Investment Thesis

Salesforce (NYSE:CRM) reported fiscal Q3 2024 that took the market by storm. Salesforce hasn’t made it into the coveted club of the magnificent 7. But those catchy names will come and go.

But what I believe will distinguish Salesforce from many of its peers is that this business generates insanely strong cash flows and profits. Yes, clean, post-SBC, GAAP operating profits.

I remain adamant that this investment is cheaply valued and that the stock is priced at approximately 20x to 23x next year’s EPS, thus making it a very attractive stock to buy.

Rapid Recap,

In my previous bullish analysis back in August I said,

Salesforce impresses [by] acquiescing that its growth rates have slowed down, but how AI will deliver tremendous productivity gains, and that “customers [will] begin to adopt these new AI technologies and understand they need to invest and grow to be able to achieve this kind of next level of productivity”.

Simply put, Salesforce makes the argument that there’s still more upside left down the road.

And for my part, I have to say, despite Salesforce being a well-known and highly followed company, I have to say that its valuation of around 20x next year’s EPS is cheap for what it offers.

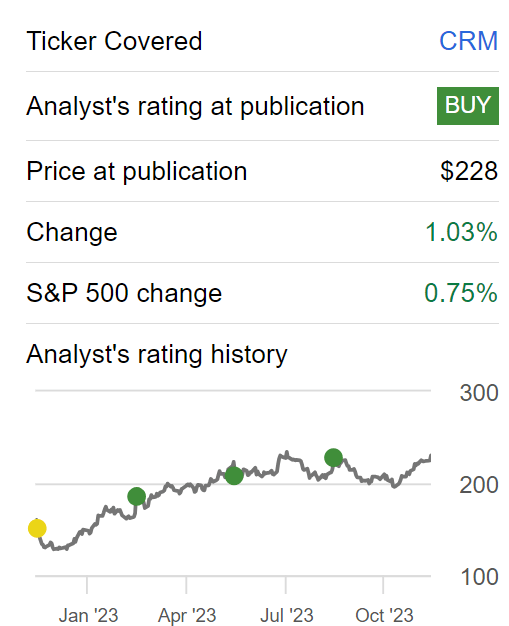

Author’s work on CRM

With the benefit of hindsight, I was right to turn bullish on Salesforce earlier in 2023 (calendar year, not Salesforce’s fiscal year). But if I’m 100% honest, its performance hadn’t been as strong as I had expected.

However, looking ahead, I believe the stock will catch up, as doubters turn to believers (and buyers).

Salesforce’s Near-Term Prospects

Salesforce’s near-term prospects are promising as the company continues to leverage its comprehensive suite of products and strategic initiatives. The recent strong performance in Q3 underscores Salesforce’s ability to execute and drive consistent, profitable growth.

A significant contributor to this success is the continued momentum of MuleSoft, a key element in Salesforce’s strategy. MuleSoft, a data integration platform, is playing a pivotal role in helping customers bring together disparate data sources, a critical aspect as companies increasingly embark on AI and digital transformation journeys.

The emphasis on data, AI, CRM, and trust, positions Salesforce at the forefront of innovation. Additionally, the company’s multi-cloud approach, evident in nine out of the top ten deals including six or more clouds, reflects the adaptability and scalability of its offerings.

However, amidst the positive outlook, Salesforce faces certain near-term challenges, particularly in the financial domain. While revenue and margin growth have been impressive (more on this soon), there are ongoing considerations noted by some restructuring charges, estimated at $0.91 per share. That being said, I don’t believe investors will be too harsh on that charge, as they’ll rapidly look further ahead to its strong profitable growth, which we discuss next.

