With the markets skyrocketing again to year-to-date highs, it’s tough and quite a gift to find stocks that remain undervalued on the recent downside. Okta (NASDAQ:OKTA) is one such example: the single sign-on security leader sank after reporting Q3 results, owing to a combination of perceived weakness in its outlook as well as a recent data breach. Okta had initially reported the breach in October, but alongside its earnings report, the company noted that the impact was more far-reaching than it initially thought and that the downstream impacts of the attack will take several quarters to assess.

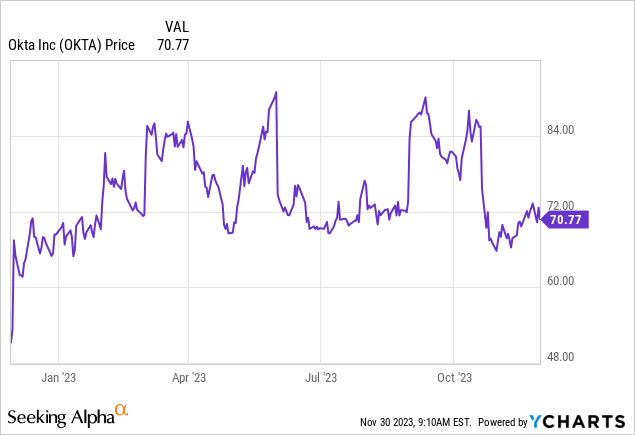

Year to date, shares of Okta are roughly flat for the year, underperforming the S&P 500 by double digits and fellow software stocks by much more. It’s a great time, in my view, for investors to re-assess the bull case for this name.

The bull case for Okta is still bright despite recent drags

I wrote a bullish opinion on Okta in September, when the stock was trading closer to $88 per share. I cited the company is dramatically scaling operating margins alongside consistent growth as the lynchpin behind a +$100 price target. Today, post-Q3 earnings and after the recent massive dip, I remain bullish on the stock.

Let’s start first with the downside drivers for the stock. A security breach for a single sign-on company that prides itself on security is, of course, a major blow. But while investors are avoiding the name due to uncertainty in the near term, it’s my view that the event will be a blip in the long run for Okta, which remains for most intents and purposes to be the only brand name in single sign-on. We shouldn’t forget all the other major data breaches in history, and among consumer-facing companies as well: Meta’s Facebook (META), Target (TGT), and Marriott Hotels (MAR). It always seems larger at the moment: When news broke on each of these breaches, the market prognosticated that these companies would lose users and customers – yet today, each of these companies is thriving. The same will be true for Okta, whose breach seems of a much smaller scale.

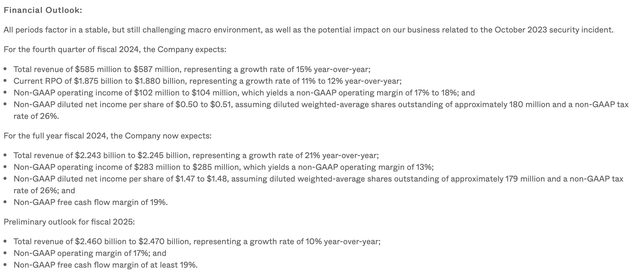

Second – Okta’s outlook, in my view, still calls for substantial 15% growth in Q4 and 10% revenue growth in FY25, both of which also factor in the expected impacts of the data breach already.

Okta outlook (Okta Q3 earnings release)

While the market is treating these outlooks as weak, we have to ask ourselves: is that risk already present in Okta’s dramatically lowered valuation? At current share prices near $70, Okta trades at a market cap of $11.15 billion, and after we net off the $1.93 billion of cash and $1.30 billion of convertible debt on Okta’s most recent balance sheet, the company’s resulting enterprise value is $10.52 billion.

This stands at a 4.3x EV/FY25 revenue multiple against the midpoint of Okta’s $2.46-$2.47 billion (+10% y/y) preliminary guidance for FY25, which historically tends to be conservative and will likely get moved higher in future earnings releases. It’s also a relatively cheap 22x FY25 FCF multiple using a 19% FCF margin on that revenue profile (which is the minimum stated in the company’s guidance, and which would be flat to FY24 margins). In my view, Okta’s low valuation more than makes up for these risks.

Investors should look beyond the short-term headline risk and to the long-term bull case drivers for Okta, which as a reminder are:

- Despite its massive scale, Okta is still able to grow at an incredible pace. Okta, despite having reached a massive ~$2 billion annual revenue scale, is expecting to grow roughly ~20% y/y on an organic basis in the upcoming fiscal year. This is a reflection of both the company’s strong execution plus the attractiveness of the IAM (identity access management) market.

