Post its 2021 merger, Topgolf Callaway Brands Corp. (NYSE:MODG) continues to navigate uncertainties, notably reflected in the stark 39.96% downturn since my prior bullish assessment. Despite its current trade at a five-year low, the company showcases enduring strengths—surpassing four billion dollars in TTM revenue and sustained profitability, albeit against a backdrop of revised guidance. Challenges persist in the aftermath of the merger, particularly in forecasting demand, warranting a cautious approach.

Ten year stock trend (SeekingAlpha.com)

Amidst these challenges, noteworthy positives emerge, such as an upward trajectory in cash flow, as seen in the Q3 2023 Earnings and the company’s ambitious target to achieve positive free cash flow by year-end. Notably, expansion plans, inclusive of eleven new golf courses, coupled with a robust portfolio of strong brands, hint at a potential for an upturn compared to the previous year. Acknowledging both the revised guidance and the positive strides, my stance leans cautiously bullish, remaining attentive to potential growth while mindful of the hurdles that lay ahead.

FY2023 Outlook versus FY2022 (Investor presentation 2023)

Company update

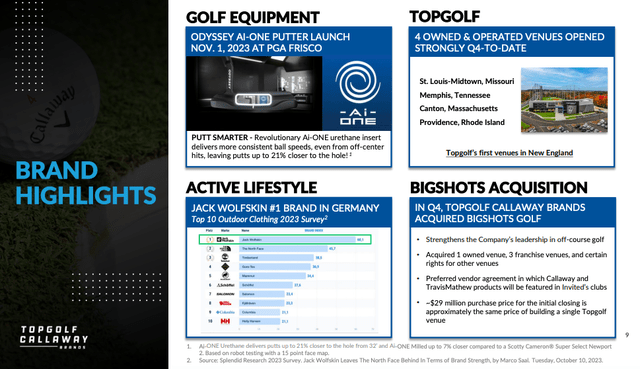

Topgolf’s performance this year has showcased a blend of successes and challenges. Its robust market share and established brand positioning in the USA remain strong pillars of its foundation. Notably, the company has exhibited commendable venue-driven margins, with the opening of seven venues this year and plans to introduce an additional 11, indicating an ambitious growth trajectory. Travis Mathew and Jack Wolfskin have emerged as notable growth drivers, contributing significantly to the company’s performance. Furthermore, the company recently acquired Bigshots Golf for $29 million.

Highlights (Investor presentation 2023)

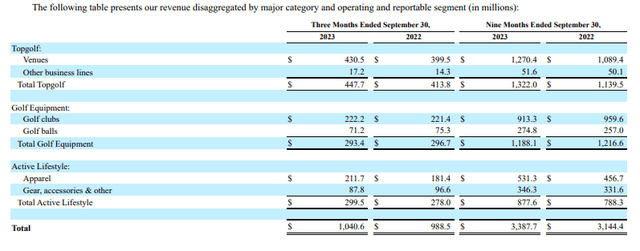

Revenue by segment

If we look at the company’s revenue and income by segment, we can see that total revenue has increased YoY. However, it fell below analyst expectations.

Revenue by segment (Sec.gov)

Despite an 8.2% year-over-year revenue increase in the Topgolf segment, primarily attributed to new venue openings, there has been a decline in same-sales venues. However, operational efficiencies have led to a rise in operating net income to $38.9 million within this segment. Conversely, the Golf Equipment segment faced revenue decline and reduced operating income due to delayed golf club launches and lower golf ball sales, although the company mitigated some impact through adjusted pricing strategies. The Active Lifestyle segment experienced a boost in revenue and operating income, fueled by the inauguration of new stores and impressive double-digit growth from the TravisMathew and JackWolfskin brands.

Despite these positive strides, the company has revised its full-year guidance downward, citing challenges from declining venue sales trends and fluctuations in foreign exchange rates as contributing factors.

Cash flow generation and growth prospects

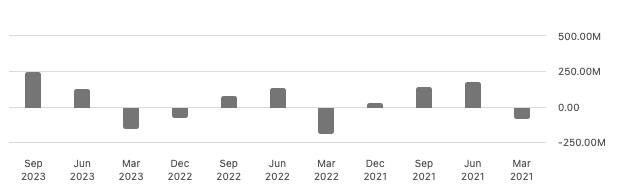

However, what bolsters my confidence in this company is its upward-trending operating income, reaching $158 million in the TTM compared to a negative $35.1 million a year prior for FY2022. Moreover, with positive free cash flow anticipated by year-end and a projected growth trajectory extending through FY2026, the company’s prospects seem promising. Analysing the quarterly cash flow operations and levered free cash flow for all three-quarters of FY2023 reveals a consistent upward trend this financial year, further reinforcing this positive outlook.