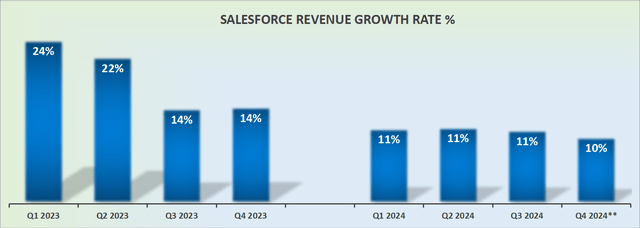

Revenue Growth Rates Continue to Tick Along

CRM revenue growth rates

In my previous analysis, I said,

There may be some investors who are taken aback at times by Salesforce’s focus on hard rhetoric. It’s not for everyone. But when it came time to step up and deliver, Salesforce did just that and continues to guide towards more growth to come ahead.

I said it then, and it’s worthwhile repeating now, that Salesforce continues to deliver solid growth. Yes, it’s no longer delivering those juicy 20% annual rates, but this isn’t where the story for investors ends. On the contrary, the bull case is found at the bottom of the income statement.

CRM Stock Valuation — Approximately 20x to 23x Next Year’s EPS

Now, we get to the icing on the cake for Salesforce. The business reiterates the message it’s been making clear in the past couple of quarters. This business is going to start to ooze some serious profitability.

Case in point, fiscal Q3 2024 saw its non-GAAP operating profit margin expand 850 basis points compared with the same period a year ago. Not only does this mean that fiscal Q3 2024 saw 31.2% of operating margins, but it now gives one the impression that perhaps 32% to 33% of non-GAAP operating margins are sustainable in fiscal 2025 (next calendar year).

Given all the criticism that Salesforce gets, justifiably, about its lavish stock-based compensation, I believe investors also should be quick to recognize that even on a GAAP basis, there was a strong improvement.

This led Salesforce’s CFO Amy Weaver to state,

We also remain focused on stock-based compensation, which is now expected to be approximately 8% as a percent of revenue.

This means that there’s a possibility that over the next twelve months, Salesforce’s clean GAAP operating margins could be reaching 20%. This would undoubtedly put Salesforce among the highest-quality businesses.

To get some perspective, last year, Salesforce’s non-GAAP EPS was $5.24 and this year it is guided for $8.19 of EPS, up 56% y/y. Although, I don’t believe that expecting this sort of growth of strong EPS next year is on the cards, nor should we expect it to be as strong.

But I do believe that around a 30% y/y increase in EPS is possible given management’s newly found focus to tighten up its cost structure, which should deliver about $10.70 of EPS in fiscal 2025 (next calendar year).

This implies that the stock is priced at about 23x next year’s EPS. On top of that, there’s also some more room for Salesforce to repurchase its stock next year. As a reference point, this is what CFO Weaver said on the call,

[…] As we focus on shareholder return and disciplined capital allocation, we continue to expect to fully offset our stock-based compensation dilution through our share repurchases in fiscal year ’24.

In fact, as a result of our ongoing share repurchases, for the first time in company history, we expect the full year’s ending share count to decrease year-over-year.

Altogether, I believe that including buybacks, Salesforce could be priced at somewhere around 20x to 23x next year’s EPS.

The Bottom Line

In conclusion, Salesforce’s near-term prospects are marked by the company’s strategic initiatives and robust product portfolio. The strong performance in Q3, fueled by the continued momentum of MuleSoft, underscores Salesforce’s ability to drive consistent, profitable growth.

Turning to valuation, Salesforce’s stock is attractively priced, ranging from approximately 20x to 23x next year’s EPS. The company’s focus on profitability is evident in the expansion of non-GAAP operating margins, reaching 31.2% in fiscal Q3, representing an 850 basis point increase year-over-year. The expectation of stock-based compensation being around 8% as a percentage of revenue signals prudent financial management, something investors have long asked for.

With the potential for clean GAAP operating margins to reach around 20%, Salesforce stands out as a very high-quality business. The anticipation of continued growth, coupled with disciplined capital allocation and share repurchases, positions the stock favorably, making it an appealing investment opportunity.

Read the full article here