In his early days as a value investor, Warren Buffett utilized a cigar butt style of investing that he learned by studying Benjamin Graham and other investment greats. This manner of investing focuses on companies that have real fundamental issues but that the market misjudges the potential of even with all the pain that they are experiencing. While Mr. Buffett moved away from that strategy long ago, and now prioritizes paying a fair price for a great business, there is a certain appeal to this manner of investing because of the potential that it offers investors when they are correct.

One firm that I think most people would agree fits into this category is Stitch Fix (NASDAQ:SFIX), the web-based retailer that, using a subscription service, allows consumers to place orders for clothing and accessories that they can send back if they don’t want. Financial performance achieved by the business over the past several quarters has been quite depressing as the number of active clients utilizing it plummeted and as revenue and profits declined. With earnings covering the first quarter of the 2024 fiscal year expected to be announced in the coming days, I can understand why investors might be taking a close look at the enterprise. This is especially true when you consider that the firm has no debt on its books and enjoys $257.6 million of cash and cash equivalents. But until we see some stabilization, this is a truly risky prospect that might result in a lot of pain for those who dive in.

Times are still tough

Back in early March of this year, I wrote an article that took a rather neutral stance on Stitch Fix. In that article, I talked about what analysts should expect for the second quarter earnings release for the firm’s 2023 fiscal year. My recommendation at the time was for investors to be rather cautious since the company did offer attractive upside but only if signs of a turnaround arose. Normally, a business reporting the kind of financial data that management had been coming out with would be one that I would rate a ‘sell’. But because of how much cash and cash equivalents the business had relative to the overall size of the enterprise, I ended up rating it a ‘hold’.

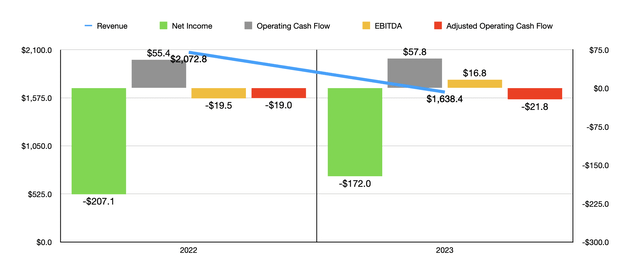

Author – SEC EDGAR Data

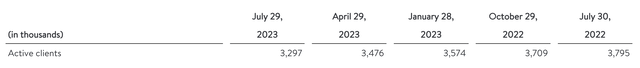

Unfortunately, things have not gone quite as planned. Since the publication of that article, shares have plunged 23.7%. That compares to the 14.4% increase seen by the S&P 500 over the same window of time. To understand why share price performance has been so awful, we should touch on the financial data provided by management. During the 2023 fiscal year, for instance, Stitch Fix generated revenue of $1.64 billion. That’s 21% lower than the $2.07 billion generated in 2022. There really were two main drivers behind this drop in sales. First, the number of active clients on the platform plunged from 3.795 million in 2022 to only 3.297 million in 2023. That’s a 13.1% drop year over year. Management attributed this drop to an unfavorable macroeconomic environment. With inflationary pressures, and rising interest rates aimed at bringing those pressures down, it wouldn’t be surprising to see some reduction in discretionary spending. So this is an explanation that I could believe. The other driver was a drop in the net revenue per active client from $546 to $497. That’s a 9% drop that management attributed to both lower new client activity and a reduction in spending from existing clients because of economic conditions.

Author – SEC EDGAR Data

Despite the drop in revenue, the firm’s bottom line improved to some extent. The company went from generating a net loss of $207.1 million in 2022 to generating a net loss of $172 million in 2023. Even though the decline in revenue proved harmful, the company saw a decrease in its selling, general, and administrative costs from 53.9% of sales to 53.1%. That was the result of lower compensation and benefit costs as the enterprise engaged in restructuring activities aimed at cutting expenses in key areas. Most other profitability metrics showed signs of improvement as well. The company went from generating operating cash flow of $55.4 million in 2022 to $57.8 million in 2023. On an adjusted basis, it did worsen slightly from negative $19 million to negative $21.8 million. Meanwhile, however, EBITDA turned from negative $19.5 million to positive $16.8 million.

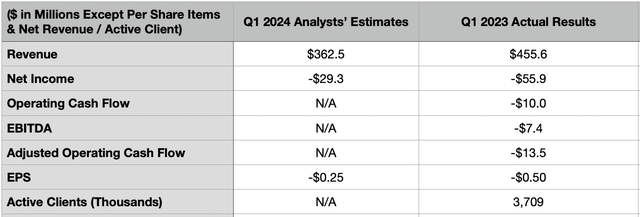

When it comes to the upcoming first quarter that management is expected to announce financial data for after the market closes on December 5, analysts have rather dour expectations. They believe that revenue will come in at around $362.5 million. That would represent a massive drop compared to the $455.6 million the company reported one year earlier. Most of that decline should be driven by the same conditions that led to a bad 2023. However, the company’s decision back in August of this year to shutter its UK business will also likely have an impact.

Author – SEC EDGAR Data

On the bottom line, analysts anticipate a loss per share of $0.25. If that comes to fruition, it would actually be a massive improvement over the $0.50 per share loss generated in the first quarter of 2023. Translated another way, the company should go from generating a net loss of $55.9 million in the first quarter of last year to generating a more modest loss of $29.3 million this year. We don’t know what to expect when it comes to other profitability metrics. But in the table above, you can see what these were for the same time last year.

Already, management does not really have high hopes for 2024. I say this because the current expectation for the business, excluding the defunct UK operations, would be for revenue of between $1.30 billion and $1.37 billion. EBITDA, meanwhile, should be somewhere between $5 million and $30 million. At the midpoint, the $17.5 million would represent only modest improvement over what the company saw last year. If this comes to fruition, I would imagine that other profitability metrics would look very similar in 2024 to what they ended up looking like when using data from the 2023 fiscal year.

Takeaway

Based on that data, the picture of the company is still very questionable. But things don’t look all that bad. Using data from the 2023 fiscal year, the company is trading at a price to operating cash flow multiple of 7.1 and at an EV to EBITDA multiple of 9.2. When you consider that the business also has no debt on hand and $257.6 million in cash against the market capitalization of $412.7 million, the picture could actually start looking appealing if the number of active clients begins to stabilize and if the average revenue per active client also stabilizes. But until then, the best that I could possibly rate the company would be the ‘hold’ I had it at previously.

Read the full article here