poorly represent the absolute value present in a company’s shares.

The firm currently trades at a P/E GAAP FWD ratio of 20.42x. This represents an 18.94% decrease in the firm’s GAAP P/E ratio compared to their running 5Y average.

Hershey’s P/CF FWD of just 14.41x is reasonable while their FWD EV/EBITDA of just 13.98x is also quite justifiable given their growth prospects. The firm’s Price/Sales FWD of 3.43 is excellent and actually illustrates a 14% decrease in relation to their 5Y average despite the “D-“ letter grade.

Their Price/Book FWD of 9.42 may be over 240% elevated compared to industry peers but actually represents a 39% decrease relative to Hershey’s 5Y average.

Considering these basic valuation metrics alone I believe Hershey already starts to appear slightly undervalued given the stock’s historic averages. While the letter grade assigned by the quant is less optimistic, we must remember that this grading system is relative to industry peers.

Seeking Alpha | HSY | Advanced Chart

From an absolute perspective, Hershey shares are trading at a significant discount relative to previous valuations with current share prices of around $187.48 representing significant 27% contraction relative to the high’s seen in May 2023.

Still, even with the significant 2023 contraction Hershey has matched the S&P500 index (SPY) posting 5Y gains of around 75%.

The selloff witnessed in 2023 largely came as a response to what many investors had deemed to be an excessive valuation in shares along with fears that new weight-loss drugs such as Ozempic may lead to falling demand for sugary confectionary and snacks.

I believe this fear is largely misplaced and represents a mostly unfounded reactionary response from investors rather than a real threat to Hershey’s business model.

The relative valuation provided by simple metrics and ratios along with the absolute comparison already allow for a basic understanding of the value present in Hershey shares to be obtained. However, a quantitative approach to valuing the stock is still essential.

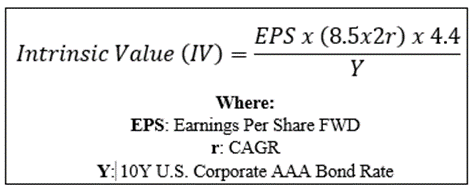

The Value Corner

By utilizing The Value Corner’s specially formulated Intrinsic Valuation Calculation, we can better understand what value exists in the company from a more objective perspective.

Using the firm’s current share price of $187.48, an estimated 2024 EPS of $10.07, a realistic “r” value of 0.07 (7%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 5.61x, I derive a base-case IV of $234.60. This represents a modest 20% undervaluation in the firm.

When using a more pessimistic CAGR value for r of 0.05 (5%) to reflect a scenario where a globally spanning recession causes Hershey’s revenue growth to flatline, shares are still valued at around $192.80 representing a fair valuation in shares.

Considering the valuation metrics, absolute valuation and intrinsic value calculation, I believe that The Hershey Company is trading somewhere between a fair valuation and a modest undervaluation.

In the short term (3-12 months), I find it difficult to say exactly what may happen to the firm’s valuation. As 2023 winds to a close, the uncertainty around a recession occurring in 2024 along with how hard such a macroeconomic environment may bite the economy means forecasting a short-term direction for the stock is essentially impossible.

Tax harvesting could see Hershey shares decline further as a less than stellar 2023 stock price trend may lead some investors to cut the firm from their portfolio as the year winds to a close.

In the long-term (2-10 years), I believe The Hershey Company will continue to remain at the forefront the U.S. confectionary industry and continue to develop their position in the snacking marketplace.

Strategic expansion into the Salty Snacks market is being achieved with an observable capital restraint which is truly excellent to see. Fundamentally, this diversification strategy into another rapidly growing segment of a close auxiliary market to their core confectionary business should yield beneficial in the long-run and decrease Hershey’s exposure to cocoa prices.

Risks Facing The Hershey Company

Hershey faces some tangible risks from both the threat of a cyclical market environment and increasing competitive pressure leading to decreasing pricing power and overall operating margins.

Consumers tend to cut back on discretionary spending during recession due to falling disposable income decrease the ability and willingness of consumers to spend on non-essential items.

While sugar is an incredibly addictive substance and undoubtedly helps decrease some of the risk Hershey may be exposed to from cyclical market environments, volume decreases during recessionary periods are still to be expected in my opinion.

The current trend for consumers to move towards healthier snacking and confectionary products could also place some downward pressure on Hershey’s core product line.

While the firm is rapidly developing healthier brands, snacks and versions of pre-existing products, there is a real opportunity for a competing firm to resonate with consumers better during such a consumer taste shift.

Furthermore, Hershey is also exposed to another cyclical market environment: cocoa and sugar. Cocoa prices are historically volatile with a recent spike in prices caused by poorer than expected yields as a result of the El Nino weather phenomenon decreasing available supply to confectioners.

While most cocoa supply deals are long-lasting contracts that specific prices for certain volumes of product, it appears that the current prices may impact confectionary production in 2025/2026 particularly.

From an ESG perspective, Hershey also faces some tangible risk mainly stemming from the nature of cocoa farming and the possibility for unfair trade practices to be occurring further upstream from Hershey’s supply chain.

Most Cocoa is farmed in Western Africa in nations such as Cote d’Ivoire and Ghana. These countries are famed for having poor workers’ rights measures in place which exposes employees in cocoa farming operations to unfair trade practices and incredibly poor conditions.

While Hershey is not responsible directly for the cocoa farming operations in these countries, their massive size and demand for cocoa arguably provides the firm with not only the ability but according to some also a responsibility to demand equitable treatment of upstream workers.

HSY FY22 ESG Report

By analyzing Hershey’s ESG report, it is clear that Hershey is dedicated towards ensuring more equitable treatment of workers involved in their supply chain. The firm is a staunch opponent of unfair worker practices in cocoa farming with the firm having 100% independently verified sources of cocoa since 2020.

Furthermore, Hershey is on track to only purchases Cocoa which is from producers verified by the Child Labor Monitoring and Remediation System (CLMRS) in order to prevent, monitor and remediate child labor in their supply chain by 2025.

Considering the tangible action being taken by Hershey, I believe the firm is acutely aware of the responsibility they hold towards ensuring that positive environmental, societal and governance impacts are achieved from the operation of their business.

The overall lack of any major environmental, societal or governance concerns suggest to me that The Hershey Company may be a good choice for the more ESG conscious investor.

Of course, opinions may vary with regards to ESG material and I implore you to conduct your own ESG and sustainability research before investing in Hershey if these matters are of concern to you.

Summary

The Hershey Company is an excellently managed enterprise with great quality products, strong brand reputation, smart capital allocation and strategic growth at the forefront of their operations structure.

Buck’s extensive experience with the company should allow her to lead Hershey successfully moving into the late 20’s with continued expansion into snacking business suggesting significant future growth may be achieved by the firm.

While the current valuation in shares may not be particularly exhilarating from a deep-value perspective, the potential for a 20% undervaluation in shares to be present in such a wonderful company as Hershey still makes for a compelling investment thesis.

Considering my belief that a wonderful company at a fair price is a much better deal than a fair company at a wonderful price, I gladly rate Hershey a Strong Buy at present time.

I have recently been taking advantage of some great opportunities and excess cash to reorganize my portfolio and have currently initiated a 5% stake in The Hershey Company relative to my total portfolio value.

I plan on holding The Hershey Company for as long as possible with the objective of never selling shares so long as the firm is well managed and retains their pricing power.

Read the full article here