Quarterly cash from operations (SeekingAlpha.com)

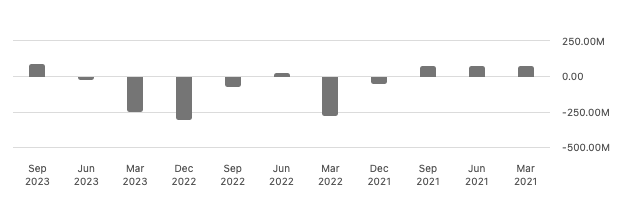

Additionally, this quarter showed a positive levered free cash flow of $93.2 million, continuing an upward trend over the last four quarters, with an anticipated year-end cash flow positivity. However, it’s important to remain cautious as the TTM levered free cash flow remains negative at $402.1 million. This negative trend restricts the business’s capacity to reinvest, reward investors, and settle debts, posing a concern for investors.

Quarterly levered free cash flow (SeekingAlpha.com)

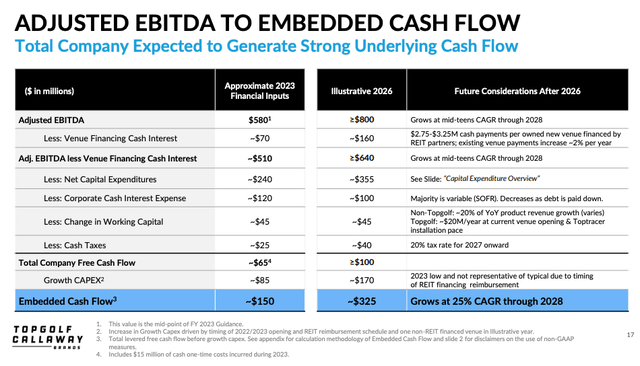

The company expects its embedded cash flow, which is total levered cash flow minus growth capex to grow at a 25% CAGR through 2028 and reach $325 million by 2026.

Growth expectations (Investor presentation 2023)

Balance sheet

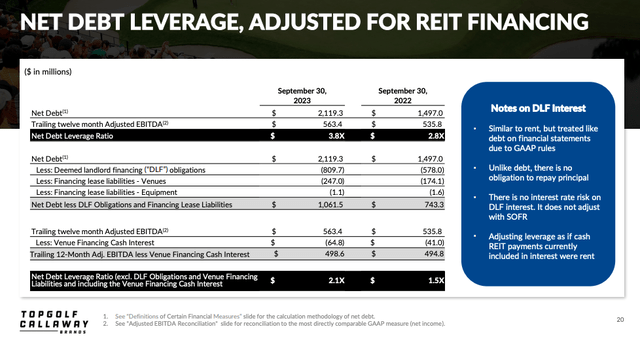

Assessing the balance sheet as of September 30, 2023, available liquidity stands at $734 million, providing ample support for the business plan despite potential market softening. However, total net debt increased to $2.1 billion, excluding convertible debt, due to new venue financing and an additional $300 million in term loan debt, up from $1.5 billion in Q3 2022. Excluding venue financing REIT debt, net debt reached $1.06 billion, rising from $0.74 billion in Q3 2022. While the reported net debt leverage improved quarter-over-quarter to 3.8x from 4.1x in June 2023, excluding venue financing REIT debt, paints a more favourable picture, revealing a net debt leverage ratio of 2.1x, offering a conservative perspective on debt obligations.

Debt overview (Investor presentation 2023)

