Summary

C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW) is a global logistics company that specializes in freight transportation and logistics solutions across various modes. It uses advanced technology platforms to cater to diverse customer needs, offering efficient, cost-effective, and reliable shipping and supply chain management services.

In this post, I am recommending a sell rating for CHRW. My recommendation is driven by its disappointing 3Q23 results, which included a double-digit revenue decline and caused its net income per share to fall 61.8%. This poor performance was largely due to decreased global freight demand and excess capacity. As a result of these, it led to suppressed transportation rates, especially in the critical North American Surface Transportation segment, which saw notable drops in volume and pricing. These challenges have led to a pessimistic revenue growth outlook for CHRW, further justifying my sell recommendation.

Financials / Valuation

Over the last 4 years, CHRW’s revenue has been on a roller coaster ride. In 2019, it reported a revenue decline of negative ~8%. In 2021, it reported ~42% before dropping down to ~6.9% in 2022. To put these numbers into perspective, its CAGR is ~8%. For its latest FY, it is growing below its CAGR. Despite fluctuating revenue, CHRW’s margin is consistent. Its gross margin has averaged ~7% over the last 4 years. The same goes for its operating margin, which averages ~5%. As a result of this, its net margin also stayed relatively stable at ~3.5%. Lastly, CHRW manages to grow its diluted EPS from 2019’s $4.19 to 2022’s $7.40.

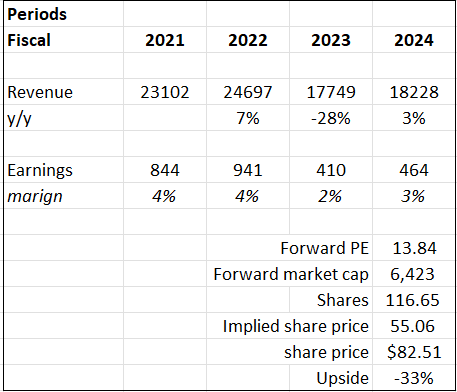

Valuation

Based on my view of the business, I anticipate a 28% decline in CHRW’s revenue for FY23, followed by a 3% revenue increase for FY24, and both assumptions align with the general market consensus. This projection is influenced by its weak 3Q23 results, where revenue was down 27.8%. My lower earnings margin for both 2023 and 2024 was driven by its declining net income per share, which fell a staggering 61.8%. In addition, its largest segment, NAST, was performing badly due to declining volume and pricing, making its growth outlook not that great. To make things worse, management stated that there are no significant changes in its already soft freight demand, and I believe it will continue into 4Q23. With the potential addition of new container ships to the air fleet and additional routes for passenger airlines, it will increase the already high capacity, which would definitely put pressure on pricing. Overall, the growth outlook and earnings margin for CHRW are grim.

Based on author’s own math

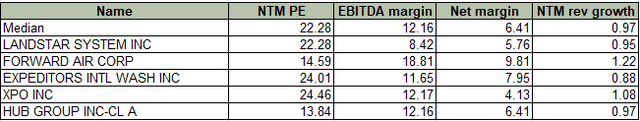

Peers overview:

Factset

CHRW now trades at ~21x forward P/E, which I believe to be too high when considering peers’ medians of 22.28x. The reasons behind this argument are due to CHRW’s weaker performance. In terms of EBITDA, CHRW is ~6%, half of peers’ ~12%. In terms of net margins, CHRW is 2% lower than peers’ median of ~6%, at 4%. In terms of growth outlook, CHRW is expected to decline 28% while peers’ is ~3%. Therefore, I believe CHRW should be trading at peers’ lower end of the forward P/E range at 13.84x. At this multiple, I anticipate its share price to drop 33%; hence, I recommend a sell rating for the stock.