- Huge $80 billion TAM – Okta estimates its total addressable market at $80 billion, which means its current revenue scale is only about ~2% penetrated. It’s also the clear market leader here, with competitors like OneLogin and Duo Security being smaller and lesser-known entities.

- Horizontal product – Okta is a true “horizontal” software company whose product is applicable to companies of any size in any industry.

- Recurring revenue and high net retention rates – All of Okta’s business is in recurring subscriptions; in addition, the company’s seat-based pricing plus its multiple modules lend themselves nicely to its +120% net revenue retention rates. In short, Okta has a very stable subscription revenue base that is a powerful growth engine from within the current install base.

- Profitable bones – Okta has achieved above-breakeven pro forma operating margins, on top of positive free cash flow. The company’s tendency to upsell aggressively into its client base also gives it excellent operating leverage.

The bottom line here: stay long and buy the dip.

Q3 download

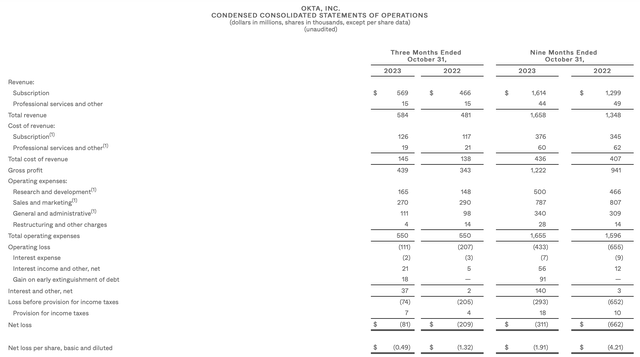

Let’s now go through Okta’s latest quarterly results in greater detail. The Q3 earnings summary is shown below:

Okta Q3 results (Okta Q3 earnings release)

Revenue grew at a strong 21% y/y clip to $594 million, ahead of Wall Street’s expectations of $560 million (+16% y/y), which was also in line with the company’s Q3 guidance released in Q2 of 16% y/y. Note as well that Okta had not anticipated any data breach at the time yet, and the impacts of that breach now slightly color the Q3 results – yet another illustration of Okta’s tendency to guide low, and why we should treat its Q4 and FY25 outlooks with a heaping grain of salt. Revenue growth also largely kept pace with 23% y/y growth in Q2.

The company continued to note macro impacts on its business that were consistent with the first half of the year. In spite of macro pressure, however, the company is still managing to execute a 115% net revenue retention rate, indicating a net 15% upsell within the existing customer base.

Per CFO Brett Tighe’s remarks on the Q3 earnings call:

Macro headwinds, while stabilized, continue to impact our business. Metrics that we use to gauge the macro environment, such as contract duration, average deal size, and pipeline mix, were largely consistent with what we experienced in the first half of the year […]

Consistent with prior quarters, gross retention rates remained strong in the mid-90% range. Our dollar-based net retention rate for the trailing 12-month period remained strong at 115% and was driven by both upsell and cross-sell activities. Similar to the past few quarters, macro-related pressure resulted in smaller seed expansions than in previous years. We believe this trend will persist in the current environment. The net retention rate may fluctuate from quarter-to-quarter as the mix of new business, renewals and upsells fluctuates. As I’ve noted previously, we’ve experienced a macro-related shift in our business mix to more upsell and cross-sell versus new business.”

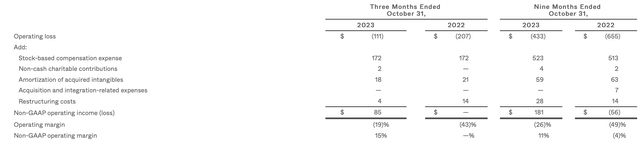

It’s in profitability, however, where Okta continues to shine. Expense controls, plus a 3-point improvement in pro forma gross margins due to economies of scale, has driven Okta’s pro forma operating margins up to 15%, a 15-point improvement from flat in the prior-year quarter, and 4 points better than 11% in Q2:

Okta operating margins (Okta Q3 earnings release)

Pro forma operating margins are expected to climb further to 17% in FY25 – and again, there’s a large likelihood that Okta’s initial outlook is quite conservative.

Key takeaways

Okta is a rarity among tech stocks in today’s market: It’s cheap. In my view, it’s cheap due to transitory factors: once the narrative on Okta turns away from the recent data breach, investors can focus on the company’s growth at scale plus its fantastic operating margin leverage. Stay long here and buy the dip.

Read the full article here