Valuation

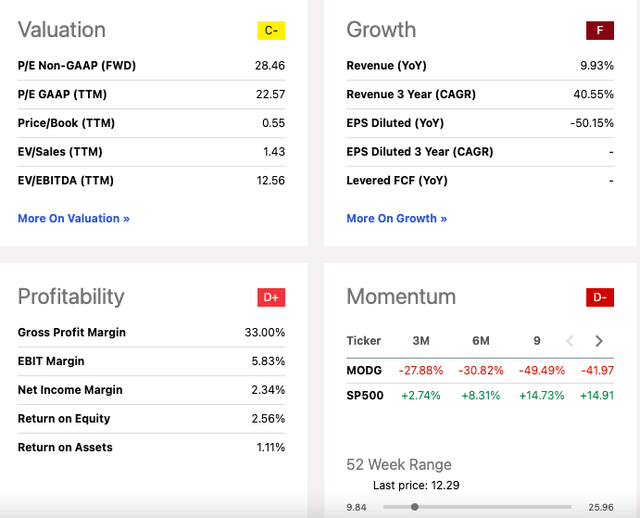

Topgolf is encountering varied analyst opinions, triggered by a significant drop in its shares due to a revised full-year outlook, primarily tied to challenges in its sports-entertainment chain. Analysts recognise a shift in golfing enthusiasm post-COVID, but concerns persist over Topgolf’s pricing impact on demand, leading to a 3% sales dip in Q3 2023. Despite efforts to manage costs, investor sentiment remains split, highlighting uncertainties about navigating entertainment segment hurdles. This shift from golf equipment to entertainment challenges reflects the evolving narrative.

Quant Valuation (SeekingAlpha.com)

While considering the company’s growth expectations and improved cash operations, cautious optimism prevails.

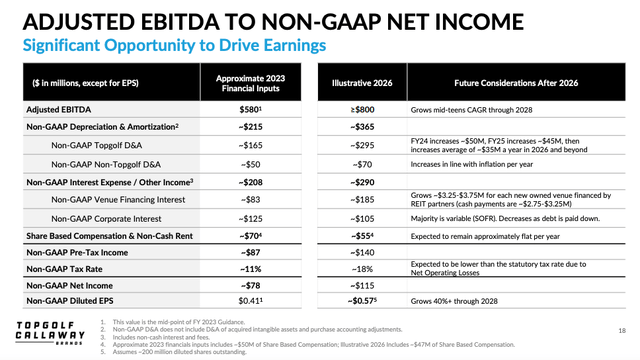

Earnings growth opportunity (Investor presentation 2023)

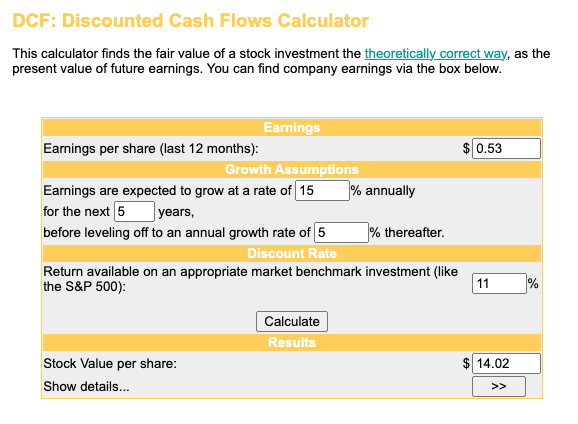

Even with conservative growth projections, there’s a potential upside, estimating a stock value per share at $14.02 using discounted cash flow and an expected 15% earnings growth for five years, followed by a 5% growth rate thereafter.

Discounted cash flow model (Moneychimp.com)

Risks

There are clearly some risks when considering the stock as a potential investment. The recent decline in same-venue sales growth poses a significant risk, potentially impacting revenue projections despite the company’s expansion efforts. Reliance on sustained growth in existing venues exposes the company to fluctuations in consumer demand, potentially affecting overall financial performance. One of the issues with regard to growth, especially in a market in which consumers are more cautious of their spending, is the company’s Topgolf entertainment chain, in which higher prices are negatively impacting demand for corporate events at their locations. Furthermore, Topgolf’s decision to lower future guidance due to sales trends and currency fluctuations signals potential earnings volatility. Investor confidence might be affected by this downward revision, highlighting the importance of monitoring currency impacts and their potential influence on the company’s financial stability amidst market uncertainties.

Final thoughts

Topgolf has encountered both hurdles and highlights since its 2021 merger, which was marked by a significant downturn in shares amid revised guidance and operational challenges. Despite trading at a five-year low, the company’s solid revenue exceeding four billion dollars in the trailing twelve months [TTM] and sustained profitability offer resilience, albeit amidst forecast uncertainties. The company’s strategic expansion plans and robust brand portfolio present potential for recovery, juxtaposed against downward guidance revisions. Reflecting on these dynamics, my stance leans cautiously bullish, considering its growth prospects while remaining attentive to the ongoing operational hurdles and market shifts.

Read the full article here