Comments

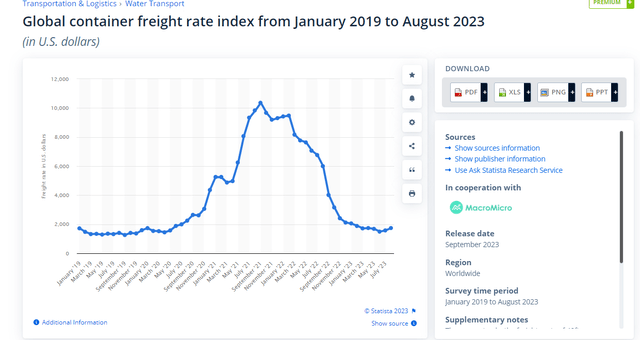

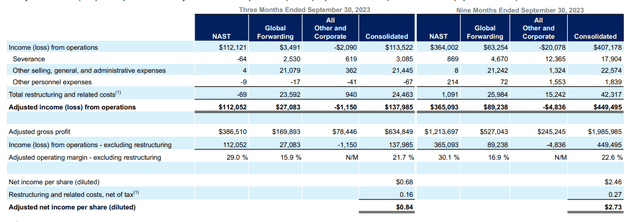

CHRW reported disappointing 3Q23 results. Total revenue was down 27.8% year-over-year to $4.3 billion. Moving down its income statement, adjusted gross profit was down 28.4% year-over-year to $635 million. Income from operations was down a massive 60.5% year-over-year to $114 million. As a result, net income per share was down 61.8% year-over-year to $0.68. This weak result was driven by weak demand for global freight, exacerbated by excess capacity. As a result of these two factors, transportation rates were heavily suppressed.

Statista

The next point I would like to talk about is its North American Surface Transportation [NAST] segment, as it accounts for ~89% of YTD operating income. The gross revenue decline in 3Q23 of 22.9% was less severe compared to last quarter, which was down 26% year over year, mainly because the comparison was easier. The main factors leading to the gross revenue decline were a 6% drop in volumes and a 16.5% drop in pricing. Gross margin [GM] came in at 12.5%, which is the lowest GM since 1Q22 and a year-over-year decline of 1.6%. Truckload [TL] declines of 40% year over year were the primary contributors to this. In addition, management also observed that the sequential declines in TL linehaul cost per mile, which began in Q2 of last year, persisted. The average gross profit per load also dropped by 36.5% due to contractual tilt and subsequent price reductions. Due to weaker demand, less-than-truckload net revenues fell 15% year over year on 2% lower volumes and 13.5% lower average gross profit per order. As NAST accounted for most of its income, the weakness in this segment really raises my concerns about the overall health of the business.

CHRW

Management has observed that there have been no significant changes in freight demand, and transportation costs are expected to remain volatile in 4Q23 and beyond. With weak demand and volatile prices, I believe 4Q23 will be impacted as its current weak conditions continue into the next quarter. Although the West Coast’s improving imports could be a good sign for its NAST and global forwarding businesses, when they hit the inflection point will depend on how much freight flows into the non-asset world. CHRW’s global forwarding business is expected to continue facing challenges due to the delayed restocking of inventory from global trade and the potential addition of new container ships to the air fleet and additional routes for passenger airlines, which will increase the capacity of belly space and add more pressure to the current capacity issue. Still, CHRW made note of the fact that they are gaining market share among forwarders by maintaining the service levels expected by shippers. On the flip side, CHRW reported an 18% increase in shipments per person per day, which is their preferred productivity metric, thanks to the headcount reductions that have been implemented so far and the tech that has been used to reduce manual touches and increase speed to market. Even with 4Q volumes that are typically lower than expected, it should still be able to meet or surpass their productivity improvement goal of 15% by the end of the year.

Risk & conclusion

If global freight market conditions improve, it will see a rebound in demand and pricing. As a result, if CHRW were to outperform its pessimistic growth outlook, its share price could increase, as investors might be taking this signal as a positive for CHRW. Global freight market conditions can be improved by factors such as easing inflation, which stimulates economic growth, or the systematic reduction in excess capacity, which is plaguing the market now.

In conclusion, I believe the future for CHRW seems challenging and full of hurdles. My belief is driven by its disappointing 3Q23 results, which show a double-digit decline in revenue. To make matters worse, its net income per share fell by 61.8%. On top of this, management was also guided to a bleak growth outlook. The significant underperformance in its largest segment, NAST, due to reduced volume and pricing, compounds these issues. Additionally, the soft freight demand and increased market capacity, likely to continue into the next quarter, further put pressure my growth outlook for CHRW. These factors collectively contribute to my recommendation for CHRW.

Read the full article here